The Impact of COVID-19 on Global Financial Market Indices and Systemic Risk ()

1. Introduction

The COVID-19 outbreak caused by the SARS-CoV-2 Coronavirus in China has been widely observed and commented on by governments, researchers and the public alike. The rapid growth of positively diagnosed cases and the subsequent secondary outbreaks in many countries around the world have increased international concerns. The spread of the disease, due to its global consequences, is compared to the influenza pandemic of 1918. Accordingly, the World Health Organization (WHO) declared the COVID-19 epidemic a public health emergency of international concern on January 31, 2020, and then classified it as a pandemic on March 11, 2020. Infectious diseases are among the leading causes of death worldwide, accounting for a quarter to a third of all deaths. They are ranked after cancer and heart disease as a flagship.

The recent COVID-19 virus has affected all financial markets around the world, with the stock price trend dropping significantly and continuously. Among the financial markets that suffer from this situation were the Dow Jones and Standard & Poor’s from the United States of America. The Daily Financial Times (2020: p. 1) supported the fact that “the Dow Jones and S & P are taking into account the share prices of a variety of companies in the United States have fallen by more than 20%”. Another global evidence of the impact of financial markets around the world is from the Nikkei trades with the Tokyo Stock Exchange. The market price trend in the Nikkei has also seen stock price fluctuations and most of them are downward all the time since the outbreak of COVID-19 became the pandemic of the whole world. The Daily Financial Times (2020: p. 1) reported that “Likewise, the Nikkei has declined, which takes into account the share prices of companies on the Tokyo Stock Exchange significant.”

2. Motivation and Purpose of the Study

Globally, the COVID-19 shock is severe even compared to the major financial crisis of 2007-08. However, the impact of COVID-19 on financial markets has not been researched. Various international monetary organizations and platforms have warned that the latest COVID-19 will have serious impacts on the global economy and the impacts may go beyond the 2007/08 global economic crises. The World Economic Forum (World Economic Forum, 2020: p. 1) insisted that “the global coronavirus shock is severe even compared to the major financial crisis of 2007-08.” Literary evidence reveals that COVID-19 has had a major impact on financial markets around the world. Indicators of the impact of COVID-19 on financial markets have been observed in various financial markets in the world, particularly the United States of America for the Dow Jones and S & P, and the trends of trading rates have decreased dramatically in response to the COVID-19 situation in America and the world at large. Economics (Economy, 2020: p. 1) details in detail that “By the time the day ended, the Dow Jones and the S & P saw their biggest one-day decline since 1987”. Lawmakers in Washington have continued to work on the economic bailout package. They are, of course, trying, responding to the impact of the Coronavirus Pandemic.

3. Study Objective

Globally, the COVID-19 shock is severe even compared to the major financial crisis of 2007-08. However, the impact of COVID-19 on financial markets has not been researched. Various international monetary organizations and platforms have warned that the latest COVID-19 will have serious impacts on the global economy and the impacts may go beyond the 2007/08 global economic crises. The current study is conducted to verify the impact of COVID-19 on financial markets from January 1, 2020 to December 12, 2020 in a group of countries in the world that recorded the highest cumulative numbers of injuries and deaths, according to WHO statistics and the financial market index for these countries.

Importance of the study: This study will add new knowledge regarding the impact of COVID-19 on the financial market from January 1, 2020 to December 12, 2020 in a group of countries in the world that have recorded the highest cumulative numbers of injuries and deaths, according to WHO statistics and the financial market index for these countries. Most importantly, the study will be very useful for the main study of applied financial economics and will support investors and decision makers in my government in some countries of the world.

4. Literature Review

Various international monetary organizations and platforms have warned that the recent COVID-19 will have serious impacts on the global economy and its effects may extend beyond the 2007/08 global economic crises. The World Economic Forum (2020: p. 1) insisted that, “Globally, the shock of the Coronavirus is severe even compared to the great financial crisis of 2007-08.” Literary evidence revealed that COVID-19 has had a significant impact on financial markets around the world. Indicators of the impact of COVID-19 on financial markets have been observed in various financial markets in the world, particularly the United States of America for the Dow Jones and S & P, and the trends of trading rates have decreased dramatically in response to the COVID-19 situation in America and the world at large. Economics (Economy, 2020: p. 1) , detailing that “by the time the day ended, the Dow Jones and the S & P had their biggest one-day decline since 1987.

