The Fundamental Theorem of Asset Pricing with either Frictionless or Frictional Security Markets ()

Keywords:The First Fundamental Valuation Theorems; Transaction Costs; Weak Arbitrage-Freeness; Strict Arbitrage-Freeness; Arbitrage-Free Pricing Theory; Locally Convex Topological Space; Separable Banach Space

1. Introduction

Arbitrage-free asset pricing theory is of fundamental importance in neo-classical finance. In this paper, we consider it in a setting of general state spaces, in particular, locally convex topological space for weakly arbitrage-free security markets, and separable Banach space for strictly arbitrage-free security markets. We deal with both frictionless and frictional security markets.

In the study of mathematical economics, arbitrage-free conditions have always been an important first step toward the general equilibrium theorem with incomplete asset markets (Duffie and Shafer [1,2]; Geanakoplos [3]; Geanakoplos and Shafer [4]; Hirsch, Magill and Mas-Colell [5]; Husseini, Lasry and Magill [6]; and Magill and Shafer [7]). Since the 1980s, for finite period economies, no-arbitrage pricing theory has been applied by various authors to prove the existence of general equilibrium for stochastic economies with incomplete financial markets (Duffie [8-10]; Florenzano and Gourdel [11]; Magill and Shafer [7]; Werner [12,13]; and Zhang [14]). In those works, the finite number of possible states of nature and the finite-dimensional commodity space are usually assumed in order for the proofs to be carried out for the general equilibrium model with incomplete financial markets. Our model considers a general state space which may have an infinite number of states.

Many mathematical economists usually apply Stiemke’s Lemma, a strict version of Farkas-Minkowski’s Lemma, to study the asset pricing theory with no-arbitrage conditions, for example, discrete-time models of dynamic asset pricing theory (Duffie [9,10]) and the theory of economic equilibrium with incomplete asset markets (Geanakoplos [3]; Geanakoplos and Shafer [4]; Hirsch, Magill and Mas-Colell [5]; Husseini, Lasry and Magill [6]; and Magill and Shafer [7]) where the commodity space is of finite dimension. Farkas-Minkowski’s Lemma and Stiemke’s Lemma are in essence the mathematical counter part of the asset pricing theory with no-arbitrage conditions. In this paper, we obtain extensions (to the general state space in our discussion) of Farkas-Minkowski’s Lemma and Stiemke’s Lemma by applying Clark’s separating hyperplane theorems (Clark [15,16]), and thus establish our main results.

Harrison and Kreps [17] initiated the study of martingales and arbitrage in multiperiod security markets. They first introduced general theory of arbitrage in a two-period economy with uncertainty, and then extended it to the models of multiperiod security markets and the models of continuous-time securities markets. Kreps [18] studied arbitrage and equilibrium in economies with infinitely many commodities and presented an abstract analysis of “arbitrage” in economies that have infinite dimensional commodity space. Harrison and Pliska [19] studied martingales and stochastic integrals in the theory of continuous trading. Dalang, Morton and Willinger [20] studied equivalent martingale measures and no-arbitrage in stochastic securities market models. Back and Pliska [21] studied the fundamental theorem of asset pricing with an infinite state space and showed some equivalent relations on arbitrage. Jacod and Sgiryaev [22] studied local martingales and the fundamental asset pricing theorems in the discrete-time case. These papers studied fundamental theorems of asset pricing in multiperiod financial models with the help of techniques from stochastic analysis. Our work is based on separating hyperplane theorems and does not rely on assumptions made for stochastic analysis to be able to carry out in the above models.

Friction in markets has attracted attention of several works in this field recently. Chen [23] examined the incentives and economic roles of financial innovation and at the same time studied the effectiveness of the replication-based arbitrage valuation approach in frictional economies (the friction means holding constraints). Jouini and Kallal [24] derived the implications of the absence of arbitrage in securities markets models where traded securities are subject to short-sales constraints and where the borrowing and lending rates differ, and showed that a securities price system is arbitrage free if and only if there exists a numeraire and an equivalent probability measure for which the normalized (by the numeraire) price processes of traded securities are supermartingales. Jouini and Kallal [25] derived the implications from the absence of arbitrage in dynamic securities markets with bid-ask spreads. The absence of arbitrage is equivalent to the existence of at least an equivalent probability measure that transforms some process between the bid and the ask price processes of traded securities into a martingale. Pham and Touzi [26] addressed the problem of characterization of no arbitrage (strictly arbitrage-free) in the presence of friction in a discrete-time financial model, and extended the fundamental theorem of asset pricing under a non-degeneracy assumption. The friction is described by the transaction cost rates for purchasing and selling the securities. We follow the model for transaction costs from Pham and Touzi [26], and then extend the first fundamental valuation theorems of asset pricing from frictionless security markets to frictional security markets, for general state space. Again, their stochastic analysis method requires stronger assumptions than ours. In addition, their arbitrage-free conditions are slightly different from ours based on that of Duffie [9].

