Covid-19 Impacts on the Public Policy and Budget Process on Executive Decision in the United States of America ()

1. Introduction

The federal government’s fiscal year has conventionally anchored on realizing sound social, economic, and political goals. According to the Center on Budget and Policy Priorities (2020) , spending priorities are enlisted through the federal budget process, with the expenditure and overall deficits determined. The executive historically proposes an annual budget that comprehensively captures the administration’s priorities. Then, the proposition is presented to Congress, where debates are made on how the priorities should be realigned. Due to competing priorities, the federal budgeting and policy formulation process is quite contentious. The Covid-19 pandemic, however, created a promising avenue for the prompt meeting of minds and realigning of the enlisted goals (Center on Budget and Policy Priorities, 2020) .

The impacts of the Covid-19 pandemic on the budgeting and overall policy formulation process were extensive. The reduction in revenue meant colossal budget deficits for the federal policy implementation. During the pandemic, extensive compromise and consensus were reached due to the vast economic and social interruptions. The challenges projected by the pandemic were comprehensive to the overall budgeting and policy formulation processes (Dzigbede et al., 2020) . For instance, tax deferrals affected federal revenues, resulting in the utilization of the reserves. Economically, the pandemic forced companies to begin layoffs, affecting the accumulated gains. Socially, the need for social distancing and the overall demand for protecting vulnerable populations projected another challenge.

Conventionally, public policies and budgeting was focused on creating an enabling environment for the stakeholders at play. Executive decisions, as such, highlighted an extensive desire to cushion the economic, social, and political interplays from the adverse effects of the pandemic (Hafiz et al., 2020) . The fiscal impacts in terms of overall federal budget deficits were extensive. Progressively, conventional federal budgeting processes were realigned to cater to families, paychecks, and comprehensive Medicare programs.

Executive decision-making within the United States of America (USA) is subject to political affiliation and the administration’s interests (Bulger et al., 1995) . Specifically, executive decisions of the Republican and Democrat candidates stipulate vast differences in the approach to the pandemic. Furthermore, federal budget cycles within the USA are four main stages. These include agency planning, budget reviews, congressional appropriation cycles, and budget execution. Indeed, Covid-19 impacted the public policy and budget processes while fine-tuning executive decision-making.

Background of Study

Accordingly, in their research findings, Vlasov and Barkova (2021) noted that the Covid-19 pandemic extensively impacted global social, economic, and political processes. Globally, heterogeneity in public policy practices has created a lacuna in the overall understanding of their potential impact. However, public policy relies on science and evidence-based practices for implementation. With the extensive spread of the virus, companies and borders quickly closed down to prevent further dam. The loss of lives and deteriorating health stalled economies across the globe, with lockdowns becoming necessary (Alcántara-Ayala et al., 2021) . Quickly, government processes were altered to prevent further loss of lives and the massive economic gains accumulated in the previous fiscal years. In the short and long term, public policies and budgets began being realigned to capture ways to provide income for citizens while quickly financing healthcare priorities for vaccine production.

Subject to an election, public administrators assume offices with a keen goal of implementing their manifestos. Historically, the executive and Congress have been subject to administration priorities at loggerheads. Essentially, numerous members of Congress revert the propositions citing different priorities hence the complexity in decision making. However, the Covid-19 impact forced the executive and Congress to collaborate in decision-making (Herbert & Marquette, 2021) . As a result, public policy and budgeting alterations were salient with the receding economic gains and loss of livelihood for countless US citizens.

Federal budgeting exemplifies its understanding of how much money to spend on activities and the funds that will be raised (Elson & Cagatay, 2000) . The role of the executive within the budgeting process remains entirely overlapping since such authorities were explicitly mandated to Congress. The remaining salient importance, public budgeting is vital for the sustenance of economic, societal, and even political models. According to Chen and Li (2021) , sound public policies and budgets are exemplary in triggering countries toward a proper recovery plan strong in fighting the pandemic.

It is discernible that the Covid-19 pandemic has ravaged economies while realigning every aspect of public policy and budgeting. Executive decisions were quickly aligned towards response budgets for the pandemic lest the loss of life became extensive. However, the loss of jobs and company closures lead to budget deficits requiring another sound executive intervention. Therefore, there is a need to understand the standard procedures of public policy and budgeting processes and their laden realignment due to the Covid-19 pandemic.

