Unveiling the SAI Uganda Audit Quality Indicator Framework: Qualitative Analysis of Auditors’ and Auditees’ Perspectives ()

1. Introduction

Audit quality and impact assessment have been topics of discussion in the academic and professional spheres for a long time, primarily due to the absence of a universal measure or definition of audit quality ( ICAEW, 2002: p. 11 ; Rezaee et al., 2016: p. C13 ; Sulaiman, 2011: p. 110 ). Furthermore, limited research has been conducted on audit quality in the government sector, as highlighted by Deis Jr. and Giroux (1992: p. 462) . In light of these challenges, this study aims to gather perspectives from auditors (Office of the Auditor General [OAG] and outsourced audit firms) and auditees (public universities) on three specific topics: 1) the existence of a framework for monitoring and reporting the impact of OAG audits, 2) the factors used to measure the quality of government audit reports, and 3) the potential public disclosure of these measures to enhance accountability for audit quality by government auditors. The overall objective is to develop an Audit Quality Indicator (AQI) Framework for the OAG Uganda, incorporating the viewpoints of both auditors and audit clients (auditees).

To achieve this, the study adopts a qualitative research paradigm and employs multiple case studies involving four public universities (as audit clients), the OAG Uganda, and five private audit firms regularly engaged in government audits. Semi-structured open-ended interviews were conducted with 51 respondents, and the data was coded a priori and analyzed using the Atlas. TI software.

The article proceeds by summarizing relevant literature on audit quality debates and reviewing AQI initiatives implemented in various countries, including the Netherlands, Switzerland, the United Kingdom, the United States, Canada, Australia, New Zealand, and Singapore, as well as international frameworks. The research methodology is then described in more detail, followed by an explanation of the study findings and a conclusion that includes a summary of the key findings and the proposed SAI Uganda AQI framework.

2. Literature Overview

This section provides an overview of available literature on AQIs, related initiatives or frameworks, prior research studies and international frameworks.

2.1. Audit Quality Debates

According to the FEE (2016: p. 5) , AQIs are also referred to as audit quality drivers/measures/factors and are used to measure a firm’s achievement of set quality objectives and its impact on stakeholders. Thus, the issue of audit quality is profoundly relevant especially in enhancing the credibility and acceptability of the financial statements, audit conclusions, opinions and report and, according to DeFond and Zhang (2014: p. 296) , is important in preventing engagement risk arising from litigations, non-compliance and reputation loss. However, it must be emphasised that audit quality has been a subject of debate for quite some time because there is no universal measure/indicator or definition of audit quality ( ICAEW, 2002: p. 11 ; Rezaee et al., 2016: p. C13 ; Sulaiman, 2011: p. 110 ). For example, Vaicekauskas and Mackevičius (2014: p. 177) define audit quality in terms of its ability to meet third party expectations; DeFond and Zhang (2014: p. 275) describe it as “greater assurance of high financial reporting quality”; and Chadegani (2011: p. 312) as “the production of financial information without misstatements, omissions or biases”.

Surprisingly, the endless debates about the meaning of audit quality seem to have emanated from DeAngelo’s (1981: p. 186) definition of audit quality by stating that the “Big 4” firms produce better quality reports than the smaller firms; an argument which has been vehemently rejected by the findings of several studies such as those by Kaawaase et al. (2016: p. 269) , Nwanyanwu (2017: p. 146) and Sulaiman (2011: p. 31) .

Aside from audit quality definition debates, there have also been ceaseless debates about AQIs or measures among scholars and researchers because, according to Kaawaase et al. (2016: p. 272) , audit quality measures “depend on the perspective from which audit quality is being examined” and the desire to define these for the public. To begin with, Nwanyanwu (2017: pp. 145-146) provides audit quality measures to include: auditors’ independence, technical training and proficiency; audit firm rotation; and earnings quality—although Fernando and Thevaranjan (2017: p. 50) warn that this particular measure leads to creative accounting and earnings manipulation by management which in the long run affects the company’s ability to continue as a going concern as was the case with Enron.

