Building a Theoretical Framework to Link Local Taxes and Parental Choice of Education ()

Received 9 June 2016; accepted 29 July 2016; published 1 August 2016

1. Introduction

A number of researchers (e.g., Lin and Quayes, 2006 [1] ) have demonstrated that local taxes and school performance are significantly related, which suggests that local taxes have a direct effect on education output. In addition, local taxes are the main source of funds for public school districts, which means that they significantly determine the quality of public schools. For that reason, local taxes may influence parents’ choice of education.

While local taxes are determined by local governments, they are in turn elected by local inhabitants. Parents who prefer their children to go to private schools may be not willing to pay taxes to support public schools. As a result, local taxes and choice of education rely on parents’ preference, which suggests that local taxes per public school pupil and parental choice of education may be jointly determined.

Therefore, the purpose of this paper is to build a theoretical framework to link local taxes and parental choice of education. That is, local taxes per pupil and private school enrollment rate (or public school enrollment rate) are endogenously determined.

2. A Brief Literature Review

In addition, numerous studies have examined the issue of the coexistence of public and private education. For examples, Hamilton and Macauley (1991) [7] developed an optimization model for households that face an educational choice between public and private schools. Their investigation suggests that household income and its standard deviation are primary factors in the education production technology. Gradstein and Justman (1996) [8] created a theoretical model that allows for the coexistence of public and private education. They found that in the face of an inefficient public education system, the economy fluctuates between private and mixed education systems. Lin (2003) [9] examined the link between income growth and inequality in a regime that allows the coexistence of public and private education. He concluded that income inequality under the mixed education system will decline over time, but the pure private education system will collapse in the long run. Nechyba (2003) [10] applied a CGE model to analyze the impact of public school financing on private school enrollments. He investigated various aspects of private and public school choice focusing on interactions with public school financing institutions. His investigation suggests that public school finance centralization will not necessarily lead to an increase in the private school enrollment rate.

3. The Theoretical Framework

The core problem of this paper is to solve the optimal local tax rate which is a function of public school enrollment rate and average of total household income or total value of total properties in a community.

Consider a community in a mixed education system (in which public and private education co-exist), parents can choose private or public education for their children. Assume:

1) A community i consists of total M (= m + n) families (note: m families have their children in private schools, and n families have their children in public schools).

2) Each family has only one child.

3) The total costs (i.e., total expenditures) for public education are completely financed by total local tax revenues with a marginal tax rate t.

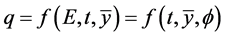

Suppose that the local government for a community i derives social welfare utility (W) from the overall academic quality of public schools (q). Therefore, the social welfare function is specified as . It is also assumed that W is an increasing function of q, concave, and twice differentiable, and has an infinitely large derivative at zero.

. It is also assumed that W is an increasing function of q, concave, and twice differentiable, and has an infinitely large derivative at zero.

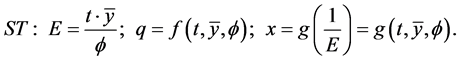

In addition, based upon our assumption, the total costs (i.e., total expenditures) for public education are completely financed by total local tax revenues with a marginal tax rate t. Thus, the total expenditures per pupil (i.e., total local taxes per pupil) can be specified as follows:

, (1)

, (1)

where  stands for household j’s total income or total value of properties, and

stands for household j’s total income or total value of properties, and  stands for public school enrollment rate.

stands for public school enrollment rate.

Note that  is the threshold value of the public school enrollment rate. If

is the threshold value of the public school enrollment rate. If , the median voter is switching to the private education sector; therefore, based upon the median voter theorem and majority vote, total expenditures per pupil in public schools will be zero and the public education sector will not exist because the preferred tax rate for families with children in the private education sector must be zero. In addition,

, the median voter is switching to the private education sector; therefore, based upon the median voter theorem and majority vote, total expenditures per pupil in public schools will be zero and the public education sector will not exist because the preferred tax rate for families with children in the private education sector must be zero. In addition,  stands for the average of total income or total value of total properties in a community i. In other words,

stands for the average of total income or total value of total properties in a community i. In other words,  reflects the quality of the community.

reflects the quality of the community.