Section 2 presents our model without transaction costs, we define the weakly arbitrage-free security markets and strictly arbitrage-free security markets, following Duffie [9]. In the next two sections, we establish the first fundamental valuation theorem of asset pricing (a necessary and sufficient condition for arbitrage-freeness) with weakly arbitrage-free security markets in Section 3 and strictly arbitrage-free security markets in Section 4. In the rest of the paper we extend our work to markets with transaction costs, following the model of Pham and Touzi [26]. The transaction cost model is presented in Section 5, and the corresponding first fundamental valuation theorems of asset pricing are done in Sections 6 and 7. Section 8 concludes our article with some remarks.

2. Frictionless Security Markets

We consider a two-period model (dates 0 and 1) with uncertainty over the states of nature in the date 1. The unknown nature of the future is represented by a general set  of possible states of nature, one of which will be revealed as true. Here we make no assumption about the probability of these states. The

of possible states of nature, one of which will be revealed as true. Here we make no assumption about the probability of these states. The  securities are given by a return “matrix”

securities are given by a return “matrix” , where

, where  denotes the number of units of account paid by security

denotes the number of units of account paid by security . Let

. Let  denote the vector of prices of

denote the vector of prices of  securities. A portfolio

securities. A portfolio  has market value

has market value  and payoff

and payoff .

.

Let  be a topological space consisting of processes in

be a topological space consisting of processes in ,

,  is the positive cone of

is the positive cone of . Let

. Let  be the dual space composed of the continuous linear functionals on

be the dual space composed of the continuous linear functionals on ,

,  the positive cone of the space

the positive cone of the space  (the space of all positive continuous linear functionals on

(the space of all positive continuous linear functionals on ) and

) and  the interior of the cone

the interior of the cone  (the space of all strictly positive continuous linear functionals on

(the space of all strictly positive continuous linear functionals on ):

): .

.

In this paper, we assume  for

for . Then

. Then . Our proof must adopt the following notation

. Our proof must adopt the following notation  and

and .

.

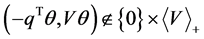

[Definition ]">1] The frictionless market  is weakly arbitrage-free if any portfolio

is weakly arbitrage-free if any portfolio  of securities has a positive market value

of securities has a positive market value  whenever it has a positive payoff

whenever it has a positive payoff .

.

[Definition ]">2] The frictionless market  is strictly arbitrage-free if (1) any portfolio

is strictly arbitrage-free if (1) any portfolio  of securities has a strictly positive market value

of securities has a strictly positive market value  whenever it has a positive non-zero payoff

whenever it has a positive non-zero payoff ; and (2) any portfolio

; and (2) any portfolio  of securities has a zero market value

of securities has a zero market value  whenever it has a zero payoff

whenever it has a zero payoff .

.

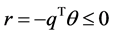

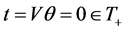

Definition 2 implies Definition 1 obviously. We follow the definition for arbitrage opportunity as provided by Duffie [9,]">10]. An arbitrage is a portfolio  with either (1)

with either (1)  and

and , or (2)

, or (2)  and

and . That is to say, the frictionless market

. That is to say, the frictionless market  admits an arbitrage opportunity if there exists an portfolio

admits an arbitrage opportunity if there exists an portfolio  of securities such that either (1)

of securities such that either (1)  and

and , or (2)

, or (2)  and

and

. Consequently, we can define the strictly arbitrage-free (no arbitrage) frictionless market

. Consequently, we can define the strictly arbitrage-free (no arbitrage) frictionless market  as follows.

as follows.

[Definition 2¢] The frictionless market  is strictly arbitrage-free if (1) any portfolio

is strictly arbitrage-free if (1) any portfolio  of securities has a strictly positive market value

of securities has a strictly positive market value  whenever it has a positive non-zero payoff

whenever it has a positive non-zero payoff ; and (2) any portfolio

; and (2) any portfolio  of securities has a positive market value

of securities has a positive market value  whenever it has a positive payoff

whenever it has a positive payoff .

.

[Lemma ]">1] Definitions 2 and 2’ are equivalent.