Audit Scotland (2017: p. 9) and CAQ (2019: p. 3) believe audit quality is evidenced in the provision of viable and actionable recommendations that address significant risks and publication of annual transparency and audit quality reports. Abate (2018: pp. 1-2) , as well as Vaicekauskas and Mackevičius (2014: p. 177) provide indicators based on auditees to include the reduced likelihood of fraud and error, improved insights into complex issues/estimates, accuracy of financial statements, improved internal controls and greater identification and awareness of risk. Furthermore, firm characteristics and size like audit fees has also been advanced as a key AQI, although Caruana et al. (2000: p. 1349) discovered that sometimes users may prefer a basic level of quality at an affordable price instead of striving for a high quality audit at a high price and hence this counters the notion that “higher audit fees are associated with higher audit quality”.

Other reported measures include; increased professional scepticism, values and attributes; interpersonal and behaviour skills; independence, qualifications, industry specialisation and reputation; auditor communication, team experience and knowledge; accuracy of financial information, restatements, accuracy of audit opinions, going concern audit opinions that are reversed in the subsequent year, regulatory sanctions and audit failures/litigation cases ( Al-Khaddash et al., 2013: pp. 206-218 ; Aobdia et al., 2018: p. 2 ; DeFond & Zhang, 2014: pp. 283-290 ; Francis, 2004: p. 345 ; Giroux & Jones, 2011: pp. 60-64 ; Hussein & Hanefah, 2013: p. 88 ; Kilgore et al., 2014: pp. 7-8 ; Sulaiman, 2011: p. 24 ; Tanzer & Oquendo, 2009: pp. 16-17 ; Vaicekauskas & Mackevičius, 2014: pp. 180-182 ).

The FRC (2007: p. 15) provides for effectiveness of the audit process, well-structured audit methodology (sufficient and appropriate procedures), effective documentation, work review and effective QC procedures; while Kaawaase et al. (2016: p. 269) report on measures such as compliance with standards, laws and regulations/GAAP (Generally Accepted Accounting Principles), mandatory audit partner rotation and auditor tenure. Furthermore, the ICAEW (2002: pp. 12-15) suggests indicators such as good leadership, appropriate client relationships, proper working practices, effective QC systems and monitoring processes, teamwork, knowledge sharing, effective team supervision, empowerment of junior staff and consultation within the team.

Besides private sector audits, AQI discussions have spread to the government sector Audits albeit with fewer studies which, according to Van Zyl et al. (2009: p. 17) , arises from the difficulty for SAIs, especially in developing countries like Uganda, to track the level of implementation of their audit recommendations and to assess the impact of their audit reports. Nonetheless, SAIs can measure audit quality through publicity of audit recommendations/findings, willingness by the executive arm of government to implement recommendations, presence of a good communication strategy with a well spelt out target audit audience, clear message and effective communication channels for feedback, transparency reports, inspection findings/reports and information on the Key Audit Matters (KAM) ( CPA Australia, 2019: p. 12 ; González et al., 2008: p. 435 ; González-Díaz et al., 2012: p. 583 ; Van Zyl et al., 2009: p. 19 ).

Additionally, other SAI related AQIs include; receipt of an independent accredited quality standard recognition like ISO certification; developing a “database of recommendations” and monitoring their implementation; obtaining feedback from auditees; follow-up or impact audits; public satisfaction surveys; comments on the SAI website; impact on the MDGs and SDGs; and consultations with experts and management ( Cordery & Hay, 2019: p. 128

Similarly, Flanary and Watt (1999: p. 515) consider measures for SAIs to include: parliamentary follow-up of audit recommendations, collaboration with other accountability institutions, investigation reports which lead to convictions and funds recovery, increase in anti-corruption campaigns, strengthening the autonomy of accountability institutions and the SAI’s agility to respond to complaints on quality from its clients.

For universities, Shah (2012: pp. 761-767) revealed that high quality audits lead to improvement in processes and systems such as course development, approval and review; quality teaching focusing on student satisfaction; strengthened and proactive quality assurance systems and appropriate staffing; improved coordination of external audits, management compliance and audit quality monitoring systems; data and information management; and strengthened governance structures. Accordingly, studying AQIs in public Ugandan universities helps to define the expected operational standards of public universities in respect to financial reporting and audit quality leading to value addition to the country’s education system and the public.

