Emerging Economics, Emergent Currencies: A Look into Dedollarization in Southeast Asia ()

1. Introduction

With the rise of the post-WW2 economic order, many countries have had to adapt to a global economic order dominated by the dollar. The US had the world’s largest and most liquid financial markets, played a pivotal role in the global oil market and the dollar dominated cross-border trade. A network effect was created where the ubiquity of the dollar made it the default choice for numerous transactions. The Euro was created in part to provide a counterweight to the dollar but shifted a relatively small share of trade away from the dollar. Countries have long been resigned to the dollar as the de facto world currency.

As geopolitical tensions rise, countries in Southeast Asia are beginning to see the potential benefits of diversifying their currency exposure and minimizing their vulnerability to financial shocks and economic sanctions. This research paper goes over the dollarisation landscape of ASEAN nations and examines each region’s efforts to reduce their reliance on the US dollar. This study begins by explaining the history of the dollar’s dominance and the definition of dollarization. It then delves into the current level of dollarisation of each of the ASEAN countries. It then goes over the numerous cases of trade and domestic dedollarisation in Southeast Asia, and the extent to which they are contributing to dedollarisation. The study then ends with a brief summary and a potential alternative to dedollarization as a whole.

2. Understanding Dollarization

Numerous countries have looked for ways to promote the stability of their currency since the Bretton Woods Conference after World War II (Victoria Hyde, 2023) . Initially, the most common method for achieving such stability was to peg their local currency’s exchange rates to an anchor currency like the US dollar. However, a supplement to pegging which has gained traction over the past few decades is to supplement the country’s local currency with the secure and stable dollar. This is known as dollarisation.

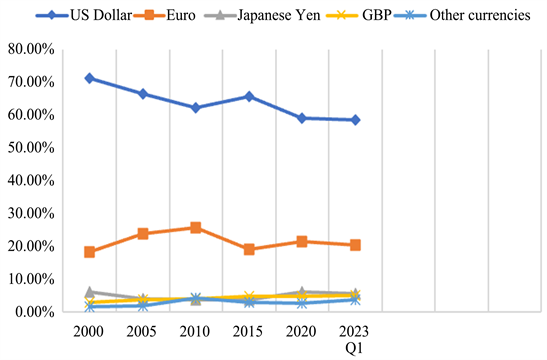

As seen in Chart 1, this is a global phenomenon, with the US dollar representing approximately 60% of total foreign exchange reserves globally in 2023.

Dollarization offers emerging markets a number of advantages, including a decline in inflation rates, a decrease in transaction costs, the removal of depreciation risk, ease of trade and transaction, and the development of a solid foundation for a sound financial sector.

Such comforts do, however, come with their fair share of drawbacks. A nation that does accept the dollar loses control over its interest rate and money supply. By embracing the US dollar, the country’s monetary authority relinquishes control over its interest rate and money supply. The dollarized economy would also lose revenue from seigniorage, that is, the profits earned by the government from issuing their own local currency. The exports and imports of the dollarized country are also affected by any change in US monetary policies.

Chart 1. US dollar continues to dominate global foreign exchange reserves. Source: IMF (International Monetary Fund: https://www.imf.org/en/Home).

3. Current Dedollarization Status in Southeast Asia

There is currently a great diversity of dollarization levels among Southeast Asian nations currently. Currency regime types in the region run the range from currency boards and stabilized arrangement—effectively heavily dollar-based regimes—to freely floating exchange rates that signify a relatively low level of dollarisation (Table 1).

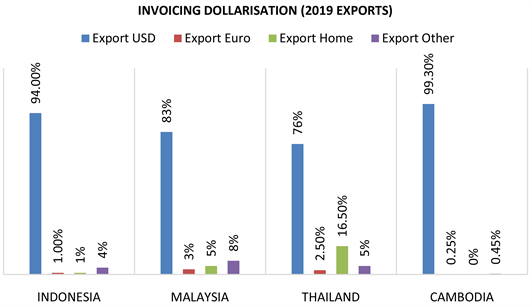

Invoicing of trade remains heavily dollar-based, with the vast majority of both exports and imports denominated in dollars. Even countries with relatively less dollarisation such as Malaysia and Thailand see more than three quarters of their trade denominated in dollars (Chart 2).