An arbitrage is therefore, in effect, a portfolio offering “something for nothing”. Not surprisingly, an arbitrage is naturally ruled out in reality. And this fact gives a characterization of security prices as follows: A valuation functional is a functional  for the weakly arbitrage-free frictionless market

for the weakly arbitrage-free frictionless market  with consistency

with consistency ; and a functional

; and a functional  for the strictly arbitrage-free frictionless market

for the strictly arbitrage-free frictionless market  with consistency

with consistency , where

, where . The valuation functional is called to be a positive linear consistent valuation operator for the weakly arbitrage-free frictionless market, a strictly positive linear consistent valuation operator for the strictly arbitrage-free frictionless market, respectively.

. The valuation functional is called to be a positive linear consistent valuation operator for the weakly arbitrage-free frictionless market, a strictly positive linear consistent valuation operator for the strictly arbitrage-free frictionless market, respectively.

The idea of arbitrage and the absence of arbitrage opportunities is fundamental in finance. The strict arbitrage-freeness is important in the study of general equilibrium theory with incomplete asset markets (Husseini, Lasry and Magill [6]; Werner [13]; and Magill and Shafer [7]). Theorem 2 to be presented in the following is an important step in the study of equilibrium for economies with general state spaces considered in our work. The principal mathematical tool applied here is the Separating Hyperplane Theorems of Clark [15] and [16].

[Fact ]">1] (Clark [16]) Suppose  and

and  are non-empty disjoint convex cones in a locally convex topological vector space

are non-empty disjoint convex cones in a locally convex topological vector space . Then there exists a non-zero continuous linear functional

. Then there exists a non-zero continuous linear functional  separating

separating

from

from :

:  for all

for all  and

and  for all

for all  if and only if

if and only if . Moreoverif

. Moreoverif , then for any

, then for any  we may select

we may select  so that

so that .

.

[Fact ]">2] (Clark [15]) Suppose  and

and  are non-empty convex cones (with vertices at the origin) in a separating Banach space

are non-empty convex cones (with vertices at the origin) in a separating Banach space . Then there exists a non-zero continuous linear functional

. Then there exists a non-zero continuous linear functional  strictly separating N from M:

strictly separating N from M:  for all

for all  and

and  for all

for all  if and only if

if and only if .

.

Fact 1 and 2 will be used to prove Theorems 1 and 2 in Sections 3 and 4, Theorems 3 and 4 in Sections 6 and 7, respectively. We assume , which is a topological space, then

, which is a topological space, then  is the positive cone of

is the positive cone of , which is a positive closed convex cone of

, which is a positive closed convex cone of  with its vertex at the origin. The marketed subspace

with its vertex at the origin. The marketed subspace

is a linear subspace of the space .

.

3. Weakly Arbitrage-Free Security Valuation Theorem with Frictionless Security Markets

In this section, we assume that  is a locally convex topological space.

is a locally convex topological space.

[Proposition 1] The frictionless market  is weakly arbitrage-free if and only if

is weakly arbitrage-free if and only if .

.

Proof.  implies that there exists

implies that there exists  such that

such that  and

and . On the other hand,

. On the other hand,  implies that

implies that  from Definition 1, then

from Definition 1, then . Thus

. Thus  and

and

, that is,

, that is, .

.

Conversely, if there exists  such that

such that  and

and , then

, then . Thus

. Thus

and

and .

.

This is a contradiction! Therefore the frictionless market  is weakly arbitrage-free. Q.E.D.

is weakly arbitrage-free. Q.E.D.

[Theorem 1] The frictionless market  is weakly arbitrage-free if and only if there exists a positive functional

is weakly arbitrage-free if and only if there exists a positive functional  satisfying

satisfying .

.

Proof. Both  and

and  are closed and convex cones of

are closed and convex cones of  with their vertices at the origin.

with their vertices at the origin.

The frictionless market  is weakly arbitrage-free if and only if

is weakly arbitrage-free if and only if . Note that

. Note that

is a convex set. Let

is a convex set. Let , then

, then  is a (non-empty) convex set. Both

is a (non-empty) convex set. Both

and  are non-empty disjoint convex cones

are non-empty disjoint convex cones .

.  implies

implies . Clark [16] stated that there exists a non-zero continuous linear functional

. Clark [16] stated that there exists a non-zero continuous linear functional  separating

separating  from

from , that is,

, that is,  for all

for all  and

and  for all

for all . Moreover,

. Moreover, .

.

is a positive continuous linear functional on

is a positive continuous linear functional on . In fact, for any

. In fact, for any  and natural number

and natural number ,

,  and

and . Therefore,

. Therefore, . Thus

. Thus

.

.

That is,  is a positive continuous linear functional on

is a positive continuous linear functional on .

.

Thus  is represented by some

is represented by some  and

and  by

by  for any

for any . In fact,

. In fact,  is represented by some

is represented by some  and

and  by

by  for any

for any . The fact that

. The fact that

implies

implies . If

. If , then there exists

, then there exists  such that

such that . Take

. Take

, then

, then  and

and . The contradiction means

. The contradiction means .

