1. Introduction

Since the work of Black-Scholes in 1973 see [1] , the financial markets have expanded considerably and traded products are increasingly numerous and sophisticated. Most widespread of these products are the options. The basic options are the options to sell and purchase, respectively called put and call. If option can be exercised at any time until maturity, we speak about American option otherwise it is a European option.

The two researchers provide a method of evaluation of European options by solving a partial derivative equation called (black-Scholes’s equation). However, we cannot get explicit formula for pricing of American options, even the most simple. The formalization of the problem of pricing American options as variational inequality, and its discretization by numerical methods, appeared only rather tardily in the article of Jaillet, Lamberton and Lapeyre see [2] . A little later, the book of Wilmott, Dewynne and Howison see [3] has made it much more accessible the pricing by L.C.P from American Option problem. For the problems at free boundary several numerical results have been obtained for parabolic and elliptic variational and quasi-variational inequality see [4] -[8] .

For our part, we are interested to asymptotic behavior of V.I related to the American options problem. Where we adapted to our problem result obtained in [4] and we eliminated an additional factor . We discretize the space

. We discretize the space  by a space

by a space  constructed from polynomials of degree 1 and the time by θ- scheme. Subsequently, we demonstrated the error estimate between the continuous solution and the discrete solution of the problem given by:

constructed from polynomials of degree 1 and the time by θ- scheme. Subsequently, we demonstrated the error estimate between the continuous solution and the discrete solution of the problem given by:

For , we have

, we have

and for , we have

, we have

We used the uniform norm, because it is a realistic norm, which gives us the approximation described above and which enables us to locate the free boundary, a crucial thing in practice of the American options.

The paper is organized as follows. In Section 2, we give the problem of American options as a parabolic variational inequality. In Section 3, we discretize by the finite elements method and we deal the stability of θ-scheme for our V.I. In Section 4, we adapt to our problem results obtained for similar problems see ([7] [9] ) namely a contraction associated with our problem which allows us to define an algorithm of Bensoussan-Lions [10] . Finally, in Section 5, we establish the estimate of the asymptotic behavior of θ-scheme by the uniform norm for American options problem.

2. Formulation of American Options Problem as Variational Inequality

In this section, we recall the context of our problem (see [11] -[13] ). An American option is a contract which gives the right to receive the payoff  at some time

at some time , where

, where . This payoff is then given as a function of the prices

. This payoff is then given as a function of the prices  at the time t of n financial products constituting the underlying asset. Such as these prices are strictly positive, we set

at the time t of n financial products constituting the underlying asset. Such as these prices are strictly positive, we set

(1)

(1)

and we express the payoff under the form

(2)

(2)

where

(3)

(3)

is a given regular function.

We assume that the following stochastic differential equation is satisfied by the logarithmic transformation of the prices

(4)

(4)

where  is the interest rate,

is the interest rate,  is invertible Volatility matrix and

is invertible Volatility matrix and  is a standard ndimensional Brownian motion defined on a probability space

is a standard ndimensional Brownian motion defined on a probability space

The Continuous Problem

Under some assumptions on financial markets (no-arbitrage principle) see [2] [14] and the above assumptions one can prove, that  is a solution of the following parabolic inequality:

is a solution of the following parabolic inequality:

(5)

(5)

Now we will give the variational inequality related to American options problem in a more compact form, where we starts by giving new notations and imposed certain conditions.

By a change of variable , the problem (5) becomes:

, the problem (5) becomes:

Find  solution of

solution of

(6)

(6)

where K is a closed convex set defined as follows:

(7)

(7)

with

(8)

(8)

and  is a bounded smooth domain in

is a bounded smooth domain in , with boundary

, with boundary .

.

A is an operator defined over  by:

by:

(9)

(9)

and the coefficients:  where

where  and

and  are satisfy the following conditions:

are satisfy the following conditions:

(10)

(10)

(11)

(11)

(12)

(12)

f is a positive function.

For more detail on the parabolic inequality associated with American options problem (see [2] [13] [15] -[17] ).

