An Alternative Estimation for Functional Coefficient ARCH-M Model ()

Received 4 June 2016; accepted 25 July 2016; published 28 July 2016

1. Introduction

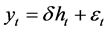

ARCH-M model (Engle et al. [2] ) has been widely studied in last decades due to its various applications. Specially, ARCH-M model gives a way to study the relationship between return and the volatility in finance (for instances, see [3] [4] ). Let  denote the excess return of a market and

denote the excess return of a market and  denote the corresponding conditional vola- tility at time t. A frequently applied conditional mean in ARCH-M models is

denote the corresponding conditional vola- tility at time t. A frequently applied conditional mean in ARCH-M models is  with

with  being an error term. The above equality gives a straightforward linear relationship between volatility and return: high volatility (risk) causes high return. The volatility coefficient

being an error term. The above equality gives a straightforward linear relationship between volatility and return: high volatility (risk) causes high return. The volatility coefficient  can be addressed as relative risk aversion para- meter in Das and Sarkar [5] and price of volatility in Chou et al. [6] . Many empirical studies have been done based on the above conditional mean. However, some researchers found

can be addressed as relative risk aversion para- meter in Das and Sarkar [5] and price of volatility in Chou et al. [6] . Many empirical studies have been done based on the above conditional mean. However, some researchers found  nonconstant and counter-cyclical [7] - [9] . To capture the variation of the volatility coefficient

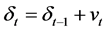

nonconstant and counter-cyclical [7] - [9] . To capture the variation of the volatility coefficient , Chou et al. [6] studied a time-varying parameter GARCH-M. In their GARCH-M model, the volatility coefficient was assumed to follow a random walk, namely

, Chou et al. [6] studied a time-varying parameter GARCH-M. In their GARCH-M model, the volatility coefficient was assumed to follow a random walk, namely  with

with  being an error term.

being an error term.

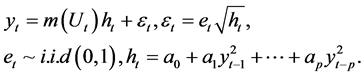

Based on Chou et al. [6] , it makes sense to study the ARCH-M model with a time-varying volatility coefficient. Motivated by the functional coefficient model, Zhang et al. [1] consider a class of functional coefficient (G) ARCH-M models. For simplicity, we focus on the functional coefficient ARCH-M model of the form

(1)

(1)

Here  are observable series and

are observable series and  is independent of

is independent of  for

for .

.

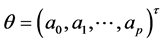

is the unknown parameter vector and

is the unknown parameter vector and ![]() is an unknown smooth function. All throughout

is an unknown smooth function. All throughout

this article, the superscript ![]() denotes the transpose of a vector or a matrix. In (1), the volatility coefficient is treated as some unknown smooth function

denotes the transpose of a vector or a matrix. In (1), the volatility coefficient is treated as some unknown smooth function![]() . The conditional variance

. The conditional variance ![]() is assumed to be driven by a new-typed ARCH (p) process: the original

is assumed to be driven by a new-typed ARCH (p) process: the original ![]() is replaced by the observable

is replaced by the observable![]() . Similar to Chou et al. [6] , the modification for

. Similar to Chou et al. [6] , the modification for ![]() is helpful to estimate the model. In fact, such a setting for the conditional variance in (1) is not new, Ling [10] , Ling [11] , Zhang et al. [12] and Xiong et al. [13] have taken advantage of such specifications for the conditional variance. Considering

is helpful to estimate the model. In fact, such a setting for the conditional variance in (1) is not new, Ling [10] , Ling [11] , Zhang et al. [12] and Xiong et al. [13] have taken advantage of such specifications for the conditional variance. Considering ![]() in (1) as a measure of risk aversion as in Chou et al. [6] , the improvement of (1) lies in that it gives a way to understand how certain variable impacts the risk aversion.

in (1) as a measure of risk aversion as in Chou et al. [6] , the improvement of (1) lies in that it gives a way to understand how certain variable impacts the risk aversion.

For model (1), we need to estimate ![]() and

and ![]() based on the observable

based on the observable![]() . In

. In

Zhang et al. [1] , the estimation procedures is as follows.

