A Comparative Study of Mean-Variance and Mean Gini Portfolio Selection Using VaR and CVaR ()

1. Introduction

During a financial crisis, it is of critical importance to implement the best investment strategy possible to match an investor’s preferences in terms of risk and returns. Several studies have evaluated and compared different pairs of portfolio strategies in terms of their return and risk characteristics. The Mean-Variance (MV) theory, suggested by Markowitz (1952a, 1952b) , marked the starting point of the development of modern finance theory. The theory is based on the presumption that distribution of portfolio returns is normal and can be successfully described by two moments: mean and variance. However, the application of MV optimisation is questionable because it does not consider the direction of price movement; optimising the variance can prevent an investor from losses in the same manner as from gains. Roll (1977, 1978, and 1979) was the first to point out other weaknesses of the theory. This evidence forced several theorists to search for other, more appropriate models to determine the best possible return/risk relationship. For instance, Markowitz (1959) , Fishburn (1977), Bawa (1977) proposed the use of the mean-lower partial moment approach, Yitzhaki (1982) , Shalit and Yitzhaki (1984) proposed the use of the Mean- Gini (MG) portfolio selection model, and Konno and Yamazaki (1991) proposed the use of the Mean-Absolute Deviation (MAD) approach.

The restrictive character of variance as a risk parameter, led us to choose the MG strategy as an alternative to the MV strategy. The MG strategy uses Gini as a parameter of risk instead of variance. The concept of MG was proposed by Shalit and Yitzhaki (1984) as an alternative method to the MV approach proposed by Markowitz (1952) because it can outstrip normal assumptions of return distribution and utility function quadratics. Yitzhaki (1982) has shown that the Gini coefficient satisfies the second degree stochastic dominance, which makes the MG model compatible with the theory of expected utility.

This study provides a comprehensive statistical analysis of four strategies: the MV strategy versus the MG strategy and the Minimum Variance (Min-V) versus the Minimum Gini (Min-G) strategy.

Following Agouram and Lakhnati (2015) , in order to verify the reliability of these strategies, we used quasi- analytic VaR, computing and only portfolio VaR, with any additional information pertaining to important characteristics of financial asset returns (i.e. their volatility, clustering and non-normal distributions). We considered the following aspects in forecasting VaR for each strategy.

Firstly, we used the GARCH (1.1) model to explore the sensitivity of VaR to return distribution characteristics assuming that portfolio return follows the classical normal distribution and the student-t distribution.

Secondly, we numerically computed VaR using the Cornish-Fisher expansion and the Johnson SU approximation to forecast portfolio VaR, to take into account fat tails and skewness on forecasting VaR.

Finally, we utilised CVaR to compare the two pairs of strategies because the outcomes are similar and CVaR can better capture the tail risk. This risk measure follows directly from the value-at-risk.

This paper is organised as follows: Firstly, we present the framework of the four models: MV, MG, Min-V and Min-G. Secondly, we provide a comprehensive explanation of the data and methodology used, and define the key terms. Finally, we apply the GARCH (1.1) model with the Cornish-Fisher expansion and the Johnson SU approximation to forecast VaR and CVaR.

2. Materials

2.1. Mean-Variance

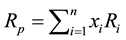

A portfolio is defined to be a list of weights  for assets

for assets ,

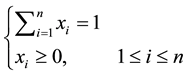

,  , which represent the amount of capital to be invested in each asset. We assume that one unit of capital is available and require that capital to be fully invested. Thus we must respect the constraint that

, which represent the amount of capital to be invested in each asset. We assume that one unit of capital is available and require that capital to be fully invested. Thus we must respect the constraint that . The return of portfolio

. The return of portfolio , obtained by

, obtained by  (

( is the return of asset

is the return of asset  per period).

per period).

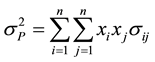

In the traditional Markowitz portfolio optimisation, the objective is to find a portfolio which has minimal variance for a given expected return. More precisely, one seeks such that:

Min

Subject to:

(1)

(1)

where  is the covariance between the returns of

is the covariance between the returns of , and

, and  and

and  is the minimal rate of return required by an investor.

is the minimal rate of return required by an investor.

The Minimum Variance analysis consists of constructing a portfolio without a given expected return; the optimisation program is presented mathematically as follows:

Min

Subject to:

(2)

(2)

2.2. MG Analysis

The MG approach is consistent with stochastic dominance for decisions about risk and is ideal for portfolio analysis for a variety of financial assets. The MG analysis introduced by Shalit and Yitzhaki (1984) defines the Gini coefficient as an index of variability of a variable random.

The approach used by these authors assumes that the cumulative distribution corresponding to the observation with rank ![]() is

is![]() .

.

Specifically, Dorfman (1979) and Shalit and Yitzhaki (1984) retain as a measure of the Gini coefficient:

![]()

where ![]() is the cumulative distribution function of

is the cumulative distribution function of![]() .

.

