Analysis of the Long-Term Trend of the Exchange Rate of RMB Based on ICP’s Datum in 2011 Year ()

1. Introduction

In the year 1922, Swedish economist Gustav Cassel systematically proposed the static PPP theory based on the existing theory of purchasing power parity (PPP). That is the absolute PPP theory and relative PPP theory, which can be expressed as the ratio of the purchasing power of currencies of two countries. It is the foundation of the exchange rate, and the changes in the exchange rate are caused by the ratio changes of the purchasing power of currencies of the two countries. Afterwards, it was further expressed as: the exchange rate is an unbiased estimation of the purchasing power parity, for the change of exchange rate always converges to PPP by Chinese scholars Zhang Daozheng et al. [1] . Purchasing power parity can be reflected by the price level; in other words, the rising of a country’s price level means the declining of currency purchasing power, which leads to currency devaluation. In contrast, a drop of country’s price level means that the rising of currency purchasing power in turn leads to currency appreciation.

Since the purchasing power parity theory has some strict assumptions, the domestic and foreign scholars have carried out extensive research on the applicability of their own countries, in an attempt to provide a basis for governments to adjust the exchange rate. Krug-man (1978) and Frenkel (1981) used the ADF unit root test and cointegration method to explore the relationship between exchange rate and the PPP, with the conclusion that purchasing power cannot be used as the basis to determine exchange rate [2] . Choi (2002), Bai and Ng (2004), Moon and Perron (2004) used the panel unit root test and got the conclusion that the real exchange rate has long-term behavior [3] . Chortareas and Kapetanios (2009) used the panel selection method and their results showed that power parity theory could only be applied in countries with a smooth sequence [4] . Since the demise of Bretton woods, nonlinear model has been applied to the study of PPP with the conclusion that exchange rate fluctuates along with an equilibrium line [5] . The same result is drawn by Jinquan Liu et al. (2006), who described the structural transition behavior of purchase power parity based on Markov regime switching matrix [6] . In consideration of the change of the exchange rate system and the economic system, increasingly more scholars pay attention to structural break models, such as Lee and Strazicich (2003), who have proposed the LM unit root test method with a structural break or two breakpoints, and concluded that exchange rate deviates from PPP in the short term [7] . Recently, Enders and Lee (2012) put forward a method called Fourier series transformation method, to study on the relationship between PPP and exchange rate [8] . All of the studies can be summarized as follows: under the condition of market economy, short-term equilibrium exchange rate fluctuates along the long-term equilibrium exchange rate, while the long-term equilibrium exchange rate is highly correlated with PPP. However, some difference occurs between the developing countries and developed countries; specifically, long-term equilibrium exchange rate is determined by PPP for the developing countries, with a sustained and rapid economic growth period, whose long-term equilibrium exchange rate will gradually tend to the purchasing power of money. On the other hand, long-term equilibrium exchange rate is the purchasing power of currency for the developed countries. According to the 2006 stocktaking on exchange rate issues, 40 percent of IMF staff reports incorporated PPP-based real exchange rate assessments [9] . In China, the PPP method should be a perspective of analyzing exchange rate of RMB [10] .

This paper analyzes the latest data of purchasing power and exchange rate provided by ICP, so as to further study the relationship between PPP and exchange rate. Finally, we would predict the long-term trend of the RMB exchange rate worldwide.

2. International Comparison Program

Since 1968, the United Nations and other international organizations have organized 8 sessions of international statistical activities, and the number of the participating countries and regions has increased from the initial 10 to 199 now, to meet the needs of information on the international comparability in terms of international economic, social and related decisions on economic analysis of statistical [11] . Through the collection of price data of various representative goods in the participating countries, the weight is compiled basing on the corresponding expenditure of GDP. The aim of weighting average all kinds of price is to compute purchasing power parity of goods and services so as to exchange GDP calculated by the domestic currency into comparable GDP calculated by purchasing power parity. By doing so, international comparison analysis is carried out on the national economy and structure. The data of a basket of goods and services price is collected in a fixed period of time according to the international standard. So the defects of the consumer price index and the GDP deflator index in international comparability can be overcome. Significant progress has been made with the above-mentioned common set of weight.

