A Glance on the Monetary Politics from the Sustainability Perspective ()

1. Introduction

The fight against inflation has always been problematic. As we learned from the long global inflation of the 1960s and 1970s. In 2023, the difficulty is confirmed also because the fight requires paying the price of a recession induced by the increase in interest rates. The battle of the central banks is a very unstable balance between the maneuver to raise interest rates and the danger of an adverse economic response. This unstable equilibrium is also disturbed by the fact that the successful battle against the double-digit inflation of the FED Chair, Volcker at the beginning of the 1980s required setting an interest rate that is higher than that of inflation. Now it is clear that the responsibilities of the central banks are multiplying due to the inevitable burden to be paid in terms of the economy performance. In short, not an easy job, especially if you decide to use a stop-and-go maneuver with progressive increments of 0.50%. A caution that seeks to see in the field the reaction of prices to the slow but progressive growth of rates. Since inflation does not let up, the pressure of quasi-monthly increases becomes the norm. But with results that are still not very significant. In Figure 1 we can observe the range of inflation rates in the EU countries in August 2023. We can see that the European picture is complicated by different economic policies in each state belonging to the Union, while monetary policy is centralized in the European Central Bank. An additional complication that causes inflation to fluctuate from 6.4% in Germany to 3.21% in Finland. The choice to continue with rates rising in fits and starts is inevitable, even though there is no great progress on the price front.

But is interest rate therapy the right therapy to resect current inflation which

![]() Source: EBC.europa.eu.

Source: EBC.europa.eu.

Figure 1. HICP Inflation rate—Overall index 2000—August 2023-Euro area.

certainly does not have the same characteristics as the 1960s and 1970s? No, I would say, because price pressure in Europe and America (deflation wins in China) is not the same as in the last century, which was global, whereas today it is not! We are in a different era and thinking that we can use the same strategy more than half a century later could be a mistake. This may mean that using the strategy of chasing prices with interest rates today may not be appropriate. In fact, they are not dealing with an inflation which at the time had lasted for twenty years and now emerges when we have come out from an extended period of trend to deflation. A trend towards a structural decline in prices, which began in the 2000s and lasted over twenty years.

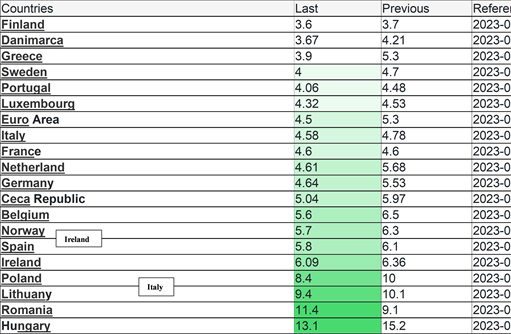

The problem is that this time inflation is due to geopolitical factors and the war in Europe but also to factors not adequately considered. We must glance the speculation that has grown and expanded throughout the long time we have been subject to deflation. What, one might say, does multi-year deflation and speculation have to do with anything? In fact, the two fearful realities, deflation, and speculation, have been paired during the entire previous twenty-year period. This time too, the responsibility could fall on the central banks who responded to deflation with the collapse of interest rates close to zero. A condition that was not exploited by the real economy, which instead slowed down due to the consequences of the decline on the corporate and family balance. It is no coincidence that throughout the first decade of the 2000s, the strong rising pressure in the prices of oil and rare materials was only partially reflected in the final prices of daily shopping. While for over two years consumer price have increased, highlighting an inflation against which we are fighting today (Table 1).

Table 1. HICP Inflation rate—Overall index August 2023 Euro area countries.

Source: EBC.europa.eu.