2. Research Questions

The general research question examined the impact Covid-19 had on public policy and budget processes in executive decision-making. Specifically, the paper aimed to answer the following questions:

1) What are the fiscal impacts of the Covid-19 pandemic regarding federal budgeting?

2) What impacts of the Covid-19 pandemic on the public policy and budgeting processes?

3) How did executive decision-making align public policy and budgeting to mitigate Covid-19 impacts?

Significance of Study

The research demonstrates a new understanding of the Covid-19 pandemic regarding executive decision-making. It is discernible that the Covid-19 pandemic shifted public policy and budgeting processes towards mitigation strategies such as prioritizing healthcare. However, the executive decision-making variable brings extensive insight into such an approach choice. The study presents a new frontier of knowledge on how changes in executives and their underlying decision-making mitigate pandemics and their overall impacts.

3. Literature Review

3.1. Background of Study

The literature review section examines various theoretical underpinnings and empirical studies influencing public policy and budgeting. The literature review will explore the impacts of the Covid-19 pandemic and assess public policy and budget processes while examining the underlying decision-making processes. First, previous scholarly work was reviewed on budget deficits, cycles, investment recovery strategies, and evaluating policy effectiveness. A theoretical framework was designed to map an impetus of the public policy and budgeting processes. Finally, a conceptual framework was drawn to map the researchers’ understanding of the topic.

3.2. The Public Policy and Budgeting Processes

Therefore, in his research findings, Diamond (2013) outlines that public policy formulation is a contentious issue within the USA, amassing colossal breakdowns and differences in opinion. Therefore, policy formulation and laden budgeting processes are salient. New public administration models lean towards the community’s involvement through participatory policy formulation and budgeting. These are extensive procedures for realizing sound policies and leveraging resources for economic benefits for everyone.

The federal budgeting processes within the USA derive from two main statutes. These include the executive branch budgeting (Budget and Accounting Act of 1921) and the congressional budget process act of 1974. Sound public policy formulation is deeply rooted in enhancing societal equality, fairness, and cohesion. Policies should capture areas of interest for the general public, not specific populations. The executive’s influence within the policy formulation processes is preliminary within the USA. The federal government sets the tone of the policy formulation process by creating its annual budget. Federal funding is a comprehensive statement of the administration’s priorities in boosting the nation’s economy.

The presidential budget formulation encompasses two essential stages. These include the agency planning and the Office of Management and budget review. The two processes are exemplary since federal units begin their internal budget planning (Govinfo, 2022) . The agency budget process intensively captures policies through bottom-up connotations and top-down monitoring. During the process, the President’s policy preferences are incorporated within the budget proposition and examined through an information-intensive activity (Govinfo, 2022) . The final document moves to the Office of Management and Budget review, which captures which projects and policies the administration will prioritize over others. Federal agencies feeling dissatisfied can appeal the decisions and rulings made by the office.

The executive’s role is to offer a budget request submitted to Congress. Congress’s role in budgeting is exemplary since they approve the funding (Meyers & Rubin, 2011) . The President’s proposition is met with a Congress appropriation subject to an extensive review. Two main processes trigger the Congressional review. First, the President delivers a budget speech followed by a Congressional Budget Office economic and overall fiscal outlook to help with policy assessment (Meyers & Rubin, 2011) . The resumption of the Congressional Appropriations cycles berths on the passage of the annual budget resolution. The resolution sets a bar for the funding decisions of the company.

The appropriations committee’s action follows the Congressional Appropriation Cycle. First, the appropriation committees create subcommittees dependent on the different specializations of the members. Then, they begin to hold a hearing on the President’s budget for each bill proposed. Once each bill has passed through the appropriations chamber committee, it’s subjected to a hearing by the full chamber (Shepsle et al., 2009) . Finally, after the legislation passed through both houses of Congress, differences between the versions are discussed and presented to the President for signing.

