Tax Knowledge, Penalties and Tax Compliance in Small and Medium Scale Enterprises in Nigeria ()

Received 16 October 2015; accepted 28 February 2016; published 2 March 2016

1. Introduction

Taxes and tax system are essential in nation building. They are required for state capacity building for meaningful economic development [1] . The fundamental goal of any revenue authority is to collect taxes and duties payable according to the law. However, taxpayers are not always willing and ready to comply when it comes to the obligations imposed on them by law. Tax compliance is the ability and willingness of taxpayers to comply with tax laws, declare the correct incomes in each year and pay the right amount of taxes on time [2] . Reference [3] considered tax compliance as the taxpayers’ willingness to obey tax laws in order to attain economic development and goal. From a wider perspective, tax compliance requires a degree of honesty, adequate tax knowledge and capability to use this knowledge, timeliness, accuracy, and adequate records in order to complete the tax returns and associated tax documentation [4] .

A key component of any tax system is the manner in which it is administered. No tax is better than its administration, so tax administration matters a lot [5] . An essential objective of tax administration is to ensure the maximum possible compliance by taxpayers of all types with their tax obligations. Unfortunately, in many developing countries, tax administration is usually weak and characterized by extensive evasion, corruption and coercion. In many cases, overall tax compliance levels are low and large proportion of the informal sector of the economy escapes the tax net entirely [1]

Tax compliance is a major problem for many tax authorities. It is not an easy task to persuade taxpayers to comply with tax requirements even as the tax laws are not always precise in some respects [6] . Taxpayers are inherently disposed to reducing their tax liability either through tax evasion or tax avoidance. This may give rise to incorrect filling of their tax returns and loss of revenue to the government. An unduly complex regulatory system and tax regime enforcement makes tax compliance unduly burdensome and often have a distortionary effect on the development of small and medium scale enterprises (SMEs) as they are tempted to change into forms that offer a lower tax burden or no tax burden at all [7] , and as such results in a tax system that imposes high expenses on the society. A poorly executed tax system also leads to low efficiency, high collection charges, and waste of time for taxpayers [8] . SMEs usually have to operate in an overbearing regulatory environment with the plethora of regulatory agencies, multiple taxes, cumbersome importation procedure and high port charges that constantly exert serious burden on their operations [9] . Existing empirical evidence clearly indicates that small and medium sized businesses are affected disproportionately by these costs when scaled by sales or assets. The compliance costs of SMEs are higher than the larger businesses [10] .

This leads to limited capacity of developing countries to raise revenues for development purposes. A lot of factors affect the low level of tax compliance in developing countries, such as attitudes, penalty, income, education, knowledge, gender and age of the taxpayers, corruption, high marginal tax rates, lack of availability of information and accounting systems, a large informal sector, weak regulatory systems, ambiguity in the tax law, the existence of non adherent culture, and the ineffectiveness of tax administration [6] .

The objectives of this paper therefore are to assess the degree of compliance of the relevant tax laws by taxpayers and find out the effects of tax knowledge and tax penalty over tax compliance. The rest of the paper is divided into four parts. Beside this introduction, Section two is a review of literature while Section three is on methodology. Section four presents the results and discussion while the last section is on summary and conclusion.

2. Literature Review

We present a review of literature on two factors influencing tax compliance below. These are tax knowledge and tax penalty.

2.1. Tax Knowledge

Tax knowledge is the level of awareness or sensitivity of the taxpayers to tax legislation. Tax knowledge refers to the processes, by which taxpayers become aware of tax legislation and other tax-related information [11] . The level of formal general education received by taxpayers is an important factor that contributes to the understanding of tax requirements, especially regarding registration and filling requirements. Generally, citizens have very limited knowledge on government true expenditures and the cost of public services provided by the government [12] . Hence, those taxpayers without tax knowledge are compelled to solicit the service of tax professionals [13] [14] . One of the fundamental ways to increase public awareness is for taxpayers to have knowledge about taxation [15] [16] . Reference [17] observes that general education level is significantly related to tax evasion.