As if to say that deflation overshadowed the rising international prices, which could not be fully expressed in the prices of daily goods. It almost seems like a good omen except that resisting the rise in consumer prices puts trade and industry in crisis. An additional danger, because deflation is a dark threat that a large part of diligent citizens do not perceive. On the other hand, we must remember that deflation is like a message to communities about the long path to take to get out of the slowing mud of deflation. We must accept the decline of the economic situation, which is capable of dispersing in time this monetary anomaly. It should not be overlooked that both the last century-style inflation and the current first twenty-year style deflation are not mechanisms driven by some unknown organism. They are in reality treatments that universal laws impose on the economy of states or at a global level to give the sign that development is taking the wrong path with severe damage to nature ( Milanović & Lakner, 2013 ). And it therefore imposes, as a resolution, a period of pause or decline in development, which is capable of correcting the direction and thus limiting damage to the environment.

We certainly cannot forget, looking at the inflation that threatens us today, that the scenario we face today has changed significantly compared to the past century. Because the difficult struggle undertaken by central banks in the West to stem the reappearance of inflation, which nowadays, after a prolonged period of absence, has a dual source.

We certainly cannot forget, looking at the inflation that threatens us today, that the scenario we face today has changed significantly compared to the past century. Because the difficult struggle undertaken by central banks in the West to stem the reappearance of inflation, which nowadays, after a prolonged period of absence, has a dual source.

First, an improvement in the economic climate in the West, which pushes us almost as if it were a positive wave (and it really is) out of the prolonged period in which we were subject, at least in the West, to deflation. In fact, the rule applies that a prolonged worsening of the economic it leads us into the mouth of deflation. While, on the contrary, a recovery of stability in the economy brings with it the gradual dissolution of deflation.

It is no coincidence that we can see that the looming inflation, which is not expected, is the previous presentation of effects linked to the dissolution of deflation in our economic quadrant. As we mentioned, it is not expressed globally ( Kissinger, 2022 ). The phenomenon of the swing in consumer prices could be explained in this way, although the driving force behind the gradual emergence on prices front is linked to the intermittent deflation. In other words, we could say that the ups and downs of inflation and above all the variance of values between the various states in the EU can be attributed to the different influence of the dissipation—alternating and geographically different—of deflation of the different territories included in the European Union.

In Figure 2, we can observe the creeping curve of inflation rates in EU tending towards zero since 2000 for almost twenty years; until 2020 when the inflation curve marks a growing surge followed by the decisions of the European Central Bank (moving with the same cadences as the Fed), which gradually increases interest rates up to 4.5% for fight inflation. It is interesting to note that the EU inflation curve moves at the same pace as prices in Germany for the entire period.

2. Procedures Decisive in the Past May Be of Little Influence Today

All this, however, seems to lead to the conclusion that the intervention of the ECB for the euro countries was not of great use. That is, that the progressive increases in the cost of money up to 4.75% did not bring the expected fruit.

It should be noted that it should not be surprising that the repetition of procedures that were decisive in the past may be of little influence today. I am referring to the bold test of the FED Chair, Volcker, who, in order to eradicate double-digit inflation in the USA, did not hesitate, with the agreement of the US President, at the end of the Seventies to increase interest rates a few points above the inflation rate ( Kissinger, 2022 ). The monetary tightening caused a controlled recession for two years in America, with vibrant protests from the world of industry and commerce. But the results were not lacking. At the beginning of the 1980s inflation fell to 5% and then to 2% the following year and remained so until the end of the century. The stability gained had favorable repercussions on the economy across the Atlantic, which achieved better performances than in the past.

Well, why apply Volcker’s winning strategy to the inflation, which today creates so much concern, and above all why do today’s results with the intermittent increase in rates not justify the illustrious past? Meanwhile, saying that Volcker’s inflation strategy does not work today is an exaggeration. But the results are certainly confusing; we therefore have no reason to believe that this confusion will clear up in the near future. It must always be said that the past in economics is not repeated, especially if times move away and conditions are different. Let us not forget that we are on the not-so-close eve of achieving full neutrality of our existence with the planet that welcomes us. An eve that creates apprehension due to the difficulties in necessary investments and work and also the leap that research and science must make. Times that certainly cannot just blend with a not so recent past ( Cossiga, 2021 ).

