Understanding the Optimum Thresholds for the Macroeconomic Convergence Criteria in Africa’s Regional Economic Communities: Evidence from SADC, COMESA and ECCAS ()

1. Introduction

The aim of this article is to empirically determine the optimal thresholds for the variables defined as convergence criteria (inflation, public debt/GDP ratio, reserves in months of imports and budget deficit/GDP ratio) within SADC, COMESA and ECCAS. The results of this study should enable the authorities of these RECs to reassess the convergence pact and set criteria adapted to the different economies of the region with a view to accelerating the process of regional economic integration. Indirectly, it will above all show that the nominal objectives or convergence criteria of the RECs in Africa are not optimal. To show the weakness of the African convergence process and the steering of the Monetary Cooperation Program in Africa (PCMA), four studies are used as support, namely the work of Loufir and Reichlin (1993) , Diop (2002) , Gammadigbé (2013) and Sarant (2017) . From the outset, it should be emphasized that this is essentially a question of a long-observed weakness, mainly related to the design of common macroeconomic policies in general and, in particular, the design and definition of the critical thresholds of the convergence criteria and their adoption at the highest level of steering (AUC, ABCA, CCBG).

For the former ( Loufir & Reichlin, 1993 ), there is a causal relationship between the establishment of a monetary union and nominal convergence between countries. In other words, macroeconomic convergence is a necessary condition for the materialization of a monetary union. The second statement by Diop (2002) , highlights a line of thinking shared by a group of economists who see the convergence of macroeconomic policies and results as a major prerequisite for the creation of a monetary area between several countries. Moreover, a monetary union, he adds, could only be viable if the countries joining it achieved satisfactory results, firstly in terms of “comparable” inflation rates and sustainable budget deficits. As for the work of Gammadigbé (2013) carried out on a sample of three monetary unions, which, in addition to showing the endogeneity of monetary unions, also proved that, in addition to a positive relationship between the synchronization of cycles and trade integration, the convergence of the cycles of the economies over the period prior to monetary union confirms the thesis of the endogeneity of monetary zones. In this respect, is it possible to achieve this convergence of cycles if the monetary policy objectives of each country considered were not optimal beforehand?

Finally, Sarant (2017) points out that the underlying assumption of the Maastricht Treaty is that the objective of exchange rate and price stability is primarily aimed at fostering economic growth and integration, which will in turn be vectors for the achievement of common nominal targets and convergence of economic structures. This should ultimately lead to the establishment of EMU. Following this hypothesis, this author concludes that there is a strong link between nominal convergence and real convergence, stating that the nominal convergence of potential members should undoubtedly favour their real convergence.

This study also seeks to show that the failure to take account of data from the constituent countries of a REC when defining the convergence criteria is in itself an asymmetric exogenous shock. The remainder of the paper is presented as follows. Section 2 provides a brief review of the empirical literature on the determination of optimal thresholds. Section 3 presents the methodology. The results are given in Section 4 and Section 5 concludes the paper.

2. Related Literature

A review of empirical work on optimal thresholds generally highlights the importance of four (4) macroeconomic indicators, namely the optimal inflation threshold ( Sarel, 1996 ), the optimal reserve threshold in months of imports ( Mendoza, 2004 ), the optimal deficit threshold as a percentage of GDP ( Onwioduokit, 2012 ) and the optimal public debt threshold as a percentage of GDP ( Mupunga & Le Roux, 2015 ). Analysis of the question of optimal inflation has been the subject of numerous studies ( Khan & Senhadji, 2001 ; Kremer et al., 2008 ). These studies highlight the existence of a positive link between inflation and economic growth below a certain threshold, and that beyond this threshold, this relationship becomes harmful. Khan and Senhadji (2001) re-examined the existence of threshold effects in the relationship between inflation and growth using new econometric methods. Using a panel data set of 140 countries covering the period 1960-1998, the authors were able to identify a threshold of 1% - 3% for industrialized countries and a threshold of 7% - 11% for developing economies. Using a large sample of 124 countries, and seeking to shed new light on the impact of inflation on long-term economic growth over the period 1950 to 2004, Kremer et al. (2008) identified a threshold of 2% for industrialized countries and 17% for non-industrialized countries. Ibarra and Trupkin (2011) , analyze this issue for a set of 120 countries around the world, using a smooth transition regression model on panel data (PSTR) for the period 1950-2007. Investment, population growth rate, per capita income, degree of openness and standard deviations of terms of trade were used as control variables. The results reveal an inflation threshold of 4.1% for industrialized countries, and a threshold of 19.1% for non-industrialized countries.