We can reformulate the problem (6) to the following parabolic variational inequality:

(13)

(13)

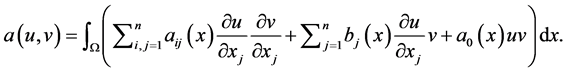

where  is a continuous bilinear form associated with operator A defined in (9). Namely,

is a continuous bilinear form associated with operator A defined in (9). Namely,

(14)

(14)

Theorem 1 (Cf. [10] ): If , the problem (13) has an unique solution

, the problem (13) has an unique solution  Moreover, one has

Moreover, one has

(15)

(15)

3. Study of the Discrete Problem

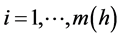

We decomposed  into triangles and let

into triangles and let  denotes the set of all those elements, where

denotes the set of all those elements, where  is the mesh size. We assume that the family

is the mesh size. We assume that the family  is regular and quasi uniform. Let

is regular and quasi uniform. Let  denote the standard piecewise linear finite element space, and

denote the standard piecewise linear finite element space, and  be the matrix with generic coefficients

be the matrix with generic coefficients  where

where ,

,  , are the basis function of the space

, are the basis function of the space , defined by

, defined by  where

where  is a vertex of the considered triangulation.

is a vertex of the considered triangulation.

We introduce the following discrete spaces  of finite element constructed from polynomials of degree 1:

of finite element constructed from polynomials of degree 1:

(16)

(16)

and

(17)

(17)

We consider rh be the usual interpolation operator defined by:

(18)

(18)

The discrete maximum principle assumption (d.m.p): We assume that the matrix  defined above is an M-matrix (Cf. [18] ).

defined above is an M-matrix (Cf. [18] ).

Theorem 2 (Cf. [19] ): Let us assume that the bilinear form  is weakly coercive in

is weakly coercive in  there exists two constants

there exists two constants  and

and  such that

such that

(19)

(19)

Notation:

3.1. Discretization

We discretize the space  by a space discretization of finite dimensional

by a space discretization of finite dimensional  constructed from polynomials of degree 1 and for the regularity of the solution see [20] . In a second step, we discretize the problem with respect to time using the θ-scheme. Therefore, we search a sequence of elements

constructed from polynomials of degree 1 and for the regularity of the solution see [20] . In a second step, we discretize the problem with respect to time using the θ-scheme. Therefore, we search a sequence of elements  which approaches

which approaches , with initial data

, with initial data

We apply the finite element method to approximate inequality (13), and the semi-discrete P.V.I takes the form of

(20)

(20)

Now, we apply the θ-scheme on the semi-discrete problem (20); for any  and

and , we have for

, we have for

(21)

(21)

where

(22)

(22)

(23)

(23)

We have  that is admissible because

that is admissible because

Thus we can rewrite (21) as: for  and

and

(24)

(24)

Thus, our problem (24) is equivalent to the following coercive discrete elliptic variational inequality:

(25)

(25)

Such that

(26)

(26)

3.2. Stability Analysis of θ-Scheme for the P.V.I

The study of the stability of θ-scheme for the American options problem is adapted to [4] .

It is possible to analyze stabilitytaking advantage of the structure of eigenvalues of the bilinear form  and wecall that W is compactly embedded in

and wecall that W is compactly embedded in  since

since  is bounded.

is bounded.

Let  the eigenvectors of

the eigenvectors of  form a complete orthonormal basis of

form a complete orthonormal basis of  in the finite dimensional problem. At each time step

in the finite dimensional problem. At each time step , can be expressed

, can be expressed  as well:

as well:

Moreover, let  be the

be the  -orthogonal projection of

-orthogonal projection of  into

into , that is,

, that is,  , one has

, one has

We are now in a position to prove the stability for , choosing in (21)

, choosing in (21) , thus we have for

, thus we have for

(27)

(27)

For each , the inequalities (27) is equivalent to

, the inequalities (27) is equivalent to

(28)

(28)

Since  are the eigenfunctions means

are the eigenfunctions means

(29)

(29)

If one solves relative to , we find:

, we find:

(30)

(30)

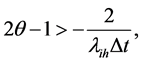

This inequality system stable if and only if

(31)

(31)

that is to say

(32)

(32)

means

(33)

(33)

So that this relation satisfied for all the eigenvalues  of the bilinear form

of the bilinear form , we have to choose their highest value, we take it for

, we have to choose their highest value, we take it for

Lemma 1 (Cf. [4] ):

For  the θ-scheme way is stable unconditionally i.e., stable

the θ-scheme way is stable unconditionally i.e., stable

And if  the θ-scheme is stable unless

the θ-scheme is stable unless

(34)

(34)

With

(35)

(35)

(spectral radius of

(spectral radius of ).

