Optimal Funding Strategy and Quality Competition in a Mixed Oligopoly ()

1. Introduction

There are many services, such as education and health, which are provided by not only the welfare-maximizing public providers but also the profit-maximizing private providers, of which the marginal costs are distinguishing, commonly those services like education or health are supplied by not only public providers but also private providers, who focus on both the quality and quantity supplied. Thus, we introduce heterogeneous private providers into the quality competition model formulated by Ghandour and Straume (2022) . In such a model, where both the private providers and the public providers coexist with different objectives, strategic competition decisions are made by different private providers when they face different funding strategies. Certainly, the regulator has several choices when deciding on the optimal funding strategy. For example, should the private providers be included in the public funding schemes? And if so, should homogeneous or heterogeneous funding strength apply to different private providers with distinguishing marginal costs? Or is any negative effect caused by the funding strategy sticking to maximize social welfare? Take the education markets for example, some regions in Ireland have announced to reject to grant any aid to the profit-maximizing schools, while others, including most of the Chinese provinces, encourage private schools to be included in the public schemes in order to meet the huge demand for fundamental education in the circumstance of compulsory education. Furthermore, quality is also an essential concern in both the education and health markets, which requires certain consideration of the providers strategically when responding to different funding schemes.

2. Literature Review

This paper is related to the literature on mixed oligopoly and on quality competition between public and private providers. There have been considerable empirical and theoretical works on the theory of mixed oligopolies, which derive from the groundbreaking contribution of Cremer et al. (1989) . The latest relevant works include Wang and Chiou (2018) , Colombo and Labrecciosa (2021) and Da Silva et al. (2022) . Compared with these works, the providers in our model compete not only in price and quantity, but they compete also in quality, which is not an issue in the above works.

Indeed, there are also several works related to quality competition in mixed oligopolies. The early related literature is Grilo (1994) , studying the quality and price competition in a vertically differentiated mixed duopoly. A later work dealing with quality competition in mixed oligopolies is Brunello and Rocco (2008) , who discuss a mixed duopoly game between a public school choosing quality and a private school choosing quality and price. De Donder and Roemer (2009) and Nabin et al. (2014) also build a product-differentiated model to study the quality competition between a state-owned provider and a private provider in a mixed market, which is the subsequent result of privatization. In addition, more recent studies of mixed duopoly quality competition have addressed various issues, such as partial privatization policies (Chang et al., 2018; Minh et al., 2021) , delegation strategy (Wang & Wang, 2021) and location choices (Hehenkamp & Kaarbøe, 2020; Takahara, 2022) , which are significant premises to be decided before the providers choose the optimal quality provision.

All the above-mentioned literature is related to competition without funding schemes set by a regulator, which is a key difference from this paper, in which the subsequent actions of the private providers depend on the funding strategy. In this respect, an early study is Wolinsky (1997) who analyses the quality competition between oligopolistic differentiated-product providers under different regulatory regimes which can control prices and impose quantity restrictions. Brekke et al. (2006) analyse the quality competition between two private providers in a price-regulated market where the regulator can commit to a price to induce first-order optimal but inefficiently high quality. Matsumura and Tomaru (2013) and Scrimitore (2014) also study quantity or quality competition between a public and a private provider under the assumption that subsidies are policy instruments to improve efficiency in imperfectly competitive markets. Whereas, Latine and Ma (2017) assume several policy implications for the mixed oligopoly quality competition and infer the optimal equilibrium under sufficient conditions on the consumer valuation distributions. A broader and recent review of the optimal funding strategy of mixed markets is given by Li et al. (2021) , who conclude that equal treatment of both the public provider and the private one is the optimal subsidy policy in a mixed oligopoly setting. What’s more, Choi (2022) studies the organizational form and effect of taxation in a multiproduct mixed market.

Overall, all the existing works broadly focus on the study of the aspect of the quality competition in mixed oligopolies, however, they have not paid enough attention to the quality gap and price gap between heterogeneous private providers. This paper, based on the mixed oligopoly with quality competition among heterogeneous providers, not only analyzes various funding strategies, but also discusses the change of the quality gap and price gap owing to inclusion of the private providers in the funding scheme, which is an extension of the existing literature.

