1. Introduction

Tax revenues are the major source of income for governments in financing public services as well as stimulating the economic growth of most developing countries [1] . In recent times, there have been growing concerns by taxpayers on the rapid surge in tax rates aimed at financing public debts and public services yet taxpayers seem not to reap the benefit attached to complying to taxes thus encouraging noncompliant behaviors from taxpayers. Noncompliant tax intentions leading to tax evasion renders a recess in the economic growth of most developing and emerging economies [2] . Noncompliant behaviors mainly due to unfairness in tax systems in most countries have caused a rise in the number of persons engaging in the underground economic thus posing incessant detrimental effect on the economic growth of both developing and emerging economies [1] . Despite numerous researches in calculating the actual size of the underground economy, such calculations have been futile on the basis that such calculations are only based on estimates. Due to this, most governments in developing countries are relentlessly putting out strategies to either eradicate or reduce the size of the underground economy to an appreciable level yet the underground economy is swelling in most developing countries. Most taxpayers’ exploits various loopholes in tax systems by employing techniques with the support of tax administrators thereby hindering the economic growth of most countries [3] .

Tax evasion affects various sectors of an economy and heaps adverse effect on an economy as a whole. Evasion of taxes tempers on the accuracy of microeconomic statistics thus leading to the misallocation of resources needed to stimulate the growth of an economy [4] . Additionally, the evasion of taxes alters the distribution of income in an arbitrary and erratic way [4] . Increment in the propensity to evade taxes renders most governments unable to deliver it obligations and responsibilities in terms of improvement in standard of living to its citizens. Several countries have experienced loss in tax revenues due to tax evasion. The United Kingdom estimates loss in tax revenues to be $21 billion per year [5] , Greece estimates showed loss in tax revenues to be $30 billion per year [6] . In developing countries, overall tax revenues loss due to tax evasion is estimated to $285 billion per year [7] . The noncompliant behaviors of citizens have forced most governments in raising tax revenues thereby heaping most burden on individuals with favorable compliance behaviors. However, increment in such burdens towards the few citizens complying to taxes may not be economically viable on the basis of moral issues as well as social and cultural characteristics [8] .

Governments’ annual budget and development plans have seemed to be sluggish due to tax evasion behaviors of taxpayers. A research from [1] shows the top ten countries severely affected by the evasion of taxes as well as tax evasion across continents. From Table 1, the continent mostly affected by the percentage of tax evasion to GDP is South America. With reference to Table 2: the country severely affected by tax evasion is Brazil because the tax evasion to GDP ratio is higher than the ten countries reported. The report is shown in Table 1 and Table 2.

In Ghana, one of the many problems facing tax administration is tax evasion [9] . Tax evasion is rampant due to lack of appropriate monitoring strategies in tracking tax revenues from tax officials and taxpayers. Several media platforms in Ghana headlines tax evasion as a massive hit in the Ghanaian economic. In 2012, an additional $36 million shipped abroad mostly to non-taxable offshore accounted on the blind side of tax authorities. In October 2013, a giant media platform known as peacefmonline reported

![]()

Table 1. Continental evasion of taxes.

Source: Ameyaw et al. (2015) The Effect of Personal Income Tax Evasion on Socio-Economic Development in Ghana: A Case Study of the Informal Sector. BJEMT, 10(4): 1 - 14, Article no. BJEMT.19267.

![]()

Table 2. The ten topmost countries affected by tax evasion.

Source: Ameyaw et al. (2015) The Effect of Personal Income Tax Evasion on Socio-Economic Development in Ghana: A Case Study of the Informal Sector. BJEMT, 10(4): 1-14, Article no. BJEMT.19267.

that the presidential taskforce uncovered over $367 million was lost to the state as a result of the tax evasion. In December 2014, it was reported that about $140 million in taxes were lost to the state in the mining sector alone between 2005 and 2007. Due to the massive airwave reports on tax evasion, trust issues have been a problem in combating the evasion of taxes in Ghana. Taxpayers are often of the view that tax officials hold the key to tax evasion by engaging in several corrupt practices such as issuing fake tax payment receipts to taxpayers etc. Aside the trust issues, there are several non-eco- nomic and economic factors affecting tax evasion in Ghana. Tax rates, tax burden, income level, tax audits, penalty, etc. are factors encouraging the evasion of taxes in Ghana [1] [10] . Therefore, it is important to investigate the determinants of tax evasion in Ghana.

