Trend Analysis of Exchange Rate of the Ghana Cedi against the US Dollar Using Time Series ()

1. Introduction

A currency’s exchange rate, commonly referred to as the foreign exchange rate or forex rate, indicates a country’s worth in comparison with another. It is how much a foreign currency worth compared to a local or home country’s currency. While a fluctuating exchange rate has been a significant barrier to the economic growth of most African countries, of which Ghana is not an exclusion, a stabilized exchange rate has been the bedrock factor for the economic advancement of developed countries.

Some studies have focused on the irregular and unpredictable pattern of rate exchange of other currencies. Less developed countries have gotten less attention despite some prior research suggesting that changes in exchange rate may have the capacity to alter a nation’s economic performance. Volatility is a key factor in all financial markets throughout the world, and risk managers, portfolio managers, investors, academics, and every partaker involved in the financial markets considers it as such [1] . The purpose of this study is to analyse the trend of the Ghana cedi against the US dollar, and to make predictions of future rate of exchange of the Ghana cedi to the US dollar.

To accurately predict the future of how volatility and financial assets returns will be, is crucial for value-at-risk models, optimal asset allocation, portfolio risk management, and dynamic hedging. According to [2] appropriately predicting business prospects is a crucial component of managerial and financial decision-making. It is well acknowledged that the use of inappropriate variables in predicting financial market’s indexes is destructive to a nation’s economic development due to their related negative effects on global trade. Therefore, predicting economic variable in the financial markets is crucial, particularly in a nation like Ghana.

The depreciation in the cedi caused Ghana’s balance of payments which generated a surplus of 1.9% in 2021, to record a deficit of 5% of GDP. Foreign exchange reserves, which serve as a buffer against factors that can adversely affect a currency’s exchange rate, saw a decline from 9.1 billion which constitute 4 months imports in December 2021 to 5.6 billion which is 2.5 months imports in December 2022, making it very challenging to keep the cedi’s exchange rate stable against the dollar and other major international currencies [3] . The collapse of the gold market price in 1930 and the subsequent development of the Bretton Woods agreement, which made currency pegging possible starting in 1940, marked the beginning of exchange rate regulation [4] . Changes in the currency rate are thought to have an impact on business success since international investors always favor stable exchange rates.

High inflation and interest rates have a detrimental influence on private consumption and investment. The lock-down due to the COVID-19 pandemic forced many businesses to close, which affected their productivity leading to revenue shortfalls. Oil prices also increased in the world market. Lack of access to financial markets and significant debt servicing commitments by the government, led to the Cedi to lose more than 50% of its value to the US dollar, this currency depreciation drove up the cost of living in Ghana. Electricity, water, Value-Added Tax (VAT), fuel and other consumables all saw major increase in their prices, which resulted in the cedi classified as the world’s worst-performing currency in 2022 and a junk economy rating by Fitch [5] . Despite the recent report from Ghana Statistical Service on the recent economic recovery growth rate of 4.2%, the cedi is still “unrest” against the US dollar as it still sees an upward increase in the exchange rate and inflation of 42.5% in June 2023.

Stabilizing and proper control of the exchange rate system could address some structural robustness, trade imbalances, and poor growth which are of high importance to policy makers. This means that improper exchange rate policies have a detrimental impact on investment, technology, imports & exports and ultimately, on the economic growth in Ghana.

Accordingly, currency stability encourages financial development. A standard measurement unit of one currency that may be used to buy an equivalent number of units of another currency is called the exchange rate [6] . The national agenda changed from the peg routine to an adaptive trade market routine with the introduction of Structural Adjustment Policy (SAP) in 1986. Thus, according to [7] no exchange rate is ideal. Instead, trade rates are entirely determined by market conditions, with the exception of an overarching framework where financial specialists periodically intervene in other exchange markets to attain specific strategic goals.

1.1. Exchange Rate and Ghana’s Trading History

Since Ghana’s independence in 1957 to 1992, Ghana had a fixed exchange rate regime to govern its exchange rate [3] . The then Ghana Cedi was tied to the British Pound and the American Dollar. As was customary in those days’ market economies, the predetermined rate was not preserved through active involvement in the foreign exchange market. Instead, a number of administrative controls were put in place to control any excess demand for foreign money, and the exchange rate was essentially fixed by decree. One such measure of control was the issuance of import licenses.