These are very different times to accept the strategies of almost a century ago without some complaints. All that remains is to look further at what differences between the two eras have materialized, when compared. First of all, I would like to make a brief speech on an often-overlooked topic, that is, inflation wave is always the same. In other words, the inflation that has rolled unchecked across the entire quadrant of the global economy for over twenty years last century can be compared without flaw with the inflation that currently torments us. Well, I would say that the overlap is risky. Why? Well, the inflation of the 1970s and 1980s had a global hold while today’s inflation is a recent anomaly that derives from the increased cost of fossil fuels and rare minerals. Furthermore, inflation is not reflected everywhere but especially in the West. These are differences that probably do not justify the limited impact of the monetary tightening imposed by the central banks in the USA and the EU. May see in Figure 2 Inflation-core in China in last ten years, now in the throes of deflation. The price trend in China does not follow the path followed in the Western area. The inflation line from 2014 to 2020 remains around 2% in China. Slowly falling, in 2020 inflation fell below zero and then maintained the average of 0.50%. In China we are therefore in a deflationary area while in the West the tendency towards inflation prevails.

However, the reason that makes the difference between the two inflation models, current and historical, is much more conclusive. The difficulty encountered in removing the twenty-year presence of inflation depended on its basic characteristic. In short, the inflation rate appeared at the beginning of the 1960s due to the development tension accumulated by unwary administrators. They attempted to maintain the pace of development of the 1950s but did not realize that the post-World War II acceleration drive was now exhausted. Thus, began as a weak inflation which, however, had a very serious flaw, that is, it accelerated at a constant rate independent of the state of the economy. As if to say that the struggle of the Central Banks had the advantage of partially demolishing the pressure of inflated prices, but in the meantime the push to raise prices was recharged at the rate of the constant acceleration that characterized the phenomenon.

In essence, inflation was born at the time due to the fever of the economy, but then became independent from the condition of the economy and subject only to the constant acceleration without end. This is why the equally constant struggle exercised by the Central Banks with the maneuver to increase the interest rates was, as it were, overwhelmed or canceled out by the constant increase due to the acceleration rate. In short, a fight like Sisyphus, or like Penelope who

![]() Source: Trading Economics.

Source: Trading Economics.

Figure 2. Inflation core in China—2014/2923.

untied the day’s work at night. This absurd mechanism can explain the difficulty encountered by monetary policy in defeating the inflation that was continually rising again. Only a period of controlled recession could have overcome the recurring phenomenon, which is now unrelated to the fate of the economy.

Therefore, with the maneuver devised by Volcker the nascent inflation could have been defeated at the beginning with little pain, but the reiteration of the inflation recharging mechanism on the basis of a constant acceleration had the effect of maintaining the plague for over twenty years. The characteristics of the inflation of the Sixties are therefore:

· Monetary policy causes a reiteration of the process that removes and recharges the wave of inflated prices ( Kose, Otrok, & Whiteman, 2019 ).

· Subduing the price run requires, as the only way, a controlled recession for a relatively prolonged period.

· The inflation of the Sixties always arises from an attempt to force the economy.

· It has the characteristic of renewing itself in a cycle with a rhythm according to a constant acceleration rate, which depends on the basic state of the economy at the start of the inflationary cycle.

· The state of the economy does not matter while the prices wave it is subject to the motion of constant acceleration1.

I would add that attempts to follow the Volcker rule in part, that is, by mitigating the monetary policy decision for fear of a sharp decline in the economy, was a misstep for many countries, including Italy. The Treasury Secretary at the time chose to avoid a sharp recession. A concern that cost a decade (1990s) of inflation above 5% and a decline in development throughout. Disadvantages therefore against the advantages in the USA with inflation stable at 2% and a better than average performance of the economy throughout the 1990s.

