Emission Tax, R&D Subsidy and Green Innovation of Firms: An Analysis Based on Mixed Oligopoly Theory ()

1. Introduction

At present, the increasingly serious environmental pollution has become a major global problem and one of the main factors leading to global warming. At present, global climate change research has clearly pointed out that since the end of the last century, the Earth’s surface temperature has been rising. There is therefore an urgent need for effective and vigorous action to adapt to climate change and reduce greenhouse gas emissions, leading to green development. The core of this paper is to guide all enterprises in the Economic Society to achieve green production and reduce the emissions of greenhouse gases and other pollutants. How to formulate effective policies to guide and regulate is a major challenge for policy makers. The two most closely watched policy instruments are emissions taxes and R&D subsidies.

In recent years, there are many documents about emission tax and green subsidy policy. Firstly, an emissions tax is a government tax on pollutants emitted by manufacturers, and an emissions tax has become a core policy that motivates manufacturers to reduce pollution (Stucki et al., 2018) . Xepapadeas (1992) found that emissions taxes can be effective in promoting green innovation and improving social welfare. Montero (2002) demonstrated that in a fully competitive market, an emissions tax can have a greater incentive effect than permits and emission standards. Gil-Moltó and Varvarigos (1) compared economic and environmental outcomes under mixed and pure oligopolies when emission taxes are exogenously given; Lambertini et al. (2017) established a static oligopoly model and found that in the static case, when the environmental damage is large, the tax rate will decrease with the spillover. Xing et al. (2020) examined the influence of environmental tax policy on environmental R&D. In addition, Wei et al. (2019) show that an emissions tax can be effective in motivating oligopoly polluters to engage in green technology innovation and improve social welfare. Ohori (2014) considered the optimal environmental tax in a mixed duopoly market and obtained a similar result. Shen et al. (2020) point out that emissions tax is an important incentive for manufacturers to innovate green processes. The above literature analyses the problem that the government makes use of the pollution tax regulations to regulate the manufacturers. Recently, some scholars have gradually appeared to study the impact of emissions tax on supply chain enterprises. For example, Yu et al. (2019) examined the impact of an emissions tax on the competitive mechanisms of sustainable supply chain networks. It was also pointed out that the implementation of environmental tax policies would promote the sustainable operation of enterprises and reduce their overall carbon footprint. Zhang et al. (2020a, 2020b) found that the product strategies of downstream firms are largely influenced by the carbon tax rate and the unit cost of low-carbon products.

Secondly, the incentive effect of R&D subsidies on green innovation is another important factor in this paper. Yi et al. (2021) found that subsidy policies provide greater incentives for manufacturers to reduce pollution. Haruna and Goel (2017) show that whether R&D of a public firm is a strategic substitute or complement for a private firm is dependent on the degree of R&D spillovers. Wang et al. (2017) found that subsidy policies are not only effective incentives for companies to invest in green technologies, but also a necessary tool to address the externalities of pollution. Xing et al. (2021) analyzed how full privatization affects R&D, environment, and welfare. Li et al. (2021) considered the effects of government subsidy programs and channel power structure on the investment level of two-tier supply chain, consumer subsidies are more effective than producer subsidies in promoting investment in innovation. Haruna and Goel (2019) study optimal pollution abatement under a mixed oligopoly when firms engage in emissions-reducing research and development (R&D) with imperfect appropriation. Results show that in a mixed oligopoly, the public firm has positive emissions reduction in equilibrium; however, emissions reductions of the private firm could be positive or zero. In addition, Sun et al. (2019) , Wang et al. (2021) , Khosroshahi et al. (2021) , and Meng et al. (2021) have studied green decision- making in supply chains under government subsidies, respectively.

The above research has yielded some critical insights. Based on the above literature review, this paper established a mixed oligopoly model (see, e.g., Gil-Molto et al., 2011; Haruna & Goel, 2015 ) to comprehensively compare the impact of emission tax and R&D subsidy on the output decision-making and green R&D decision-making of public and private firms.

