Joint Decision of Pricing and Cross-Ruff Coupon Value under Substitute (Complement) Demand ()

1. Introduction

Coupon is a very typical method of promotion widely used by manufacturers and retailers. Coupons are superior to direct discount for the commodity price, because direct price discount will affect consumers’ price expectations or form price discrimination in the market. According to the report issued by Marketing Services Company of NCH Group, coupon is the most powerful method to stimulate demand and encourage customers to try new brands. The report points out that in the case of issuing coupons, 27.2% customers who originally planned to buy other brands will decide to replace the brand temporarily, 64.3% customers who have no specific brand purchase plan will change the brand. There are many types of coupons, which are widely applied in practice or discussed among theoretical workers, such as direct mail coupons [1- 3], coupons published in newspaper or magazine [4,5], and package coupons [6].

This study will mainly focus on the Cross-ruff Coupon. Cross-ruff Coupon refers to this kind of coupons, which consumers get another assigned product or brand discount coupons during the purchase process of a particular brand or product, resulting in the purchase of the assigned product/brand can get a discount. For example, a customer enters a beverage store to buy a bottle of Diet Coke (a Coca Cola Company’s low-calorie cola soft drinks), at the same time, he received a Diet Sprite (a Coca Cola Company’s low calorie lemon flavored soft drinks) discount coupons. This coupon gives an advantage in the linkage between different brands/products consumers purchase activity. During September 28, 2008 to January 3, 2009, HP Company has provided coupons of type DJ D1560, DJ D1455 and DJ D4360 printers for purchasers who buy any type of HP notebook or desktop computers.

In order to the convenience of description, we define brand/product which issues coupons as Carrier Brand, and define promotion brand/product as Target Brand. According to the survey, cross coupon acceptance ratio is the double of coupons published in newspaper. The academic community’ study on coupons mainly focuses on the influence on the choice of general coupons [2,6,7], influence on consumer behavior [8], the influence on social welfare [9] etc. However, cross coupons is different from direct mail coupons, coupons published in newspaper or magazine, consumers buy other products when they accept cross coupons, so it links different buy behavior. Cross coupons is also different from package coupons, the later can only make consumers buy the same product, cross coupons achieve the aim that promote another product (i.e. target brand) by purchasing one brand product (i.e. carrier brand). Therefore, research model related to these types of coupons will be not suitable to cross coupons. Some researchers also studied on cross coupons, such as Dhar and Raju [10], they studied on the influences of cross coupons on customer choice behavior, got the condition to improve sales and profits, and further give the management implications to select suitable carrier brand and target brand. While this study only analyzed the influence degree of issuing coupons, didn’t solve such questions as the optimal coupon value, and how to determine the price of products of carrier brand and target brands respectively. Therefore, this paper will focus on resolving joint decision of pricing and cross-ruff coupon value under substitute (complement) demand conditions based on the literatures.

2. Analysis for Decision Model

Raju [6] proposed that there are different distribution forms when enterprise issues coupons with product package, according to cost, product characteristics, policy constraints and other actual conditions, including In-Pack coupons, which is packaged within the package, and OnPack coupons, which is printed or pasted on the outer package. Accordingly, this paper will mainly constructs two kinds of models, i.e. optimal decision model for crossruff coupons within the package and cross-ruff coupons printed or pasted on the package. In order to the concision for writing, the following use “IPC coupons” instead of coupons which is packaged within the package, and use “OPC coupons” instead of coupons which is printed or pasted on the outer package. The desired symbol is defined as follows:

D = |

Demand for product |

P = |

Price of product unit |

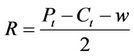

R = |

Value of Cross-ruff Coupon |

C = |

Cost of product unit |

w = |

Cost of acceptance of coupon unit |

π = |

Profit of enterprise |

In the process of building model, we use subscript c represent carrier brand, use t represent target brand, use s represent demand condition, use m represent the demand is complementary, use d represent the demand is independent. And as for all symbols “±” or “ ”, the upper part represents demand for substitutive conditions, the lower part represents demand for complementary conditions, such as “±” represent that when the demand for carrier brand and target brand demand is substitutive, we take “+”; when the demand for them is complementary, we take “–”. Firstly, we develop and analyze the IPC coupons optimal value decision model, and then, we give the same process of OPC coupons.

”, the upper part represents demand for substitutive conditions, the lower part represents demand for complementary conditions, such as “±” represent that when the demand for carrier brand and target brand demand is substitutive, we take “+”; when the demand for them is complementary, we take “–”. Firstly, we develop and analyze the IPC coupons optimal value decision model, and then, we give the same process of OPC coupons.

