1. Introduction

The literature of asymmetrical price adjustment, both theoretical and empirical, is large ([1] who offer an extensive comprehensive survey). For modern new Keynesian macro, the whole point was analytically to develop microfoundations to justify the existence of price asymmetry or sticky prices. Others theoretical models combined this microeconomic foundation with the strategic interaction factor in order to generate price asymmetries during the adjustment process [2] -[4] . Different kinds of models were built to show up price asymmetries.

In this long list there wasn’t, however, a macroeconomic foundation of downward money price inflexibility based on classical Monetary Economics as it is presented in this note. Here, we assume a money demand where agents are risk averse. The conclusion derives an endogenous asymmetric price adjustment as prices adjust more rapidly when they go upward than downward. We analyze price reaction around a neighborhood—at a starting price equilibrium—after we modified the money supply (hence the neutral money axiom holds since prices movements are caused by changes in the quantity of money). This result does not disappear at the second order; on the contrary, it intensifies.

We work with a standard Monetary model that builds on the same model that J. H. G. Olivera [5] used to study how prices adjust to its equilibrium value, but we reconstruct Olivera’s approach in order to analyze how prices behave under changes in the monetary supply. First, we show a first-order effect that the price adjustment process when the quantity of money varies is heterogeneous—a result more or less present in Olivera’s model. Second, we show a second-order effect that the initial price asymmetry tends to increase as time goes by a simple but a definitely new innovation. We reconcile this result with some previous empirical and we discuss the essence of this asymmetry arguing that there is an economic intuition behind this result not only a mathematical truth.

2. The Model

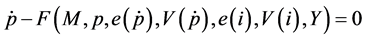

The starting point is the classical conception that prices fully adjust according to money supply variations:

(1)

(1)

where  is the price level,

is the price level,  is the price time derivative,

is the price time derivative,  is the nominal money supply,

is the nominal money supply,  is the real interest rate,

is the real interest rate,  and

and  are the mathematical expectation and the volatility level of the price variation respectively, while

are the mathematical expectation and the volatility level of the price variation respectively, while  and

and  are the mathematical expectation and the volatility level of the real interest rate. Finally,

are the mathematical expectation and the volatility level of the real interest rate. Finally,  is the real national income. We define

is the real national income. We define  as the excess money supply function (EMSF), which according to traditional assumptions, varies positively with the nominal money supply.

as the excess money supply function (EMSF), which according to traditional assumptions, varies positively with the nominal money supply.

The EMSF also varies negatively with the price level and positively with expected prices and price volatility. These two assumptions typically capture the reaction of money demand under expected price change and its corresponding volatility. From now on, we concentrate on money variations and its impact over the price dynamic adjustment; hence we assume that  and

and  are fixed and remain constant over time.

are fixed and remain constant over time.

Proposition 1: Suppose that

Proposition 1: Suppose that  and

and  is a strict increasing function of

is a strict increasing function of![]() . Then, if

. Then, if

![]() ;

;![]() ;

;![]() ;

;![]() ; the immediate price reaction is asymmetrically under changes in

; the immediate price reaction is asymmetrically under changes in

the quantity of money.

Proof. Recall we assume that ![]() and

and ![]() are fixed and remain constant over time—hence, we can eliminate from (1) for the simplicity of the exposure. Also, that

are fixed and remain constant over time—hence, we can eliminate from (1) for the simplicity of the exposure. Also, that ![]() and

and ![]() is a strict increasing function of

is a strict increasing function of![]() . Therefore, we can re-write equation (1) into:

. Therefore, we can re-write equation (1) into:

![]() (2)

(2)

Let’s define an equilibrium value for price as![]() . Initially, the system is in equilibrium and the

. Initially, the system is in equilibrium and the

quantity of money at this point is![]() . We are interested to analyze the immediate impact of changes in the

. We are interested to analyze the immediate impact of changes in the

quantity of money around![]() , hence we assume that

, hence we assume that ![]() to simplify. The corresponding Taylor ap-

to simplify. The corresponding Taylor ap-

proximation of equation (2) can be expressed as:

![]() (3)

(3)

where![]() ;

;![]() ;

;![]() ;

;![]()

![]() ,

, ![]() and

and ![]() are positive constants while

are positive constants while ![]() is a negative

is a negative

constant. Notice that the sign that accompanies the term ![]() eventually depends on the sign of

eventually depends on the sign of ![]() as we

as we

show in the next lines1. Equation (3) can be re-written as:

![]() (3.1)

(3.1)

Or,

![]() (3.2)

(3.2)

If prices are initially at equilibrium![]() , any movement in prices will be given by changes in the quantity of money supply. From here, two cases arise. The case when

, any movement in prices will be given by changes in the quantity of money supply. From here, two cases arise. The case when![]() , where it holds that

, where it holds that

![]() —

—![]() —and therefore

—and therefore![]() . Then,

. Then,

![]() (3.3)

(3.3)

Conversely, when ![]() it holds that

it holds that ![]() and

and![]() :

:

![]() (3.4)

(3.4)

From equations (3.3) and (3.4), it is immediately inferred that upward price adjustment is more rapid than downward price adjustment when the quantity of money deviates from its equilibrium value.![]()

![]() Proposition 2: Suppose that the same assumptions of Proposition 1 hold. Then, the price asymmetry stated in Proposition 1 is increasing in time.