2. Literature Review

Previous researches have cited many factors as the main determinant of tax evasion [11] [12] [13] [14] [15] . These factors include tax burden, income level, source of income, tax audits, tax rates, penalties, gender, marital status, public service, tax system, tax mentality and tax morale as the factors augmenting the evasion of taxes worldwide. Despite the numerous factors believed to impact the evasion of taxes, this research groups all these factors into four main factors believed to be the reasons for tax evasion in Ghana.

2.1. Taxation and Fiscal Factors

Tax rates have been widely recognized as the most primary determinant of tax evasion. Empirical evidence on the impact of tax rates and tax evasion have experienced varied results ranging from neutral effect to significantly positive and negative effect [16] . Irrespective of the results obtained by researchers, some studies have concluded that there exists a statistically significant positive effect of tax rates to tax evasion [11] [17] . The relationship between tax cuts and increment in tax rates in curbing tax evasion has attracted numerous researches around the world. The pioneering work of Allingham and Sandmo argues that tax cuts may broaden tax base and improve compliance behaviors of citizens. In furtherance, Allingham and Sandmo asserted that increment in tax rates will exert fear into taxpayers’ hence encouraging tax compliance. However, earlier research carried on after the pioneering work of Allingham and Sandmo stressed that tax rates increase will result in an increase propensity to evade taxes [18] [19] [20] . Additionally, [17] stressed that an upsurge in tax rates shifts the burden of tax payments to few individuals complying to taxes. He further asserted that such upsurge in tax rates will eventually compel taxpayers to adopt noncompliant behaviors hence affecting tax revenues needed to fund public expenditures.

2.2. Administrative Factors

Penalties for tax evasion widely accepted as a deterrence force to encourage taxpayers’ compliance. Thus, compliance to taxes can be improved when the monetary cost of tax evaders is raised. However, scholars argue that an increment in tax penalties beyond their required set limit is cost prohibitive due to probable “crowding out” of voluntary compliance [21] . Empirical evidence on the relationship between tax penalties and tax evasion also ranges from statically no effect to a significant effect. Spicer and Lundstedt in their work two decades ago asserted that there is no significant relationship existing amongst tax evasion, tax penalties and detection probability [22] . A similar research conducted by [11] captured no effects between tax evasion and tax penalties. Yet, a potential increment in penalties resulting from tax evasion connote a corresponding decrease in taxpayers’ potential tax-evading behaviors [23] . Tax audit have also seen a fair share of varied results from researchers. An increase in tax audits automatically minimizes the rate at which taxpayers evade taxes [11] . Similarly, [24] emphasized that an increase in tax audits results in an increase in tax evasion. In a study comparing the compliance behaviors of both audited and non-audited taxpayers, it was revealed that compliant behaviors of most audited taxpayers have reduced drastically [25] .

2.3. Economic Factors (Income Level and Income Components)

Income level fluctuations have had an impact on taxpayers evading behaviors. These fluctuations (higher income level and lower income level) have gingered many works. It is widely asserted that higher income level attracts higher compliance [11] whiles lower-income taxpayers connote lower compliance [26] . Aside such fluctuations in income levels and components, most literatures have based their findings on increment in income levels and it resulting increase in tax evasion behavior [27] . High income earners are expected to exhibit his wealth by complying to taxes whiles low income earners are expected to hide their actual income from tax officials. An argument made by [28] emphasized that income components is a major driving force in curbing tax evasion. In furtherance, [28] asserted that income source solely from wages and salaries minimizes tax evasion to an appreciable level. Nevertheless, works have also proven that there exists no statistically significant relationship between tax evasion and income [29] .