2.1. IPC Coupons

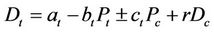

Assume that the demand is linear function, due to the substitutive (complementary) relationship between two products demand, the change of one product’s a price will affect the demand for another product. At the same time, according to the definition of IPC coupon, we know that at the time of purchase, customers do not know whether there are coupons in the package, only when the purchase completed and the package is opened, they find coupons and determine whether exchange. So this kind of coupons has no effect on the needs of carrier brand no effect, it can only affects the demand for target brand. Therefore, the demand function of carrier brand and target brand can be expressed as follows respectively.

,

,

Among them, Dc represents the demand of carrier brand, Dt represents the demand of target brand, ac, bc, cc, at, bt, ct are parameters of demand function of carrier brand and target brand. r represents the acceptance rate of coupons, it is determined by the relative size of coupon value and reference price P0, and P0 is the maximum value of coupons when there is 100% coupon acceptance ratio, function form as follows [11]:

Profit function of enterprise can be represented as follows:

(1)

(1)

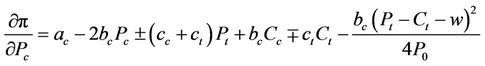

The first order partial derivative of profit function with respect to variable R can be represented as follows:

(2)

(2)

Appoint Equation (2) is equal to zero, we can get

(3)

(3)

Take Equation (3) into Equation (1), the first order partial derivative of profit function with respect to Pc, Pt can be represented as follows respectively:

(4)

(4)

(5)

(5)

Further get Hessian Matrices of profit function to Pc and Pt:

(6)

(6)

The first and second order principle which can judge the characteristic of H is D1 and D2 respectively, and ,

,

.

.

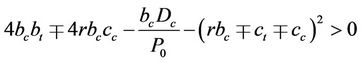

As a concave function, profit function π ask , and

, and , if

, if

Simplified it, condition (7) can be obtained

(7)

(7)

Because , by a validated numerical experiments indication,condition (7) is true at actual situation of enterprise operation.

, by a validated numerical experiments indication,condition (7) is true at actual situation of enterprise operation.

Let (4), (5) are equal to zero, dissolve the equation system, we can get:

1) Under the substitutive conditions, the optimal product price of carrier brand and target brand  and

and  are

are

(8)

(8)

(9)

(9)

2) Under the complementary conditions, the optimal product price of carrier brand and target brand  and

and  are

are

(10)

(10)

(11)

(11)

Let ,

,  , the optimal product price of carrier brand and target brand under independent condition

, the optimal product price of carrier brand and target brand under independent condition  and

and  are

are

(12)

(12)

(13)

(13)

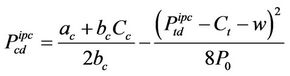

Take the optimal price of target brand  into (3), the optimal value of IPC coupons

into (3), the optimal value of IPC coupons  can be obtained.

can be obtained.

Compare expressions (8)-(13), such conclusion can be educed:

Conclusion 1: When IPC coupons are issued,the optimal price of carrier brand and target brand, the value of coupons is higher at the condition of substitutive than that of complementary, that is,  , and

, and .

.

2.2. OPC Coupons

According to the definition of OPC coupons, customers have known that there are coupons when they buy one product. So this kind of coupons can not only excite customers to buy the carrier brand/product, but also inspire them to buy the target brand/product, namely, there are influence on the demand for the two type of brands. The demand function of carrier brand and target brand can be represented as follows respectively.

,

,

The profit function of enterprise is

(14)

(14)

Further changes to

(15)

(15)

Lemma: the enterprise profit is optimal, if and only if

(16)

(16)

The prove method refer Khouja [11].

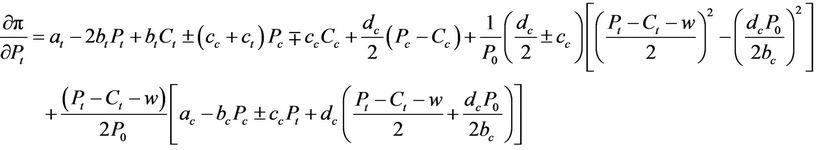

Take (16) into profit function (15), the first order partial derivative of profit function with respect to variable Pc and Pt, we can get

(17)

(17)

(18)

(18)

Further get Hessian Matrices of profit function to Pc and Pt :

(19)

(19)

The first and second order principle which can judge the characteristic of H is D1 and D2 respectively, and ,

,

.