Firstly, given![]() , calculating

, calculating ![]() based on the second equation of model (1);

based on the second equation of model (1);

Next, getting the estimator ![]() by functional coefficient regression technique based on the first equation of model (1), by treating

by functional coefficient regression technique based on the first equation of model (1), by treating ![]() as observable variable;

as observable variable;

Thirdly, calculating residuals ![]() and acquiring

and acquiring ![]() by minimizing

by minimizing

![]()

with respect to![]() , where

, where ![]() is a known weight function.

is a known weight function.

It is shown in Zhang et al. [1] that the above estimation is consistent. However, there is no concrete conver- gence rate. Moreover, it can be seen that in the above estimation, ![]() depends on

depends on ![]() and hence depends on

and hence depends on![]() . However, there is no simple or explicite expression between them, which will make the calculation a bit time-consuming. In this article, a new simple estimator is given for model (1), which is shown to be consistent and convergence rate is also obtained.

. However, there is no simple or explicite expression between them, which will make the calculation a bit time-consuming. In this article, a new simple estimator is given for model (1), which is shown to be consistent and convergence rate is also obtained.

The article is arranged as follows. In Section 2, we explain the idea about estimation approach. Section 3 lists the necessary assumptions to show the convergence results followed in Section 4. We conclude the paper in Section 5. Proofs of lemmas are put in the Appendix.

2. Estimation

For model (1), we need to estimate ![]() and

and ![]() based on the observable

based on the observable![]() . Denote

. Denote

![]() to be the probability density function of

to be the probability density function of![]() . Let A be a compact subset of R with nonempty interior and satisfies

. Let A be a compact subset of R with nonempty interior and satisfies![]() . For each

. For each![]() , based on (1) we have

, based on (1) we have

![]() (2)

(2)

where,![]() . Given

. Given![]() , define

, define

![]() (3)

(3)

Denote ![]() to be the true value for

to be the true value for![]() . Then,

. Then, ![]() according to (2) and (3). Let

according to (2) and (3). Let ![]() and

and ![]() be corresponding local linear estimators for

be corresponding local linear estimators for ![]() and

and ![]() respectively (Fan and Yao [14] ). Then we can define a estimator for

respectively (Fan and Yao [14] ). Then we can define a estimator for ![]() as

as

![]() (4)

(4)

For convenience of notation, we put

![]() (5)

(5)

![]() (6)

(6)

Further, define

![]() (7)

(7)

![]() (8)

(8)

![]() (9)

(9)

where ![]() is a nonnegative weight function whose compact support is contained in A. Then, in terms of (3) and (9), estimators for

is a nonnegative weight function whose compact support is contained in A. Then, in terms of (3) and (9), estimators for ![]() and

and ![]() are given as

are given as

![]() (10)

(10)

In the above estimation procedure, we follow the ideas from Christensen et al. [15] and Yang [16] . When![]() ,

, ![]() in (8) becomes the commonly used log-likelihood function in the literature. However the direct minimizer of

in (8) becomes the commonly used log-likelihood function in the literature. However the direct minimizer of ![]() with respect to

with respect to ![]() is not practical because the quantity

is not practical because the quantity

![]() in

in ![]() depends on the unknown function

depends on the unknown function![]() . Note that

. Note that ![]() in (9) can be considered as an approximation to

in (9) can be considered as an approximation to![]() . Consequently, to obtain a feasible estimator for

. Consequently, to obtain a feasible estimator for![]() , we switch to minimize

, we switch to minimize![]() . For practical minimization in (10), one can refer the algorithm given by Christensen et al. [15] .

. For practical minimization in (10), one can refer the algorithm given by Christensen et al. [15] .

Remark 1. From (4), it can be seen that there is a simple specification between ![]() and

and![]() . Such a simple explicite expression will greatly improve computational efficiency compared to the method in Zhang et al. [1] .

. Such a simple explicite expression will greatly improve computational efficiency compared to the method in Zhang et al. [1] .

3. Assumptions

The following assumptions will be adopted to show some asymptotic results. Throughout this paper, we let ![]() denote certain positive constants, which may take different values at different places.

denote certain positive constants, which may take different values at different places.

Assumption 1. The kernel function ![]() is a bounded density with a bounded support

is a bounded density with a bounded support ![]()

Assumption 2. The process ![]() has a continuous pdf

has a continuous pdf ![]() satisfying

satisfying![]() , where A is a compact subset of R with nonempty interior. Further, there are constants m and M such that

, where A is a compact subset of R with nonempty interior. Further, there are constants m and M such that

![]() for

for![]() .