.

Since  is a linear space,

is a linear space,  for all

for all , that is,

, that is,  for all

for all . Then

. Then

. And therefore, the vector

. And therefore, the vector  is that we want.

is that we want.

The converse is obvious. Q.E.D.

[Remark 1] If  is a finite set, then

is a finite set, then  is an Euclidean space, Definition 1 is the usual concept of weak arbitrage-freeness. Theorem 1 is the well-known Farkas-Minkowski’s Lemma (Duffie [9]; Farkas [27] and Franklin [28]).

is an Euclidean space, Definition 1 is the usual concept of weak arbitrage-freeness. Theorem 1 is the well-known Farkas-Minkowski’s Lemma (Duffie [9]; Farkas [27] and Franklin [28]).

[Remark 2] Theorem 1 (The Extension of Farkas-Minkowski’s Lemma) means that the present value of the securities prices at date 0 is the value of their returns at date 1.

4. Strictly Arbitrage-Free Security Valuation Theorem with Frictionless Security Markets

In this section, we assume that  is a separable Banach space. We prove Proposition 2 and Theorem 2 by using Definition 2 of the strictly arbitrage-free frictionless market

is a separable Banach space. We prove Proposition 2 and Theorem 2 by using Definition 2 of the strictly arbitrage-free frictionless market .

.

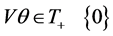

[Proposition 2] The frictionless market  is strictly arbitrage-free if and only if

is strictly arbitrage-free if and only if  and

and  intersect precisely at

intersect precisely at , that is,

, that is, .

.

Proof.  implies that there exists

implies that there exists  such that

such that  and

and . If

. If , then

, then  from Definition 2 (1),

from Definition 2 (1),  , a contradiction! If

, a contradiction! If , then

, then  from Definition 2 (2),

from Definition 2 (2),  and

and . Thus

. Thus . And hence,

. And hence, .

.

For sufficiency, we must consider two cases: (1) If there exists  such that

such that  and

and , then

, then  and

and , a contradiction. Therefore, any portfolio

, a contradiction. Therefore, any portfolio  of securities has a positive non-zero market value

of securities has a positive non-zero market value  whenever it has a positive payoff

whenever it has a positive payoff . (2)

. (2)

If there exists  such that

such that  and

and , we discuss the problem for the following two settings. (2.1) When

, we discuss the problem for the following two settings. (2.1) When , then

, then , thus

, thus . This is a contradiction! (2.2)

. This is a contradiction! (2.2)

When , then

, then  and

and , thus

, thus . This is a contradiction! The two contradictions mean that the frictionless market

. This is a contradiction! The two contradictions mean that the frictionless market  is strictly arbitrage-free. Q.E.D.

is strictly arbitrage-free. Q.E.D.

[Theorem 2] The frictionless market  is strictly arbitrage-free if and only if there exists a strictly positive functional

is strictly arbitrage-free if and only if there exists a strictly positive functional  satisfying

satisfying .

.

Proof. Both  and

and  are closed and convex cones of

are closed and convex cones of  with their vertices at the origin.

with their vertices at the origin.

Since  is a polyhedral (convex) cone in

is a polyhedral (convex) cone in  and

and  is a closed convex cone of

is a closed convex cone of , then

, then  is a closed convex cone from Lemma of Clark [15], that is,

is a closed convex cone from Lemma of Clark [15], that is, . Thus

. Thus  is a closed convex cone

is a closed convex cone .

.

The frictionless market  is strictly arbitrage-free if and only if

is strictly arbitrage-free if and only if . We claim that

. We claim that

. On the contrary, we assume that there exists

. On the contrary, we assume that there exists then

then  and

and  for

for  and

and . Thus

. Thus

contradicting the conclusion

contradicting the conclusion  and

and .

.

Note that . It follows that

. It follows that . Thus

. Thus

. Since both

. Since both  and

and  are non-empty convex cones with vertices at the origin in the separable Banach space

are non-empty convex cones with vertices at the origin in the separable Banach space , Theorem 5 in Clark [15] states that there exists a non-zero continuous linear functional

, Theorem 5 in Clark [15] states that there exists a non-zero continuous linear functional  on

on  strictly separating

strictly separating  from

from , that is,

, that is,  for all

for all  and

and  for all

for all .

.

The condition  for all

for all  implies that

implies that  is a strictly positive continuous linear functional on

is a strictly positive continuous linear functional on . Thus

. Thus  is represented by some

is represented by some  and

and  by

by  for any

for any .

.

Since  is a linear space,

is a linear space,  for all

for all , that is,

, that is,  for all

for all . It follows that

. It follows that . The vector

. The vector  is that we want.

is that we want.