Addressing the same issue in the case of SADC, Seleteng et al. (2013) examined the non-linearity of the inflation-growth link in this regional economic community over the period from 1980 to 2008. The results reveal a threshold level of 18.9%, above which inflation is detrimental to economic growth in the region. Ndoricimpa (2017) , examines the non-linearity of the inflation-growth link for 47 African countries. A dynamic panel threshold regression is applied to account for potential endogeneity bias in the model. The results of this study confirm the existence of non-linearity in the inflation-growth link. An inflation threshold of 6.7% is estimated for the sample as a whole, 9% for the sub-sample of low-income countries and 6.5% for middle-income countries. Kelikume (2018) uses a dynamic panel model to identify inflation thresholds in relation to long-term economic growth. The analysis covers the period 1960-2015 and includes a set of 41 African countries. The empirical results identify an inflation threshold of 11.1% for all countries. However, the thresholds are different for resource-rich and non-resource-rich countries, at 12.5% and 9.4% respectively. An almost similar result is highlighted by Abdulqadir et al. (2020) . The latter analyzed the optimal inflation level for an appropriate exchange rate policy in 15 oil exporting countries in Sub-Saharan Africa between 1996-2017. The findings revealed that the threshold for the optimal inflation rate is 14.47% and implies that beyond this threshold found, an inflation target would have serious consequences for the conduct of monetary policy in this group of countries. Recently, Oloo et al. (2022) analyzed the threshold effects of macroeconomic convergence criteria on real GDP growth in the East African Community (EAC) over the period 2005 to 2020. The authors identify an inflation threshold of 7.5%. It emerges that the problem of the optimal inflation threshold, often developed within the framework of an economic community, as well as at the level of individual countries, very generally leads to single-digit inflation thresholds for advanced economies and double-digit thresholds for emerging and developing economies. In addition, most of these studies use the Hansen (1999) method.

According to the literature, limiting the public deficit to a given threshold is the most fundamental norm of the various convergence pacts that exist and are necessary for monetary integration, since compliance with this criterion enables the synchronization of economic cycles Brunila et al. (2001) . However, the review of the empirical literature on the problem of the optimal deficit threshold (not to be exceeded) remains recent and sparse. In fact, most of the work reviewed in this note concerns the WAEMU and ECOWAS zones, which are virtually completed monetary union projects in Africa. Based on a sample of 40 developing countries covering the period 1990-2012, Slimani (2016) , unlike Adam and Bevan (2005) and Onwioduokit (2012) , find a public deficit threshold of around 4.8% of GDP and a budget surplus threshold of 3.2% of GDP. They therefore find that public spending has a negative impact on economic growth above these two thresholds. In the opposite case, the effect of fiscal policy on economic growth is positive. Amadou and Kebalo (2019) address the problem of limiting the public deficit threshold not to be exceeded in order to facilitate the introduction of a single currency in the Economic Community of West African States (ECOWAS). Using a non-linear panel data model à la Hansen (1999) , this study assesses the validity of the (current) threshold while determining the public deficit threshold that must not be exceeded for fiscal policy to have a positive effect on economic growth. The results of this empirical investigation reveal that over the decade 2007-2016, this threshold is estimated at 4.74% of GDP. In addition, the authors argue that the proposed convergence criterion of 3% of GDP is pro-growth but can be revised upwards in order to exploit the additional margin provided by the new estimated threshold. This margin could obviously be used to support economic growth and strengthen the resilience of the zone’s various economies. Kebalo and Zouri (2022) , working on the same issue for the WAEMU zone, use the Hansen (1999) model to estimate the budget deficit threshold that maximizes economic growth and whose respect by countries is favourable to the convergence of economic cycles. The results of this analysis, which covers the 8 EU countries over the period 1990-2018, show that the budget deficit threshold that must not be exceeded to support growth is 11.42% of GDP. However, by reducing the sample since the start of debt relief through the HIPC initiative in 2006, the study also concludes that the estimated budget deficit threshold not to be exceeded falls from 11.42% of GDP to 3.97% of GDP. Conversely, Oloo et al. (2022) working on the Community of East African States (EAC), find, using a dynamic threshold panel model, a budget deficit/GDP ratio threshold of 6% that the members of the EAC must respect in order to achieve the objective of monetary union. Overall, the research generally concludes that the budget deficit thresholds used as convergence criteria in the various stability pacts are pro-growth but sub-optimal in terms of the synchronization of economic cycles.