China has launched International Comparison Program five times (see Table 1) respectively in 1993, 1999, 2005, 2009, and 2011. Only the one taken in 2011 could be called full participation, and it is the best indicator of the true situation. On the other hand, due to the strengthening of international statistical capacity, the International Comparison Project has made great improvement in the respect of survey framework design, specification product selection, comparison of non-market services, data matching validation, data links, and other aspects in 2011.

![]()

Table 1. The comparison method and the results of previous participating into ICP.

Source from: literature [11] -[13] .

3. Analysis of the Long-Term Trend of the RMB Exchange Rate

3.1. The Establishment of Model and Calculation

Using 2011 ICP’s data to analyze the long-term trend of RMB has some scientific meaning. In order to analyze the future trend of the RMB exchange rate, we have adopted the same research methods as Wu Jun, Zhao Na, Zhang Li (2009), that is, a country (or region) is defined in the relative price level in a year as follows [14] :

(1)

(1)

and

and  represent the number of local currency per one US dollar.

represent the number of local currency per one US dollar.

Through the definition of relative price level in Equation (1), we can see that under the conditions of constant exchange rates, the decrease of domestic relative price levels means the declining of purchasing power of domestic currencies. Vice versa, the increasing of Kt indicates the increased purchasing power of currency, and the magnitude of the changes of Kt equals purchasing power of money. Table 1 and Table 2 respectively describe the sharpest change of Kt of 16 countries, taking 2005 and 2011 as the base year. From Table 2, we can see that in the countries which have the sharpest reduction of Kt except the United Kingdom, Slovenia, Australia and Sweden, the remaining 12 country (region)’s per capita GDP is below $20,000, the reason leading to this phenomenon is PPP of developing countries will depreciate in the long-term [1] .

From Table 3, we can see that the countries which have the biggest increase of Kt are the six developed economies (Surakarta, Iceland, Oman, United States, Taiwan and Bahrain) and 10 developing countries/regions whose per capita GDP is below $20,000. By comparing Table 2 with Table 3, we can draw a conclusion that the developing countries and economies with rapid growth are more easily to undergo changes in value of the currency. K1 and K2 respectively stand for the relative price level taken the year of 2005 and 2011 as the base period, and .

.

In 2011, China’s per capita GDP is $5456 calculated at the exchange rate, and K value correction amplitude is −22.37%, which means China’s currency purchasing power decreased by 22.37%, and significantly higher than its amplitude correction in the average amplitude correction packets (−15%). From this perspective, in the year of 2005-2011, Chinese currency has experienced some kind of devaluation. In Table 4, notation “+”indicates an increase, while “?” indicates a decrease. With the income levels increasing, the magnitude of the devaluation of national currencies become increasingly smaller, of which countries, per capita income is $5000 - 10,500, the average K value of the amplitude correction becomes positive, which means that in this income range, the currency tends to appreciate. In addition, different from the past studies, the correction magnitude of the K value does not show a gradual upward trend with income levels increasing; on the contrary, it shows a downward trend after reaching a peak shock.

Figure 1 shows the relative price level scattered points datum in 2011 year. We can find that developing countries with the increasing of per capita GDP (purchasing power parity (PPP) method), K value decreases gradually until tending to 1. For the developed economies, the value of K waves in the vicinity of 1. A conclusion can be drawn that the exchange rate of developing countries with rapid economic growth and deepening of the globalization process will gradually tend to purchasing power parity (PPP). In the other side, exchange of the developed economies fluctuations in the vicinity of purchasing power parity. And even, the phenomenon of the

![]()

Table 2. The largest reduction of K value of 16 countries respectively datum in year 2005 and 2011.

![]()

Table 3. The largest amplification of K value of 16 countries respectively datum in year 2005 and 2011.

exchange rate is higher than the purchasing power parity (PPP) occurs.

Based on the above description, we establishment a model for K value of the countries all over the world datum in year to analysis the long-term trend of RMB. Due to the long-term equilibrium exchange rate in the de-

![]()

Table 4. Compare fluctuations of K values in groups.