3.3. Evaluating the Effectiveness of Policies

Public policies amass colossal use of resources within the various chosen strategies and overall designs. With clear objectives in place, public policies are subject to extensive scrutiny seeking to examine whether they work or not (Güner et al., 2021) .

Through proper monitoring and evaluation, public policies should amass vast applicability to influence change within the economic, social, and political structures. Moreover, by understanding public policies’ effectiveness, their laden implementation structures can be ascertained, and prevention of failure mitigated.

Effective policies are less complex and have clear objectives. According to Güner et al. (2021) , policy effectiveness is deeply embedded in the laden ability of stakeholders to understand what is required of them. Complex policies create misunderstandings between federal agencies and Congress, reducing their implementation and passing. Effective policies are easier to understand and resonate with the needs of every party involved, from the executive to Congress.

Evaluating policy effectiveness is vital within the public domain since massive resources are at stake. However, public policy evaluation is complex since it entails multiple considerations (Hanberger, 2001) . First, the effectiveness failure of a project encompasses a range of technical and institutional factors. For example, public policy failures could indicate underlying issues such as procedural ineffectiveness or even the failure of goal determination. Second, since the chosen public policies involve considerable resources and people at stake, governments must consistently evaluate their policies to ensure extensive benefits for the public.

Research findings show that effective public policies rely on extensive data and statistics. Public policies depending on numbers, are more accessible than those with no numbers. With the administration’s interest in mind, public policies created by federal agencies are primarily one-sided. Effective policies have objectives that make them measurable. Public policy becomes easier to monitor and evaluate through such an aspect. Another crucial element in assessing the procedure’s effectiveness is the overall public benefits.

Effective public policies hoard extensive benefits for the communities at large. The policy adoption amasses total confidence among people that the project will reap the required results (King & Rebelo, 1990) . Moreover, when the policy targets are realized, massive community changes are visible through the lens of cost, quality, and even complexity.

3.4. Impacts of Covid-19 on the Public Administration and Public Budgeting Process

The Covid-19 pandemic has questioned every conventional economic, social, and political model. Once the pandemic occurred, public policies were realigned to capture recovery measures. Vigorous measures were put in place to safeguard the livelihoods of US citizens. Unfortunately, numerous US citizens died (Weinberger et al., 2020) . In addition, many individuals were affected economically, devasting their lives.

3.5. Revenue Reduction

A significant effect of the pandemic was revenue reduction. Tax deferrals reduced the nation’s budget extensively, posing an extensive threat to achieving the projected goals. Substantial budget reductions meant that the conventional objectives could not be captured within the previous projected goals and objectives (Chernick et al., 2020) . Budget reductions were because the Covid-19 pandemic led to a massive company closure and loss of jobs.

Though the Covid-19 pandemic brought about adverse effects, it also helped bridge the existing gap. During this time, the masses of individuals developed and produced countless great living ideas. Technology in business was advanced, and many pictures were living and surviving individuals were set. For Covid-19, all these innovations and great ideas could still be idle and never utilized.

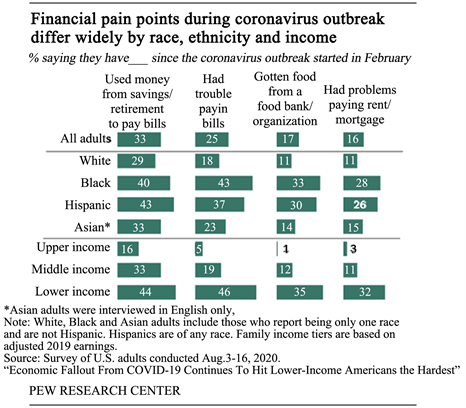

Among the notable effects that occurred and led to significant public policy and budgeting is the loss of jobs. Numerous US citizens lost jobs; therefore, substantial revenue to the USG was lost (Coibion et al., 2020) . Furthermore, the loss resulted from a multitude of individuals not working; such a reduction in employment meant a lower revenue for the government and high expenditure due to the massive need to take care of vulnerable families. In addition, executive decision-making could have been more balanced since previous government priorities were forced to be abandoned in the face of the threat (see Appendix A).