Limiting the threshold of the public debt/GDP ratio is an equally essential criterion of the convergence pact of most of the RECs. Although there is a vast empirical literature on the effects of debt thresholds on economic growth, few studies have focused on samples of developing countries. Reinhart and Rogoff (2010) study the non-linear effect of public debt on economic growth in 20 advanced economies over the period 1946-2009. The study found that public debt becomes detrimental to economic growth when the debt-to-GDP ratio reaches the 90% threshold. However, this work was subsequently criticized by Herndon et al. (2014) on the accuracy of the 90% debt threshold, arguing that the 90% threshold systematically worsened economic growth in the long run. In response, Herndon et al. (2014) corrected several methodological flaws on the same data sample used by Reinhart and Rogoff (2010) and found that the impact of public debt on economic growth varies considerably across countries over time. However, they found that a debt threshold of 30% hampers economic growth in these advanced economies. It should be noted that despite the resurgence of debt problems in Africa, studies focusing specifically on Africa are still rare. Two studies have focused on African countries, namely Ndoricimpa (2017) and Alagidede et al. (2018) . The first uses the non-dynamic panel threshold regression model of Hansen (1999) and shows that the estimation of the debt threshold is sensitive to the estimation technique used and the growth control variables taken into account in the estimation. In some cases, the debt threshold is estimated at 92%, while in others it is estimated at 102%. However, this study reveals that even if a low debt ratio is neutral or conducive to growth, a high debt ratio is systematically detrimental to growth in all the cases taken into consideration. As for Alagidede et al. (2018) , he applies the panel-ARDL threshold model and finds that debt hampers economic growth when it is between 20% and 80% of GDP. Based on the debt trajectory, this study shows that increasing public debt beyond 50% to 80% of GDP affects economic growth in Africa. In addition, Ndoricimpa (2017) re-examines the threshold effects of public debt on growth in Africa by applying a smooth transition panel threshold model à la Gonzalez et al. (2017) , which captures both heterogeneity and a smooth change in regression coefficients from one regime to another. The results of this empirical investigation indicate that a debt threshold of between 62% and 66% is estimated for the entire sample. Moreover, a low debt ratio is found to have a neutral effect on growth, while a higher public debt ratio is detrimental to growth.

From the existing empirical literature, it is worth noting that different estimation methods are applied, including quadratic and spline models, panel threshold regression (non-dynamic and dynamic), panel smooth transition regression, panel threshold-ARDL model, etc. The empirical literature also provides mixed evidence on the effect of the debt threshold on growth. The empirical literature also provides mixed evidence on the effect of the debt threshold on growth, which can be explained by the difference in the threshold estimation approaches used as well as the country samples considered. The estimated debt threshold for developed countries turns out to be much higher than that for developing countries.

Finally, the literature on the issue of determining the optimal level of international reserves is sparse, both at the level of regional economic communities and at the level of individual countries. A few rare indications could be used to measure and evaluate the adequacy of foreign exchange reserves. Eichengreen and Mathieson (2000) suggest a coverage of 4 months of imports. The IMF recommends a level of foreign exchange reserve accumulation that should meet short-term debt obligations. Oloo et al. (2022) analysed the threshold effects of macroeconomic convergence criteria on the real GDP growth rate in the East African Community between 2005 and 2020. For the foreign exchange reserve criterion, the authors identify a threshold of 4 months of imports favourable to economic growth. With the exception of the rare works mentioned above, it should be noted that the review of the literature dealing with the determination of international reserve accumulation thresholds remains less extensive. However, a consensus seems to be emerging in favor of a target level of 4 months rather than the 6 months set by most of the RECs.