.

Assumption 3. The considered parameter space ![]() is a bounded metric space. The process

is a bounded metric space. The process ![]() from (1) is strictly stationary and ergodic.

from (1) is strictly stationary and ergodic.

Assumption 4. ![]() holds uniformly for

holds uniformly for![]() ,

,

![]() , where

, where ![]()

Assumption 5. The function ![]() defined in (7) has an unique minimum point at

defined in (7) has an unique minimum point at![]() .

.

Assumption 6. ![]() defined in (2) satisfy

defined in (2) satisfy ![]() uniformly for

uniformly for

![]() . The corresponding estimators suffice

. The corresponding estimators suffice![]() ,

,

![]() , where

, where ![]() is the bandwidth such that

is the bandwidth such that ![]() and for some

and for some

![]()

![]() and

and ![]()

Remark 2. Assumptions 1 - 3 are frequently adopted in the literature. Assumptions 4 - 5 have been analogously adopted by Yang [16] . In Assumption 6, the boundness is regular. When the bandwidth ![]() suffices the described conditions and the processes

suffices the described conditions and the processes ![]() satisfies certain mixing conditions, the uniform convergence holds for local linear regression method (Fan and Yao [14] , Theorem 6.5).

satisfies certain mixing conditions, the uniform convergence holds for local linear regression method (Fan and Yao [14] , Theorem 6.5).

4. Asymptotic Results

Theorem 1. Suppose that Assumptions 1 - 6 hold. Then for any ![]()

![]()

Theorem 1 shows our estimators are consistent. The following Theorem 2 further gives certain convergence rate.

Theorem 2. Suppose that Assumptions 1 - 6 hold. Then for any ![]()

![]()

In order to prove Theorem 1 and 2, we need the following lemmas whose proofs can be found in the Appendix.

Lemma 1. For ![]() and

and ![]() given in (3) and (4), suppose that Assumptions 1 - 6 hold. Then for

given in (3) and (4), suppose that Assumptions 1 - 6 hold. Then for

![]()

![]() (11)

(11)

Lemma 2. For ![]() and

and ![]() given in (8) and (9), suppose Assumptions 1 - 6 hold. Then for

given in (8) and (9), suppose Assumptions 1 - 6 hold. Then for ![]()

![]() (12)

(12)

Proof of Theorem 1. From (7)-(8), it is not difficult to get

![]() (13)

(13)

Here, for each ![]() takes value between

takes value between ![]() and

and![]() . Similar to (A.18), when

. Similar to (A.18), when![]() , it can be shown

, it can be shown

![]() (14)

(14)

holds for certain finite M. Put

![]() (15)

(15)

According to (A.18) and (A.19), (13)-(15), for certain M, it follows

![]() (16)

(16)

Note ![]() is independent of

is independent of ![]() and

and ![]() Then similar to (A.22), it can be shown that

Then similar to (A.22), it can be shown that

![]() , implying

, implying![]() . Applying Lemma 1 and Theorem 1 in Andrews [17] to

. Applying Lemma 1 and Theorem 1 in Andrews [17] to![]() , then it follows that

, then it follows that

![]() (17)

(17)

(12) and (17) give

![]() (18)

(18)

which implies the consistency of ![]() in (10) by Lemma 14.3 (page 258) and Theorem 2.12 (page 28) in Kosorok [18] . In addition,

in (10) by Lemma 14.3 (page 258) and Theorem 2.12 (page 28) in Kosorok [18] . In addition,

![]()

where ![]() is between

is between ![]() and

and![]() .

.

Proof of Theorem 2. According to (10) and (12), it follows

![]()

![]() (19)

(19)

where,

![]() (20)

(20)

From Theorem 1 and Lemmas 1 - 2,

![]() (21)

(21)

In the above second equality, the first ![]() is from the consistency of

is from the consistency of![]() . Put

. Put

![]()

![]()

From (A.9),

![]() (22)

(22)

By the martingale central limit theorem (see, for example, Theorem 35.12 in Billingsley [19] ), it is not difficulty to show

![]() (23)

(23)

According to (19)-(23), it follows that

![]() (24)

(24)

Moreover,

![]() (25)

(25)

Conjecture. According to (19)-(25), if one can show![]() , then we can state the following asymp- totic normality:

, then we can state the following asymp- totic normality:

![]()

![]()

where ![]()

5. Conclusions

In this paper, a new approach is proposed to estimate the functional coefficient ARCH-M model. The proposed estimators are more efficient and, under regularity conditions, they are shown to be consistent. Certain convergence rate is also given.