3.6. Changing Budgeting Priorities

Before Covid-19, the projected spending on healthcare services was 17.8% of the total government budget (Stasha, 2022) . However, after Covid-19, the projected spending on the health sector rose steadily to 19.4% and is expected to remain until 2027 (Stasha, 2022) . It is also noteworthy that the increased budget allocation on health calls for more resources in the budget allocation (Sen-Crowe et al., 2020) . Therefore, the demand placed much pressure on public policy and budgeting to ensure that the health sector is allocated the optimal share without adversely affecting other sectors.

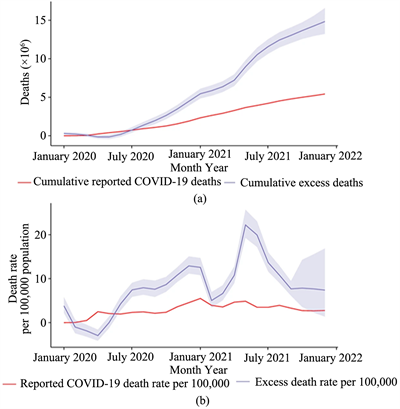

The healthcare sector received massive capital injections to help develop vaccinations. The appropriations committee would have ordered a redirection of funds towards other avenues. The Covid-19 pandemic led to an extended need to cushion the public from the adverse effects of healthcare investment. Covid-19 brought a higher mortality rate in the USA. From April, the rates were exceedingly high compared to the year’s initial months before the pandemic’s beginning. Since the pandemic’s start, the number of deaths has been remarkably high, and the government has had to invest more in the health sector to curb or reduce the casualties. The pandemic disrupted the budget allocation and the executive decision on what to do. Various industries had to cut spending to save more for the health rate to cater to rising fatality rates (Weinberger et al., 2020) . The pandemic also brought the most significant economic recession witnessed countless years ago.

3.7. Fastening of Public Budget Processes in Creating Covid-19 Policies

Public budgeting processes take colossal periods in meeting minds between Congress and federal agencies. Policies are usually based on facts, and Covid-19 was not an exception. The policymakers would analyze the pandemic’s damage, the available resources, and the implication of that policy (Butler & Higashi, 2022) . Data analysis methods were used during the pandemic, including inductive thematic analysis. The guidelines were primarily created to mitigate Covid-19 issues. Before adopting similar policies, the following challenges were encountered in comparing different approaches and their short-term effects on the general population.

Lack of a reputable source of information refers to a situation whereby various credible sources contradict information about the same thing. For instance, according to OWID, an accredited data information source, China already had twenty-seven confirmed Covid-19 cases as of 31 December 2019. However, according to the World Health Organization (WHO), China reported the first case of Covid-19 in January 2020, which contradicted the validity of China’s initial report in 2019 and the honesty of the WHO. Research on Covid-19 as a global issue should be based on something other than assumptions, significantly since transparent sources of the policies will cut across a myriad of regions. Despite the amount of information available, only scientifically proven and significant data on Covid-19 should be used as accurate and factual data is limited. Also, since the available data needed to be scrutinized, interventions, policies, and responses faced great uncertainty (Maor & Howlett, 2020) .

The next challenge focuses on the need for more standard measurements and reports. For the USA and any other country to effectively deal with the pandemic, consistent data reporting was necessary initially, which was different. For example, several countries reported data every week. Others said the number of tests done, and others reported the number of individuals assessed. As a result, the need for more clarity in deciding what data type to use has delayed the policy-making procedures. The delay has called for streamlined reporting procedures, which has dramatically helped.

Another challenge is the difference in enforcement policies, implementation, and variation in content. Since the global pandemic could not be dealt with effectively by one particular country, collaboration was needed in all countries, which was not the case. For example, wearing masks in Belgium was made a law, whereas it was just a recommendation in the USA and became law under the 46th US President, Joseph R. Biden. The issue of lockdowns did not spread across countries; for example, several countries-imposed city lockdowns while never imposing any lockdowns. Policy variations exist when leaders need to know the exact mitigation plan. One of the best venues to deal with the earlier issue understands where the difference in policies arises. Understanding the source of a difference will also help develop a coherent plan and can be used to analyze public health security and planning.