Ultimately, the review of the empirical literature remains little discussed, particularly for the optimal thresholds of nominal convergence criteria relating to the public deficit and foreign exchange reserves in months of imports. It should be noted that the levels chosen in the various African RECs are determined by reference to the requirements recommended by international institutions. However, this study proposes to fill this gap by proposing thresholds derived from a rigorous econometric procedure.

3. Methodology

The threshold effect panel model is used to determine the optimal endogenous thresholds for the convergence criteria of inflation, budget deficit as a percentage of GDP, reserves in months of imports and the debt/GDP ratio that maximize economic growth in the member countries of the various RECs (SADC, COMESA and ECCAS). There are four reasons for choosing this approach. Firstly, the economic literature indicates that model proposed by Hansen (1999) makes it possible to take account of the non-linearity of a relationship and/or the temporal heterogeneity and instability of the slope coefficients. In fact, this approach is presented as a regime change model insofar as it can be used to model situations where the economic relationship between two variables changes from one regime to another, depending on an endogenously estimated threshold ( Fouquau et al., 2008 ). Secondly, the thresholds estimated by this technique better reflect economic realities while taking into account temporal and individual dimensions ( Ndoricimpa, 2017 ; Alagidede et al., 2018 ). Thirdly, Hansen’s (1999) approach can be used in various fields to estimate thresholds. Hansen (1999) initially used it to describe the non-linear link between the investment behavior of firms and the financial constraints they face. Hurlin (2006) uses this approach to highlight network effects in the analysis of infrastructure productivity through threshold effects, while Savvides and Stengosb (2000) adopt it to represent the Kuznets curve linking inequality to economic development. Fourthly, Hansen (1999) develops an analysis based on disaggregated data, which allows economic dynamics and individual heterogeneities to be brought out more clearly ( Canry et al., 2007 ).

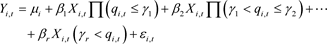

Generally speaking, the Hansen (1999) model is as follows:

(1)

(1)

With  the transition variable which captures the number of thresholds,

the transition variable which captures the number of thresholds,  the different thresholds,

the different thresholds,  the dependent variable,

the dependent variable,  the independent variable,

the independent variable,  the indicator function,

the indicator function,  fixed effects and

fixed effects and  the model parameters. n the case of this study, the dependent variable is the economic growth rate of the real GDP of the countries of the different RECs (SADC, COMESA and ECCAS). The overall budget deficit, including grants, the inflation rate, reserves in months of imports and the debt/GDP ratio are both variables of interest and transition variables. With reference to the economic literature and given the availability of data, a certain number of control variables will be used. The economic literature shows that there are several factors that can influence the economic growth of a geographical entity.

the model parameters. n the case of this study, the dependent variable is the economic growth rate of the real GDP of the countries of the different RECs (SADC, COMESA and ECCAS). The overall budget deficit, including grants, the inflation rate, reserves in months of imports and the debt/GDP ratio are both variables of interest and transition variables. With reference to the economic literature and given the availability of data, a certain number of control variables will be used. The economic literature shows that there are several factors that can influence the economic growth of a geographical entity.

Three control variables are used in this empirical investigation. Firstly, the rate of trade openness. A number of studies have shown that trade openness has a positive impact on a country’s economic growth ( Zahonogo, 2016 ). Thus, in reference to Frankel and Romer (1999) , all outward-oriented economies would have a high level of growth, compared with that of closed economies. Next, we consider the population growth rate. Indeed, the size of the population (especially a skilled workforce) could have a positive effect on economic growth ( Zahonogo, 2016 ; Amadou & Kebalo, 2019 ). Furthermore, in the context of ECOWAS, Agbékponou and Kebalo (2019) find that population growth helps to sustain economic growth through the demand channel. Finally, we also take into account the flow of Foreign Direct Investment.

The inflow of FDI has a positive effect on a country’s economic growth. In addition, the data used is mainly drawn from the International Monetary Fund database. This database provides information for all the constituent countries of the RECs covered by this study. The data used in this work covers the annual period from 2009 to 2021 and is processed in Panel format. Table 1 below gives a description of the different variables selected for the empirical analysis.