High awareness by the society would encourage people to fulfill their obligations to register as taxpayer reporting and paying taxes properly are forms of national and civic responsibility. Most citizens do not have much understanding of what tax laws mean and why the tax system is structured and administered as it is [18] . Reference [19] states that tax knowledge reveal that there is a relationship with taxpayers’ ability to understand the laws and regulation of taxation and their ability to comply. In this study, SMEs did not consider local authority levies to be different from government taxes because they lacked tax knowledge. This misconception has an impact on their compliance decision because when they pay council levies they might consider that they have paid tax and complied. Reference [9] found that SMEs did not pay their tax obligations because of their inability to understand tax law requirements.

From the foregoing, it is observed that previous studies have evidenced that tax knowledge play an important role in increasing tax compliance. Tax knowledge could potentially encourage taxpayers to be more prudent in completing their tax returns. Hence, we hypothesized that there is a significant relationship between tax knowledge and tax compliance.

2.2. Tax Penalty

Tax penalty is a punitive measure that the tax law imposes for the performance of an act that is proscribed, or for the failure to perform a required act such as failure to timely file return or filling wrong or undervalued returns etc. If a taxpayer is required to file an income or excise tax return and fails to timely do so, a late filing penalty may be assessed. The penalty is 5% of the amount of unpaid tax per month (or partial month) the return is late, up to a maximum of 25% (Legal Dictionary). How does tax penalty imposable on taxpayers for noncompliance can promote tax compliance amongst taxpayers?

Deterrence factors such as probability of being audited and being detected by tax authorities are found to reduce noncompliance among taxpayers [25] [26] . For instance, Nigeria Personal Income Tax Act (PITA 2011 as amended) strengthen such issues as record keeping, self?assessment and provides penalty of ₦50,000 and ₦500,000 for individuals and companies respectively for contravening the provisions of the Act [27] . Furthermore, under self-assessment in Nigeria the failure of taxpayer to file returns will make him liable upon conviction to pay a sum of ₦200 and further ₦40 for everyday during which the failure continues [28] . In Malaysia, if it is discovered during the audit process that there is underreporting or misstatement, a penalty will be imposed under subsection 113(2) of the ITA (1967), although revenue authorities in Malaysia encourage taxpayers who underreport their income to voluntarily make disclosure of such underreporting if later they understand that they made underreporting of their income. Failure to do so is subject to penalty depending on the time that has lapsed between omission and voluntary disclosure [29] .

2.3. Theories on Tax Compliance

There are various opinions as to the best ways to improve tax compliance. Given the opportunity, a lot of businesses will not pay taxes unless there is a motivation to do so. Some believe that the best way is to increase tax incentives [38] while others believe that the best way is to increase tax penalties. Thus, tax compliance theories are broadly classified into two. They are the deterrence based theory and psychology based theory.

2.3.1. Deterrence Theory

This theory places emphasis on incentives. The theory suggests that taxpayers are amoral utility maximizers who are influenced by economic motives such as profit maximization and probability of detection. Hence, the taxpayers analyze alternative compliance paths for instance whether or not to evade tax, the likelihood of being detected and the resulting repercussions and then select the alternative way that maximizes their expected after tax returns after adjusting for risk. Therefore according to the theory, in order to improve compliance, penalties for non-compliance should be increased. Thus, there is a theoretical positive relationship between tax penalty and tax compliance. Increase in tax penalty would lead to increase in tax compliance and vice versa.

2.3.2. Psychology Theory

Psychology theory posits that taxpayers are influenced to comply with their tax obligations by psychological factors. It focuses on the taxpayers’ morals and ethics. The theory suggests that a taxpayer may comply even when the probability of detection is low. As opposed to the deterrence theory that emphasizes increased penalty as solution to compliance issues, psychology theory lays emphasis on changing individual attitudes towards tax systems. Thus, one instrument of changing taxpayers’ attitude to tax matters is tax education. It is assumed that improved tax education would increase tax compliance and vice versa.

3. Methodology

This section presents the model specification for the study and methods of data collection and analysis.

3.1. Model Specification

In the earlier study on tax compliance in Nigeria, [39] expressed attitude of taxpayer towards tax compliance (ATTCOM) as a function of tax morale (TMOR). The functional relationship is shown in Equation (1).