The last challenge was that politics led the efforts during the pandemic instead of science. Data from countries with leaders believed to have much control over the media required further verification. Even though the countries with these political leaders have implemented specific policies to curb the pandemic, scientists, experts, and policymakers faced various challenges in making their scientific-based policies.

Establishing mutual objectives of discussions validated by facts can significantly help deal with the pandemic. Creating dependable, accountable, and consistent leaders is the primary way of coping with the politicking problem during pandemics. The target audience’s recommendations to curb the consequences of the pandemic lie in the hands of vast US institutions. They start with state health agencies and local, federal, and national governments. Each institution should play its role in ensuring the public’s safety all the time. Political leaders, emergency managers, and political analysts’ administrative leaders provide the correct information to the public and all other persons to ensure collaboration and coordination. However, it is worth noting that it is not only the above group but primarily an individual responsibility to counteract the impacts of any pandemic.

Upon the challenges, the result created a framework for developing various policies to deal with the pandemic. The first action that impacted public policy and budgeting was creating different supplementary budgets. The budgets apply to the national, federal, and local governments. The supplemental funding is designed to mitigate Covid-19. Additionally, the funds are derived from expenditure reductions across numerous US institutions (Milstein & Wessel, 2022) . Since no entity budgeted for the pandemic, the funding source was forced to be created from necessity, which was spending reductions in USG institutions. Unfortunately, such spending reductions at USG institutions continued to place undue financial hardships on their assigned budgets, affecting their prior allocations. Despite the policy and a history of a robust and the most expensive healthcare system, the USA has failed in its initial stages of containing the pandemic. However, healthcare experts adopted the following ways to recover from the pandemic’s loss and the effect caused by the pandemic.

The option to strengthen the US public health system was the initial target of a health system, which is to ensure the safety of citizens in terms of protecting them against outbreaks and risks. However, when the Covid-19 pandemic emerged, it proved how marginalized, fragmented, and flawed the US health system was in protecting the citizens. As the pandemic caused extensive traumas, there is a need to build a more resilient and interconnected system that serves US citizens perfectly by addressing the full range of health-related issues (Sagan et al., 2020) . The healthcare system should be enhanced to create an improved framework that leaves room for local innovations and inventions. Increased funding and actions must be improved to realize the above system.

The health information sector should be enhanced to ensure that all governments present accurate, consistent, and timely information. The improvement of the informatics infrastructure should be well addressed because the lack of accurate and timely information was one of the main challenges that delayed ways of curbing the Covid-19 pandemic. According to Dash et al. (2019) , using electronic systems and frequently updating the health sector data pace will significantly aid in delivering quality information.

Investing in strengthening the health sector should be an agile, modern approach. Federal and local public health funding should be predictable and sustainable to allow the health facilities to enhance the health departments to run smoothly and even adopt evidence-based policy frameworks (Kub et al., 2017) . Identifying specific centers for researching a particular disease or pandemic is also an aid in supporting America’s health care system and other countries. For example, both levels of the USG should have centers for researching pandemics like Covid-19 and other deadly diseases. Moreover, USG institutions such as the Center for Diseases (CDC) have assisted US citizens by providing health advice and monitoring the Covid-19 trend as precautions for future threats or damage likely to be caused by the pandemic. As a result, policymakers and budget makers should consider such policies into allocations and implement them accordingly.

Correspondingly, another option for consideration is empowering individuals to make healthier choices. Several individuals believe that prevention is better than cure. It is the responsibility of the USG to provide the public with the most practical and accurate information on how to protect themselves and the dangers exposed to them if the public needs to defend themselves. The individual states should ensure that all US citizens install and adopt the culture of personal responsibility. When empowering individuals towards health care, all barriers to primary health care must be removed to help ensure this policy protects US citizens against unhealthy foods while providing sustainable, healthier, and farmer-supportive foods.

Additionally, the USG can establish and empower institutions that ensure quality in consumption by US citizens (Allen et al., 2003) . With this action, US citizens can enjoy safe food, which improves their health. Another avenue of consideration is promoting healthy physical activity. The method allows individuals to engage in different actions depending on their age, ensuring safety by promoting a secure and non-polluted environment. As a result, this will help prevent the adverse effects of Covid-19 and help maintain other respiratory diseases.