4. The Shift of ASEAN Countries away from the Dollar

The chief reason countries are starting to reduce exposure to the USD for trade and financial transactions is to achieve monetary policy independence. Relying heavily on the dollar makes a country’s economy vulnerable to US monetary policy fluctuations and other U.S. government policies such as trade and investment sanctions. Changes in the US economy, monetary or trade policies, and fiscal reforms can also have an outsized impact on the dollarised country. Fluctuations in the value of the dollar can have a serious influence on inflation rates, trade, and the overall economy of the dollarised country. In addition, Russia’s invasion of Ukraine has triggered a wave of financial sanctions on Moscow by the US and other western countries. The most significant among them has been the decision to freeze nearly $300 billion of Russia’s foreign currency reserves. Similarly, if another country perceives an increased risk of sanctions or economic instability due to such conflicts, it might accelerate efforts towards dedollarisation to reduce vulnerability to such economic sanctions.

![]()

Table 1. Currency regimes sorted from most to least dollarized.

Source: IMF (International Monetary Fund).

Chart 2. Dollar continues to dominate in trade invoicing. Source: Boz et al. (2020) , “Patterns in Invoicing Currency in Global Trade,” IMF Working Paper 20/126. https://t.ly/H7MKg.

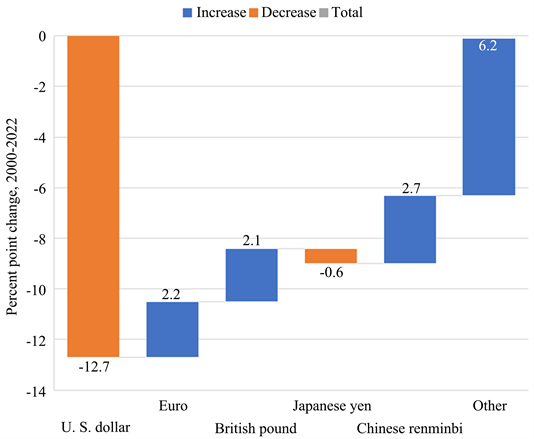

There are a number of methods of fostering dedollarization, ranging from complete currency substitution (rarely seen in ASEAN nations) to systems that limit the use of foreign currencies. The leaders of ASEAN countries have increased their focus on promoting the use of their local currencies and believe that it will improve intra-ASEAN trade and transactions. There have been two sets of initiatives—one focusing on cross-border settlement of transactions in local currencies, and another focusing on the dedollarisation of the domestic economy (Chart 3).

4.1. Cases of Trade Dedollarization

There are a number of cross-border initiatives in the region. The following are a few recent examples.

Local Currency Settlement Framework: Three ASEAN nations (Thailand, Indonesia, and Malaysia) signed a deal in 2016 to conduct bilateral trade in their national currencies (Tama & Wijayanti, 2023) . This was one of the first steps taken by Southeast Asian nations in their campaign to de-dollarize trade. In addition to the above deal, ASEAN is currently working to develop a cross-border digital payment system.

NETS—DuitNow QR: In March of 2023, neighboring countries Singapore and Malaysia unveiled NETS—DuitNow QR (Hamzah & Yuit, 2023) , a cross-border QR payment system (DuitNow, n.d.) developed by the Monetary Authority of Singapore and Bank Negara Malaysia (https://www.bnm.gov.my/-/information-on-local-currency-settlement-framework). Currently, this system is solely used for merchant transactions, however by the end of 2023 it should be more than capable of handling person-to-person transactions. The use of QR codes in this system simplifies payment transactions, reducing the need for tourists to convert their currency into local currency.

Chart 3. As the US dollar share of FX reserves declines, other countries have increased. Note: The Euro, British Pound, Chinese Renminbi, and other currencies have seen increases of 2.2, 2.1, 2.7 and 6.2 percentage points of their global foreign exchange reserve shares respectively. The US has lost the most, reducing its share by 12.7 percentage points. The Japanese Yen has seen a slight decline of 0.6 percentage points. Source: “The International Role of the U.S. Dollar”, Board of Governors of the Federal Reserve System https://t.ly/1eYY4. (Bertaut, 2021)

LCT in Indonesia: Indonesia has currently established local currency transaction (LCT) cooperation with five countries: China, Malaysia, Thailand, Japan and South Korea. Indonesia hopes to accelerate the use of these systems to increase usage of local currency. Such cross border digital payment systems facilitate frictionless bilateral trade transactions between countries and allow countries, many a time with similar monetary policies, to engage in trade without dependence on the dollar. As digitalization and eCommerce continue to influence the global economy, we can expect to see such digital payment systems gaining extreme traction over the next few decades all over the world.