Concise conclusion, the inflation of the 1960s only fell with a controlled recession for the time necessary to absorb the rising price tensions. Thus characterized, the inflation of the last century has a motivation (the end of accelerated post-war development) but has no “godfather”. In the absence of any promoter, we must convince ourselves that global historical inflation was produced through universal laws, which control the lives of human beings beyond matter. That is, Inflation (or deflation) are like messages that the community receives through the movement of prices to signal that things in the economy are not going well. The pace of development is therefore not good in relation to our planet’s ability to absorb greenhouse gases, responsible for global warming ( Fagan, 2017 ). A sort of alarm for the community to put pressure on the management of power to start a recession that slows down the forcing of our environment.

Therefore, in general, monetary anomalies (inflation and deflation) do not have an identifiable promoter and have an autonomy that ensures their survival (obviously until the decisive force of the recession is chosen). To distinguish them, the other forms of monetary anomalies that do not have the growth factor clearly (constant acceleration), are connected as a node to the economy (while historical inflation is not connected to the state of the economy at the time). Current inflation may be the result of an improvement in the economic situation (which brings with it the see-sawing of deflation), therefore presents an alternating movement and is generally not very sensitive to the interest rate maneuver implemented by the Central Banks. In short, these are the imprints of the inflation plaguing the West. An unexpected inflation linked to the cost of oil and rare earths, which has risen back to the surface in prices, after years that deflation had held back the transfer of the higher cost of fossil energy onto daily consumer goods. A surprise because deflation in the USA and EU had accustomed communities to a controlled increase in daily goods. A phenomenon now linked to the improvement in the economic situation, which has gradually canceled the downward pressure on prices.

It should not be surprising that deflation and inflation are maneuvers connected to the laws of the universe that govern life in the world and therefore interfere with the issue of the economy of human beings, that is, with life itself. In other words, life is not only made possible by universal laws so even a minimal deviation from the basic values of matter would not make existence in our world possible. But also, by defining limits, almost “dragons” (represented by inflation and deflation), which (if not respected) could lead to catastrophe in the rules of the economy.

So, the reason for the unexpected outbreak of inflation had long been buried in the folds of deflation. The improvement in the economic situation, unheard of, is responsible for something that was veiled and then came out into the open. Nothing to do with “historical inflation”, which instead arises in modest doses and then accelerates constantly without any direct relation to the economic situation. The purpose of historical inflation or deflation is to wake up communities that there is a need for a change in the management of the economy. It is therefore an alarm from the natural system that the damage to the environment is excessive and that a pause or recession is needed to return to quasi-equilibrium (Less possible damage to nature).

3. Monetary Policy—Greater Caution in the Reduction of Interest Rates Would Perhaps Be Appropriate

It is reasonable why restrictive monetary policy can have a negligible effect, because—as is understandable—it is the greater or lesser resistance of deflation that blocks or unblocks consumer prices. Hence the up-and-down trend of current inflation. It could be added that even the recession, given as a solving factor in the case of inflation in the last century, would not have any profound influence on the today’s price movement. In present case, in fact, we do not need even a deep recession to control prices, which are already subject to the declining forces of awakened or no deflation. As we have said, deflation tends to worsen with recession and loosen with the recovery of the economy. So, the recovery of deflation would be the solution that seems to contain prices and control inflation ( Cossiga, 2018b ).

A nice sticky situation. Because what it seems is not true. The consequences of the interest rate adjustment could be essentially nothing. They are an indirect result of the decreasing or increasing force of deflation, which in turn is influenced by the state of the economy. Even the ECB’s recent decision to increase the interest rate for euro countries to 4.5% could apparently bring with it a reduction in average inflation in the EU, but once again appearances do not correspond to the truth. Because interest rates have low effect on international cost inflation; the rise in interest rates, however, is sensitive to the decline in the economic situation in the EURO countries and the resumption of deflation, which reduces the fate of consumer prices.

In concrete terms, inflation due international costs would not be remediable with monetary maneuvers. But it would still be relatively short-lived because it is not self-sustaining and is only aroused by tensions at an international level. Once the progressive rise in consumer costs has been produced, they stop at a new equilibrium, so that inflation also disappears. In other words, if the cost increases in certain imported goods (fossil energy, etc.) there is no saint to help. The increased costs are gradually shared on the market until a new equilibrium is reached, which also marks the end of cost inflation.