Specific legislative action can be adopted for the USG to install and promote healthier choices by individuals. For example, law enforcement officers should ensure everyone wears masks in public places to protect themselves and others (Haischer et al., 2020) . In addition, having a mandatory screening of other deadly diseases can help provide individual health and safety. Once these healthy habits are made laws, they will be part and norm of the communities and will effectively be adaptable, ensuring safety for all individuals. The unification actions of the national, federal, and local governments to save the lives of all human beings are also a benefit in dealing with the pandemic. At any given time, policymakers and budget makers should know that a healthy nation is wealthy.

Last, the remaining action to save the USA from the effects of Covid-19 is reorienting the US healthcare delivery system. Infants have a fragile immune system as they are born. If affected by Covid-19, the survival chances are minimal for any opportunity. Due to the above reason, the USG’s responsibility is to ensure that infants are born in a protected and secure environment.

4. Territorial Effects

According to Da Silva et al. (2021) , the local and regional effects of the outbreak of Coronavirus are highly heterogeneous, leading to fundamental implications for crisis public budgeting and policy responses. Many researchers believe that Covid-19 presents a vast territorial dimension, as states have not been impacted in the same capacity. Scientist predicts variance in this deadly disease’s medium- and long-term effects.

Health crises have exhibited different results across the states and municipalities within the USA concerning the declared cases and deaths. Regional disparities in cases and death rates are high in some states, highlighting heterogeneous access to quality health services, comorbidity rates, and demographic criteria. At first, densely populated areas were severely impacted, but the second wave spread to some states’ less-dense regions. Furthermore, CDC Covid-19 Response Team (2020) also outlined that areas with low-income distribution and deprived neighborhoods registered increased deaths.

Many states in the USA moved from the approach applied by the federal government to a more territorial method across the regions. The aim was to adapt the Covid-19 response to local needs and limit the cost of national lockdowns. Additionally, specific localities adopted certain measures and conditions concerning masks, school closures, restaurant closures, and full lockdowns. Elgin et al. (2020) outlined that by December 2020, the USA adopted territorial and multi-level governance to enhance vaccination campaigns in the country.

Similarly, the economic crisis due to the Covid-19 pandemic differs across regions. Donnelly and Farina (2021) outlined areas that have been affected differently depending on whether or not the areas participate in global value chains. Regions that engage in value chains and have a higher SME share were highly affected. Wang et al. (2020) recorded that the unemployment rate improved drastically in rural areas during the second half of 2020 compared to the same period in 2019.

Moreover, the federal government has provided substantial financial aid to safeguard corporates, households, and vulnerable populations. For example, the Federal budgetary support in the USA in 2021 amounted to USD 20 billion. This fund is much more than the financial support during the 2008 global crisis. In addition, the USG continued to direct new financing and reallocate public funds towards crisis priorities such as health care, subject matter expert (SMEs), vulnerable populations, and states devastated by the crisis.

4.1. Fiscal Impacts

Covid-19 has led to severe deterioration in the public finances, adding to the early strains the country was already experiencing due to structural challenges. Auerbach et al. (2022) outlined that the outbreak of Covid-19 led to a health crisis in the USA and a budgetary crisis. In addition, the situation led to drastic swings in household spending; according to a survey conducted by the US Census Bureau (2020) , retail sales, which usually track sales of consumer goods in the country, reduced by 8.8 percent from February to March 2020. Further, this represented the most significant crisis since Census Bureau began tracking data in the country.

In just a few weeks, the pandemic turned from a health problem into an economic crisis, leading to a considerable GDP contraction that it experienced in 2008 (Pirque, 2020) . The USA reported USD 20.94 trillion in 2020 and an increase of 10 percent in 2021 to USD 22.99 trillion (The Economic Times, 2020) . The federal government has worked tirelessly with states to develop policy responses to the coronavirus pandemic by involving numerous fiscal aids for businesses, households, and vulnerable populations to prevent a more significant decline in unemployment rates, income, and output country. This year, the ongoing vaccination campaigns, policy support, and gradual resumption of numerous economic activities across the USA have resulted in economic growth and development.