2.2. Review of AQI Initiatives

The search for a universally accepted measure of audit quality has not yielded definitive results, leading regulators and institutions to develop their own AQI initiatives. These initiatives encompass principle- and rule-based AQIs, qualitative and quantitative AQIs, or a combination thereof ( FEE, 2016: p. 3 ). The disclosure of AQIs remains a topic of debate, with some scholars advocating for public disclosure to enhance stakeholder assessment, while others argue that certain engagement-level information should remain confidential ( Pinello et al., 2019: p. 2

1) NBA Netherlands’ framework for disclosure of audit quality factors

According to the FEE (2016: pp. 7-8) and the Royal NBA Netherlands (2016: pp. 4-6) , the “Nederlandse Beroepsorganisatie van Accountants” (NBA) developed AQIs in 2015 requiring audit firms of public interest entities to report on them in annual transparency reports on a “comply or explain” basis. These are summarised into inputs (partner workload, time spent on audits, CPE, training hours and staff turnover); process factors (accounting and auditing consultations made, reviews held internally and EQCR, time spent by specialists on the project); and output factors (reported independence violations, errors and adjustments to the financial statements and internal and external reviews on the report).

2) The FRC audit quality framework

The FRC in 2008 issued its Audit Quality Framework to ensure effective communication on audit quality among stakeholders. According to the FEE (2016: p. 10) , the FRC UK (2008: pp. 1-7) and Sulaiman (2011: pp. 61-62) , the five key AQIs that UK audit firms are required to report on in their annual transparency reports include:

· Culture within the firm (entity values, objective appraisal and reward systems, investments in audit quality, sufficient time and resources, team consultations);

· Skills and personal qualities of audit partners and staff (understands client’s business, professional scepticism, experience and knowledge);

· Effectiveness of the audit process (understanding of the audit methodology, technical support to the team, sufficient and appropriate documentation);

· Reliability and usefulness of audit reporting (accurate and reliable audit reports, effective communication with management and those charged with governance); and

· Contextual factors (existence of proper corporate governance, shareholder support to auditors, reasonable time for auditing services and audit regulatory environment).

3) The U.S. CAQ AQI framework

The CAQ issued its audit quality disclosure framework in January 2019 to encourage all member firms that audit public companies to report on them in their annual transparency or audit quality reports on a principle basis. However, the FEE (2016: p. 13) reported that during pilot testing, respondents discouraged public disclosure of engagement level AQIs because it may be detrimental to the firms and organisations given its confidentiality levels.

According to the CAQ (2019: p. 1) , the AQIs include among others leaders’ evidence of accountability for audit quality, staff composition and experience, reporting structure, independent committees, staff turnover, CPE hours per staff, and audit team hours per engagement.

4) Canadian public accountability board (CPAB) AQIs

According to the FEE (2016: p. 16) , despite the CPAB developing its AQIs in 2014, there was emphasis that confidential information obtained at engagement level should not be made public but should only be shared with management and audit committees. The CPAB AQIs include:

· Engagement team (experience, training and Continuous Professional Education (CPEs), staff turnover, workload);

· Audit execution (time spent on significant areas, extent of technology use, specialists’ time); and

· other indicators (inspection results, independence violations, and tone at the top).

5) IAASB framework for audit quality

The IAASB (2014: p. 1) published its framework for audit quality with five key elements classified as inputs, process, outputs, key interactions and contextual factors, with the first three elements and their respective measures/indicators being relevant for this study.

· Inputs (exhibit ethical values and attitude, acting in public interest, independence, competence and due care, experience and capability, reasonable judgements);

· Process (compliance with auditing framework, methodology and QC policies, IT use);

· Outputs (unqualified opinion, restatements, going concern reporting that results in the collapse of the company, key audit matters (KAM), quality recommendations).

6) PCAOB audit quality indicators

The PCAOB (2013: p. 2) published its framework for AQIs in 2013, however in respect to public AQI disclosure, Pinello et al. (2019: p. 1) and Rezaee et al. (2016: C12) reported that stakeholders advised against mandatory reporting on AQIs in the USA, suggesting a flexible and voluntary framework (principle based).