The rest of the paper is structured as follows. In the next section, we present a mixed oligopoly model with the regulator’s quantity compensation, to which a public provider and two private providers with distinguishing marginal costs respond. In Sect. 4 and Sect. 5, we derive the equilibrium quality provision and price choice under three different assumptions about public funding coverage, where either no private provider is included in the funding scheme, or both private providers are homogeneously subsidized or heterogeneously funded, and we discuss not only the relationship between these variables and the funding parameter, but also the effect of the funding strategy on the price gap and quality gap between the two private providers. In Sect. 6, we provide concluding remarks.

3. The Model

Consider a market for a good (e.g., education and health) that is supplied by three different providers that are equidistantly located on a circle with circumference equal to 1. Among the three providers, Provider 1 is publicly owned and funded, while the two other providers with distinguishing cost functions are privately owned, but may or may not be included in the funding scheme, where they will experience different government subsidies from Provider 1 or the same one as what Provider 1 does. The private providers can decide the optimal choice and charge a price p per unit of the good supplied in the market. On the other hand, the publicly funded provider is subsidized a portion s for each consumer it attracts and will receive a price 0 per unit of the good supplied owing to the circumstance (e.g., compulsory education). It is also assumed that all the providers differ with respect to their objectives. Here we follow the assumption in most of the mixed oligopoly literature that the private providers make a profit-maximizing choice while the public one maximizes social welfare.

Consumers that are normalized to 1 are uniformly distributed on the same circle just as the assumption in the Salop model, and each consumer demands only one unit of the good from the optimal provider who can bring him maximized utility. The utility of a consumer for the good supplied by the provider i is given by

(1)

where

is the quality offered by Provider i, and

is the distance between the consumer and Provider i; the variable

denotes the price set by Provider i or paid by its consumers, and considering the circumstance (e.g., compulsory education),

is equal to 0. It is assumed that the parameter

is large enough to ensure full market coverage for all the good supplied by the providers. In addition, the parameter

measures the marginal willingness to pay for quality, showing that higher quality attracts more consumers, while the parameter

measures the marginal transportation cost, indicating that a farther distance away from the provider will raise the cost of a consumer and reduce the utility.

It is supposed that each consumer in the market seeks maximized utility when choosing the provider. Let

represent the distance from the location of Provider i to the consumer who is indifferent between Provider i and the neighbor Provider j. Since every consumer maximizes utility, this distance is given by

(2)

Considering that each provider has two neighbors, the demand for Provider i is given by

(3)

It should be noticed that in this equation and the following equations if

, then

, and if

, then

. Calculating with the solution of (2), this equals to

(4)

It should be noticed that the Salop model characterized above includes only three providers, driving each provider to keep both of the remaining providers in the market as neighbors, implying that each provider competes with both of the other two providers. What’s more, it is obvious that the function of demand satisfies

(5)

and

(6)

It is assumed that the cost of provision is correlated to the quality and quantity, the function of Provider i is given by

(7)

where

denotes the marginal cost for each consumer attracted by Provider i. We assume that the private providers’ marginal costs are respectively

(Provider 2) and

(Provider 3) before they are included in the funding scheme, whereas the marginal cost of Provider 1 is

when funded a portion s for each unit of good it supplies. And it should be noted that Provider 2 has lower marginal cost in that it is located in the regions with relatively lower economic levels and relatively lower living costs (e.g., education or health costs).

The profit of Provider i is thus given by

(8)

The two private providers are assumed to maximize profits, while the public provider aims to maximize social welfare W, which consists of total profits, public funding and aggregate consumer utility, denoted U, just as being given by

(9)

where J is the set of publicly funded providers. The aggregate consumer utility is given by

(10)

Considering that the price consumers pay is what goes from the pocket of consumers to the pocket of the providers, and the monetary transfer is what goes from the government to the providers, implying that price and funding do not have a direct impact on social welfare, thus the social welfare depends directly on the total cost of provision and aggregate utility of consumers, and its expression can be simplified as

(11)

where the first two terms represent the total cost of provision, the last three terms represent the aggregate consumers utility in which

(12)

and

(13)

can be interpreted as the aggregate transportation costs calculated by the aggregate utility function.

We consider the following three-stage game:

Stage 1 The regulator decides on its funding strategy to maximize social welfare.

Stage 2 All of the providers choose the level of quality provision to maximize the social welfare (public provider) or profit (each of the private providers).