The country in the policy response prioritizes the most affected demographics by establishing strategies that put this population at the center of the recovery effort. The proposed containment measures, increased government spending, and reduced tax revenues have led to budget deficits and debt. Today, restoring public finances is a priority in the USA. Finally, the USA needs to develop public finance strategies that prioritize country-specific circumstances and incorporate policies to aid sustainable tax revenues and enhanced public spending (Horton & El-Ganainy, 2020) .

4.2. Gender Difference in Response to Policy

The coronavirus outbreak and the policy response create a hostile and gender-differentiated effect in all country dimensions. There have been several cases of unequal access to resources and services in the USA, limited decision-making power, restricted mobility, and lower education status among women in rural settings. FAO (2020) states that many women living in rural environments need help to meet their nutritional needs, access quality healthcare services, and earn low household incomes. Furthermore, Das et al. (2020) outlined how poor households adopted coping strategies and approaches during this period, such as purchasing less food, eating less nutritious meals, and lowering the number of meals per day.

Mitigating the Covid-19 policies should consider women’s vital roles in agricultural food systems, household food security, and nutrition. It is critical to ensure the availability of sex-and-age-disaggregated data to allow policymakers to monitor gender-related effects. Furthermore, the government should develop measures to reduce gender discrimination in food security and nutrition. Finally, investing in women’s leadership and career progression will contribute to the Covid-19 response (Power, 2020) .

4.3. Mortality Rates

According to Gaffney et al. (2020) findings, the country was ill-prepared to manage health emergencies, as demonstrated by the government’s high death rates. According to statistics, about 5.84 million American citizens have died due to Covid-19. Early interventions have played a vital role in containing the number of deaths. However, Gaffney et al. (2020) demonstrated that the higher the mortality rates, the higher the time lapses between the coronavirus case and the proper directives on handling Covid-19.

The policymakers strategized and developed policies to contain the spread of Covid-19. The response policy banned visitors and reduced group activities during the initial period of the outbreak. These lockdowns and movement restrictions led to severe health problems. Unfortunately, the policymakers did not prioritize testing and personal protective equipment during the preliminary stages of the outbreak. As a result, Cohen and van der Meulen Rodgers (2020) recorded that more than 30% of workers did not use personal protective equipment (PPE), leading to higher mortality rates. Today, the government has prioritized the sector of Covid-19 vaccination campaigns and further enhanced the preparedness of the emergency response team (see Appendix B).

4.4. Theoretical Framework

Various theories governed the study within the public administration and underlying budgeting, where the approaches were crucial in triggering a sufficient understanding of the variables at stake.

4.5. Classical Public Administration

The theory focused on the need for the centrality of power (Nhema, 2015) . The main contributors to the approach are Henry Fayol and Luther Gulick. Classical public administration was against contracting government services as in traditional periods. Every tool aimed to maintain the centrality of power and decision-making. The contracting process was thought to remove power from the government while failing to achieve any worthwhile objectives. It, however, insisted on the need for efficiency in the various government sectors.

4.6. New Public Management Model

The model was first introduced in the United Kingdom (UK) and Australia, pursuing business-like approaches in public administration. Adopted in the early 1980s, the model aimed to leverage various private-sector models to realize efficiency and improve the quality of services within public administration (Dunleavy & Hood, 1994) . Many critics claimed this school of thought was central to realizing the various contracting processes. Learning sound intergovernmental approaches with the private sector is crucial to discovering quality.

5. Methodology

The study was conducted through secondary data collection methods and analysis. As such, extensive research was born on the existing literature to establish complementary data on public administration and the underlying budgeting during the Covid-19 pandemic. By assessing the previous literature, the researcher derived meaningful connections and statistics vital to the variation of the three variables. The research methodologies aim to produce data free of bias and errors critical for decision-making.

5.1. Research Design

The research design is the general map where questions are answered and rely on secondary data sources, whereby the research utilized is the experimental research technique. Additionally, experimental research design uses loads of information and helps refine and increase the data-collection comparability.

5.2. Data Collection Methods

The research design is the general map where questions are answered and rely on secondary data sources, whereby the research utilized is the experimental research technique. Additionally, experimental research design uses loads of information and helps refine and increase the data-collection comparability.