Lawmakers in Washington continued to work on an economic rescue package. They are, of course, trying to respond to the impact of the Coronavirus Pandemic. Economists have predicted a serious impact of COVID-19 on the economy. Economists have analyzed that COVID-19 will have an impact on social welfare and the economy in general, particularly in the business and public business financial markets. In terms of import, export, production and fuel prices, (Shambaugh, 2020: p. 1) to support this issue, said, “Therefore, the decisive measures taken to curb the spread of the pandemic will have the greatest impact on the broader welfare and the economy.”

The global pandemic, COVID-19, is expected to be the most defining economic and social event in decades. Not only has it caused millions of injuries and hundreds of thousands of deaths, but it has also caused devastation in the global economy on a scale not seen since at least the Great Depression (Laing, 2020) . The impact of COVID-19, in a negative or positive way, is expected to affect food security, inequality, democracy and human rights (European Institute, 2020) , human development, pollution and waste (Mitra et al., 2020) , Crawford et al. 2020) , and education (Zhang et al., 2020) , urban and rural development, gender equality (Alon et al., 2020) and human poverty (Mahler et al., 2020; Sumner et al., 2020) , trade links and discussions of globalization. According to Tokitch, the pandemic will accelerate the “de-globalization and de-dollarization” of the economy (Tokic, 2020) , while others call for global cooperation in public health and economic development, or science (Loayza & Pennings, 2020; Baldwin & Tomiura, 2020) notes the pandemic should not be misinterpreted as a justification for anti-globalization, but rather it should lead to dual sources to avoid over-dependence. The COVID-19 crisis has demonstrated to financial market participants, policymakers and the general public People argue that natural disasters can directly create devastating global economic impacts on an unprecedented scale (Goodell, 2020) .

Several contributions have discovered that population health is positively related to economic well-being and growth (Mckibbin & Fernando, 2020) ; Others emphasize the social, economic, environmental and political impacts of the global epidemic (Nicola et al., 2020) as a cornerstone of the concept of sustainability. As theoretical modeling (Eichenbaum et al., 2020) has indicated, there is some interaction between epidemics/disease outbreaks and economic dynamics (Yu & Aviso, 2020) . The spread of COVID-19 has reduced economic activity around the world and led to new threats to financial stability (Boot et al., 2020) . The development of the disease and its economic impact remain uncertain, making it difficult for Governments (and national banks) formulate an appropriate macroeconomic policy response to improve market efficiency by ensuring long-term sustainability.

A world experiencing financial market lockdowns could drastically drop stock prices due to the COVID-19 pandemic. COVID-19 has taken financial markets in different trade directions, which will ultimately affect the global economy. In particular, it was forced to close trading three times during this week. “Various literature indicated that the current COVID-19 will seriously affect the global economy, noting that the world is heading towards a global recession.” A global recession is a situation in which global production is declining. With an impact on employment which means that the production of industries will be affected and decrease and people will lose their jobs while the import and export activities in general will be affected by recessions around the world. Euro News (2020: p. 1) to support the debate, they report that “the global recession is now a real possibility; Central banks around the world have cut interest rates to record levels.”

There are no vaccines or distinct treatments for COVID-19. However, there are several ongoing clinical primers for evaluating possible drugs. The international financial market is located at a place where budgetary fortunes are exchanged between people (and between nations). It tends to be viewed as a broad arrangement of norms and institutions where resources are exchanged between surplus specialists and operators in short supply and where organizations set guidelines. What is more in this market is a wide range of global exchanges. So this market is an indicator of monetary development. Right now, Coronavirus Day affects every area of life. A review of the literature suggested Antonakakis et al. (2020) that in new cases announced outside of China only, the mortality ratios of the tested models have a conclusive and constructive result, and besides, the meridian ratios are more ingrained than in China; COVID-19 resilience could make another scene of global budget pressure. McKibbin and Fernando (2020) consider the temporally volatile links between financial exchange returns, enabling instability and dealing with vulnerability. Their findings suggest that relations certainly oscillate with time, that oil demand is staggering, and that the economic downturn in the United States is tempting them. And that the involved escalation could have a major impact on the global economy in the short term, these conditions show the size.