Stage 3 The two private and profit-maximizing providers outside the public funding scheme choose the optimal price.

It is necessary to notice that the choice of funding strategy includes not only the quantity compensation, but also the decision on whether to let the private providers include in the scheme, and whether to subsidize homogeneously to the two private providers when including them in the funding scheme. In addition, in order to ensure the following analysis reaches equilibrium, and just as calculated in the appendix, we assume that the quality cost parameter k satisfies

(14)

4. Equilibrium Pricing Choice, Quality Provision and Funding Strategy

This section includes the condition and solution of the subgame-perfect Nash equilibrium for three different given funding strategies, where either no private provider is included in the funding scheme, or both private providers are homogeneously subsidized or heterogeneously funded owing to their distinguishing marginal costs. The concrete solution of the game is going by backwards induction, which starts from the last stage of the game, figuring out the optimal prices that both of the private providers choose, and prepares for the next stage to solve the optimal level of quality, with the subsequent funding strategy of the regulator.

4.1. No Private Provider Is Included in the Funding Scheme

Suppose that neither of the two private providers is included in the funding scheme. Under the circumstances, both of them raise the profits gained from the market by respectively charging prices p2 and p3. The game is solved by backwards induction, which derives by calculating the optimal pricing choices of private providers at Stage 3.

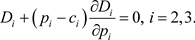

The first-order condition for the optimal prices chosen by the private Provider i is given by

(15)

(15)

By together calculating the first-order condition for the optimal prices, it is found that the equilibrium prices are given by

(16)

where

and

, thus, we can respectively reformulate the equilibrium prices as

(17)

(18)

(18)

And it is easy to find that each of the provider’s price is negatively related to the quality provision of each of the rival providers, just as given by

(19)

It is obviously seen that when the quality is indifferent, the price of Provider 2, with lower marginal cost, is relatively lower than the private provider with higher marginal cost, which is consistent with the cost theory. When it comes to quality of the good supplied, we can see that the price of each private provider is relative to each rival provider’s quality. The quality levels of the other two rival providers reduce the price of each private provider. It is acknowledged that demand tends to be more price elastic when it drops with a higher-quality good supplied by a rival provider, all others equal. The increasingly price-flexible demand in turn leads to a decrease of price when the private maximizes profit, which means here the optimal price of the private provider is a substitute strategy facing the quality provision of a rival provider. On the other hand, the provider’s own quality increases its optimal price. Since the cost of the provider is positively correlated to the quality, the price will raise as the cost theory describes, what’s more, a higher quality provision will be more attractive in the market and has a positive impact on the demand, driving demand less price elastic, which raises in turn the profit-maximizing price. Furthermore, price and quality can be considered as complementary and combinable strategies for private providers.

At Stage 2, for the sake of maximizing objective functions, all providers independently choose qualities after forecasting the price choices of private providers. The first-order condition for the optimal quality chosen by the welfare-maximizing public provider is given by

(20)

in which the sigma notation derives from

in the condition that

. Analyzing from the given first-order condition, it is obviously that the average quality in the market, the average marginal cost of the whole market, and the aggregate transportation costs have not only a direct effect on the quality provision of the public provider, but also an indirect effect on it, via the pricing choices of the private providers. What’s more, we can see that the public provider prefers reducing average marginal cost and aggregate transportation costs and increasing average quality in the market.

Simultaneously, the profit-maximizing private providers respectively decide on the quality provision, the first-order condition is given by

(21)

where

and

. Considering the fact given by (5) and (15), the equilibrium quality provision of each private provider can be reformulated as

(22)

In view of the fact given by (6) and (19), we see that

is positive and

is negative. Analyzing each term separately, we can see from the first term that higher quality provision brings to the provider direct profit gain when it leads to higher demand; from the negative coefficient of  in the second term, we find an indirect negative profit effect via the rival provider’s subsequent price choice, which implies that it is a nice choice for each of the private provider to mildly reduce its level of quality when it hopes its rival private provider’s subsequent price increases. Besides, the third term captures the diminishing marginal return of private provider’s quality.

in the second term, we find an indirect negative profit effect via the rival provider’s subsequent price choice, which implies that it is a nice choice for each of the private provider to mildly reduce its level of quality when it hopes its rival private provider’s subsequent price increases. Besides, the third term captures the diminishing marginal return of private provider’s quality.