.

when  and

and , profit function π is concave function. So, profit function is concave function, if

, profit function π is concave function. So, profit function is concave function, if

(20)

(20)

By a validated numerical experiments indication, condition (20) is true at actual situation of enterprise operation.

Let (17) (18) are equal to zero, dissolve the equation systems, we can get 1) Under the substitutive conditions, the optimal product price of carrier brand and target brand  and

and  can be represented as follows:

can be represented as follows:

(21)

(21)

(22)

(22)

2) Under the complementary conditions, the optimal product price of carrier brand and target brand  and

and  can be represented as follows:

can be represented as follows:

(23)

(23)

(24)

(24)

Let Cc, Ct, the optimal product price of carrier brand and target brand under independent condition  and

and  are

are

(25)

(25)

(26)

(26)

Take the optimal price of target brand  into (16), the optimal value of OPC coupons

into (16), the optimal value of OPC coupons  can be obtained.

can be obtained.

Compare expressions (21)-(26), such conclusion can be educed:

Conclusion 2: When OPC coupons are issued, the optimal price of carrier brand and target brand, the value of coupons is higher at the condition of substitutive than that of complementary, that is,

,

, .

.

If there is no coupon to issue, the optimal price of two kinds of products can be represented as follows respectively

(27)

(27)

(28)

(28)

Next, we can further analyze the concrete decision process for IPC and OPC coupons by numerical exam- ples, and validate the conclusions educed above.

3. Numerical Examples

Assume that the demand function of carrier brand is , demand function of target brand is

, demand function of target brand is

.

.

Unit cost of carrier brand , Unit cost of target brand

, Unit cost of target brand , cost of acceptance of coupon unit

, cost of acceptance of coupon unit , and the ratio of customer exchange coupons is a linear function of the value of coupons, reference price

, and the ratio of customer exchange coupons is a linear function of the value of coupons, reference price . When enterprise does not issue coupons, namely

. When enterprise does not issue coupons, namely , the optimal value of two brands are

, the optimal value of two brands are

and

and  the maximum enterprise profit

the maximum enterprise profit

;

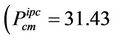

; .If enterprise issue coupons, but coupons does not affect the demand of carrier brand, namely IPC coupons,

.If enterprise issue coupons, but coupons does not affect the demand of carrier brand, namely IPC coupons,  , then the optimal price of two brands are

, then the optimal price of two brands are

;

;  and

and

;

;

, the optimal value of coupons is

, the optimal value of coupons is

;

; , the maximum enterprise profits

, the maximum enterprise profits

;

;

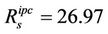

. Conspicuously, the profit is bigger when enterprise issue coupons than that of don’t issue. When coupons has effect on the demand of carrier brand, namely OPC coupons, let

. Conspicuously, the profit is bigger when enterprise issue coupons than that of don’t issue. When coupons has effect on the demand of carrier brand, namely OPC coupons, let , then the optimal price of two brands are

, then the optimal price of two brands are

;

;  and

and

;

; ,the optimal value of coupons is

,the optimal value of coupons is

;

; , the maximum enterprise profits

, the maximum enterprise profits

;

; , Conspicuously, the profit is bigger when enterprise issue coupons than that of don’t issue, and is higher than that of issuing IPC coupons, the above rate is about 44.58%.

, Conspicuously, the profit is bigger when enterprise issue coupons than that of don’t issue, and is higher than that of issuing IPC coupons, the above rate is about 44.58%.

From the research results, we can see when enterprises use cross ruff coupons for promotions, the stronger the substitution between the target brand and carrier brand, the bigger the enterprise profit is, and the promotion effect is better. Conversely, the stronger the complementary the selected brand, the smaller the enterprise profit increment is, and the promotional effect is worse.

4. Conclusions

According to the enterprise management reality, i.e. during the sales process of best-selling products or mature product, enterprises often choose to release coupons to promote the unsalable goods or new product, this paper studied the determination problems of coupons value and product price. Through the construction of joint decision model for two most common cross-ruff coupons (IPC and OPC coupons) value and product price, analyzed the optimal coupon value and the optimal carrier brand and target brand product pricing strategies under different demand structure (substitutive, complementary, independent). According to the related strategy, this paper put forward the management implications for the choice of associated brand when enterprise chooses coupons to sales promotion, i.e. enterprise should choose the brands pair which have strong demand substitution as carrier brand and target brand as far as possible, while minimize the needs complementary between associated brands.