Baret et al. (2020) discussed in detail the impact of COVID-19 on financial markets and banks. He emphasized that COVID-19 has significant impacts on the public financial markets as the world has recently witnessed the fall of stocks, oil, stocks and bonds around the world. This is evidence that COVID-19 has been seriously pushing financial markets in a different direction and responding to investments. Baret et al. (2020) detailed that “since February 21, 2020, bond yields, oil and equity prices have fallen sharply, and trillions of dollars, across nearly all asset classes, have expanded to safety”. A different international organization stated that since COVID-19 will have a major impact on the global economy and may be more than the financial crisis of 2017, it is clear that measures to rebuild and restore the economy will be difficult and will need the world to stand together and strong to overcome the economic impact of Coronavirus. The S & P Global Report (2020: p. 1) said, “It is now clear that the damage to global economic activity from measures to curb the spread of the Coronavirus pandemic will be enormous.” From a global business perspective, the coronavirus has also affected. Different firms suffer from lower output which leads to lower revenue collection. Jim (2020) outlined the extent to which companies have been affected by the recent COVID-19 epidemic. Jim (2020: p. 1) explained, “Companies are experiencing low revenue, high operating costs and/or cash flow challenges due to COVID-19”. It has reported that, as the world is experiencing an economic recession, the recovery and restoration of the economy will be in the long run due to the large and dangerous negative impact of COVID-19 on the global economy. The ICAEW Report (2020) , on the contribution of their report, states that “the COVID-19 pandemic has made listening difficult, if not completely unexpected, but has given hope for a long-term recovery.”

Larry (2020) suggests that since the world depends in large part on Chinese commodities and production, importing goods becomes the challenge because the spread of the Coronavirus is seriously stopping production and exports as well. So, a large number of countries that depend on importing goods from China are automatically affected by COVID-19. Larry (2020: p. 1) explained in detail that “the impact of imports into China has directly affected the export economy of countries around the world”. The financial markets’ response to the COVID-19 pandemic is believed to be investor concerns. The literature indicates that as the increase in COVID-19 spreads across the globe, this has led to serious concerns and uncertainty in investing in financial markets, as the results of various global financial markets have become very volatile and stock prices have fallen dramatically. Segal & Gerstel, (2020: p. 1) analyzed the sentiment of investment concerns and argued in detail that “fears of a wider outbreak and its economic impact spread to financial markets last month”.

5. Relationship between Pandemic and Stock Price

An effective market hypothesis describes the response of information to a stock price, and is how the information affects the share price. According to the efficient market hypothesis, the market will respond to the information quickly. The players in the capital market must be selective in choosing information. Information relevant to the state of the capital market is the information that the players in the capital market require when making decisions. However, not all information is valuable; some information is not relevant to the activity of the capital market. Marston (1996) identified types of bad information. First, sometimes the quality of the information is of no value. The quality of the information is related to the included content. From this content, information can be aggregated into relevant or unrelated capital market activity. Second, information is bad when the information distribution to investors is not smooth. Ederington & Jae (1993) and Frech & Richard (1996) examine the relationship between market ups and downs with timing of macroeconomic announcements and government reports. Schwert (1981) finds a weak relationship between stock movement and macroeconomic information. Torben (1996) states that the movement of stock prices is mainly caused by the introduction of new information and the processing of new information along with the market price. Houlthousen & Verrechia (1990) suggest that ads that do not contain new information will not change investor confidence, so investors will not think about trading. This result is in line with that reached by Kim, Taylor and Taylor (2020) who state that trade volume is a function. The change in absolute prices the increases, as the price reflects the change in the level of information. The difference in the weight of public information can change the investor confidence, which leads to trading.

6. Research Methodology

This study is conducted to investigate the impact of COVID-19 on financial markets from January 1, 2020 to December 12, 2020 in a group of countries in the world that records the highest cumulative numbers of injuries and deaths, according to WHO statistics and the financial market index for these countries. The study applies a simple regression model to investigate the impact of COVID-19 on financial markets over the cited period. Time series data are used on a monthly basis from January 1, 2020 to December 12, 2020 in a group of countries in the world that records the highest cumulative numbers of injuries and deaths, according to WHO statistics and the financial market index for these countries. And it relies on historical data from stock exchanges of the sample countries. The study applies simple regression in double linear models and quasi-logarithms to investigate the effect of using quantitative method with application of Excel (Microsoft office excel 2007), on financial markets during the study period. Study design, descriptive and analytical SPSS (VERSION 24). The study uses the following equations to analyze the impact of COVID-19 on financial markets:

(1)

where, Dependent Variable, (Close price) CNF/C is COVID-19 Confirmed cases. The α0 is constant, and β1, is the coefficient parameter.