From the above analysis of the first-order conditions considered by both the public provider and the private providers, the strategic interaction at the quality competition stage is characterized by the following best-response functions

(23)

(24)

(24)

(25)

It is an interesting finding that there are strategic substitutions among the choices of quality provision of each provider, which means higher quality provision of one provider results in subsequent lower quality provision of the else rival providers. For the public provider, the objective function to be maximized is the social welfare, which includes the actual average cost as shown in (11) and the average quality provision as defined by (12). Thus, the incentives of the public provider when choosing quality is mainly determined by the actual average cost and the average quality provision in the market. First, it is obvious that the actual average cost in the market depends on the quality choices of both public and private providers. If one of the private providers increases its level of quality provision, an increased trend of the actual average cost will be anticipated by the public provider, who considers the actual cost of all the providers as part of the minimizing goal and then responses via a lower quality provision to avoid rapidly rise for the actual average cost; in addition, when it comes to the average quality provision, the mechanism is relatively complicated. Before the analysis of this mechanism, it is necessary to notice that the higher the market share of one supplier leads to the greater the positive effect of its marginal quality increase on the average quality in the market. It is easy to find the subsequent results following the increasing quality of one private provider, in which this private provider’s market share is increased but the public provider’s is decreased, all else equal. In this condition, the effect of public provider’s marginal quality increase on the average quality in the market is reduced, which implies that lowering the quality provision is the optimal choice for the public provider, as shown by (23).

For the private providers, there is price strategy (reducing price to win more market share and profit) and quality strategy (increasing the quality to obtain more market share and profit) to choose from, thus, the mechanism behind the strategic substitutability is relatively simple, which is caused by the subsequent increasing price elasticity of demand following the competing provider’s quality choice. The profit-maximizing characteristic of the private providers tends to consider the marginal utility of the indifferent consumers who create profit for them, for which consumers’ marginal utility has an effect on the subsequent demand after each of the providers chooses its quality provision. Take Provider 2 for example, if one of the other two providers increases its quality, the demand for Provider 2 drops and becomes increasingly price elastic when the price-demand function is convex. Thus, when the price strategy is superior to the quality strategy, Provider 2 will choose to reduce the price for the sake of higher demand, which in turn requires a decreased quality to control the cost and adapt to the lower price-cost margin and higher quality-cost margin.

Synthesize all the best-response quality functions and the best-response price functions of the providers, the subgame-perfect Nash equilibrium for the price and quality stage is given by

(26)

(27)

(28)

(29)

(30)

and it can be calculated that the price gap and quality gap between the two private providers with distinguishing marginal cost, as given by

(31)

From the optimal quality and price functions of the two private providers, compared to the higher-marginal-cost provider, we can obviously see that the private provider with the so-called lower marginal cost (Provider 2) tends to choose lower quality with lower price, which may keep and even widen the regional development gap between the providers via inter-generational transmission as time goes by.

What’s more, it is a slightly extraordinary phenomenon that neither the best-response quality functions nor the bets-response quality functions depend on the funding scheme, which is frequently adopted by the regulator in order to raise the social welfare or the average market quality provision in most cases. However, the reason for this anti-realist condition is that a strict assumption is made, limiting the funding scheme related merely to demand and just open to the public provider, whereas the regulator always chooses a funding scheme related not only the demand, but also the quality provision, simultaneously including the private providers in the funding scheme for variety of consideration. Thus, it is necessary to consider the condition that both the two private providers are included in the funding scheme, as the following sections go.

4.2. Homogeneous Inclusion of Both the Two Private Providers in the Funding Scheme

Suppose now that both of the two private providers are homogeneously included in the funding scheme. As a result, the profit functions of the two private providers change, causing that each of the two private providers has a lower marginal cost when obtaining the same quantity compensation s, which changes the first-order condition for private providers’ optimal prices as follows

(32)

Compared to the condition given by (15), we see the demand for every privately owned provider becomes less price elastic when the private providers is included in the funding scheme with a quantity compensation. Indeed, the essence of the quantity compensation is like a kind of price subsidy and the effect of these two funding scheme is extremely similar.