Summarizing in broad terms, the essential difference between constantly accelerating inflation, driven by the needs of a relationship with nature (least possible damage) and international cost inflation lies in the long wave of the former (if not slowed down by the Volcker maneuver)—and the relatively short life of cost inflation. Do not think that the two typical forms of inflation can be resolved in the same way. The first is slow at the beginning and then continues to rise in inflated prices; the other is unexpected at birth and then reabsorbed without interventions in a new equilibrium in consumer prices. There can be no misunderstanding in distinguishing the two main inflationary waves.

Let us try to understand the reason for these differences. Let us start from today’s case, which shows the typical characteristics we have described, i.e., the sudden jump in unexpected prices, which reaches more than 10% of the initial jump. Thus, the gradual descent, which depends on the gradual absorption in consumer prices of the international price gap. The simple image can be found in Figure 2 and Figure 3. In essence, however, we can say that the revival of inflation from international costs is linked to the long previous period in which interest rates slipped downward to follow the wave falling deflated prices. As

![]() Source: Trading Econmics.

Source: Trading Econmics.

Figure 3. Inflation core in USA-2014-2023.

shown in a simplified way in Figure 3. Why?

In some ways we can say that the discomfort we feel today is due to the long stasis of monetary policy, which lasted twenty years, with interest rates stuck near zero. In other words, monetary policy always follows the trend of both deflation and inflation with a rate maneuver that repeats the trend of prices falling (deflation) or rising (inflation). In other words, rates rise following the movement of rising prices, or they fall to zero or even negative if deflation afflicts the economy. Everything OK! Yes, but with a limit. Low or very low interest rates during the lengthy period of deflation have weighed on the economy since 2000, only to recede from 2022. Which is to say that during the long phase of deflation that affected world economies, rates were close to zero. In other words, cheap credit from which speculation has fished for to boost international prices, which today support the pressure of inflation. So, we gave ourselves a hammer on the foot, letting speculation push up asset values and the stock market. The dark side of all this is that the real economy, while finance was inflating, showed an underlying weakness. Deflation is a serious disease that is also misleading and distorts the situation. In fact, the strength of the financial situation seems like a crutch for the economy, but it is the opposite. The stock market and financial markets made extensive use of very low-cost credit, while the real economy suffered because deflation requires a recession to be cured.

This means that there is a dark side to the dizzying drop-in rates to ward off deflation. That is, ignite speculation which will then present the bill in the form of a sudden jump in inflation from international costs. When? We experience it when deflation leaves the field. As can be seen from Figure 4, in the last decade the Dow Jones has almost doubled with prices going from 23,000 to 33,000. Obviously, the downward maneuver by the central banks is ultimately reasonable because the rate maneuver follows the downward movement of deflated prices. Only when central banks begin a slow increase in interest rates in the

![]() Source: Market Wathch.

Source: Market Wathch.

Figure 4. US Dow Jones trend in the last ten years.

Based on its current assessment, the Governing Council considers that key ECB interest rates have reached levels that, if maintained for a sufficiently long period, will make a substantial contribution to a timely return of inflation to target. Future decisions of the Governing Council will ensure that key ECB interest rates are set at sufficiently restrictive levels for as long as necessary. The Governing Council will continue to follow a data-driven approach in determining the appropriate level and duration of the restriction. In particular, the Governing Council’s decisions on interest rates will be based on its assessment of the inflation outlook given the most recent economic and financial data, the dynamics of underlying inflation and the intensity of monetary policy transmission.

The Governing Council decided to raise the ECB’s three key interest rates by 25 basis points. Therefore, interest rates on the main refinancing operations, marginal lending facility and deposit facilities will be raised to 4.50%, 4.75% and 4.00% respectively, with effect from 20 September 2023. ECB Monetary policy decisions—14 September 2023.

expectation of an improvement in the economic situation (especially in the USA), at that point the stock market curve inverts and inflation appears unexpected2.