(2)

where, lnY is the natural log of Dependent Variable, CNF/D is COVID-19 deaths. The α0 is constant, and β1, is the coefficient parameter.

(3)

where Re is return on stock, CNF/C is COVID-19 Confirmed cases.

(4)

where Re is return on stock, CNF/D is COVID-19 deaths.

6.1. Research Hypotheses

A. The first hypothesis: There is a significant and significant correlation between the number of injuries in the Corona pandemic and the returns of financial market indicators in the countries that record the highest injuries for the twenty countries in the world. B. The second hypothesis: There is a significant and significant correlation between the number of deaths in the Corona pandemic and the returns of financial market indicators in the countries that recorded the highest deaths for the twenty countries in the world.

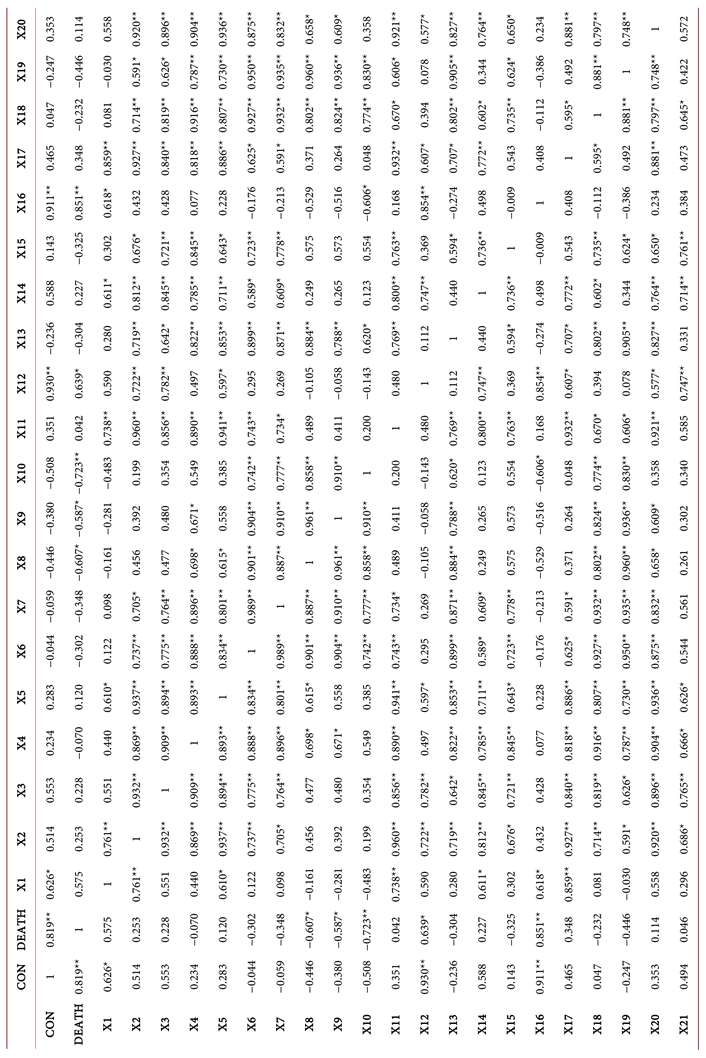

First: Discussing the results: Correlations and testing the correlation hypotheses for returns Table 1 shows the correlations between the number of injuries and deaths and the return on financial market indicators, which is expressed by the Pearson coefficient for the research sample countries that records the highest cumulative injuries during the year 2020 according to the data of the World Health Organization. The Pearson correlation coefficient between the number of injuries in the pandemic and the returns of global financial market indicators reached 0.626*, which is a significant correlation at the level of 5%. In the countries, the study sample records the highest value of it, 0.930** in MEXICO (Y11), which indicates a strong correlation between the returns of the market index and the number of injuries with a significant level of 1%, followed by TURKEY (Y15) with a significant correlation of 0.911** and a significant level of 1%. The values of the relationship between the number of injuries and the returns of indicators for the rest of the countries varied, as it reached the lowest value for the correlation relationship in FRANCE (Y5) is −0.044, indicating a very weak correlation between the number of infections worldwide and the returns on stock index in France.