Further, by backwards induction, we solve out the optimal pricing choices at the price stage again. The equilibrium optimal prices are given by

(33)

(34)

This price depends on not only the qualities as previous analysis, but also the strength of quantity compensation which does not exist in the previous analysis where no private provider is included in the funding scheme. When the private providers are included in the funding scheme, the quantity compensation means to them lower marginal cost which has a similar effect on their price strategy as price subsidy. Thus, the inclusion in the funding scheme of quantity compensation impels the providers reduce the price to a certain extent.

At Stage 2, since the added item (private providers’ quantity compensation) is monetary transfer which does not have a direct impact on the public provider’s objective function (social welfare), the first-order condition of public provider’s welfare-maximizing quality provision is the same as given by (20). However, for each of the profit-maximizing private providers, the changed objective function alters first-order condition for profit-maximizing quality provision as given by

(35)

where

and

. Comparing (22) and (35), we see the profit effect of quality provision through increased demand has not changed, for the assumption that the funding scheme is only in connection with the quantity. Whereas the quantity compensation impacts on the price elasticity of every private provider, which causes that the negative effect of quality provision through the competing provider’s subsequent price choice mildly decreases.

Synthesize all the optimal quality and price functions of the providers again, the subgame-perfect Nash equilibrium for the price and quality stage is now characterized by the following best-response functions

(36)

(37)

(38)

(39)

(40)

and the price gap and quality gap between the two private providers with distinguishing marginal cost is now given by

(41)

which does not shifted with the change of the quantity compensation on which both the optimal quality provision and the price choice depend, it may be due to the predictability of the funding scheme when the two different private provider homogeneously obtain the compensation, which causes the effect offsets. Thus, it makes sense to consider the two private providers are included in the funding scheme heterogeneously in the following section.

What’s more, distinguished from the equilibrium results with no private provider included in the funding scheme, the equilibrium quality provision and price choice now depend on the funding parameter. A simple inspection of (36)-(41) is sufficient to conclude the relationship between the providers’ optimal choices and the parameter of the funding scheme. The concrete result is summarized as follows:

Lemma 1 Suppose that both of the private providers are included in the funding scheme. In this case, 1) an increase in the quantity compensation (s) leads to lower price for both of the private providers; 2) an increase in the quantity compensation leads to lower quality provision for the public provider and higher quality provision for the private providers; 3) an increase in the quantity compensation has no effect on the quality gap or price gap between the two private providers.

Notice first that, when both the public provider and the private providers are included in the funding scheme, the profit-maximizing equilibrium price choices and quality provisions can be affected by the profit functions that are related to the strength of funding received by the private providers. Whereas, the equilibrium quality provision of the public provider depends on the social welfare that is not related to the funding scheme, the mechanism behind the fact, where increasing funding strength leads to lower welfare-maximizing quality provision, is that a higher quantity compensation brings to the private providers lower marginal costs and higher quality provision, which in turn causes lower quality choice of the public provider, as analyzed aiming to (23).

In addition, at Stage 1, the welfare-maximizng regulator decides on the optimal quantity compensation (s) by maximizing the social welfare, and the optimal choice of the quantity compensation is given by

(42)

and the maximizing social welfare is given by

(43)

From the optimal quantity compensation, we see the funding strength s surpasses the marginal cost of the higher-marginal-cost private provider, which means the funding scheme actually contains somewhat a part with essence of quality compensation, whereas not explicitly stated.

4.3. Heterogeneous Inclusion of Both of the Two Private Providers in the Funding Scheme

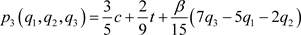

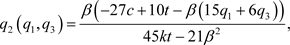

Suppose now that the two private providers are heterogeneously included in the funding scheme and do not know each other’s funding strength in advance. In this condition, Provider 2 and Provider 3 respectively obtain the quantity compensation s2 and s3. Analyze similarly as in the previous section, the optimal quality provision and price choice are now characterized as follows:

(44)

(45)

(46)

(47)

(48)

and the price gap and quality gap between the two private providers with distinguishing marginal cost is now given by

(49)

It is obvious that both the price gap and the quality gap are now related to the different strength of quantity compensation applied on the two private providers, which is different from the previous condition. It is worth mentioning that the concrete relationship between the providers’ optimal choices and the parameter of the funding scheme is as follows:

Lemma 2 Suppose that the two private providers are heterogeneously included in the funding scheme, knowing nothing about each other’s funding strength in advance. In this case, 1) an increase in any one private provider’s quantity compensation leads to lower price for each of the two private providers; 2) an increase in one of the private provider’s quantity compensation (take s2 for example) leads to its higher quality (for Provider 2) but lower quality for the public provider and the competing private provider (for Provider 3); 3) an increase in the quantity compensation of the lower-marginal-cost private provider leads to wider price gap and tinier quality gap between the two private providers, whereas opposite results are caused following the increase in the funding strength of the higher-marginal-cost private provider.