4. Results and Discussion

This section presents and comments successively on the results of the endogenous thresholds of the various nominal convergence criteria in SADC, COMESA and ECCAS. The results for the different convergence thresholds are shown in Table 2. For the SADC, a statistically significant level of inflation of 10.6% at the 5% threshold emerges. Within this economic community, the relationship between inflation and economic growth is non-linear. In fact, these results corroborate those found by the majority of studies carried out for developing countries ( Khan & Senhadji, 2001 ; Kelikume, 2018 ). Using a large sample of African countries, the authors identified inflation thresholds close to 7-11% and 11.1% respectively. The analyses show that the statistically significant threshold for optimal foreign exchange reserve cover in months of imports for the SADC zone is 4.1975 with a 95% confidence interval of [4.0076, 4.2101]. This minimum level of reserves for member countries is compatible with other objectives, in particular economic growth within the zone. Indeed, during the analysis period, the countries in the region achieved an average coverage of 4.27 months of imports. Although some countries, including Angola, Botswana and Comoros, have no major difficulties in meeting the 6-month criteria set by the Community, the majority of member economies very rarely achieve this target.

Source: Author.

Source: Computed by the author. ***p < 0.01, **p < 0.05, *p < 0.1 are 1%, 5% and 10% levels of significance, respectively. Note. Min (minimum value). Max (maximum value).

The estimation of the non-linear model makes it possible to determine a significant budget deficit threshold (expressed as a percentage of GDP) of 6.5%. When this deficit threshold is exceeded, expansionary fiscal policy has negative effects on economic growth. This result confirms those found in certain African regional communities. These have identified deficit thresholds above the current 3% criterion of their convergence pacts. Kebalo and Zouri (2022) and Oloo et al. (2022) found budget deficit thresholds of 11.42% and 6% for the West African Economic and Monetary Union (WAEMU) and the East African Community (EAC) respectively. However, as part of the new convergence pact to be proposed, the 3% of GDP deficit standard could be gradually adjusted, as moving from a standard of 3% to 6.5% of GDP seems too high and could have serious implications (economic and political). There is a non-linear relationship between the debt/GDP ratio and economic growth, characterized by a threshold of 75.6% over the analysis period. In fact, these results reveal that when debt dynamics are higher than the estimated threshold, the debt/GDP ratio has a negative effect on economic growth within the region. However, when debt dynamics are below the estimated threshold, countries in the region incur opportunity costs in terms of economic growth over the sub-analysis period. These results corroborate those found by Ndoricimpa (2017) , who estimates a debt threshold of between 62% and 66% for a sample of African countries. Moreover, compliance with this threshold would help to accelerate the convergence process within the zone.

For COMESA, an inflation threshold of 9.2% confirms the presence of non-linearity in the relationship between inflation and economic growth within COMESA. In fact, the definition of stable inflation that is not detrimental to economic growth in this economic zone must take account of the increase in the general price level that does not exceed a figure of 9.15%. Beyond this threshold, any increase in inflation would be detrimental to growth prospects within the regional community. While this result confirms previous studies that have found an inflation threshold of less than 10% in the WAEMU ( Combey & Nubukpo, 2010 ) and the East African Community ( Oloo et al., 2022 ), it contrasts with the result highlighted by Seleteng (2006) , who identified an inflation threshold of 18.9% for SADC member countries. However, a threshold of 9.15% turns out to be an intersection between the inflation thresholds found above. It is therefore plausible to suggest this level of inflation compared to that of (7%) set as one of the primary convergence criteria at COMESA level. This proposed threshold would also allow greater flexibility in the conduct of macroeconomic policies within the zone and at the same time ensure a non-conflicting balance between inflation and growth. There is a significant optimal foreign exchange reserve coverage threshold of 2.7 months of imports. This threshold should be compared with the average of 3.3 months of foreign exchange reserve cover observed by all the countries in the sub-region between 2009 and 2021.