Table 1. The correlations between the number of injuries and deaths and the return on financial market indicators.

On this basis, the first hypothesis can be proven, which states (There is a significant and significant correlation between the number of injuries in the Corona pandemic and the returns of financial market indicators in the countries that record the highest injuries for twenty countries in the world). As for the relationship between the global monthly number of deaths, according to the World Health Organization, and the returns of financial market indicators, the sample of the study since the spread of the pandemic in the world during the year 2020 has reached its value at the level of the global index 0.575, which is a correlation higher than the average level, which indicates that changes in the number of deaths cause Change in index returns, and this reached the highest value of the Pearson correlation coefficient in the countries. The study sample records its highest value 0.63t in MEXICO (Y11), which indicates a strong correlation between market index returns and the number of deaths with a significant level of 5%, followed by TURKEY second place (Y15) with a significant correlation of 0.851***, and at a significant level of 1%. The values of the relationship between the number of deaths and the returns of indicators for the rest of the countries vary, as the lowest value of the correlation relationship in GERMANY (Y10) was 0.042, which indicates a very weak correlation between the number of worldwide deaths and stock index returns in Germany.

On this basis, the validity of the second hypothesis can be tested, which states (There is a significant correlation significant between the number of deaths in the Corona pandemic and the returns of financial market indicators in the countries that recorded the highest deaths for the twenty countries in the world).

As for the correlation between the financial market returns indicators in these countries only, the data of Table 1 vary with each other between a strong moral relationship with the highest value of which reached −0.429 between the United States index (Y1) and the GERMANY (Y10) index, which indicates the changes in the returns of the financial market index for one of them lead to a change in the returns of the other index, while the lowest value of the correlation coefficient was between the return of the COLOMBIA index (Y9) and the return of the SOUTH AFRCA (Y16) index, which reached 0.048, which indicates a weak confusion relationship between the two indicators.

Second: Regression analysis through regression analysis that is performed using the EXCEL & SPSS program, and the results of the analysis appear in Table 2, which show the coefficients of the regression relationship in column (2) which represents the equation constant (A), which expresses the value of the adopted variable when the value of X is zero Column (3), which represents the coefficient (B) of the independent variable X, which represents the number of confirmed cases. Thus, the model for forecasting the returns of financial market indicators for countries is the research sample and on the monthly basis as follows:

(5)

where is y1 = Dependent Variable, x =number of confirmed cases.

![]()

Table 2. The variables between the number of infected cases and the return of financial market indicators for countries with higher corona injuries during the study period.

It is also evident from Table 2 Systemic Risk (Beta), which includes market, economic and environmental factors that affect the research variables. It is noted from the values that they are negative, and this indicates that the tendency of the indicators’ returns has a negative direction with the dependent variable, the number of injuries. The multiple correlation coefficient in column (4) and the highest value of the multiple correlation coefficient was 0.982 in the returns of the SPAIN Y8 index, and the lowest value in IRAN Y13 was 0.0222. As for the effect coefficient R2, shows the table indicating the percentage of what is explained by the independent modulator (X), the number of injuries in the dependent variable (Y) stock price returns. As the highest value of the index 0.964 SPAIN Y8 is achieved, this means that 96% of the changes in the adopted variable returns indicators in the financial markets explained by the independent variable the number of cases of COVID-19, and the lowest value for this indicator was 0.000492 in IRAN (Y13). In addition, the highest value of Adjusted R in column 6 of Table 2 is 0.960 recorded by the Financial Market Index in SPAIN (Y8), while the lowest value was 0.004652 in GERMANY (Y10). The rest of the values varied between these two limits.

The results of the analysis in Table 3, which show the coefficients of the regression relationship in column (2), which represents the equation constant (A), which expresses the value of the adopted variable when the value of X is zero, and the column (3), which represents the coefficient (B) of the independent variable X, which represents The number of deaths and thus the model for forecasting the returns of financial market indicators for the research sample countries on a monthly basis is as follows:

(6)

where is y1 = Dependent Variable, (PRICE) and DEADS/C is COVID-19 Confirmed cases. The α0 is constant, and (B, β1, …) is the coefficient parameter.

![]()

Table 3. The variables between the number of infected cases and the PRICE of financial market indicators for countries with higher corona injuries during the study period.