2.4. Demographic Factors (Gender, Age, Race and Education)

Demographic factors effect on tax evasion cannot be underestimated. On the count of gender, female taxpayers are male compliant than their male counterparts [30] . Evasion of taxes is more unacceptable behavior to female taxpayers than their male counterparts [31] . The emergence of more independent non-traditional generation seems to be lowering the compliance gap between male and female taxpayers. With respect to age, it is believed that the aging taxpayers tend to be more compliant than the younger taxpayers [30] . Younger taxpayers are more risk seeking and less sensitive to penalties. It is also argued that taxpayers who are 65 years and above comply more to taxes [15] . With regards to ethnicity, minimal research has been undertaken in accounting for the impact of ethnicity on tax compliance. With reference to race, white folks are more compliant done non-whites [32] but [33] argued that the results from [32] was found to have a distortive effect. The relationship between education and tax compliance have also attracted conflicting findings. Previous literatures have identified four measures of education in providing in-depth understanding about the misunderstandings surrounding the impact of educational variables on taxpayers’ compliance behaviors. This measures includes knowledge involving evasion opportunities, general educational attainment, specific tax knowledge and the general degree of fiscal knowledge [33] . Taxpayers level of education has a significant relationship with income level, perception of fairness in tax administration, sanction and detections thus encouraging evasion of taxes if not controlled [34] .

2.5. Literature Review Summary

In all, the literature reviews group the determinants of tax evasion as taxation and fiscal factors, Administrative factors, economic and demographic factors. Taxation and fiscal factor hinges on volatilities in tax rates and how it exerts burden on a taxpayers’ income. Administrative factors mainly focus on whether or not tax penalties and tax audits serves as a deterrence model for taxpayers. Economic factors pivot on how fluctuations in income level encourages or minimizes compliance to taxes. Finally, demographic factors center on how an individual affiliation to a certain demographic factor encourages compliance or non-compliance to taxes.

3. Methodology

In studying the factors influencing tax evasion behavior in Ghana, a survey was conducted in the ten (10) regional capitals of Ghana. Out of the 500 questionnaires submitted to 50 randomly selected taxpayers in each of the ten (10) regional capitals in Ghana, 432 questionnaires were retrieved from questioners. The sample comprised waged and salary earners working in various (public, private) institutions, and self- employed business owners. Questionnaires contained a total of thirty-three (33) questions. The questionnaires comprised two sections. The first section contained demographic characteristics of taxpayers and second sections contained statements relating to respondents’ tax evasion behavior. In the second section of the questionnaires, respondents were asked to rate the importance of each question using a five-point Likert scale ranging from strongly disagree to strongly agree with neutral scores amidst the two scores. Statistical Package for the Social Sciences (SPSS) and Microsoft excel tool packages was used to analyze data obtained from respondents. Data obtained from respondents was presented and analyzed using statistical techniques such as descriptive analysis, Factor Analysis and multiple regression analysis. Additionally, validity and reliability test was also conducted to confirm the strength of items on each construct.

3.1. Data Presentation and Analysis (Demographic and Factor Analysis)

Table 3 gives a report on the demographic variables. Of the sample in the study, 51.16% were males whiles the remaining 48.84% were female. On the count of age, almost half of the subjects (49.07%) were in the 20-40-year-old range. 42.82% fell within the age range of 41 - 60 whereas 8.10% were between 61 and above. With regards to occupation 54.36% were self-employed workers and the remaining 45.41% were wage and salaried workers. Regarding level of education, 37.96% of the respondents had a bachelor degree, 8.32% were postgraduates, 19.91% had primary school education, 16.66% had junior high school education and the remaining 17.13% had senior high education.

The Cronbach’s alpha test performed on the data revealed that all factors proposed to be influencing the evasion of taxes were all above 0.70 indicating a suitable level of internal consistency amongst the scale items. It can therefore be concluded that the measurement model’s reliability and validity was satisfactory (Table 4).