The converse is again obvious. Q.E.D.

[Remark 1] If  is a finite set, then

is a finite set, then  is an Euclidean space, Definition 1 is the usual concept of strict arbitrage-freeness. Theorem 2 is the well-known Stiemke’s Lemma (Duffie [9,10]).

is an Euclidean space, Definition 1 is the usual concept of strict arbitrage-freeness. Theorem 2 is the well-known Stiemke’s Lemma (Duffie [9,10]).

[Remark 2] Theorem 2 (The Extension of Stiemke’s Lemma) means that the present value of the securities prices at date 0 is the value of their returns at date 1.

[Remark 3] If  where

where  is a linear functional on

is a linear functional on , we can prove Theorem 2 by Kreps [18]. The sufficient condition is obvious, we only need prove the necessary condition. Take

, we can prove Theorem 2 by Kreps [18]. The sufficient condition is obvious, we only need prove the necessary condition. Take , then any element

, then any element  is of the form

is of the form  where

where . Take

. Take  as a linear functional on

as a linear functional on  solving the equation

solving the equation  for all

for all , i.e.

, i.e.  and take

and take . If the frictionless market

. If the frictionless market  is strictly arbitrage-free, then the pair

is strictly arbitrage-free, then the pair  admits no free lunches. Kreps’ conditions (4.7) and (4.10) are applied, then the pair

admits no free lunches. Kreps’ conditions (4.7) and (4.10) are applied, then the pair  is

is  -viable from Theorem 3 (Kreps [18]), that is, the pair

-viable from Theorem 3 (Kreps [18]), that is, the pair  has the extension property for

has the extension property for . Thus the necessary condition is obtained.

. Thus the necessary condition is obtained.

5. Frictional Security Markets

Suppose that there are transaction costs in the trading, the coefficients  and

and  are respectively the transaction cost rates for purchasing and selling the security

are respectively the transaction cost rates for purchasing and selling the security . Then the algebraic cost induced by (buying) a position

. Then the algebraic cost induced by (buying) a position  units of security

units of security  is

is  and the algebraic gain induced by (selling) a position

and the algebraic gain induced by (selling) a position  units of security

units of security  is

is . We introduce the functions

. We introduce the functions  defined by

defined by

and the functions  defined by

defined by

Then .

.

For any integer , a function

, a function  is subliner if, for any

is subliner if, for any ,

,  ,

,  and

and ,

,

The function  is sublinear, and hence convex. Therefore the function

is sublinear, and hence convex. Therefore the function  is also sublinear, and hence convex.

is also sublinear, and hence convex.

The total cost or gain induced by (trading) a portfolio  is

is . We define the function

. We define the function  by

by

Then the total cost or gain induced by (trading) a portfolio  is

is . As we know, the function

. As we know, the function  is sublinear, and hence convex.

is sublinear, and hence convex.

[Definition ]">3] The frictional market  is weakly arbitrage-free if any portfolio

is weakly arbitrage-free if any portfolio  of securities has a positive total cost or gain

of securities has a positive total cost or gain  whenever it has a positive payoff

whenever it has a positive payoff .

.

We note that Definitions 2 and 2’ are equivalent. However, in the presence of transaction costs, the corresponding Definitions 4 and 4’ (as follows) are not. We establish Theorem 4 for Definition 4’ of the strictly arbitrage-free frictional market .

.

[Definition ]">4] The frictional market  is strictly arbitrage-free if (1) any portfolio

is strictly arbitrage-free if (1) any portfolio  of securities has a strictly positive total cost or gain

of securities has a strictly positive total cost or gain  whenever it has a positive non-zero payoff

whenever it has a positive non-zero payoff ; and (2) any portfolio

; and (2) any portfolio  of securities has a zero total cost or gain

of securities has a zero total cost or gain  whenever it has a zero payoff

whenever it has a zero payoff .

.

[Definition 4’] The frictional market  is strictly arbitrage-free if (1) any portfolio

is strictly arbitrage-free if (1) any portfolio  of securities has a strictly positive total cost or gain

of securities has a strictly positive total cost or gain  whenever it has a positive non-zero payoff

whenever it has a positive non-zero payoff ; and (2) any portfolio

; and (2) any portfolio  of securities has a positive total cost or gain

of securities has a positive total cost or gain  whenever it has a positive payoff

whenever it has a positive payoff .

.