The Economic Recovery Programme (ERP) introduced by the government made several Cedi devaluations between 1983 and 1986. The Cedi gradually depreciated from c2.75 = 1 US dollar in 1983 to c90.00 = 1.00 US dollar by the third quarter of 1986. The plan of bonuses on exchange receipts and other aspects of the new foreign exchange policy were fees for currency transactions. The given payment and receipts were converted at a multiple exchange rate of c23.38:1 US dollar and c30.00:1 US dollar. In October 1983, the two official rates were finally combined at c30.00:1 US dollar. In the scope of purchasing power parity (ppp), a real exchange rate rule cost was introduced [8] . This necessitated quarterly currency rate adjustments in accordance with its main trading partners to combat inflation. It was believed that the real exchange rate was overvalued, a new policy of exchange rate devaluation was substituted for the quarterly adjustment mechanism in December 1984 [3] .

1.2. Auction Market Strategy

In September 1986, the government implemented an auction market strategy to hasten exchange rate adjustments and achieve the aim of trade liberalization, leaving certain market forces (demand and supply) to determine Cedi-dollar exchange rates. This new setup had two windows and a dual exchange rate. Window One utilized a set exchange rate linked to the cedi and dollar at c90.00:1 US dollar, which is mostly employed when dealing with cocoa export revenue and oil residuals. Window two’s supply and demand were balanced in a weekly auction run by the Bank of Ghana, which handled all other transactions. Nevertheless, the two systems were combined in February 1987. It was decided to use the dual-retail auction, which was based on marginal price [9] . The Dutch auction, a second auction format, was created, and under it, winning bidders were required to pay the bid amount. The foreign exchange bureau system was created in an effort to include the illegal foreign exchange trading platforms. These “forex” offices were fully licensed businesses run by private persons, organizations, or institutions.

Due to its operation in conjunction with the auction, the foreign currency market was defined by two spot foreign exchange rates. The weekly retail auction was replaced with an entire sale auction which was inaugurated in March 1990 to take the role of market auctioning. A composite exchange rate mechanism used in this system was the wholesale system and an inter-bank system.

Under the entire sale method, participants receive qualifying foreign currencies from the Bank of Ghana for sale to their end-user clients and for their own internal requirements. They are now able to provide their consumers with foreign exchange, subject to a margin decided by each approved dealer. In April 1992, the inter-bank market was introduced to replace the wholesale auction system, which has become a competitive platform for Commercial and the Forex Bureau [9] . Since 1986, the Bank of Ghana has adopted the managed floating exchange rate as the preferred method of determining exchange rate. The cedi’s stability has been the major aim of Bank of Ghana’s involvement in the currency market in order to control and to reduce volatility of the cedi on the international financial market and against other foreign currencies [3] .

1.3. Re-Denomination of the Cedi

With the introduction of new money into circulation on July 3, 2007, the Cedi was re-denominated, giving rise to the Ghana Cedi and Pesewas. It was created to alleviate one significant lasting effect of previous macroeconomic instability and inflation. The rapid increases in price and foreign exchange rates in terms of local currency were left over from previous instances of high inflation.

The economy bore a heavy deadweight burden during the preceding note system. When the old Ten Thousand Cedis was re-denominated, it became one Ghana Cedi, which was equal to one hundred Ghana pesewas. Therefore, 10,000 = GH and 1 = 100 GP. The value or purchase power of the new notes and coins was the same.

2. Material and Methods

2.1. Material

Data were gathered from a legitimate source, the Bank of Ghana (the country’s central bank) and the Ghana Stock Exchange (the country’s main stock market). The central bank has a historic exchange rate for the Ghana cedi (from January 2000 to May 2023), but for the purposes of this study, the range was restricted to January 2010 to May 2023, which is good enough for time series analysis. The data indicate the monthly average exchange rates of the Ghana cedi and the US dollar, which is useful for making monthly exchange rate predictions of the Ghana cedi against the dollar. Table 1 gives Statistics on Exchange Rate. There are a total of 161 observations with a mean of 4.157 and variance of 5.378.

2.2. Methods

This study considered both the ARIMA (Autoregressive Integrated Moving Averages) and the SARIMA (Seasonal ARIMA) models to model the trend of a 13 year data of exchange rates of Ghana cedi and the US Dollar spanning from 2010 to mid 2023 (Bank of Ghana Economic data on Exchange rate, https://www.bog.gov.gh/economic-data/exchange-rate/ and https://www.gse.com.gh/) and to forecast rates.

The ARIMA model forecasts future trends for businesses based on historical data sets. The parameters (p, d, q) of ARIMA model can assume different values to estimate the best fit model for a dataset. p, d and q are the autoregressive, differencing and moving averages respectively of an ARIMA model. Auto-regressive integrated moving average (ARIMA) models are used to describe the linear trends that exist between the current behaviour of the Ghana cedi and its previous exchange rates values against the US dollar.

The asymmetric effect when observed in the data and the variance error if not serially autocorrelated, the method of Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) becomes inappropriate as the earlier study adopted. Hence, the ARIMA and SARIMA models of time series are sufficient to model trends and to forecast exchange rates taking into account the asymmetric nature of the data.