I am afraid it is not possible to do otherwise now. But greater caution in the reduction of interest rates would perhaps be appropriate. In the sense that economic policy must not push the descent of the lows rates beyond what is fair and above all never to zero or below zero. The decline in rates should not fall beyond 2%, i.e., the “magic” number that Central Banks indicate as an indicator of a healthy and stable economy. Economy close to 2% indicates almost stable prices. But stability is still a utopia, at least until we have achieved complete neutrality with nature. Then only the value of prices will be an immutable to 2%. For now, while waiting to reach neutrality and stability in the economy, 2% is a hypothetical value that is still unattainable. Therefore, if the economy shows a change in prices close to 2%, we must think that we are approaching deflation and not instead to the longed-for stability, precisely because for now this goal is unattainable.

Since the hypothetical value 2% marks the condition of full stability of the economy, it means that price stability will not be zero but a value close to 2%. Which is to say that values between 0 and 2% can be interpreted as background noise of the economy. The value of the predicted interval is therefore to be assimilated to zero. It should not be used to fix the interest rate, in an unlikely attempt by Central Banks to control deflation by degrading the interest rate to zero ( Cossiga, 2018a ).

We must accept that deflation can only be beaten with the recession of the economy that corrects the anomalies of the ongoing management, in the same way indicated by Volcker. In other words, we do not need to cut rates to escape the noose of deflation. On the contrary, rates must be kept high, thus withstanding the economic downturn at the level necessary to calm the pangs of deflation. Unfortunately, in economics if you take a wrong turn, the exit is not free ( Cossiga, 2022 ). Therefore, interest rates should not fall when we are in the throes of deflation. IN any case, never below 2% which is the utopian signal for now of the economy’s stability for ever, because—I repeat—below this number of utopian price stability there is only deflation that needs to be fought ( Milanović & Lakner, 2013 ).

4. Conclusion

Returning to the topic of inflation plaguing family accounts in the West, stating that the increase in interest rates adopted by the ECB and the FED may not be relevant in the fight against rising prices is a half-truth. At least in the current condition in the USA and EU, which show mixed results in this struggle for stability. However, it can at the same time be argued that to address the increase in international prices of oil and rare metals, increasing interest rates was a sacrosanct decision. Not so much to calm the prices of daily shopping, but to put a stop to speculation, which is the main cause of the movement of international prices and therefore of the increase in the costs of daily shopping. In other words, monetary policy, with the manipulation of interest rates, acts on inflation indirectly, that is, it does the job that governments should do by putting the brakes on speculation with harsh fiscal measures. The same speculation that is largely responsible for the jumps in oil and rare metal prices. Raising rates close to 5% both in the USA and in Europe means weighing on credit which fuels speculation. For those who are uncertain about the meaning of the contrasting trend between rising financial values and the weak stability of the real economy, consider that the former is fueled to the detriment of the other. Not only that. Because the rising cost of international prices punishes consumption and slows down GDP. Yet, I must say that complaints about the excess prices of stock market values or international prices are rarely heard, while the cry of the fewer wealthy classes ( Milanović & Lakner, 2013 ) is directed at the final bad fruit, inflation.

Perhaps because we have the unfortunately wrong feeling that “if the stock market goes well, the economy goes well too”. Unfortunately, this apparently sound rule does not work when deflation is at the bottom of the market ( Kose, Otrok, & Whiteman, 2019 ). In this Hamlet-like case, the tendency towards zero in rates everywhere annihilates the cost of credit and gives vent to speculation. Which we will then pay on the market every day.

We therefore do not blame monetary policy which plays the game on behalf of others, while suffering the criticism of the poor results in terms of costs for families and businesses. A photographic image of the brake effect caused by the intermittent increase in interest rates can be found in Figure 5 which shows the performance of the Dow Jones over the last year, during which the US and EU

![]() Source: Market Wathch.