· Inputs (training and CPE hours, industry experience, staff turnover, team workload, specialist hours, technical resources, internal and external reviews);

· Audit process (tone at the top, investments in IT, independence violations, internal quality reviews); and

· Results (inspection results, reported fraud, litigations, restatements, going concern reporting, unqualified opinions with errors in the subsequent year).

7) AQIs in Uganda

According to Kaawaase et al. (2016: p. 269) , audit quality in Uganda is measured based on compliance with the legal framework, accounting standards and audit fees. Under government auditing, the challenge faced by the OAG is the inability to assess the impact of its reports. For example, the Ugandan OAG (2013: p. 17) revealed that, as a result of misappropriation of donor funds in the OPM between 2010 and 2012, the government made a refund to the donors of UGX 49.8 billion with the expectation that this would be recovered from the responsible officials implicated in the scandal. However, there is no evidence to date to show that these funds were refunded, which highlights a disservice to the citizens and limits the impact of the OAG’s reports in meeting the public interest objectives. Likewise, despite an upward trend in unqualified opinions issued by the OAG to government entities, the question remains whether or not these depict the quality of OAG reports because, according to Mwaka (2018) , supervision of audits at all stages was poorly done in the OAG with notable ethical compliance issues hence the possibility that the high number of unqualified opinions were a result of opinion shopping.

Overall, the literature review highlights several gaps in the field of AQIs that the research aims to address. Firstly, there is a lack of a universally accepted measure or indicator of audit quality, despite numerous studies and frameworks on the topic. Moreover, while extensive literature exists on audit quality in the private sector, there is a significant scarcity of studies focusing on government sector audits, particularly in developing countries like Uganda. This is problematic given the challenges faced by SAIs in evaluating the impact of their reports amidst the increased need for accountability and transparency in this sector. Furthermore, the literature review predominantly focuses on auditors and audit institutions, neglecting the perspectives of stakeholders such as auditees essential for developing a comprehensive AQI framework.

To fill these gaps, the research aims to contribute to the literature on audit quality by examining and addressing the challenges faced by SAIs in monitoring, assessing, reporting, and measuring the quality and impact of their audits. The study will focus on the context of government sector audits in developing countries and propose strategies to enhance audit quality by considering the perspectives of both auditors and auditees in order to provide a more holistic understanding of audit quality and inform the development of appropriate AQIs.

3. Method

In line with suggestions by Benoit and Holbert’s (2008: pp. 615-618) , the interpretivist philosophy was adopted for this study due to the desire to achieve optimal saturation of themes and to study audit teams and clients in their context to achieve a deeper description and understanding of how the OAG measures, monitors and reports on the impact of its audits.

Lewis and Creswell (2015: pp. 57-58) revealed that interpretivist studies involve studying multiple participants with the aim of establishing what they universally believe about the study phenomenon and reporting this shared experience in line with purposive sampling. Therefore, for the current study, data was collected from experienced, qualified and professional participants with data analysis revealing the average being twenty years of relevant audit experience (both practice and management) as illustrated in Figure 1 below. This confirms that participants provided data of the highest level of authenticity, validity, credibility, reliability and quality.

This versed experience was also replicated in the age distribution whereby most participants were between 31 and 60 years hence a representation of a participant group with a rich vein of significant and relevant experience for the study as demonstrated in Figure 2.

Admittedly, as alluded to by Öhman (2005: p. 273) , the desire to create new knowledge based on the participants’ beliefs, experiences and perceptions of different AQI frameworks and government audit quality, influenced the choice of the qualitative research strategy/approach and an inductive process whereby

![]() Source: Primary Bio-data.

Source: Primary Bio-data.

Figure 1. Participants’ audit related experience in management and practice.

![]() Source: Author’s graphically analysed primary Bio-data.

Source: Author’s graphically analysed primary Bio-data.

Figure 2. Participants’ age group distribution.

![]()

Table 1. Interview participants per region.

Source: List of study participants.

data was collected based on the participants’ understanding of the context and perceptions of AQIs in Government Audits.