Auto Regression (AR) and Moving Average (MA) are two models while Differencing (I) is the integration of the two models. When a time series is non-stationary, these three operate together. We may refer to a model as an ARIMA model if differencing (I) technique is at least applied once to the dataset to make it stationary, and autoregressive is combined with moving averages to provide some forecasts based on historical time-series data.

![]()

Table 1. Descriptive statistics on exchange rate.

ARIMA models are a type of statistical model that describes time series data patterns and trends. Because of its simplicity and ability to generalize for stationary series, it is widely used in forecasting models. In other words, it is a technique for predicting how something will perform in the future based on previous performance. The arima model was appropriate for this study because of its unique ability to model time series data and generates predictions based on past data taking into consideration how exchange rates fluctuate over time. They consist of three main components (p, d, q): autoregression (p), integration (d), and moving average (q). Autoregression denotes that the present value of a series is influenced by its earlier values with some lags. Integration implies that the series is differenced in order to make it stationary, removing any non-constant mean or variance. Moving average indicates that the current value of the series is also affected by the model’s previous errors or residuals.

SARIMA is a further technique of the ARIMA model that takes into account any seasonality patterns within the data such as seasonal trends and seasonal differences. The parameters of SARIMA model is (p, d, q) (P, D, Q)s, where P and Q are derived from the ACF and PACF plots and the number of periods S is 12.

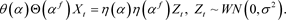

The correlation between a time series’ current value and some of its earlier values is captured by the autoregressive (AR) component. For instance, AR1 denotes a correlation between the current observation and its value at time  in the recent past and this can be seen in the equation:

in the recent past and this can be seen in the equation: ; the influence of a random (unexplained) shock is depicted by the Moving Average (MA) component. For instance, MA1 denotes a correlation between a shock’s effect on the series’ value at time t and the shock at time

; the influence of a random (unexplained) shock is depicted by the Moving Average (MA) component. For instance, MA1 denotes a correlation between a shock’s effect on the series’ value at time t and the shock at time , and it is represented in the equation:

, and it is represented in the equation: ; where

; where  is the white noise series distributed with constant variance. Therefore;

is the white noise series distributed with constant variance. Therefore;

Prediction = constant term + linear combination lags of Y + linear combination of lagged forecast errors.

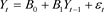

An ARIMA is an ARMA (Autoregressive Moving Averages) model after differencing , d times. Thus,

, d times. Thus,  satisfies the difference Equation (1),

satisfies the difference Equation (1),

(1)

(1)

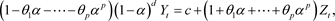

(2)

(2)

Given that d and D are positive integers, the time series is SARIMA (p, d, q), (P, D, Q)f process with period f when the differenced time series is Equation (3).

(3)

(3)

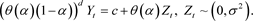

Equation (3) is a causal ARMA process and  causal if there exist a constant

causal if there exist a constant  such that

such that  and

and , gives

, gives

(4)

(4)

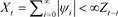

3. Results and Discussion

The initial plotting of data (Figure 1) was non-stationary thus not conforming to the assumptions of time series data for forecasting which assumes zero mean and constant variance, the first order differencing was then applied to the data to remove the trend component in order to achieve the constant mean (that is a stationary series, Figure 2) with a constant variance. A series is stationary if spikes decay exponentially or if series fluctuates around a constant mean, variance and covariance, thus  = constant,

= constant,  = constant and

= constant and ![]() = constant.

= constant.

To statistically determine the stationarity of the data, Dickey-Fuller test (adf.test) is further used to analyze the stationarity of the data. The null and alternative hypotheses state that:

H0: there is a unit root in the data (data is not stationary);

H1: the data is stationary.

![]()

Figure 1. Non-stationary plot on exchange rates.

![]()

Figure 2. Stationary plot on exchange rates.

The adf.test is performed on the first differenced data. The Dickey-Fuller test (adf.test) output has a p-value of 0.01 which is less than the alpha value (α - 0.05). Thus, the null hypothesis is rejected and the alternative is upheld to conclude that the data is stationary, which means that the mean, the variance, covariance and the standard deviation of the data do not change with time. Again, there is no trend in the data which meets the assumption of time series data and for forecasting.

DATA1 = diff(EXCHANGERATES)

adf.test(DATA1)

Augmented Dickey-Fuller Test

data: DATA1

Dickey-Fuller = −5.2621, Lag order = 5, p-value = 0.01

alternative hypothesis: stationary

The study used ARIMA (3, 0, 0) from Table 2, and SARIMA (1, 1, 2) (1, 1, 0)12 from Table 3 to determine the best fit model for the data for better prediction. From the two outputs, it can be seen clearly that ARIMA (3, 0, 0) is a better model than model (1, 1, 2) (1, 1, 0)12 based on its parameters like AIC, BIC, MAPE, stationary R-squared etc. The output of ARIMA (3, 0, 0,) has a stationary R-squared of 0.926, and an R-squared value of 0.958, indicating that, more than 95% of the variations or errors are being controlled and explained by the model, while the remaining variations are only white noise (Figure 3).