It is also evident from Table 3 systemic risk Beta, which includes market, economic, health and environment factors that affect the research variables, and it is noted from the values that they are negative, and this indicates that the tendency of the indicators’ returns has a negative direction with the adopted variable, the number of injuries. 3) The multiple correlation coefficient in column (4) and the highest value of the multiple correlation coefficient was 0.645 in the returns of the BERU Y14 index, and the lowest value was recorded in India Y2 which was 0.127. As for the effect coefficient R2, which shows the table indicating the ratio of what is explained by the independent variable (X) the number Injuries to the dependent variable (Y) stock price returns. As the highest value of the index 0.416 was achieved in BERU Y14, this means that 42% of the changes in the adopted variable returns indicators in the financial markets explained by the independent variable the number of deaths in COVID-19, and the lowest value for this indicator is 0.016 in India Y2. Moreover, the highest value of Adjusted R in column 6 of Table 3 is 0.126782 recorded by the UK Financial Market Index Y7, while the lowest value was 0.004384 in NETHERLANS Y19, and the rest of the values varied between these two limits.

First: Correlations and testing of hypotheses for correlation of prices Table 4 shows the correlations between the number of injuries and deaths and the prices of financial market indicators, which is expressed by the Pearson coefficient for the countries of the research sample that recorded the highest cumulative injuries during the year 2020 according to WHO data.

![]()

Table 4. The correlation coefficient between the number of infected cases and the returns of financial market indicators for countries with higher corona injuries during the study period.

The table shows that the correlation coefficient Pearson between the number of infections in the pandemic and the prices of global financial market indicators reached 0.5969, which is a correlation above the average in the countries. The study sample records its highest value of 0.9559** in MEXICO (Y11) and it indicates a strong correlation between market index prices and the number of injuries, with a significant level of 1%, followed by TURKEY (Y15) with a significant correlation of −0.65, with a significant level of 5%. The values of the relationship between the number of deaths and index prices varies for the rest of the countries, as the lowest value of the correlation relationship in SOUTH AFRCA Y16 was 0.0075, indicating a very weak correlation between Worldwide number and stock index prices in France. On this basis, the first hypothesis can be proven, which states (there is a significant and significant correlation between the number of injuries in the Corona pandemic and the prices of financial market indicators in the countries that record the highest injuries for twenty countries in the world).

As for the relationship between the global monthly number of deaths, according to the World Health Organization, and the prices of financial market indicators, the sample of the study since the outbreak of the pandemic in the world during the year 2020, its value at the global index level reaches 0.575, which is a correlation higher than the average level, which indicates that changes in the number of deaths cause A change in index prices, and this reached the highest value of the Pearson correlation coefficient in the countries. The sample of the study records its highest value 0.639* in MEXICO (Y11), which indicates a strong correlation between market index returns and the number of deaths with a significant level of 5%, followed by TURKEY second. (Y15) with a significant correlation of 0.851***, and with a significant level of 1%. The values of the relationship between the number of deaths and the returns of indicators for the rest of the countries vary, as the lowest value of the correlation relationship in GERMANY (Y10) was 0.042, which indicates a very weak correlation between the number of Deaths at a global stock index in Germany. D. On this basis, the validity of the second hypothesis can be tested, which states (there is a significant correlation relationship between the number of deaths in the Corona pandemic and the prices of financial market indicators in the countries that recorded the highest deaths for the twenty countries in the world).

As for the correlation between prices of financial market indices in these countries only, the data of Table 4 vary with each other between a strong moral relationship with the highest value of which reached 0.9559** between the United States index (Y1) and the GERMANY (Y11) index, which indicates that the changes In the returns of the financial market index for one of them, it leads to a change in the returns of the other index. As for the lowest value of the correlation coefficient, it is between the prices of the Iran (11) index and the return of the MEXICO (Y13) index and reached 0.1103, which indicates a weak confusion relationship between the two indicators.

Second: Regression analysis of prices and the number of injuries Table 5 shows the coefficients of the regression relationship in column (2), which represents the equation constant (A), which expresses the value of the adopted variable when the value of X is zero, and the column (3), which represents the coefficient (B) of the independent variable. X, which represents the number of confirmed cases, and thus the model for forecasting the prices of financial market indicators for the countries of the research sample and on a monthly basis as follows:

(7)

where is y = Dependent Variable, x = number of confirmed cases. It is also evident from Table 5 the systemic risk (Beta), which includes market, economic and environmental factors that affect the research variables. It is noted from the values that they are negative, and this indicates that the tendency of index prices has a negative trend with the dependent variable number of injuries.