There are some differences between this conclusion and the one concluded in the previous considered game. In contrast to the previous conclusion, the increase of the quantity compensation for one private provider leads to lower quality provision of the rival private provider. The mechanism behind it is owing to asymmetric information. If the two private providers are included in the funding scheme heterogeneously, knowing nothing about the funding strength of the rival provider in advance, each one of the two private providers will find that the competing private provider’s quality increases when it realizes that its rival has got the quantity compensation from the funding scheme. Just as the previous analysis for the result of one provider’s higher quality, the predicted higher quality of the one private provider causes in turn lower quality for the other private provider, who chooses a robust price strategy rather than fierce quality competition.

In addition, the regulated quantity compensation has now an influence on both the quality gap and the price gap between the two private providers. The effect of the funding scheme on the price gap is related to the concrete coefficient for each of the funding parameters. As is shown in (44) and (45), the negative effect of s2 on p2 is larger than that on p3, while that of s3 is opposite. It means that s2 brings to p2 a more serious decrease than to p3, which in turn widen the price gap while s3 does conversely. With the previous analysis, it is easy to explain the decreasing quality gap after the two private providers are heterogeneously included in the funding scheme. Take Provider 3 for example, an increase in funding strength for Provider 3 leads to its higher quality but the rival private provider’s lower quality, thus, it widen the quality gap between them, while an increases in funding strength for Provider 2 leads to the opposite results.

As the calculation for Stage 1 in the previous section, both of the optimal quantity compensations (s2 & s3) are given by

(50)

by which we can calculate the social welfare that surpasses the one given by (43), the maximizing welfare function is given by

(51)

and reformulate the price gap function and the quality gap function as follows

(52)

5. Discussions on the Optimal Funding Strategies, the Quality Gap and the Price Gap

In the condition that both private providers are homogeneously subsidized or heterogeneously funded, it can be seen that the regulators may find an optimal funding strategy. Thus, we assign a value to the parameters to explore the relationship between the optimal quantity compensation (s) and the consumer’s marginal willingness to pay for quality (β). Here we assume

,

, and

, and conduct a numerical simulation by let β shift from 0.1 to 0.5. The concrete result is as shown in the following Table 1.

It can be viewed more intuitive in the following Figure 1, showing that when both private providers are homogeneously subsidized, the optimal funding strength should be slightly increased when the consumer increases his or her marginal willingness to pay for quality. However, when the two private providers are heterogeneously funded, the optimal quantity compensation for the provider with lower marginal cost of quality should be raised with the increase of consumer’s marginal willingness to pay for quality, while the optimal funding strength for the provider with higher cost should be reduced, which is −0.333 when β increases to 0.5. By this adjustable funding strategies, it may help more providers with lower marginal costs for quality survive and make the ones with higher marginal costs for quality be eliminated by the market mechanisms and the government intervention.

What’s more, the price gap and quality gap between the private providers are essential problems that are studied on the production behavior of different manufacturers. Here we discuss the concrete results concluded in the previous chapter.

Proposition 1 Inclusion of two private providers with different marginal costs in the funding scheme of quantity compensation will widen the price gap between them, whereas narrow the quality gap and even lead to a reversal on the quality gap.

For any one of the private providers, the quantity compensation when included in the funding scheme will result in lower price and increased demand, and the provider in turn has more motivation and ability to increase the quality provision, which leads to a further and greater increase in demand and profits. Thus, the regulator, in order to better play the substantial effect of quantity compensation, alters a biased strength of quantity compensation for the provider with lower marginal cost (even if private providers with different marginal cost take the same degree of compensation, for the lower-marginal-cost provider, the actual strength of funding is still relatively greater owing to the production dividend which will make its quality improves more facing the same degree of compensation). The inclusion of the private providers in the funding scheme eventually narrows the quality gap between the private providers with different marginal costs, or even the lower one even exceeds the quality of the higher-marginal-cost provider, which is higher at first.