(1)

(1)

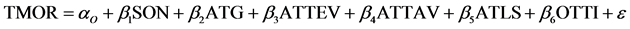

However, tax morale (TMOR) was expressed as a function of social norms (SON), attitude of taxpayers towards government (ATG), tax evasion (ATTEV), tax avoidance (ATTAV), legal system (ATLS), and obedience to traditional institution (OTTI). This was expressed as shown in Equation (2) below.

(2)

(2)

However, in this study we opined that the attitude of taxpayers towards tax compliance (TCOMP) depends on the knowledge of taxpayers on tax matters (TKNOW) and the amount of tax penalty levied on taxpayers for noncompliance (TPEN). This model is therefore expressed as shown in Equation (3).

(3)

(3)

where:

TCOMP = Tax compliance,

TKNOW = Tax knowledge,

TPEN = Tax penalties,

ε = The error term.

3.2. Methods of Data Collection and Analysis

The research design adopted in this study is survey design. The primary source of data employed is the administration of questionnaires. The questionnaire consists of two parts. The part A of the questionnaire is on the demographic characteristics of the respondents while part B of the questionnaire is on the research questions on the research variables namely, tax compliance, tax knowledge and tax penalty. Five-point Likert-style rating scale method of questionnaire was employed in this study ranging from strongly agree of 5-point to strongly disagree of 1-point. The Likert -style rating method of questionnaire design enables numerical value to be assigned to cases for easy quantitative analysis. To test for the content validity of the instrument used for data collection in this study, the questionnaire was given to three experts in the Departments of Accounting, Business Administration and Sociology of University of Benin for review. To ensure the reliability of the instrument, the questionnaire was pre-tested using twenty (20) respondents. Using Statistical Package for Social Sciences (SPSS) to test the reliability, the Cronbach alpha coefficient of 0.82 was obtained. This compares favourably with a stipulated standard of above 0.70 for reliability test. The reliability ratio for this work (0.82) showed that all the research questions in the questionnaire have internal consistency.

The small and medium enterprises in Benin City in Edo state, Nigeria constitute the population of the study. A total of four hundred respondents were randomly sampled from small and medium enterprises in Benin City in Edo state, Nigeria. Out of the four hundred (400) questionnaires administered to SME operators, two hundred and seventy seven (277) were retrieved and analyzed. The data obtained were analysed using Statistical Package for Social Sciences (SPSS) to obtain the frequency distributions of the demographic characteristics of the respondents. The descriptive statistics of the variables as well as the Ordinary Least Square (OLS) multiple regression analysis was carried out to assess the relative predictive power of the independent variables (i.e. tax knowledge and tax penalty) on the dependent variable (i.e. tax compliance).

4. Results and Discussion

The results of the data analysis in this study are presented and discussed in this section. The section contains three parts. The first part describes the frequency distribution of three demographic characteristics of the respondents in this study. The second part presents the results of the descriptive statistical analysis of the research variables of tax compliance, tax knowledge and tax penalty under study. The last part is the result of regression analysis.

4.1. Demographic Characteristics of the Respondents

Four demographic characteristics of the respondents were considered in this study. These are the gender, age, education, and annual income. Majority of the respondents were male (198% or 71%) while the rest were female (79% or 29%). The reason could be far from the fact that many business operators in SMEs are male as many females before now are more into business of home managers. Most of the respondents (54%) were above 40 years of age. Table 1 shows the age distribution of the respondents.

Again, the majority of the respondents had first degree certificate and above (71.5%) while few had just secondary school certificate (28.5%). Table 2 shows details. The implication is that majority of the respondents had general education. Does level of general education translate or fix a person with tax knowledge? This may not be so. It is tax education that fixes a person with tax knowledge. However, general education may predispose a person to tax education with its concomitant tax knowledge.

The annual income of the respondents spans from below N200,000 to over N500,000. However, majority of the respondents have annual income within the bracket of N200,000 - N500,000. Table 3 shows the details.

![]()

Table 1. Age distribution of respondents.

Source: Authors (2015).

![]()

Table 2. Education distribution of respondents.

Source: Authors (2015).

![]()

Table 3. Annual income distribution of respondents.

Source: Authors (2015).