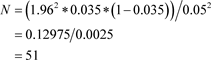

In line with Collis and Hussey (2009: pp. 82-83) , Creswell (2003: p. 15, 2007: p. 38) and Wahyuni (2012: p. 72) emphasis, a multiple case study covering 51 respondents distributed accross four public Ugandan universities (as government sector auditees), the OAG and five private audit firms (outsourced auditors) was adopted which enriched the diversity of discussions and ideas during data collection; as per Table 1. The sample size was determined using the Cochran formula, as detailed below;

where:

· N is the Sample Size;

· Z desired confidence level (Z-Score);

· P Estimated proportion of the sample;

· Q is 1 – P;

· E margin of error.

Therefore, using the Cochran formula:

· OAG’s lowest confidence level factor for its audits is 95% hence Z-score = 1.96 while the sensitivity factor is 5% hence E = 0.05.

· Estimated sample proportion was 3.5% given that the study targeted mostly top and middle level managers who are a small proportion of the staffing hence P = 0.035.

From Table 1 above, the mean number of participants in the data set was 17 across the three case studies of OAG, Public Universities and Private audit firms.

The study collected both primary and secondary data, whereby primary data was obtained through conducting open ended semi-structured, in-depth one on one interviews with the participants, observation of their behaviour and taking notes while secondary data was obtained through review of archival information such as audit reports and quality management manuals; with a major guiding principle as suggested by Mason (2010: p. 2) , being saturation of themes. Some of the archival information sources reviewed include;

· Annual Performance report of the Auditor General of Uganda, 2016.

· Overview of Audit Quality Indicators Initiatives. Federation of European Accountants (FEE), 2016 .

· Achieving Audit Quality: Good Practices in Managing Quality within SAIs, EUROSAI (2010) .

· Audit Quality Indicators Final Report, Canadian Public Accountability Board (CPAB), 2018 .

To ensure appropriateness, acceptability and adoptability of the AQI framework developed by OAG, a group discussion with six audit experts from the OAG and private audit firms using the Delphi technique was conducted in line with suggestions by Creswell (2007: pp. 63+68) and Ho (2006: 05.1) .

The study adhered to research ethics requirements, including voluntary and anonymous participation. Certainly, given that qualitative data is analysed to establish recurring or uniform patterns or themes that provide linkages to the study phenomena and as guided by Saunders et al. (2007: p. 475) , all interviews were recorded and later transcribed. To ensure confidnetiality and anonymity, participants were assigned codes such as “AC” = Audit Client; “A” = OAG auditor; “ML” = OAG middle level manager (from Senior Auditors to Senior Principal Auditors); “TL” = OAG top level management (from Assistant Directors of Audit to Auditor General); and “PAF” = Private audit firm participant. The ATLAS.ti software package was used to analyse, identify and organise themes from interview transcripts by employing an a priori coding approach.

Accordingly, two major code groups were created on which all the other codes were attached with their corresponding quotations, illustrated in Figure 3.

Relatedly, the codes were also analysed using the network structure in Atlas.TI tool to indicate their alignment per code group as indicated in Figure 4.

The distribution of quotations according to each code is illustrated as per Table 2.

“Audit” and “quality” were the most quoted words, further confirming the high knowledge base of the selected respondents towards the study phenomena, as illustrated in Figure 5.

4. Findings and Recommenations

The study findings are structured in accordance with the AQI coded themes from the interview transcripts:

4.1. Monitoring and Reporting the Impact of Government Audits

Amazingly, the study revealed that audit impact assessment, monitoring and reporting creates an unnecessary extension of scope and workload for the OAG whose mandate stops at issuing an opinion and/or assurance. This is perhaps the justification for the absence of an Impact assessment, monitoring and reporting framework for government audits in Uganda.

Similarly, the study results found that the OAG’s audit impact assessment is

![]() Source: Author generated from Atlas.TI data analysis tool.

Source: Author generated from Atlas.TI data analysis tool.

Figure 3. Code groups for data analysis.

![]() Source: Author generated from Atlas.TI data analysis tool.

Source: Author generated from Atlas.TI data analysis tool.

Figure 4. Coded network structure.

![]()

Table 2. Number of quotations per code generated.