![]()

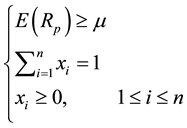

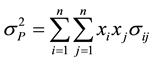

The MG mathematical model is presented as follows:

Minimize: ![]()

Subject to:

![]() (3)

(3)

where ![]() is the portfolio Gini,

is the portfolio Gini, ![]() is the amount invested in asset

is the amount invested in asset![]() ,

, ![]() is the expected return of asset

is the expected return of asset ![]() per period, and

per period, and ![]() is the minimal rate of return required by an investor.

is the minimal rate of return required by an investor.

The Minimum Gini as the Minimum Variance analysis. The optimisation program is presented mathematically as follows:

Minimize: ![]()

Subject to:

![]() (4)

(4)

2.3. VaR

Value-at-Risk is a measure of risk. It represents the maximum loss of the portfolio with a certain confidence probability![]() , over a certain time horizon. Formally, if the portfolio’s price

, over a certain time horizon. Formally, if the portfolio’s price ![]() at time

at time ![]() is a random variable where

is a random variable where ![]() represents a vector of risk factors at time

represents a vector of risk factors at time![]() , then the value-at-risk

, then the value-at-risk ![]() is implicitly given by the formula:

is implicitly given by the formula:

![]()

In the case of normal distribution, the parametric VaR is calculated by:

![]()

where![]() : average return, σ: the standard deviation of returns and

: average return, σ: the standard deviation of returns and ![]() is the quantile from a normal distribution.

is the quantile from a normal distribution.

Zangari (1996) , Favre and Galeano (2002) provide a modified VaR calculation that takes the higher moments of non-normal distributions (skewness and kurtosis) into account through the use of the Cornish-Fisher expansion.

![]()

![]()

where ![]() is the skewness of

is the skewness of ![]() and

and ![]() is the excess kurtosis of

is the excess kurtosis of![]() .

.

The Johnson SU distribution we use here differs from the Cornish-Fisher approach. It transforms a random variable ![]() into a standard normal variable

into a standard normal variable![]() , and writing in general:

, and writing in general:

![]()

where ![]() is a standard normal variable;

is a standard normal variable; ![]() and

and ![]() shape parameters;

shape parameters; ![]() the location parameter and

the location parameter and ![]() scale parameter.

scale parameter.

The Johnson SU value-at-risk is obtained by:

![]()

2.4. CVaR

CVaR, also known as Expected Shortfall, can be defined as the expectation of the loss when the loss exceeds VaR. Since VaR measures the value that separates the ![]() of the distribution, the aim was to focus on the tail of the loss, the remaining

of the distribution, the aim was to focus on the tail of the loss, the remaining![]() , of which we know neither the distribution nor the expectation. So we defined a complementary measure to the risk of loss, Conditional VaR. For a random variable,

, of which we know neither the distribution nor the expectation. So we defined a complementary measure to the risk of loss, Conditional VaR. For a random variable, ![]() is defined by:

is defined by:

![]()

2.5. GARCH (1.1) Model

In this study, volatility was estimated by applying a GARCH (1.1) model to each portfolio. This is a familiar model in econometrics; see Shephard (1996) . If ![]() denotes the observed series (in this case, the observed daily return) on day

denotes the observed series (in this case, the observed daily return) on day![]() , assumed standardised to mean 0, then the model represents

, assumed standardised to mean 0, then the model represents ![]() in the form:

in the form:

![]() ,

,

where ![]() are i.i.d.

are i.i.d. ![]() random variables, and the volatility

random variables, and the volatility ![]() is assumed to satisfy an equation of the form:

is assumed to satisfy an equation of the form:

![]()

3. Methods

This paper focuses on the MADEX. We propose to build a portfolio composed only of assets from the MADEX over a period of national and global financial crisis spanning 01/01/2011 to 10/01/2014. Our dataset consists of a daily series of returns, which served as a benchmark for comparing relative profitability of strategies MV and MG. The six risky assets selected are those most sensitive during the examined period: Addoha, Atlanta, BCP, Delta Holding, Managem and Maroc Telecom.

This study begins with an analysis of the characteristics of six selected assets that allows the construction of a portfolio using the MV strategy, the MG strategy, the Min-V strategy and Min-G strategy. This analysis determines the weights of the six assets. Descriptive statistics are presented in Table 1.

The strong results for the normality test (Jarque-Bera) for each stock, led us to reject the null hypothesis of the normality test at 99% confidence level. These results indicate a well-known property of financial data series: returns are usually not normally distributed. In addition, skewness and kurtosis, other properties of risky assets, have been discovered in our data series. Since both properties are apparent in our data, we assume that using the Mean- Gini strategy should provide the best portfolio due to the fact that the Gini strategy exceeds normal return distribution assumptions. Based on these results, we assume that in the context of our data, MG strategy must produce better results than the MV strategy.