The model also has a lower BIC values as compared to the SARIMA model, for better prediction and a well fit to the dataset. The autocorrelation and partial autocorrelation functions are statistically significant. From the correlogram plots the ACF and PACF have about 90% of the observations lying between the UCL and LCL (Figure 4 & Figure 5). Also, the Root Mean Square Error (RMSE) of 0.955 tells us how concentrated or close the dataset are around the model best fit line, a lower error of 0.955 is the difference between the model’s predictions and the actual data.

![]()

Figure 3. Variations plot on exchange rates.

![]()

Figure 4. Exchange rates partial ACF plot.

The value of RMSE is a measure of how far the estimated values are from the actual data of which a lower percentage is appropriate, which means that the forecasted values are about 95.5% close to the actual data (Figure 7). Mean Absolute Percentage Error (MAPE) helps to check and compare forecast accuracy between time-series models by using their relative errors, which is also a measure of the accuracy of a forecast data. In effect, MAPE of 4.367 is the average prediction error of the model. This means that we are more than 95% confident about the prediction accuracy of our model.

Again, in order to further prove statistically whether the model is a best fit for making any future predictions and does not contain any residual errors or serially correlated residuals, we test the null and the alternative hypotheses that;

H0: Residual errors are independent or successive errors are not correlated;

H1: Errors are correlated.

From the model statistics output of Table 2, the significant or the p-value of ARIMA (3, 0, 0) is 0.999. This p-value is compared against an alpha value of 5% (0.05). The H0 would be rejected or won’t be considered if the p-value is less than the α value. The opposite of this preposition is true if H0 is failed to be rejected or not rejected. This means the claim of H0 stands or holds that there is no enough evidence to reject and we conclude that residual errors are independents or successive errors are not correlated.

The p-value of the output is greater than the α, therefore the null is upheld. This means that the model does not take into account any previous or successive lag errors which will make our model inappropriate for prediction. When previous errors are correlated in the model, an overestimate or wrong prediction from the previous years would be carried on into the future. Although the coefficients of the Ordinary Least Squares (OLS) estimate no longer have the smallest variance, the OLS still becomes unbiased. Also, the standard error coefficients may not accurately reflect the real deviation of the dataset, and the Mean square error (MSE) may underestimate the true error variance.

![]()

Figure 6. Observed and forecast exchange rates model.

![]()

Figure 7. Predicted values from the exchange rates model.

Finally, the model is then used to predict the exchange rate of the Ghanaian cedi in relation to the US dollar in Figure 6, for the remaining months of the year (that is third and fourth quarters in 2023 up to Dec 2025). Exchange rate forecasting is essential for economic empowerment and studying economic swings [10] . The predicted values and the actual exchange rate data from Figure 7 are almost equal, indicating a very small RMSE and a good model. This serve as a useful results for policy makers in making economic decisions. This also becomes a source of vital information for businesses or companies in planning their activities for the second half of the year and also for budget re-forecasting.

4. Conclusions

It can be concluded from the study that the average monthly exchange rates will continue to rise fairly and steadily for the remaining quarters of this year but a decline in rates is expected to occur from 2024. This decline in the exchange rate would fairly continue throughout 2024.

The concept of exchange rate stability is key information to private and foreign investors. It is also a tool for government fiscal policy implementation and other businesses in Ghana. Better performance of the cedi on the world market benefits all parties and in the long-run boosts the economy of Ghana. From this study, the cedi continues to lose its value against the dollar and other international currencies which lot of measures need to put in place to stabilize or to maintain a constant rate against the dollar. A weaker currency means a weaker economy, which in turn affects the standard of living of the citizens. This means Government has to spend and borrow more to meet the demands of the nation. Despite the recent support from the International Monetary Fund (IMF) with funds to help stabilize and boost the economy, the cedi continues to strife in high exchange rate against the US dollar and other currencies.

Due to some goods and services priced in dollars (dollarization of the economy), the repatriation of business profits of major international companies in the country and interest rate disparity causes high demand for dollar which then weakens the strength of the Ghanaian cedi. Therefore, exchange rate stability or volatility is a measure of grade of a country’s economy. The Government must increase or diversify its exports so that it can export more goods (raw materials or finished) in order to boost growth. This in turn increases our foreign reserves which serve as a cushioning against the cedi volatility.