Source: Author generated from Atlas.TI data analysed.

![]() Source: Author generated from Atlas.TI data analysed.

Source: Author generated from Atlas.TI data analysed.

Figure 5. Word cloud for the most quoted words.

limited by significant PAC delays in discussing reports, recommendations whose implementation is beyond the accounting officers’ control, limited implementation time for prior year audit issues, differing stakeholder needs, and financial dependence of the OAG on government funding leading to increased unfunded priorities. Certainly, despite the absence of a recognised audit impact assessment framework for OAG, study findings revealed a number of practices currently being utilised such as;

· Involvement of stakeholders in the strategic project risk assessment process to capture their interests;

· Periodic country tours by the AG to discuss the impact of reports and obtain independent stakeholder feedback on the professionalism of audit teams;

· Automated tracking of implementation of prior year audit and Treasury Memoranda recommendations in the Teammate audit software;

· Reporting the impact of audits in the OAG’s annual performance report, and;

· Follow-up of issues kept in view and media campaigns by the public relations office.

4.2. Auditors’ AQIs

Interestingly, cheeky as it may sound, “the number of audit queries raised by the team” was reported as the major AQI for the OAG Uganda whereby a team that comes up with numerous audit findings is considered thorough and highly competent. However, the use of such a measure may discourage timeliness in completion of audits since most teams will be more interested in doing more work to get a large number of audit queries to please their supervisors.

Secondly, the study results reported other AQIs such as the provision of implementable recommendations and addressing significant entity risks, credibility and accuracy of audit reports, compliance with standards and methodologies, sufficient and appropriate documentation, proper review and supervision of audits and effectiveness of the QC framework; which were key suggestions from studies by Audit Scotland (2017: p. 9) , the CAQ (2019: p. 3) and the FRC (2007: p. 15) concerning desirable AQIs as seen from the perspective of the auditors.

Thirdly, the findings also revealed AQIs such as the degree of interaction with auditees and key stakeholders, the number of times a report is accessed and downloaded from the OAG website, quick attention and discussion of particular audit reports by the Public Accounts Committee (PAC), savings/fund recoveries from audit recommendations, preventing further loss and misuse of resources, getting a government audit certification for all government auditors; all of which are consistent with findings from various AQI studies ( Cordery & Hay, 2019: p. 128 ; EUROSAI, 2010: pp. 8+20 ; GAO, 2008: p. 20 ; INTOSAI, 2010: p. 26 ; Khan et al., 2007: XI ; Talbot & Wiggan, 2010: p. 54 ; Wang & Rakner, 2005: VI ).

Identical to studies on AQI frameworks in different jurisdictions by the FEE (2016: pp. 7-10) , the FRC UK (2008: pp. 1-7) and Sulaiman (2011: pp. 61-62) , the results of the study shared more AQIs such as timely production and audit of the Treasury Memoranda, inconsistencies identified and level of adjustments made on financial statements, the existence of audit manuals, having repeat business for private firms, full documentation of working papers in the Teammate software and a clear and well-supported basis of opinion.

Finally, other AQIs identified include assessed entity risks and appropriate responses, corroboration and confirmation of similar audit conclusions by an independent party, timely report submission, organisation/auditee reputation, unlimited access to information and absence of complaints or clarifications from users.

4.3. Auditees’ AQIs

The study results showed the key AQI being the need for the OAG to report auditees’ key achievements for the year instead of only reporting queries or exceptions that create an impression that the institution has not done much. This therefore points to the need for standard setters and practitioners to create a framework for positive reporting.

Similarly, other notable AQIs reported include fraud identification and reporting; reduction in audit qualifications; and proper entity risk assessment, identification and responses; which facts are analogous to study findings by Abate (2018: pp. 1-2) , as well as Vaicekauskas and Mackevičius (2014: p. 177) . Moreover Shah (2012: p. 761) suggested improvement in entity processes and systems such as increase in funding resulting from audit recommendations, and reduction in the cost-of-service delivery as a result of improved work process efficiencies.

Additionally, the study also showed that auditees assess audit quality based on the quality of audit planning; consistency in holding entrance, pre-exit and exit meetings to seek clarifications; timely audit performance; accurate reporting; sufficient working time and audit coverage/scope; and absence of bias from both sides.