Proposition 2: Suppose that the same assumptions of Proposition 1 hold. Then, the price asymmetry stated in Proposition 1 is increasing in time.

Proof. The corresponding Taylor series for price at ![]() at some

at some ![]() is given by:

is given by:

![]() (4)

(4)

where at ![]() the price level is in equilibrium and equal to

the price level is in equilibrium and equal to![]() . Equation (4) shows that the curvature of

. Equation (4) shows that the curvature of

equation (4) depends, among other things, on the value of ![]() (see below Figure 1). Let’s differentiate equa-

(see below Figure 1). Let’s differentiate equa-

tion (3) in order to get the second order time derivative at![]() :

:

![]() (5)

(5)

where![]() ;

;![]() ;

;![]() ;

; ![]() are the same constants as in Proposition 1. Similarly, the sign

are the same constants as in Proposition 1. Similarly, the sign

that accompanies the term ![]() eventually depends on the sign of

eventually depends on the sign of ![]() and therefore, equation (5) can be re-written using the respective parameters signs as:

and therefore, equation (5) can be re-written using the respective parameters signs as:

![]()

From here, two cases arise. The case when![]() , where it holds that

, where it holds that![]() —

—![]() —and

—and

therefore![]() . Then,

. Then,

![]() (5.1)

(5.1)

Conversely, when ![]() it holds that

it holds that ![]() and

and![]() :

:

![]() (5.2)

(5.2)

Equations (5.1) and (5.2) shows that the initial price asymmetry under changes in the quantity of money (Proposition 1) not only persists as time goes by, it also increase its magnitude when the quantity of money deviates from its equilibrium value. Propositions 1 and 2 are resumed in figure 1.![]()

3. Discussion of propositions 1 & 2

This subsection discusses briefly previous results. The logical economic mechanisms operating behind the price asymmetry are 1) the neutral money axiom; 2) the liquidity preference and how does it relates to the risk averse effect. In the first case, we use this fundamental building block theory in order to work over a logical deduction that follows from the neutral money axiom as the raison of price movements. On the second case, the liquidity

![]()

Figure 1. Price dynamics under changes in the quantity of mo- ney, featuring Propositions 1 & 2.

preference and its relation with volatility simply suggest that when the volatility of prices goes up, even in inflation or deflation, risk-averse attitude implies a decrease in the demand for money, increasing the EMSF.

Altogether the result is described as follows. Money functions as a reserve of value and monetary actions have a quicker impact over prices compare with monetary contractions. This can be explained due to the com-

bination of the risk averse effect ![]() and the inflation/deflation process: when money expands and infla-

and the inflation/deflation process: when money expands and infla-

tion occurs, the increase in the value of ![]() rises the value of the price volatility; as volatility is rising, an increasing value for the excess money supply function (EMSF) push prices forward reinforcing the initial inflationary process caused initially due to the monetary expansion. When money decreases and deflation occurs, the reduction in the value of

rises the value of the price volatility; as volatility is rising, an increasing value for the excess money supply function (EMSF) push prices forward reinforcing the initial inflationary process caused initially due to the monetary expansion. When money decreases and deflation occurs, the reduction in the value of ![]() increases price volatility and the money excess supply function. The increase in the EMSF will generate a price increase (inflation), which will offset part of the initial deflationary process due to the initial monetary contraction and, therefore, reducing volatility. For all this, positive monetary shocks will have a greater impact over prices compare with negative ones, likewise prices will react more rapidly in the upward case compare with the downward.

increases price volatility and the money excess supply function. The increase in the EMSF will generate a price increase (inflation), which will offset part of the initial deflationary process due to the initial monetary contraction and, therefore, reducing volatility. For all this, positive monetary shocks will have a greater impact over prices compare with negative ones, likewise prices will react more rapidly in the upward case compare with the downward.

4. Conclusion

This theoretical result resembles what Brandt and Wang [6] show empirically: the volatility of inflation is time-varying and tends to be high when the level of inflation is high; therefore, deflation periods will possess a lower volatility level compared to those characterized by high inflation. Since the mechanical process underling price reactions are quite different in the upward adjustment case ![]() compared to the downward case

compared to the downward case![]() , under changes in the quantity of money, an asymmetry in price reactions should be expected when the quantity of money varies. This asymmetry is increasing in time, as Proposition 2 shows.

, under changes in the quantity of money, an asymmetry in price reactions should be expected when the quantity of money varies. This asymmetry is increasing in time, as Proposition 2 shows.

Acknowledgements

We thank Universidad de Palermo, Facultad de Ciencias Economicas for available funding. Pablo Schiaffino wishes to thank J. H.G Olivera. Much of the spirit of this note is based on the conversations that the two academics hold over this particularly issue between 2011 and 2013.