Moreover, the overall academic quality of public schools depends on both total expenditure per pupil and demographic characteristics which can be reflected by tax rate (t) and average income ( ). Thus, the function (f) for the overall academic quality of public schools can be illustrated as follows:

). Thus, the function (f) for the overall academic quality of public schools can be illustrated as follows:

. (2)

. (2)

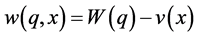

Due to family or personal problems, some students in public schools exhibit negative behaviors. They may become drug dealers and/or users or violent people who attack other children. Not only do these behaviors create problems for the children personally, but they also create problems for schools and the community. Many other kids are also influenced by bad influences. Their behavior leads to a perception of public schools as troubled environments (referred to as “adverse education = x”), and gives people a negative impression, thereby lowering public school quality. For this reason, we need to subtract the utility of education bad, v(x), from the social welfare utility, . The resulting net social welfare utility function (w) can be specified as follows:

. The resulting net social welfare utility function (w) can be specified as follows:

. (3)

. (3)

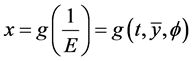

It is assumed that v is an increasing function of x, concave, and twice differentiable, and with an infinitely large derivative at zero. The adverse education is negatively associated with total expenditures per pupil. Consequently, the education bad is a function (g) that can be written as follows:

. (4)

. (4)

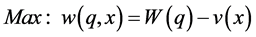

The objective of the local government is to propose an optimal tax rate by maximizing the net social welfare utility, shown in Equation (3), subject to Equations (1), (2), and (4). That is,

The optimal tax rate proposed by the local government will need legislators’ approval (i.e., majority vote for the tax rate). To set this, maximize Equation (3) with respect to the tax rate t. This yields the following first order condition:

![]() . (5)

. (5)

Based on Equation (5), we can solve the optimal tax rate ![]() which is function of

which is function of ![]() and

and![]() . That is,

. That is,

![]() . (6)

. (6)

In addition, the derivative of Equation (5) with respect to ![]() is ambiguous, which implies that total expenditures per pupil and public school enrollment rates can be positively or negatively related. There are two possible effects. On the one hand, when more people switch to the private education sector, holding tax revenues constant, each student in public schools can receive more tax support. Therefore, total expenditure per pupil and public school enrollment rates are negatively related. On the other hand, as we know, the quality of public schools can appear as total local taxes per pupil. Thus, the higher total expenditure per pupil implies a better quality of public schools, hence attracting more people into the public education sector. Therefore, total expenditure per pupil and public school enrollment rates are positively related. Actually, these two effects may co-exist and offset each other simultaneously. If the first effect is larger than the second effect, the final effect will be negative; and vice versa.

is ambiguous, which implies that total expenditures per pupil and public school enrollment rates can be positively or negatively related. There are two possible effects. On the one hand, when more people switch to the private education sector, holding tax revenues constant, each student in public schools can receive more tax support. Therefore, total expenditure per pupil and public school enrollment rates are negatively related. On the other hand, as we know, the quality of public schools can appear as total local taxes per pupil. Thus, the higher total expenditure per pupil implies a better quality of public schools, hence attracting more people into the public education sector. Therefore, total expenditure per pupil and public school enrollment rates are positively related. Actually, these two effects may co-exist and offset each other simultaneously. If the first effect is larger than the second effect, the final effect will be negative; and vice versa.

4. Conclusion

In this paper, we theoretically build the link between local taxes and education choice (indicated by private school enrollment rate or public school enrollment rate). The evidence demonstrates that local taxes and parental choice of education are endogenously determined by one another. However, the limitation of this study is that we do not have empirical evidence to support our theoretical evidence to convince readers. Therefore, in a future study, we will construct empirical models to investigate the endogenous relationship between local taxes and parental choice of education based upon our economic theoretical background.