2. The Model

We consider an oligopoly market, where there are only two firms 1 and 2, and firm 1 represents private firms and firm 2 represents state-owned firms, and they produce homogeneous goods. Let the inverse demand function be

where a is positive constant parameter measuring the reservation price (alternatively, it is a measurement of the size of the market), p is the market price,

is the market output, and

and

are the outputs of firm

, respectively. The cost function of firm i is given by

, where c is the unit cost of production, and

,

represents the green R&D firms undertake. The consumer surplus is denoted as

.

Firm’s i (net) emissions are:

where,

, represents R&D spillovers, i.e. there are spillovers in environmental R&D in that a firm benefits not only from its own R&D investment but also from its rival’s investment by an amount b. Moreover, donate the total damage function of emissions,

.

In this paper, we will compare the impact of environmental tax and R&D subsidy on the green innovation behavior of firms. To make the distinction easier, we treat the model under environmental taxes as Model 1 and the other as Model 2. As to Model 1, we set a emission tax rate t according to each firm’s pollution emission. Then, we got the profit function of the firm is as follows:

(1)

We define social welfare as the sum of consumer surplus and firms’ profit minus environmental damages:

(2)

As for Model 2, In which case, the government imposes a separate R&D subsidy ratio h on firm 2, which is the public firm. So we get the profit function and social welfare function under the condition of R&D subsidy only for the public firm:

(3)

(4)

In the following sections, we shall consider two alternative cases of R&D decisions, each featuring a three-stage game between the government and firms. In the case of Model 1, we examine a three-stage game where: in stage one, the regulator sets the emission tax so as to maximize social welfare, in stage two, firms invest in “green” R&D and in stage three market competition occurs. The equilibrium solution concept is perfect subgame equilibrium with backward induction. As for Model 2, the other two stages are similar, except that in the first stage managers set R&D subsidy rates to maximize social welfare.

3. Analysis and Results

3.1. Output and R&D Decisions: Emission Tax Case

In this case, the government sets a emission tax rate t before the firms undertake R&D investment. Then, each firm decides its R&D investment in the second stage, taking the emission tax rate as given. In the third stage, public firm chooses to maximize the social welfare,

, while the private firm chooses to maximize its own profit,

, simultaneously. For Equations (1) and (2), the first-order conditions provide the following equilibrium output level of each firm and the total output, respectively:

(5)

(6)

(7)

In the second stage, both firms choose R&D investments to maximize their objective functions. Using the first-order conditions, we obtain each firm’s optimal R&D and aggregate R&D functions:

(8)

(9)

(10)

Then we find the partial derivatives of tax rate t for the balanced innovation investment

(Equation (8)) and

(Equation (9)) of the two enterprises respectively:

(11)

(12)

Proposition 1: The emission tax works for the firm’s output decisions differently:

1) The public firm’s output increases as the emission tax increases.

2) The private firm’s output decreases as the emission tax increases.

3) The total output was not affected by the emission tax.

It is easy to obtain part 1) and part 2) directly from Equations (5) and Equation (6) that there is a positive correlation between the output of private enterprises and tax rates, while there is a negative correlation between the output of public enterprises and tax rates. Similarly, the conclusion 3) that total output has nothing to do with tax rates can be drawn from Equation (7).

Proposition 2: Impact of t (emission tax),

(market size), and b (spillover index) on equilibrium R&D:

1) The public firm’s equilibrium R&D decreases as the emission tax increases.

2) The private firm’s equilibrium R&D increases as the emission tax increases.

3) The impact of the emission tax on R&D investment is only related to the spillover index, not to the market size,

, and the higher the spillover index, the stronger the effect of R&D promotion or inhibition.

From the Equations (11) and (12), Firstly, we can see that when the spillover is in the defined domain

, the derivative of the private firm’s R&D on the emission tax is always less than zero, and the derivative of the public firm’s R&D on the emission tax is always greater than zero, it shows that the R&D of private firm’s has a negative correlation with the emission tax and the R&D of Public Enterprises has a positive relationship with the emission tax. Part 1) and part 2) can be proved.

Secondly, as for part 3), it is easy to observe that the derivative of the emissions tax in the two firms’ R&D is independent of the size of the market, which means that the size of the market has no effect on the extent to which the emissions tax affects R&D, the impact of emission tax on R&D is only related to R&D Spillover index, b, and the higher the spillover index, the stronger the effect of R&D promotion or inhibition.