4.2. Descriptive Statistics of the Research Variables

Table 4 shows the descriptive statistics of the research variables under study, namely; tax compliance (TCOMP), tax knowledge (TKNOW) and tax penalty (TPEN). The minimum value of TCOMP is 2 while the maximum value of TCOMP is about 5. The average of the TCOMP is about 4.18. The minimum TKNOW is about 2 while the maximum TKNOW is about 5. On average the TKNOW is about 4.16. The minimum TPEN is about 1.667 while the maximum TPEN is about 5. On average the TPEN is about 4.30. The high values of Jacque-Bera statistics with their probability values of < 0.05 revealed that all the variables are normally distributed.

Table 5 presents the results of the Pearson’s Product Moment correlation analysis. The results show significant positive relationships between tax compliance (TCOMP) and tax knowledge (TKNOW) and between tax compliance (TCOMP) and tax penalty (TPEN). However, there is no strong significant relationship between tax knowledge (TKNOW) and tax penalty (TPEN). This shows absence of possible multicolinearity between the two independent variables (TKNOW and TPEN).

The results of regression analysis are presented in Table 6. The two independent variables are properly signed in that both have positive effects on tax compliance. These conformed to their a-priori positive sign that indicates that increase in tax knowledge and tax penalty would lead to increase in tax compliance amongst taxpayers and vice versa. However, a unit increase in tax knowledge would lead to 0.46 increase in tax compliance while a unit increase in tax penalty would lead to 0.12 increase in tax compliance. Thus, tax knowledge has a higher tendency to promote tax compliance than tax penalty. In terms of significance, only the tax knowledge has significant effect on tax compliance at 5% level of significance. Tax penalty does not have significant effect on tax compliance at 5% level of significance. However, both the tax knowledge (TKNOW) and tax penalty (TPEN) could only explain about 31% of the systematic variations in tax compliance while about 69% of the systematic variations in tax compliance could not be accounted for by the regression model. However, the model passes the test of goodness of fit given the value of F-statistics of 63.41589 with its associated probability (prob. < 0.05). The Durbin-Watson statistic of 1.797772 shows an absence of auto-correlation, which is not a serious issue in a cross-sectional study like ours.

From the foregoing it is observed that tax knowledge (TKNOW) has significant positive relationship with tax compliance (TCOMP). The finding is consistent with the study of [20] that opined that tax awareness has to be spread in order to inform all consumers about the direction and objectives the relevant tax authorities wish to achieve by administering taxation policy. However, tax penalty has insignificant positive impact on tax compliance. This is inconsonance with the studies of [30] [31] who observed that tax penalty rates had significant positive association with tax evasion, meaning that higher tax penalty rates did indeed encourage people to cheat or avoid tax.

5. Summary and Conclusions

An attempt has been made in this paper to present an in-depth analysis of the effects of tax knowledge and tax penalties on tax compliance amongst small and medium enterprises in Nigeria. The study shows that tax knowledge has a higher tendency to promote tax compliance than tax penalty. Tax knowledge plays an important role in increasing tax compliance. Tax knowledge could potentially encourage tax payers to be more prudent in completing their tax returns. Self-employed individuals should try as much as possible to acquire reasonable level of tax knowledge as it applies to their businesses. Acquiring tax knowledge has many advantages. It would save the tax payers from hiring consultants to compute taxes for their businesses and thereby saving huge tax consultancy cost. It can assist them to accurately compute tax payable and avoid unintentional noncompliance

![]()

Table 4. Descriptive statistics on the variables.

Source: Authors (2015).

![]()

Table 5. Correlation coefficients matrix.

Source: Authors (2015); *significant at 5% level.

![]()

Table 6. Results of OLS regression.

Source: Authors (2015).

resulting from low level of tax knowledge.

We recommend that the government should consider seriously the characteristics of non compliance taxpayers; review current regulations and possibly as a result, increase awareness of the importance of tax and penalty (enforcement). Also, government should attempt to build good relationship with small and medium enterprise taxpayers in seeking to improve general tax compliance level as well as total tax revenue. Government should therefore do everything possible to increase public knowledge on tax matters and tax education should be included in school curricula at all times. Small and medium scale business owners should also seek to advance their tax knowledge and awareness for the mutual benefits of the governments and taxpayers.