5.3. Data Analysis

The research utilized secondary data tools to facilitate a good collection of information. Secondary data sources such as the government and various scholarly articles that delivered insights into the subject were used. For instance, Covid-19 statistics and federal agencies’ budget platforms were significantly capitalized to help fine-tune the data.

5.4. Ethical Consideration

They rely heavily on scholarly articles and previous research work, where it is imperative to maintain superior levels of academic honesty. Therefore, information obtained from scholarly journals and relevant articles was sufficiently referenced and cited as an ethical move to promote academic integrity.

6. Conclusion

From the research, the idea was beneficial and remained the primary weapon against Covid-19 in the USA and the global community. Though Covid-19 has impacted the public policy and budget process in making executive decisions, the stakeholders in the USG sector have ideally managed to contain the pandemic. While the article aimed to ascertain the impacts of Covid-19 on the public policy and budgeting processes of executive decision-making, the findings postulate that the budgeting processes were affected extensively by the surge in the Covid-19 pandemic.

The Covid-19 pandemic forced public committees to abandon the previous administration’s policies and begin focusing on strategies to uplift economies. As a result, the revenues were massively reduced with tax deferral, posing an existential threat to realizing the set policy objectives. However, the policymakers quickly suggested and formulated ideal policies to curb the impacts of Covid-19 in the USA. Although Covid-19 brought several positive effects; however, the adverse impact on the US economy outweighed them.

7. Recommendations

Public administration and subsequent budgeting play a colossal role in realigning the direction of a country’s economy and societal and political aspects. The Covid-19 pandemic affected public budgeting due to the tax deferrals that created budget deficits. With an extensive need to supplement such deficiencies, the paper recommends the following in public budgeting and overall administration:

1) Evidence-based policies are essential to public budgeting during the budgeting and administration processes, and subsequent appropriation committees play a colossal role in allocating resources. By relying on statistics and evidence-based practices, reasonable confidence can be amassed that policies, whether aimed at reducing Covid-19, are sound.

2) Allocating more to the disaster management fund in the future can help prevent adverse effects on the budgeting processes. Essentially, additional funding for disaster management and business continuity plans reduces public budgets to less compromise.

3) The pandemic highlighted how inappropriate strategies could result in massive public losses. By relying on experts within the fields, Congressional Representatives and executive decision-makers sought to leverage better policies, which is exemplary in realizing specialization within the vast resource networks.

4) Several suggestions, such as having a sound data management system and having non-politicking leaders in the fight against Covid-19, have been highlighted as among the best ways of dealing with the pandemic, among other methods suggested in the study.

5) Further analysis of the vaccination program in the USA is well highlighted. The program was allocated a significant budget, which deserves considerable investigation.

6) From the research, the idea was beneficial and remained the primary weapon against Covid-19 in the USA and the global community.

Acknowledgements

I want to express my special appreciation to my committee member and chair, Dr. Ian R. McAndrew, FRAeS, Dean, Doctoral Programs and Engineering Faculty. I am grateful for Dr. McAndrew’s timeless support in encouraging my research and writing to continue developing as a scientist. In addition, his advice on research and academia has been priceless. I would also like to thank Dr. Ron Martin and Carmit Levin for their enduring support. Also, thanks go to my cousin, Ms. Maria Boston, whom I was recently reunited with after 34 years of separation. Maria’s family sacrifices as a single parent did not go unnoticed, and her academic inputs were invaluable.

Appendix A: Revenue Reduction USA

Note. Adapted from Parker, Minkin, & Bennett (2020, September 24) . Economic Fallout From Covid-19 Continues To Hit Lower-Income Americans the Hardest. Pew Research Center’s Social & Demographic Trends Project. https://www.pewresearch.org/social-trends/2020/09/24/economic-fallout-from-Covid-19-continues-to-hit-lower-income-americans-the-hardest/.

Appendix B: Mortality Rates

Note. Adapted from Global Excess and Reported Covid-19 Deaths and Death Rates per 100,000 Population . | Nature. (n.d.). www.nature.com. Retrieved January 22, 2023, from https://www.nature.com/articles/s41586-022-05522-2/figures/1.