Lemma1: Environmental taxes and spillovers make the private and the public firms behave differently in R&D intentions:

1) For the private firm, if

,

, we got

, and greater the tax rate t and the spillover index b, the more the R&D.

2) For the public firm, if

,

, we got

, and greater the tax rate t and the spillover index b, the less the R&D.

3) For the whole society, if

,

, we got

, and greater the tax rate t and the spillover index b, the less the total R&D.

From Equations (8) and (9), the partial derivatives obtained by b are respectively:

(13)

(14)

Concretely, referring the Equations (13) and (14), we notice that for the private firm, if

,

, we got

, that the equilibrium R&D is greater than zero, and when market size is not taken into account, the emission tax increases and the green equilibrium R&D of the firm also increases, as shown in Figure 1.

For public firms, if

,

, we got

, the equilibrium R&D is less than zero, and when market size is not taken into account, the emission tax is reduced, but the green equilibrium R&D of the public firm is increased instead, as shown in Figure 2.

Lastly, from the Figure 3, if

,

, we got

, we can see that the total R&D of the two firms is negative, reflecting the total willingness of social R&D is negative, and when market size

is fixed, we can also see the negative correlation between total R&D and emission tax, the increase of tax revenue will further restrain the total R&D of the economy and society.

3.2. Output and R&D Decisions: R&D Subsidy Case

In this game, the government imposes a separate R&D subsidy ratio h on the public firm before the firms undertake R&D investment. Then, each firm decides its R&D investment in the second stage, taking the emission tax rate as given. In the third stage, public firm chooses to maximize the social welfare,

, while the private firm chooses to maximize its own profit,

, simultaneously. For Equation (3) and Equation (4), the first-order conditions provide the following equilibrium output level of each firm and the total output, respectively:

(15)

(16)

(17)

In the second stage, both firms choose R&D investments to maximize their objective functions. Using the first-order conditions, we obtain the optimal green investment functions:

(18)

(19)

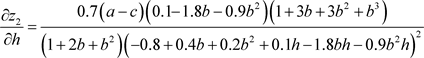

Then we find the partial derivatives of h for the balanced innovation investment

(Equation (15)) and

(Equation (16)) of the two enterprises respectively:

(20)

(21)

(21)

Proposition 4: Impact of h (R&D subsidies) and b (spillover index) on the firms’ output decisions:

1) The optimal output of both firms is not affected by R&D subsidies.

2) The private firm’s output decreases as spillover index increases.

3) The public firm’s output increases as spillover index increases.

It is easy to obtain part 1), part 2) and part 3) directly from Equations (15), (16) and (17) that there is a positive correlation between the output of private firms and spillover index, while there is a negative correlation between the output of public enterprises and spillover index. Also that whether private or public, the optimal output of firms is not affected by R&D subsidies.

Proposition 5: Impact of h (R&D subsidy rate) on two firms’ equilibrium R&D:

1) If

, the public firm’s equilibrium R&D increases as the R&D subsidy rate increases. If

, the equilibrium R&D decreases as the R&D subsidy rate increases.

2) The private firm’s equilibrium R&D decreases as the R&D subsidy rate increases.

From Equation (18) and Equation (19), Firstly, we can see that when the spillover is in the defined domain

, the derivative of the private firm’s R&D on the R&D subsidy rate is always less than zero, and if

, the derivative of the public firm’s R&D on the emission tax is always greater than zero, if

, the derivative of the public firm’s R&D on the emission tax is always less than zero, then part 1) and part 2) can be proved.

Lemma2: R&D subsidy rate and spillovers make the private and the public firms behave differently in R&D intentions:

1) For the private firm, if

,

, then

, and smaller the R&D subsidy rate and greater the spillover index b, the less the R&D.

2) For the public firm, if

,

, we got

, and smaller the R&D subsidy rate and greater the spillover index b, the more the R&D.

3) For the whole society, if

,

, and smaller the R&D subsidy rate and greater the spillover index b, the more the total R&D.