Definition 4 obviously implies Definition 4’. Definition 4’ does not imply Definition 4 because of the presence of friction. In the frictionless model, we define the marketed subspace

of the space  to prove the first fundamental theorems of asset pricing. In the frictional model, we can’t consider the corresponding marketed “subspace”

to prove the first fundamental theorems of asset pricing. In the frictional model, we can’t consider the corresponding marketed “subspace” . In fact, this marketed “subspace”

. In fact, this marketed “subspace”

isn’t a subspace of the space . Instead, we define the subset

. Instead, we define the subset  in the space

in the space  as follows

as follows

[Lemma 2]  is a closed and convex cone in the space

is a closed and convex cone in the space .

.

Proof.  is a closed cone obviously since the function

is a closed cone obviously since the function  is continuous and sublinear.

is continuous and sublinear.

For any  and

and , there exist

, there exist  and

and  such that

such that ,

,

and

and ,

, . Thus

. Thus  since the function

since the function  is sublinear, and

is sublinear, and . Therefore

. Therefore . Since

. Since  is a cone,

is a cone,  is convex. Q.E.D.

is convex. Q.E.D.

For simplicity, we use the following notations in the subsequent sections.

We define the box product of two vectors  and

and  by

by

6. Weakly Arbitrage-Free Security Valuation Theorem with Frictional Security Markets

In this section, we assume that  is a locally convex topological space.

is a locally convex topological space.

[Proposition ]">3] The frictional market  is weakly arbitrage-free if and only if

is weakly arbitrage-free if and only if .

.

Proof.  implies that there exists

implies that there exists  such that

such that  and

and . On the other hand,

. On the other hand,  implies that

implies that  from Definition 3. Then

from Definition 3. Then  and

and , that is,

, that is, .

.

Conversely, if there exists  such that

such that  and

and , then

, then . Thus

. Thus

and

and .

.

This is a contradiction! Therefore, any portfolio  of securities has a positive total cost or gain

of securities has a positive total cost or gain  whenever it has a positive payoff

whenever it has a positive payoff . Q.E.D.

. Q.E.D.

[Remark] The proof of Proposition 3 only requires the property that  is a closed and convex cone in the space

is a closed and convex cone in the space  and doesn’t need the explicit definition of the function

and doesn’t need the explicit definition of the function , so does Proposition 3.

, so does Proposition 3.

[Theorem ]">3] The frictional market  is weakly arbitrage-free if and only if there exists a positive functional

is weakly arbitrage-free if and only if there exists a positive functional  satisfying

satisfying

Proof. Both  and

and  are closed and convex cones of

are closed and convex cones of  with their vertices at the origin.

with their vertices at the origin.

The frictional market  is weakly arbitrage-free if and only if

is weakly arbitrage-free if and only if . Note that

. Note that  is a convex set. Let

is a convex set. Let , then

, then  is a (non-empty) convex set. Both

is a (non-empty) convex set. Both

and  are non-empty disjoint convex cones,

are non-empty disjoint convex cones, .

.  implies

implies

. Clark [16] stated that there exists a non-zero continuous linear functional

. Clark [16] stated that there exists a non-zero continuous linear functional  separating

separating  from

from , that is,

, that is,  for all

for all  and

and  for all

for all . Moreover,

. Moreover, .

.

From the proof of Theorem 1,  is a positive continuous linear functional on

is a positive continuous linear functional on , and

, and  is represented by some

is represented by some  and

and  by

by  for any

for any .

.

On the other hand, the fact that  for all

for all  implies

implies  for all

for all

and  for

for . Then

. Then  for all

for all . And hence we have

. And hence we have

for all . For each

. For each , assigning

, assigning , we have

, we have

that is, . Thus

. Thus

For each , we assign

, we assign  instead, it follows that

instead, it follows that

that is, . Thus

. Thus

Therefore, for any ,

,

The vector  is thus what we want:

is thus what we want:

Conversely, assume that there exists a positive functional  satisfying

satisfying

For any ,

,

For any ,

,

And for any ,

,

Thus

Summarying over , we then have, for any

, we then have, for any ,

,

Therefore the frictional market  is weakly arbitrage-free. Q.E.D.

is weakly arbitrage-free. Q.E.D.

[Remark] Theorem 3 means the first fundamental theorem of weakly arbitrage-freeness with frictional security markets. If there exists no transaction costs, that is,  and

and , then Theorem 3 reduces to Theorem 1.

, then Theorem 3 reduces to Theorem 1.

7. Strictly Arbitrage-Free Security Valuation Theorem with Frictional Security Markets

In this section, we assume that  is a separable Banach space. We prove the following Proposition 4 and Theorem 4 for Definition 4’ of the strictly arbitrage-free frictional market

is a separable Banach space. We prove the following Proposition 4 and Theorem 4 for Definition 4’ of the strictly arbitrage-free frictional market .

.