![]()

Figure 1. K value of all countries datum in year 2011.

veloped economies can be understood as the purchasing power of the currency, the relationship of the two in line with purchasing power parity theory, we pay attention to the variation rule of K value of developing countries. From Table 1, we can see K value has an obvious variation rule in high level of per capita GDP, while K value has a large fluctuation in low-level per capita GDP. Wu Chun (2009) has summed up it as follows: 1) low-income countries have smaller economies, and are poor resistance to external shocks. When the condition of mineral resources, geographical environment, foreign aid and other changes, exchange rate will be affected. 2) The financial system would have been destroyed in under-developed economies when a war outbreak, and exchange rate cannot maintain normal level. 3) The marketization degree of exchange rates is low, so governments have a manipulation of exchange rates, which will disrupt the normal exchange rate movements [14] . In order to facilitate the analysis, we filter the samples according the following principles. First, delete the countries, which per capita GDP are greater than the 8000 dollar (exchange rate method). Second, remove the relatively backward economic, because of the exchange rate does not reflect changes in the lowest economic entities as low-level marketization of exchange rate. After screening, the samples are shown in Figure 2. For the less-de- veloped economies, the trend of currency exchange rate move closer to purchasing power is more evident.

3.2. Forecast the Long-Term Trend of the Exchange Rate of RMB

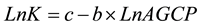

The Figure 2 shows that with the increase of income level, the relationship between the relative price levels and income can be represented with one of hyperbola in less developed economies, and mathematical expressions is .

.  is relative price levels datum in 2011,

is relative price levels datum in 2011,  is per capita income levels calculated by exchange rate method. Log Equation (1), we can get Equation (2).

is per capita income levels calculated by exchange rate method. Log Equation (1), we can get Equation (2).

![]()

Figure 2. K value of less developed countries selected datum in year 2011.

(2)

(2)

and

and  are parameter to be estimation, we use Eviews 8.0 to do the regression of the data as follows:

are parameter to be estimation, we use Eviews 8.0 to do the regression of the data as follows:

![]() (3)

(3)

![]()

Equation (3) is a hyperbolic equations model of regression analysis datum; in 2011 the fitting degree is up to 67%. Statistics F shows that the fitting degree of equation is more significant, besides, the parameters of the t test value also shows that the parameter estimation is significant, and the coefficient symbols is correct.

Basing on analyzing the difference of China’s economic growth rate with other developing countries from 2005 to 2014, it is expected that China will continue to maintain a steady growth trend in the next 10 years, which is higher than other developing countries by 3.5%. So we differential Equation (3) on both sides as follows:

![]() (4)

(4)

We know from Equation (4), due to the rapid growth of Chinese economy, K will decrease 0.308%.

![]()

That is, the RMB’s real exchange rate will be appreciation by 0.308%. This is small than Jun Ma’s (2005) result, and I think the difference is caused by price level selected.

4. Conclusions and Limitations

This paper analyzed the relationship of purchasing power of the currency and exchange rate around the world, based on the International Comparison Program (ICP) two years’ data (2005 and 2011). The results showed that between 2005 and 2011, the developing countries experienced substantial currency devaluation. It can be attributed to the following two reasons. On one hand, the opening degree is relatively low and economic development is not sufficient in developing countries [15] . On the other hand, the exchange rate policy and external environment are different among countries, and currency appreciation is little correlated with income per capita. The analysis of relative price level and income per capita shows that relative price level is above 1.5 in most countries, meaning that international market price is generally higher than domestic market price in developing countries. And relative price level is between 0.5 and 1.0 in few high-income countries, meaning that international market price is generally lower than domestic market price. And the export increases because of a few high-income countries, which control the exchange rate. The relationship between PPP and exchange rate is most obvious when income per capita is about $3000. At last, with the dynamic purchasing power parity, we have obtained results that RMB exchange rate will appreciate in a long period, but the appreciation is not obvious in every year.

We have got some expected results, but there are a lot of limitations in the respect of research methods and ideas. Firstly, currency devaluation is decided not only by PPP, but also by exchange rate policy and other economic factors, such as economic structure. This article can’t make any prediction for a short-term trend of RMB. Secondly, although PPP is more advisable than GDP deflator and CPI, it is far from perfect. Lastly, this is just a simple model applied in this paper; we will build a model which is fitter for economic realities in the future studies.