Referring Equation (20) and Equation (21), also with (18) and (19), we can learn that, for private firms, if

,

, then

, which means that private firms have a negative willingness to innovate green when the government only subsidizes research and development for public firms. On the other hand, regardless of market size

, the higher the G&D subsidy rate, the higher the equilibrium R&D will be when the technology spillovers are fixed. When the government’s subsidy rate to the public firm is fixed, the higher the spillover, the lower the private firm will be willing to invest in Green R&D, as shown in Figure 4.

By contrast, for public firms, if

,

, we got

, which indicates that public firm has a positive willingness to innovate green, supported by government subsidies. In addition, the relationship between firm’s green R&D and the R&D subsidy given by the government in a certain range, the higher the subsidy is, the less the R&D investment will be, while the subsidy by the government will remain the same when the technology spillover is controlled, the higher the technology spillover, the higher the green R&D investment, as shown in Figure 5.

As shown in Figure 6, the total green equilibrium R&D of private and public firms is positive under the same preconditions, which further indicates that in the case of government R&D subsidies only to the public firm, the public firm dominates the overall level of green research and development.

4. Comparisons and Discussion

Under the emission tax case, from the proposition1, proposition2 and lemma1, we can learn that, on the one hand, for the public firm, higher output increases social welfare, while the imposition of an emissions tax reduces the private firm’s output for the most profitable purposes. The fact that total production is not affected by emissions taxes suggests that producer surpluses are distributed between public and private firms, while total producer surpluses remain constant. On the other hand, in order to improve their market competitiveness, the private firm competes with the public firm for the surplus of producers and will carry out Green R&D. However, the public firm has negative R&D willingness for green innovation, which shows that the emission tax will restrain the production of the private firm, it makes the public firm has significantly high competitiveness in the market, and lost the impetus of innovation and R&D. It shows that appropriately lowering the emission tax can reduce the market entry difficulty of the private firm, and is conducive to stimulating the overall innovation and R&D vitality of society.

Under the R&D subsidy case, from the proposition3, proposition4 and lemma2, it is not difficult to see that when the government only provides certain R&D subsidies to the public firm, on the one hand, the public firm can make better use of R&D spillovers to increase output and capture larger markets than the private firm when R&D subsidies do not affect their output decisions. On the other hand, the private firm lacks the motivation for innovation and R&D, and the higher the R&D spillover, the lower the R&D willingness, considering the cost of R&D, the firm is more likely to enjoy the benefits of public firm’s R&D spillovers than to invest in innovative R&D. The higher government R&D subsidies, the more incentive the public firm has to innovate, and the higher the spillover, the more beneficial to social welfare.

5. Conclusion

Based on the oligopolistic competition theory, this paper considers the situation where there is only one public firm with the behavioral goal of maximizing social welfare and one private firm with the behavioral goal of profit maximization a firm that produces a non-differentiated product at the same time, the paper compares the impact of emission tax and R&D subsidy on the production and Green Innovation R&D behavior of firms. We find that with the increase of emission tax, the output of the public firm increases while that of the private firm decreases, but the total social output is not affected by the emission tax, the public firm’s investment in “Green” innovation R&D has decreased, while the private firm’s investment in R&D has increased. Furthermore, it is found that the impact of emissions tax on R&D investment is only related to the spillover index, not to the size of the market. For the comparative study of R&D subsidy as a policy tool, we assume that only one R&D subsidy is applied to the public firms, and we find that R&D subsidy has no effect on the optimal output of both private and public firms, but with the increase of spillover effect, the output of the private firm decrease while that of the public firm increases. At the same time, R&D subsidies result in negative R&D willingness of the private firm and positive R&D willingness of the public firm, and the higher the R&D spillovers, the lower the R&D willingness of the private firm but the higher the R&D willingness of the public firm, the higher government R&D subsidies, the more incentive the public firm has to innovate, and the higher the spillover, the more beneficial to social welfare. The study further shows that public firms dominate the overall green R&D level of society, while the government only subsidizes the public firm in R&D.

Several extensions are possible: 1) we consider firms are domestic, what about an international polluting mixed duopoly? 2) When do public firms compete with more than one private firm? 3) There exists the shadow cost of tax revenue. 4) Regarding the time-inconsistency policy issue between the emission tax and optimal privatization. We will consider these extensions in future.