[Proposition ]">4] The frictional market  is strictly arbitrage-free if and only if

is strictly arbitrage-free if and only if  and

and  intersect precisely at

intersect precisely at , that is,

, that is, .

.

Proof.  implies that there exists

implies that there exists  such that

such that  and

and . If

. If , then

, then  from Definition 4’(1),

from Definition 4’(1),  , which is a contradiction! If

, which is a contradiction! If , then

, then  from Definition 4’(2),

from Definition 4’(2),  and

and . Thus

. Thus and hence

and hence .

.

For sufficiency, we must consider two cases: (1) If there exists  such that

such that  and

and then

then . Take

. Take  such that

such that  and

and , then

, then which is a contradiction. It follows that any portfolio

which is a contradiction. It follows that any portfolio  of securities has a strictly positive total cost or gain

of securities has a strictly positive total cost or gain  whenever it has a positive payoff

whenever it has a positive payoff . (2) If there exists

. (2) If there exists  such that

such that  and

and , then

, then . Take

. Take  such that

such that  and

and , then

, then

, which is a contradiction! The two contradictions mean that the frictional market

, which is a contradiction! The two contradictions mean that the frictional market  is strictly arbitrage-free. Q.E.D.

is strictly arbitrage-free. Q.E.D.

[Remark] The proof of Proposition 4 doesn’t use the representation of the function , then Proposition 4 holds for usual total cost or gain function.

, then Proposition 4 holds for usual total cost or gain function.

[Theorem ]">4] The The frictional market  is strictly arbitrage-free if and only if there exists a strictly positive functional

is strictly arbitrage-free if and only if there exists a strictly positive functional  satisfying

satisfying

Proof. Both  and

and  are closed and convex cones of

are closed and convex cones of  with the vertices at the origin.

with the vertices at the origin.

Since  is a polyhedral (convex) cone in

is a polyhedral (convex) cone in  and

and  is a closed convex cone of

is a closed convex cone of ,

,  is a closed convex cone from Lemma of Clark [15], that is,

is a closed convex cone from Lemma of Clark [15], that is, . Thus

. Thus  is a closed convex cone

is a closed convex cone .

.

The frictional market  is strictly arbitrage-free if and only if

is strictly arbitrage-free if and only if . We claim that

. We claim that

.

.

On the contrary, we assume that there exists . Then

. Then

and  for

for  and

and . Thus

. Thus

contradicting the fact that

contradicting the fact that  (which follows from

(which follows from  in Proposition 4).

in Proposition 4).

Note that , then

, then

.

.

Thus, . Since both

. Since both  and

and  are non-empty convex cones with vertices at the origin in the separable Banach space

are non-empty convex cones with vertices at the origin in the separable Banach space , Theorem 5 in Clark [15] states that there exists a non-zero continuous linear functional

, Theorem 5 in Clark [15] states that there exists a non-zero continuous linear functional  on

on  strictly separating

strictly separating  from

from . That is,

. That is,  for all

for all  and

and  for all

for all .

.

The condition  for all

for all  implies that

implies that  is a strictly positive continuous linear functional on

is a strictly positive continuous linear functional on . Thus

. Thus  is represented by some

is represented by some  and

and  by

by  for any

for any .

.

The next proof is the same as the corresponding part in Theorem 3. Q.E.D.

[Remark] Theorem 4 means the first fundamental theorem of strict arbitrage-freeness with frictional security markets. If there exists no transaction costs, that is,  and

and , then Theorem 4 reduces to Theorem 2.

, then Theorem 4 reduces to Theorem 2.

8. Concluding Remarks

In Section 4, we examine the following problem: whether the security prices  can be represented by strictly positive continuous linear functional

can be represented by strictly positive continuous linear functional  as

as . More precisely, for the security prices

. More precisely, for the security prices  and the returns

and the returns , we study the existence of strictly positive continuous linear functional

, we study the existence of strictly positive continuous linear functional  as

as . Ross [29] and Kreps [18] studied how to extend a linear functional

. Ross [29] and Kreps [18] studied how to extend a linear functional  on

on  to

to  that is strictly positive continuous. However, the existence of the linear functional

that is strictly positive continuous. However, the existence of the linear functional  on

on  with

with  is not at all an assured condition. It holds under certain conditions. For example, if

is not at all an assured condition. It holds under certain conditions. For example, if , our result is an analogue of theirs. In the equation

, our result is an analogue of theirs. In the equation , each linear functional

, each linear functional  on

on  corresponds to a vector

corresponds to a vector  and each vector

and each vector  corresponds to a linear functional

corresponds to a linear functional  on

on  only if

only if  is column linear independent. Therefore, our results in Section 4 are the same as theirs under the assumption “

is column linear independent. Therefore, our results in Section 4 are the same as theirs under the assumption “ is column linear independent”. But in general, this may not hold.

is column linear independent”. But in general, this may not hold.