After the application of optimisation programs of the MV strategy, the MG strategy, the Minimum Variance strategy (Min-V) and the Minimum Gini strategy (Min-G), we obtained their optimum portfolios in Table 2 and Table 3 presents summary statistics of optimal portfolios obtained by the resolution of optimization programs.

![]()

Table 2. Percentage of stocks in optimal portfolios.

![]()

Table 3. Summary statistics of optimal portfolios.

Return series for optimal portfolios are plotted in Figure 1. Plots demonstrate that the return series are extremely unstable.

In order to make the comparison of the two strategies clearer, we used quasi-analytic VaR and CVaR methods using the GARCH (1.1) model, because the variance is not homoscedastic as the ARCH test result proves. This was done in order to take into account those specific characteristics apparent in our data. In order to move away from a normal distribution framework for the prediction of VaR and CVaR, we used the Cornish-Fisher expansion and the Johnson SU approximation.

Table 4 presents the different tests of stationary. We accept the alternative hypothesis that the series of returns of the four portfolios are stationary and the result of the ARCH test leads us to reject the null hypothesis. Therefore, it is assumed that the residual variance is not homoscedastic. The prediction the quasi-analytic VaR and CVaR of portfolios will be made on a GARCH (1; 1) model.

4. Results

4.1. Estimating Parameters

The results of the goodness-of-fit tests for different models ARMA/GARCH show clearly that a combination of AR (1)-GARCH (1.1) and Gaussian residuals and student-t residuals are the appropriate models, from a statistical

![]()

Table 4. Unit root tests of the series of returns.

point of view, for portfolios in times of market turbulence. Table 5 and Table 6 present parameters of GARCH (1.1) Model with Normal Distribution and Student-t Distribution.

4.2. Back-Testing VaR Estimates

We evaluated the accuracy of the proposed VaR estimates over a 250 day period using the now standard coverage tests of Christoffersen (1998) . We combined the GARCH (1.1) model with the approximation method. The Cornish-Fisher expansion, and the Johnson SU approximation derive the VaR estimates for each portfolio where![]() ; 5% and 1%.

; 5% and 1%.

In finance literature tells us that there are two fundamental test procedures used to compare the performances of VaR: Unconditional and Conditional. We make use of Kupiec’s (1995) Test to evaluate GARCH specifications for unconditional coverage, and the Christoffersen Test to embrace both unconditional coverage and the independence of violations. The Kupiec Test and Christoffersen Test results for the portfolios are reported in Tables 7-10.

![]()

Table 5. Estimating parameters of GARCH (1.1) model with normal distribution.

![]()

Table 6. Estimating parameters of GARCH (1.1) model with student-t distribution.

![]()

Table 7. Unconditional coverage and conditional coverage of VaR GARCH (1.1) model with normal distribution.

Finally, we utilised CVaR to compare the two pairs of strategies because the outcomes are similar and CVaR can better capture the tail risk. Results are reported in Tables 11-14.

5. Discussion

This paper discusses and compares analytical results obtained with MV, MG, the Min-V and the Min-G strategies on the Moroccan financial market (MADEX) during periods of market instability, and demonstrates, empirically, that quasi-analytic GARCH VaR forecasts can be accurately constructed using analytic formulae for higher moments of aggregated GARCH returns by using Cornish-Fisher expansion and the Johnson SU distribution.

Results show that the composition of two pairs of strategies: MV versus MG and Min-versus Min-G strategy are similar but not identical for that we have very close results in the VaR which is not convincing to compare the two strategies. The judgment is conclusive when considering the CVaR because the MG strategy has lower

![]()

Table 8. Unconditional coverage and CONDITIONAL coverage of VaR GARCH (1.1) model with student-t distribution.

![]()

Table 9. Unconditional coverage and conditional coverage of VaR GARCH (1.1) model with normal distribution.

![]()

Table 10. Unconditional coverage and conditional coverage of VaR GARCH (1.1) model with student-t distribution.

![]()

Table 11. CVaR GARCH (1.1) model with normal distribution.

**Represent the lower CVaR of both strategies.

![]()

Table 12. CVaR (1.1) model with student-t distribution.

**Represent the lower CVaR of both strategies.

![]()

Table 13. CVaR GARCH (1.1) model with normal distribution.

**Represent the lower CVaR of both strategies.

![]()

Table 14. CVaR (1.1) Model with student-t distribution.

**Represent the lower CVaR of both strategies.

*Corresponding author.

In view of these results, we conclude that the MG strategy outperforms the MV strategy in our real-world examples taken from the Moroccan Financial Market. This is due to the characteristics of the financial assets that do not follow a normal distribution and the unstable nature of the variance in time.

There was great accuracy for all significance levels (10%, 5% and 1%), when we considered for GARCH VaR forecasting. Our results are even more remarkable when we consider that the analysis is entirely out-of- sample and that the testing period (2011-2014) covers several prolonged periods of excessively turbulent financial market activity.

NOTES

*Corresponding author.