Malaysia and India MoU: In April of 2023, the Ministry of External Affairs (https://rb.gy/gn1or) announced that India and Malaysia signed an MoU to settle trade transactions in INR, in addition to other currencies. This is another major step towards trade dedollarization and shows India’s desire to establish the dollar as a dominant currency. This MoU is expected to increase trade transactions between the two nations and reduce transaction costs for businesses from both countries (MEA, Government of India, April 2023). To facilitate this change, the Union Bank of India has also opened a special Rupee Vostro account in the India International Bank of Malaysia (IIBM) in Kuala Lumpur, which allows for payments in the INR.

4.2. Dedollarization in Country’s Local Economy

In addition to cross-border dedollarization, countries are also working to de-dollarize their local economy.

Cambodia: Cambodian Riel presently accounts for roughly 1% of the country’s GDP, which is dramatically lower than the 83% of GDP in Vietnam made up of Dong deposits and the 8.5% of GDP in Lao P.D.R. made up of kip deposits (Duma, 2011) . Cambodia, often considered the most dollarised ASEAN country, has been taking small but significant steps to mitigate its reliance on the USD. In late 2020, Cambodia started cutting down on the circulation of smaller denominations of the dollar—1$, 2$ and 5$ bills. In September 2021, the central bank also introduced smart and large denomination riel notes ranging from 100 to 100,000 riel. Despite these efforts, the USD is still considered Cambodia’s second unofficial currency and is far from losing its dominance.

QRIS in Indonesia: In August 2019, Bank Indonesia launched the QRIS (Quick Response Code Indonesia Standard). This system allows consumers to simply and securely perform all transactions with the scan of a QR code, rather than having to juggle between 5 credit cards. By October 2020, over 3.6 million micro businesses in Indonesia were equipped with this system, including major tourist attractions all over the country. Thus, the implementation of such technologies has led to the strengthening of domestic financial institutions and has increased the use of the IDR, as opposed to other foreign currencies such as the dollar.

5. Conclusion

An oft-asked question today is which currency will replace the dollar? For decades, people have been looking for an alternative global currency to the dominating US dollar. Maybe the Euro, maybe the Yuan, maybe the Japanese Yen, maybe Bitcoin, Ether or any such digital currency, but what if that is the wrong question to ask? Why does there have to be an alternative? Take the example of translation across languages. Instead of everyone in the world having to learn a globally accepted language such as English, there have been numerous technological solutions, such as Google translate, to deal with language barriers. Similarly, such as the already existing LCT in Indonesia, Rupee Vostro accounts and QRIS system.

Economists, businesses, and policymakers have been looking for alternatives to the dominance of the US dollar for some time now. After analyzing the Euro, the Yuan, cryptocurrencies and other such alternatives, no definite conclusion has been reached. But what if the question being asked is incorrect? What if this approach towards dedollarisation should not involve the replacement of the dollar with another single currency? Rather, it may be possible that recent technological advancements can facilitate the advancement of local currency transactions such that the USD is not involved at all. With LCT, NETS—DuitNow QR, digital Yuan and MoUs between Southeast Asian nations all serving to answer this question, such a technologically driven financial landscape may not be that far away.

In the foregoing article, we have only touched on one region of the world and its efforts to create alternative transaction mechanisms. Other parts of the world including Latin America and regions within Africa have also attempted to reduce the dollar’s influence. Examining their experiences could shed additional light on the opportunities and limitations of the advances in technology used by Southeast Asian nations.

Acknowledgements

I would like to express my sincere gratitude to Mrs. Tani Fukui for her unwavering support and guidance throughout the course of this research project. Her expertise and approach towards the ever changing economy greatly enriched the quality of this paper. This project would not have been possible without the time and effort Mrs. Fukui put in, and I am extremely grateful for her invaluable contributions.