Source: Market Wathch.

Figure 5. US Dow Jones trend in last two years.

central banks have progressively increased the defense of interest rates of interest. Unfortunately, the defense of interest rates was not enough to mitigate the upward charge of oil, which is suffering from geopolitical tensions.

The stability of oil prices can be a good signal that pushes businesses and local communities to make investments in the production of renewable energy and reduce the production of greenhouse gases that overheat the Earth. Not all evil, comes to harm, especially when we talk about returning to the green planet. The path towards complete neutrality of our presence on the planet is paved with many challenges,

What can we expect in the next few months or so? The prospect of emerging from inflation is weak until the reasons fueling the recovery of inflation driven by geopolitical events will not subside. Therefore, at least for the whole of 2024 we will have recurring resurgences of inflation on daily goods. Monetary policy, with the pressure exerted by interest rates, is tending to keep the long hand of speculation on the stock markets at bay. But geopolitical factors will not slow down the rise of oil and everything else responsible for the intermittent rebound in consumer prices. Government policy is latent on the issue and relies on monetary policy, which ultimately postulates that its action is hindered. There is a clear need for the issue of international prices of energy and scarce metals to be addressed at UN level, because even stabilizing the price at the current level ($90 per barrel of crude oil) would be a panacea to finally stem prices for consumption. In fact, the problem of intermittent inflation lies in expectations. Therefore, the tensions on the international prices of fossil energy, even for a not short period, are supported by a speculative lever, which has repercussions on the market. So, at a greater possible level, it should decide that the super earnings linked to the elasticity of oil prices and other things are subject to a tax levy to be allocated to the needs of supra-national organisms. The risk of speculation would increase and thus the momentum of daily prices would be lost.

Let us not forget that inflation from international costs is due to the mark-up of selling prices; recharge that transfers gradually. Just as gradually it will tend to disappear if international prices stop at the new level reached. A stop in inflation occurs even if the price of fossil energy stabilizes. Unlike the inflation of the 1960s, there is no constant acceleration in price growth. But it is restarted if international prices move upwards. It must also be considered that, if the economy were to decline even briefly due to the increase in interest rates, we could witness a retreat in consumer prices just as unexpected as the revival of inflation in 2022. This time due to the reappearance in the field of deflation, which is in the balance. In fact, deflation retreats when the economy tends to rise but reappears if the cycle declines for any reason, in our case due to the impact of the cost of credit.

Apart from this supposition, it is very probable that the FED forecast that during 2024 inflation will return to historic lows (2%). The impact of the cost of money on the American economy is unlikely and furthermore there is a tendency oil prices to stabilize, although at an elevated level.

![]() Source: Federal Reserve Bank of S, Louis.

Source: Federal Reserve Bank of S, Louis.

Figure 6. Us inflation uncertainty measures.

Figure 6 is a line chart titled U.S. inflation uncertainty measure. It shows time series for the U.S. inflation component of REU, in the red solid line, the survey of professional forecasters (SPF) CPI Inflation Forecast Dispersion, in the black dashed line, and the Survey of economic professionals (SEP) Core PCE Inflation Diffusion Index, in the blue dotted line, from January of 2008 to March 2023. The time series are shown in standard deviations from the mean. The three-time series are somewhat correlated. They increase after the outbreak of COVID-19 and, by the end of the sample, all of them reach levels above 2 standard deviations from their historical means.

NOTES

1It must be added that the inflation of the last century suffered the double shock of oil prices in the seventies, so that inflation from international costs was essentially added to the classic inflation. Thus, the share for the boom in oil prices was added to the home-grown basic inflation, almost as a summation. However, the basic characteristic of classic inflation does not change, which is fueled by a basic acceleration to which the price gap is added due to the pressure of increasing (then decreasing) oil prices. However, nothing changes because the logic imposed by the accelerated movement of basic inflation prevails.

2The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy signing that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective. Federal Reserve issues FOMC statement—September 20, 2023.