Kaiser-Meyer-Olkin (KMO) value of 0.784 shows that the sample is adequate for factor analysis. The Bartlett Test for Sphericity (BTS) reported a value of 3457.813 also confirms the adequacy in applying factor analysis in this work (Table 5).

Table 6 represents the total variance explained in the factor analysis. Orthogonal extraction with varimax was deemed appropriate because it was needed to minimize large number of variables to a minimum set of uncorrelated variables. Varimax rotation was purposely used to minimize variables with high factor loadings to augment interpretation of factors. With respect to the principal component analysis, five (5) factors reported an eigenvalue equal or greater than 1.0 which further explains a total variance of 73.202 percent.

Table 7 depicted that all loadings were significant ranging from 0.412 to 0.775 with p-values < 0.01.

3.2. Regression Analysis

Regression analysis is employed to determine the factors affecting tax evasion. After

![]()

Table 3. Demographic characteristics of respondents.

Source: Authors Field work.

![]()

Table 5. KMO and Bartlett’s Test of Sphericity Kaiser-Meyer-Olkin Measure of Sampling Adequacy 0.784.

![]()

Table 6. Total variance explained (extraction method: principal component analysis).

Other variables from 9 - 30 has initial Eigen values (total) change between 0.937 and 0.120.

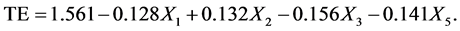

using the variables obtained from the factor analysis, gender, age and educational level were also included as independent. The regression equation is: TE= β0 + βi Xi + ε whereby Xi represents the predictor variables. These predictor variables include taxation and fiscal factors (X1), administrative factors (X2), economic factors (X3), gender (X4), age (X5) and educational level (X6). TE also represents the dependent variables and ε is the error term.

The results obtained from the coefficient table in Table 8 shows that taxation and fiscal, administrative, economic, demographic and educational level were all statistically significant with p-values < 0.005. Therefore, an increase in any of these factors will result in an increase in tax evasion because there exists a positive relationship between tax evasion and all the factors deemed significant in Table 8. Gender and age have negative relationship with tax evasion. The results from the regression analysis is consistent with the research conclusions made by [18] [19] [20] and [24] . The regression equation therefore becomes:

4. Conclusion and Recommendations

Tax evasion is imperative in promoting the economic growth of Ghana. There exists an enormous gap between the amount of taxes taxpayers owe to the Ghana Revenue Authority and the amount of taxes paid to the Ghana Revenue Authority. This gap has called for researches investigating into tax compliance behavior of taxpayers in Ghana. Several factors account for numerous behaviors in complying to taxes. The results showed that taxation and fiscal, administrative, economic, demographic and educational level are the main factors hindering tax compliance. Therefore, there is the need for governments, stakeholders and policy makers to come out with pragmatic measures to encourage tax compliance from taxpayers. Tax rates should also be reduced to enhance and boost revenue generation thereby increasing tax net in capturing many taxpayers into complying to taxes. The reduction in tax rates helps in shifting the burden of taxpayers from few individuals who perceives tax payment as an obligation bestowed

R2 = 0.714, F = 127.314 (prob. 0.000), Statistically significant at p = 0.05.

upon them. Tax penalties should also be conferred on individuals who fail to pay taxes. Based on this study, it is important that penalties conferred on taxpayers should be a fraction of the amount of income earned by taxpayers. By so doing, wealthy taxpayers will attract high penalties to themselves whiles poor taxpayers will also attract significant penalties deserved. Such policy will help in ensuring fairness in tax systems in order to encourage compliance behaviors. Furthermore, much attention should be geared towards educational level of taxpayers. Taxpayers with low educational background seem not to understand tax systems thereby rendering them unaware of tax payment processes and procedures. Changes in tax legislation should be communicated to citizens in their native languages to ensure total understanding of tax systems. Additionally, system loopholes and prevailing corruption must be dealt with accordingly in order to curb the deadweight loss of the economy. Finally, tax reforms processes should be integrated and consolidated with other macroeconomic reforms.