It therefore appears that the six (6) month criterion is too restrictive for countries facing a number of development challenges, and that the constitution of such a high level of reserves would naturally deprive these economies of important resources for financing major emergence projects. There is a non-linear structure marked by two regimes and an endogenous threshold estimated at 6.4% of GDP. This analysis shows that when the overall budget deficit does not exceed 6.4% of GDP, expansionary fiscal policy has a positive effect on economic growth in the Eurozone. Compared with the convergence criterion relating to the overall budget balance in force in the zone (budget deficit ≤ 5% of GDP), there is a margin that can be exploited to support economic growth through expansionary fiscal policies. Indeed, countries will be able to use this budgetary margin of 1.4% of GDP to finance expenditure with a view to accelerating the convergence process and bringing the economic cycles closer together. This result also calls for a review of the convergence pact, particularly with regard to the criteria for budget deficits. There is also a non-linear relationship between the debt/GDP ratio and economic growth, characterized by a threshold of 65.3% over the period. Indeed, when debt dynamics are higher than the estimated threshold, expansionary fiscal policy has a negative effect on growth within the COMESA zone. These results corroborate those found by Alagidede et al. (2018) who estimate a debt threshold of between 50% and 80% for a sample of African countries. When compared with the convergence criterion for the public debt/GDP ratio in force in the zone (public debt/GDP ratio <65% of GDP), there is an additional exploitable margin (of 0.3%) for supporting economic growth through lax fiscal policies.

Finally, the result of the estimate for the Economic Community of Central African States (ECCAS) suggests an optimal inflation level of 9%. Within this economic community, the relationship between inflation and economic growth is non-linear. This result corroborates those found by most of the work carried out for developing countries ( Khan & Senhadji, 2001 ; Kelikume, 2018 ), which identified inflation thresholds close to 7% and 11%. The identification of an optimal level of foreign exchange reserve accumulation within ECCAS leads to an optimal coverage of 1.94 months of imports. This minimum level of reserves for ECCAS member countries is compatible with other objectives, particularly economic growth. Compared with the criterion of 3 months’ import cover set at the level of the Zone, the current proposed threshold of 2 months’ imports reflects a level of equilibrium given the enormous financing requirements for growth-generating projects. It is clear that the challenges of development in this community outweigh the requirement to build up foreign exchange reserves of 3 months. Thus, with this threshold, the opportunity costs of holding reserves would be low and would give member countries much greater flexibility in financing the major projects for the emergence of the Zone.

The result indicates that the budget deficit/GDP ratio threshold that the member states of the Economic Community of Central African States must respect in order to adopt a single currency and synchronize cycles is 5.94% of GDP. In fact, when the overall budget balance position is below the estimated threshold, the overall budget balance has a positive effect on economic growth within the zone. However, when the position of the overall budget balance is above the estimated threshold, the budget balance has had a negative effect on economic growth over the analysis period. In view of this result, it appears that the budget convergence criterion in force in the ECCAS community is sub-optimal and therefore does not help to accelerate the convergence of economies. As a result, there is a margin of 2.9% that the countries in the zone can use to finance their development. In addition, the introduction of such a standard and compliance with it by the countries of the union would help to bring the economic cycles closer together, with a view to speeding up the convergence process. On the other hand, there is a non-linear structure marked by the existence of two regimes and an endogenous threshold estimated at 69.4% of GDP, but which is not significant. However, even in the presence of this statistical insignificance, this threshold level is an indication that at the level of this grouping, the member countries could have the possibility of having an additional margin of indebtedness.

5. Conclusion

In the context of the formation of future monetary unions within the various RECs (SADC, COMESA, ECCAS), this article has examined the problem of the endogenization of convergence criteria, in particular by calculating the optimal levels of the various criteria using a threshold model based on the work of Hansen (1999) . Theoretically, the definition of optimal levels allows the member countries of the zone, on the one hand, to endogenize the criteria by making them compatible with the underlying specificities of the economies of these zones and, on the other hand, to support their economic growth in order to accelerate the process of convergence and synchronization of their economic cycles with a view to establishing a monetary union. The results of this empirical investigation show that the convergence criteria as set out in the convergence pact of these 3 RECs in no way reflect the reality of the different economies of the zone with regard to the optimal levels resulting from the estimates. This situation hampers the ability of Member States to exploit the additional margins provided by the optimal levels resulting from our calculations. Furthermore, in the context of the future convergence pacts of these RECs, the additional margins released could be used to finance economic transformation in order to accelerate synchronization.

Appendix. Descriptive Statistics for Some Variables

Source: Computed by the author.