![]()

Table 1. The result of the numerical simulation.

Date sources: Calculated by the authors when parameter assumed.

![]()

Figure 1. The relationship between s and β. Date sources: Calculated by the authors when parameter assumed.

Proposition 2 Discretionary policy, while bringing greater social welfare, also widens the price gap between providers with different marginal costs, and may enhance the reversal of the quality gap, which means that the quality gap has also increased to some extent.

Sometimes the regulator takes discretionary policy measures in order to maximize the social welfare, which may improve social welfare in a short time, but in the long run, the effect of discretionary policy is subtle. On the one hand, discretionary policy leads to some negative effects. As described on the price and quality gap in the previous section, if the regulator, in order to maximize social welfare in the short term as shown by (51), announces to offer indifferent level of quantity compensation to providers with different marginal costs, but in fact treats them heterogeneously, the price gap and the quality reversal strength will increase as shown by (41) and (52), which to a certain extent widens the gap between the two private providers with different marginal costs; on the other hand, after the discretionary policy is adopted for several times, the credibility of the regulator will be greatly compromised, thus affecting the continued effectiveness of the policies.

6. Conclusion

In this paper, we consider a mixed oligopoly with quality competition among one public provider and two private providers with distinguishing marginal costs and analyze the optimal funding strategy of the regulator whose objective function is social welfare. We also compare and discuss the price gap and quality gap between the two private providers when the regulator chooses different funding strategies.

Our findings show that the optimal strength of quantity compensation can be implemented only when the private providers are included in the funding scheme, which extends funding to the market prices and quality provision through the profit functions of the profit-maximizing private providers. Thus maximizing social welfare is related to the funding strength, from which the regulator can deduce the optimal quantity compensation in order to maximize social welfare. When the regulator includes the private providers in the funding scheme, it is found that an increase in the private providers’ homogeneous quantity compensation has no effect on the quality gap or price gap between the two private providers, while the increase in the heterogeneous one does owe to asymmetric information obtained by the two private providers with distinguishing marginal costs. In addition, we also find that when the maximizing objective function of the regulator is the traditional social welfare function as assumed previously, the inclusion of private providers with different marginal costs in the funding scheme will widen the price gap among them but narrow the quality gap and even a reversal on the quality gap. Thus it is recommended that the regulator, when maximizing the objective function, should pay attention to both the quality gap and the price gap in that the social gap is an essential factor to be considered.

Appendix

Appendix A. No Private Provider Is Included in the Funding Scheme

In the pricing subgame, the second order conditions are satisfied,

(A1)

and the Nash equilibrium stability requires that the second-order Hessian matrix is positive definite, which is easily verified:

(A2)

In the quality subgame, the second order conditions include two parts, each private owned provider seeking maximized profit is well-behaved if

(A3)

and the publicly owned and welfare-maximizing provider is well-behaved if

(A4)

The Nash equilibrium stability requires that the second-order Hessian matrix is positive definite, which requires

(A5)

and the third-order Hessian matrix is negative definite, which requires

(A6)

All the above conditions are satisfied if

(A7)

Appendix B. Homogeneous Inclusion of Both of the Two Private Providers in the Funding Scheme

In this condition, the regulator’s optimal funding degree for quantity compensation is well-behaved if

(B1)

Which requires

when assuming

. Calculating the numerator

at

yields

(B2)

Thus, here we we obtain the transcendental condition of the model

(B3)

Appendix C. Heterogeneous Inclusion of Both of the Two Private Providers in the Funding Scheme

In this condition, the regulator’s optimal funding degree for quantity compensation should keep the second order condition

(C1)

satisfied, which is easily verified when the transcendental condition (B3) holds. In addition, the second-order Hessian matrix should be positive definite, which requires

(C2)

Solving the numerator in (C2) yields the range of k:

(C3)

Considering the result at (A7), (B3) and (C3), all the above conditions can be satisfied if (B3) is satisfied. Thus,

(C4)

should be satisfied to ensure the critical conditions in all of the subgames.

NOTES

*Supported by Science Foundation of Ministry of Education of China (Grant No. 22YJA790066) and Jiangsu Provincial Social Science Foundation (Grant No. 22EYB005).

#Corresponding author.