).

Notice that this condition is always satisfied if . Hence, taking the absolute value of (30), we have

. Hence, taking the absolute value of (30), we have

(36)

(36)

also we deduce that

(37)

(37)

Remark 1 (Cf. [4] ):

We assume that the coerciveness assumption (19) is satisfied with , and for each

, and for each , we find

, we find

(38)

(38)

where

4. Existence and Uniqueness for Discrete P.V.I

We consider that  and

and  are respectively the stationary solutions of the following continue and discrete inequalities:

are respectively the stationary solutions of the following continue and discrete inequalities:

(39)

(39)

(40)

(40)

where the bilinear form  satisfies the coercivity condition.

satisfies the coercivity condition.

Theorem 3 (Cf. [9] ): Under the previous assumptions, and the maximum principle, there exists a constant C independent of h such that

4.1. A Fixed Point Mapping Associated with Discrete Problem

We consider the mapping

(41)

(41)

where  is the unique solution of the following discrete coercive V.I: find

is the unique solution of the following discrete coercive V.I: find

Lemma 2 (Cf. [6] ): Under the d.m.p we have if  then

then

Proposition 1: Under the previous hypotheses and notations, if we set , the mapping

, the mapping  is a contraction in

is a contraction in , i.e.,

, i.e.,

(42)

(42)

Therefore, Th admits a unique fixed point, which coincides with the solution of discrete coercive V.I (25).

Proof: For  and

and , we consider

, we consider  (respectively,

(respectively,  solution to discrete coercive variational inequality (25) with right-hand side

solution to discrete coercive variational inequality (25) with right-hand side  (respectively

(respectively ).

).

Now, set

Since,

(because ).

).

So using Lemma 2 gives

On the other hand, one has

Indeed,  is solution of

is solution of

thus

Therefore

Similarly, interchanging the roles of  and

and  we also get

we also get

Consequently,

which is the desired result.

Remark 2: If we set , the mapping

, the mapping  is a contraction in

is a contraction in , i.e.,

, i.e.,

(43)

(43)

Therefore,  admits a unique fixed point, which coincides with the solution of discrete coercive V.I (25).

admits a unique fixed point, which coincides with the solution of discrete coercive V.I (25).

Proof: Under condition of stability, we have shown the θ-scheme is stable if and only if  thus it can be easily show that

thus it can be easily show that

also it can be found that

which is the desired result.

4.2. Iterative Discrete Algorithm

We choose  as the solution of the following discrete equation

as the solution of the following discrete equation

(44)

(44)

where  is a regular function given.

is a regular function given.

Now we give our following discrete algorithm

(45)

(45)

where  is the solution of the problem (25).

is the solution of the problem (25).

Remark 3 cf. [7] : If we choose  in (45) we get Bensoussan’s algorithm.

in (45) we get Bensoussan’s algorithm.

Proposition 2: Under the previous hypotheses and notations, we have the following estimate of convergence

(46)

(46)

And if

(47)

(47)

Proof: We set a first case , and we have

, and we have

We assume that

so

thus

For a second case  one can easily show that

one can easily show that

which is the desired result.

5. Asymptotic Behavior

This section is devoted to the proof of principal result of the present paper, where we prove the theorem of the asymptotic behavior in  -norm for parabolic variational inequalities.

-norm for parabolic variational inequalities.

Now, we evaluate the variation in  between

between , the discrete solution calculated at the moment

, the discrete solution calculated at the moment  and

and , the continuous solution of (39).

, the continuous solution of (39).

Theorem 4: (The principal result). Under conditions of Theorem (3) and Proposition (2), we have for the first case

(48)

(48)

and for the second case

(49)

(49)

where C is a constant independent of h and k.

Proof: We have

thus

Then

Using the Theorem (3) and the Proposition (2), we have for

and for  we have

we have

6. Perspective

In the following, we will consolidate our theoretical results by numerical simulation, which allows us to locate the free boundary, a very interesting thing in practice to calculate the price of the American options.

Acknowledgements

The authors would like to thank the editor and referees for her/his careful reading and relevant remarks which permit them to improve the paper.