Dalang, Morton and Willinger [20] and Jacod and Sgiryaev [22] studied arbitrage-free model, weakly arbitrage-free model, and strongly arbitrage-free model, provided simple proofs of the two fundamental theorems of asset pricing theory. Jacod and Sgiryaev [22] proved that the three concepts are equivalent to each another. In fact, the three concepts are strictly arbitrage-free securities’ price-return pair in Section 2 of our paper. Jacod and Sgiryaev [22] assumed that  is an integrable (finite expectation) random variable (martingale condition). But we only assume

is an integrable (finite expectation) random variable (martingale condition). But we only assume  is in the locally convex topological space

is in the locally convex topological space  for weakly arbitragefree frictionless market (Section 3), and

for weakly arbitragefree frictionless market (Section 3), and  is in the separable Banach space for strictly arbitrage-free frictionless market (Section 4). Therefore our study in Sections 2, 3 and 4 is more general than Jacod and Sgiryaev [22].

is in the separable Banach space for strictly arbitrage-free frictionless market (Section 4). Therefore our study in Sections 2, 3 and 4 is more general than Jacod and Sgiryaev [22].

Pham and Touzi [26] studied frictional markets with the transaction cost rates for purchasing and selling the securities, addressed the problem of characterization of no arbitrage opportunity (strict arbitrage-freeness) in the presence of transaction costs in a discrete-time financial model, and extended the fundamental theorem of asset pricing under a non-degeneracy assumption. We also study the first fundamental valuation theorems of asset pricing from frictionless security markets to frictional security markets in Sections 5, 6 and 7. However, our results are different from those in Pham and Touzi [26] in the following two aspects. (1) The definition of no arbitrage opportunity in Pham and Touzi [26] is different from our definition of strict arbitrage-freeness. (2) Our proofs of Theorems 3 and 4 are different from Pham and Touzi [26]. In fact, we provide the proof by using theory of functional analysis, while Pham and Touzi [26] applied stochastic analysis to prove their results. Therefore, our result works for more general space than theirs.

Frictional economies are fundamentally different from their frictionless counterparts. The theory of general economic equilibrium for frictional economies with incomplete financial markets should be studied. We make the first step by establishing the corresponding no-arbitrage (that is, strictly arbitrage-free) pricing theory. From the first fundamental valuation theorems of asset pricing in general state space with transaction costs we have obtained here, one may further study the corresponding existence of general equilibrium for frictional economy with infinite-dimensional commodity space and incomplete financial markets.

In Section 7, we proved the equivalent conditions (Proposition 4 and Theorem 4) of strictly arbitrage-free frictional market by using Definition 4’. There are some difference between Definitions 4 and 4’. In fact, we can obtain the following (weaker) results for strictly arbitrage-free frictional market as defined by Definition 4.

[Proposition] If the frictional market  is strictly arbitrage-free, then

is strictly arbitrage-free, then  and

and  intersect precisely at

intersect precisely at , that is,

, that is, .

.

[Theorem] If the The frictional market  is strictly arbitrage-free, then there exists a strictly positive functional

is strictly arbitrage-free, then there exists a strictly positive functional  satisfying

satisfying

The proofs of Proposition and Theorem are from the proofs of Proposition 4 and Theorem 4. Conversely, we can’t check the sufficiency. The proof of Theorem 4 holds, too. If

where  is a strictly positive vector, then, for any

is a strictly positive vector, then, for any ,

,

then

that is,

If any portfolio  of securities has a zero payoff

of securities has a zero payoff , then it has a positive total cost or gain

, then it has a positive total cost or gain  for the portfolio

for the portfolio , and a positive total cost or gain

, and a positive total cost or gain  for the portfolio

for the portfolio , thus

, thus

For any portfolio  of securities, we can’t obtain a zero total cost or gain

of securities, we can’t obtain a zero total cost or gain  when it has a zero payoff

when it has a zero payoff . That is to say, we can’t make sure that Definition 4 (2) holds. We can’t come to the conclusion that the frictional market

. That is to say, we can’t make sure that Definition 4 (2) holds. We can’t come to the conclusion that the frictional market  is strictly arbitrage-free in the sense of Definition 4.

is strictly arbitrage-free in the sense of Definition 4.

Funding

This work is supported by Social Sciences and Humanities Research Council of Canada (SSHRC Insight Development Grant Number: 430-2012-0698), National Natural Science Foundation of China (NSFC Grant Numbers: 70825003 and 71273271) Major Basic Research Plan of Renmin University of China (Grant Number: 14XNL001)

NOTES

*Corresponding author.