Other notable AQIs suggested include; the audit load given to teams; clarity of the audit objectives; simplicity and/or understandability of the audit issues; clients’ knowledge of the auditors’ area of focus; relationship between the auditor and auditee whereby friendly encounters encourage auditees to freely disclose information; and gender sensitivity by the audit team.

4.4. Public Disclosure of AQIs

Study findings revealed mixed reactions towards the need for public disclosure of government AQIs. Specifically, participants preferred that AQIs are classified into Technical and Non-Technical AQIs; whereby only Non-Technical AQIs are selectively disclosed to the general public to avoid widening the expectation gap given that they may perceive them as the gospel truth despite the fact that these can change.

The key arguments against public disclosure of AQIs include; inherent audit limitations like sampling; auditors may approach audits with a pre-determined and/or biased mind-set due to fluctuating stakeholder expectations; and some AQIs take longer to cause an impact, hence the public may judge the OAG prematurely and falsely. These arguments align with those of Pinello et al. (2019: p. 2) as well as Tanzer and Oquendo (2009: pp. 17-19) who revealed that disclosure of AQIs remains debatable due to the sensitivity of the information involved and possible consequences for audit institutions.

4.5. Summary of the SAI Uganda AQI framework

To sum up the study findings, the AQI framework presented in Table 3 takes into consideration the Institutional Quality objectives, related quality risks, Auditors’ and Auditees’ Perspectives and related disclosure complexities.

5. Conclusion

The study focused on establishing, evaluating, and developing the OAG AQI framework for government audits from the perspectives of auditors and auditees. The study reveals that the OAG needs to collaborate with regulators and carefully examine the legal and operational implications of performing audit impact assessment and reporting, as these activities were considered outside its mandate. It is also highlighted that the effectiveness of audit impact assessment is hampered by significant delays in discussing reports by the PAC, recommendations that are beyond the control of accounting officers, limited time for addressing prior

Source: Author’s Summarisation of Study findings.

year audit issues, varying stakeholder needs, and the OAG’s financial dependence on government funding, which leads to unfunded priorities.

Regarding auditors, the study identifies the number of audit queries raised by the audit team as a significant AQI. However, it emphasizes the importance of striking a balance between identifying critical issues and avoiding excessive auditing which can lead to client audit stress and discourage adherence to the adopted audit methodology of the OAG.

For auditees, the study highlights the need for a total or positive audit reporting system that accurately reflects both the achievements and exceptions of the entity. This approach helps prevent misrepresentation of the auditee’s position and ensures an accurate reflection of their performance. Other key Auditee AQIs include fraud identification and reporting, reduction in audit qualifications; proper entity risk assessment, identification, and responses, as well as the provision of implementable or actionable audit recommendations by auditors.

Regarding public disclosure of government AQIs, the findings suggest that only non-technical AQIs should be selectively disclosed to the general public to avoid widening the expectation gap. This recommendation takes into account inherent audit limitations such as sampling biases, Auditors’ preconceived notions and flactuating stakeholder expectations, necessitating informed communication to prevent unrealistic expectations and premature or misguided judgment of the OAG.

Overall, the study underscores the importance of SAIs engaging with regulators and carefully considering the legal and operational implications of audit impact assessment and reporting. It highlights the need for auditors to strike a balance between identifying critical issues and avoiding excessive burden on clients. Additionally, the study recommends promoting a total or positive audit reporting system for auditees to provide an accurate reflection of their performance. It also discusses the selective disclosure of AQIs to the public to manage expectations and mitigate potential misinterpretations.

These findings have broader implications for the OAG, key stakeholders, and international jurisdictions in their efforts to develop universally agreed AQIs that enhance transparency and quality in government sector audits.

Data availability statement:

The Study is extracted from my PHD Thesis submitted to the North-West University of South Africa with Ethical Clearance NWU-00941-20-A4. The data that support the findings of this study are available on request from the author, [Simon Peter Mulati] with approval of North-West University. The data are not publicly available due to Confidentiality restrictions that could compromise the privacy of research participants.