![]()

Table 5. The variables between the number of infected cases and the PRICE of financial market indicators for countries with higher corona injuries during the study period.

In the same context, Table 5 shows the multiple correlation coefficient in column (4), and the highest value of the multiple correlation coefficient was 0.651 in the returns of the POLAND Y12 index, and the lowest value in IRAQ Y20 is recorded at 0.053. The independent variable (X) the number of hits in the dependent variable (Y) stock price returns. As the highest value of the index was achieved, 0.424, which means that 42% of the changes in the adopted variable, the prices of the indicators in the financial markets, are explained by the independent variable, the number of cases of COVID-19, and the lowest value of this indicator was 0.0021 in IRAN (Y13).

Moreover, the highest value of Adjusted R in column 6 of Table 5 is 0.366 recorded by the Financial Market Index in POLAND (Y12), while the lowest value is 0.02016 in India Y2, and the rest of the values varied between these two limits.

6.2. Regression Analysis of Prices and the Number of Deaths

Table 6 shows the coefficients of the regression relationship in Column (2), which represents the equation constant (A), which expresses the value of the

![]()

Table 6. The variables between the number of infected cases and the PRICE of financial market indicators for countries with higher corona injuries during the study period.

adopted variable when the value of X is zero, and the column (3), which represents the coefficient (B) of the independent variable. X, which represents the number of confirmed cases, and thus the model for forecasting prices of financial market indicators for the countries of the research sample, and on a monthly basis as follows:

(8)

where is Y = Dependent Variable, X = the number of cases of COVID-19.

It is also evident from Table 6 the systemic risk (Beta), which includes market, economic and environmental factors that affect the research variables. It is noted from the values that they are negative, and this indicates that the tendency of index prices has a negative trend with the dependent variable number of injuries.

In the same context, Table 6 shows the multi-correlation coefficient in column (4) and the highest value of the multiple correlation coefficient is 0.358 in the returns of the POLAND Y12 index, and the lowest value in IRAQ Y20 is recorded at 0.053. The independent variable (X) the number of hits in the dependent variable (Y) stock price returns. As the highest value of the index is achieved, 0.424, which means that 42% of the changes in the adopted variable, the prices of the indicators in the financial markets, are explained by the independent variable, the number of cases of COVID-19, and the lowest value of this indicator was 0.0021 in IRAN (Y13). In addition, the highest value of Adjusted R in column 6 of Table 5 is 0.454 recorded by the UK Financial Market Index (Y7), while the lowest value is 0.02016 in India Y2, and the rest of the values vary between these two limits.

7. Conclusion

This study is conducted to investigate the impact of COVID-19 on financial markets from the period from March 1, 2020 to 12/12/2020 in twenty countries that have recorded the highest cumulative number of confirmed cases of infection and deaths and that broadens knowledge regarding the impact of COVID-19 on The financial market during this period, more importantly, that the study will be very useful for the main study of the applied financial economy and will support investors and decision-makers in the study, the results of the study reveal that there is a positive relationship with statistical significance between COVID-19 confirmed case and all financial markets. This means that COVID-19 has had a significant impact on the financial markets, as the results show the difference in the correlation between the number of injuries and deaths and between the returns and stock prices in the countries sample of the study and the relationship range from a strong correlation to a weak correlation and this indicates the difference of changes in the indicators and stock returns Interstate study sample.

In the same context, the results show that the regression analysis has demonstrated the impact of the pandemic on the returns and prices of financial market indices, and with different impact ratios. The State of Peru recorded the highest value of the number of deaths in the returns of financial market indicators. Spain also records the highest R2 value in the number of injuries.

As for the impact of the pandemic on the number of injuries on index prices, it varies between countries in the degree of impact, and the highest value of the interpretation coefficient R2 is recorded in Poland, in addition to the effect of the pandemic, the number of deaths in the price of indices, the highest percentage represented in Britain.

As for the systemic risk, is represented by the tendency between the number of deaths, injuries, the prices and returns of the indices and the deceptive characteristic is of a negative tendency, and this means the negative trend of the returns and prices of indices in the financial markets, and this is what can predict the prices and returns of future stocks due to the pandemic.