Besides that the proof of conjecture in Section 4 needs further development, it is meaningful to further consider a GARCH type conditional variance in model (1). However, such an improvement is not trivial because the estimation method adopted in this paper can not be applied to the GARCH case. An alternative approach needs further development.

Acknowledgements

We thank the Editor and the referee for their comments. Research of X. Zhang and Q. Xiong is funded by National Natural Science Foundation of China (Grant No. 11401123, 11271095) and the Foundation for Fostering the Scientific and Technical Innovation of Guangzhou University. These supports are greatly appreciated.

Appendix

Proof of Lemma 1

Proof. We only show the case of![]() . Other situations can be proved by similar argument. Let

. Other situations can be proved by similar argument. Let

![]() and

and![]() . Then

. Then ![]() can be written as

can be written as![]() ,

, ![]() can be

can be

written as ![]() Noting, for

Noting, for![]() ,

, ![]() equals 1 when

equals 1 when![]() , and 0 for

, and 0 for

other cases. Then it is easy to have

![]() (A.1)

(A.1)

Hence,

![]() (A.2)

(A.2)

According to Assumption.6, it is easy to obtain the following equalities:

![]()

![]() (A.3)

(A.3)

Note that ![]() and

and ![]() implying

implying

![]() . Then Equation (11) follows from (A.2)-(A.3).

. Then Equation (11) follows from (A.2)-(A.3).

Proof of Lemma 2

Proof. We only consider the case of![]() , other cases can be obtained with similar and easier arguments. From (5)-(6),

, other cases can be obtained with similar and easier arguments. From (5)-(6),

![]() (A.4)

(A.4)

Further,

![]() (A.5)

(A.5)

Let

![]() (A.6)

(A.6)

Then,

![]() (A.7)

(A.7)

We can further have

![]() (A.8)

(A.8)

![]() (A.9)

(A.9)

From (A.9), ![]() can be easily obtained by replacing

can be easily obtained by replacing ![]() with

with![]() . Then

. Then

![]() (A.10)

(A.10)

Here,

![]() (A.11)

(A.11)

![]() (A.12)

(A.12)

![]() (A.13)

(A.13)

![]() (A.14)

(A.14)

![]() (A.15)

(A.15)

![]() . (A.16)

. (A.16)

Note ![]() because of

because of ![]() Hence to show (12), it suffices to prove

Hence to show (12), it suffices to prove

![]() To save space, we only give detailed proof of

To save space, we only give detailed proof of

![]() It is easy to have

It is easy to have

![]()

In terms of (A.4)-(A.5), ![]() can be written as

can be written as

![]() (A.17)

(A.17)

Without loss of generality, there exists a ![]() such that

such that ![]() According to (5), Assumptions 2 and 5, when

According to (5), Assumptions 2 and 5, when![]() ,

,

![]() (A.18)

(A.18)

The last inequality comes from the fact ![]() is uniformly bounded for

is uniformly bounded for![]() . Similarly, when

. Similarly, when ![]() we can show

we can show

![]() (A.19)

(A.19)

From Lemma 1, it follows that

![]() (A.20)

(A.20)

(A.17)-(A.20) gives

![]() (A.21)

(A.21)

Note that ![]() is independent of

is independent of ![]() and

and![]() . Based on Assumption 3, we have

. Based on Assumption 3, we have

![]() (A.22)

(A.22)

(A.20)-(A.22) implies![]() .

.

![]()

Submit or recommend next manuscript to SCIRP and we will provide best service for you:

Accepting pre-submission inquiries through Email, Facebook, LinkedIn, Twitter, etc.

A wide selection of journals (inclusive of 9 subjects, more than 200 journals)

Providing 24-hour high-quality service

User-friendly online submission system

Fair and swift peer-review system

Efficient typesetting and proofreading procedure

Display of the result of downloads and visits, as well as the number of cited articles

Maximum dissemination of your research work

Submit your manuscript at: http://papersubmission.scirp.org/

NOTES

![]()

*Corresponding author.