1. Introduction

Organizational managers and policymakers use the budget for accountability and decision-making purposes. Budgeting is a process that involves the allocation of resources to the objectives of a given entity or a strategic plan (İpek, 2018; Brusca & Labrador, 2016) . The distribution of resources to a policy can influence various policy aspects. This paper aims to demonstrate how a public budgetary decision process impacts policy and how public policy affects the general budgetary decision process at the federal level. The document also discusses the potential complications of making budgets and policy-related decisions (see Appendix A).

2. How a Public Budgetary Decision Process Impacts Policy

A policy can be defined as a course of action or strategy created to achieve a goal or procedure. Any strategic plan or objective that requires implementation needs a budget. According to Brusca and Labrador (2016) , a budget is a financial statement that will help to predict the expenditure and revenues for a course of action or strategy for a given period. The relationship between public policy and the policy formulation process emanates from the fact that general activity can only be conducted if otherwise stipulated by clear objectives and appropriate policies. Professor Rubin’s policymaking concept postulates that public budgets play a role in policy development and advocacy efforts. Budgetary decisions made at the federal level can influence socio-economic issues such as housing, transportation, police, defense agencies, public education, poverty, and healthcare (see Appendix B).

The budget-making process will always consider the needs and wants of the public in determining resource allocation. According to İpek (2018) , a budget reflects the needs, preferences, and priorities of the society members that the budget serves. Budgeting provides a platform for the government to decide relevant strategies for meeting the needs of its population. Each budget decision will affect each category’s policies’ amount, level, and success. For example, the obesity pandemic has become a significant health concern that warrants the government’s attention. Given the prevalence of the condition and its debilitating effects, lawmakers and healthcare department stakeholders have been considering developing new policies to curb it. Such policies target health programs like Medicare or Medicaid to address the situation effectively. By influencing the amount of money allocated to treating obesity, the healthcare department stakeholders can reduce obesity prevalence in the country. The government may need to expand funding for treatment opportunities such as weight management, behavioral therapy, and bariatric surgery.

The policymaker’s proposed treatment options will have implications for both sides of the budgetary players. For example, if the federal government approves the funding of these treatment opportunities, the federal budget will be directly affected. Similarly, if the government rejects the proposed policies, the condition’s prevalence may exacerbate debilitating effects on the population’s health. For example, the United States Government approved a budget in 2018 for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). The program helped protect the vulnerable population’s well-being by providing essential nutrition, where the spending was approximately $5.3 billion in the fiscal year of 2018 on the schedule above (Hodges & McLauhlin, 2020) . According to the Centers for Disease Control, the program has reduced obesity incidences among children between two and four years in thirty-one states between 2010 and 2014 (Schwarz & Hamburg, 2016) . In addition, the approval of this program led to a policy that updated nutritional standards in schools. Moreover, the WIC program’s support was based on the needs of the public; it can be surmised that the public wants are a mechanism through which the budgetary process can influence policies.

A second mechanism is through the advocacy activities of relevant stakeholders in the healthcare system in the U.S. The WIC program’s data demonstrates how the government budget can result in policies significantly improving the country’s socio-economic conditions. The approval process of the WIC budget involves a wide range of stakeholders. A study conducted by Marume (2016) revealed that the politics of political parties, activities of interest groups, and public wants and needs influenced public policy development. Marume (2016) demonstrated the role of interest groups and the public’s needs and wants in influencing these policies. From the data shared above, it is clear that people’s demands affect public policies. Policymakers typically recognize the need to avail healthy nutrition to vulnerable populations to improve their health outcomes and, therefore, approve the budget (Hodges & McLauhlin, 2020; Schwarz & Hamburg, 2016) . Advocacy is also a crucial aspect that is instrumental in supporting budgets to facilitate policy development.

The socio-economic and political environment of policy development is critical to the nature and type of procedures that will be formulated. According to Marume (2016) , the socioeconomic background is both a source and a public policy recipient. Competing and conflicting institutions interested in policy formulation have a role in the budgetary process. Civil society refers to people outside the government interested in policy. Collectively, this group has created a mechanism by which different public views can be integrated into the policymaking process. Therefore, civil society links individual society members and the state, which builds a consensus for an expected budget approval process. These organizations’ activities hold the government accountable and ensure that the developed policies are relevant, enforceable, and responsive to people’s demands. They significantly influence public policy because of the shared information and the individuals they represent in the budget approval process.

While various studies have demonstrated the role of the public’s needs and civil society in the budgetary process and their implication on policymaking, other economists have rejected their stance. In her publication, “Early Budget Theory: The Progressive Theory of Expenditures”, Mabel Walker analyzed two major perspectives of the budgetary process: the judgmental and economic-scientific approach (Egbunike & Nkiru, 2017) . The critical policy to the fiscal process referred to a system where the budgetary process was influenced by making appeals and justice claims. Walker rejected these approaches’ importance in controlling the fiscal process. Although she acknowledged its role, Walker asserted that the notion had no meaningful contribution to budget planning and decision-making. In contrast, she rallied behind the economic-scientific approach due to its systematic and rational approach to influencing a budget. This approach involved utilizing an economic theory, routine analyses, and empirical data to determine and weigh budget allocation decisions.

From Mabel Walker, the stance that civil groups or public wants are essential in influencing the budgetary process is to be questioned. Even though civic society and society members play a role in the budget-making process, the approval decision will be based on empirical data supporting the budget’s financial viability. A study conducted by Egbunike and Nkiru (2017) confirmed Mabel Walker’s stance. According to the article’s authors, performance evaluation based on empirical data significantly influenced budget costs and controls (Egbunike & Nkiru, 2017) . From an economist’s perspective, limited public resources can be wasted if they are concerned with satisfying infinite human wants. Therefore, logical criteria such as performance evaluation, empirical data, and economic theories should guide decision-making.

The personal views of the political office in the budgeting process can also influence policies. U.S. public budgeting is based on accounting and financial management principles, accountability, and governance. A core tenet of the American system is that control is based on the separation of powers. Each branch of the government has a role in the budgetary process. For example, the legislature’s executive is responsible for preparing and submitting budgets in the public sector, especially the government. Once sanctioned by the parliament, federal funding is typically distinguished as licit documentation. The executive branch of the government highlights the objectives and policy priorities for every fiscal year.

In collaboration with the executive budget office, public agencies prepare departmental budgets compiled and submitted to the legislature for appropriation. Upon submission, the legislature will hold hearings, and stakeholders or individuals, interest or advocacy groups, and businesses will provide testimonials to the legislature. This approach fosters transparency and accountability in the budgetary procedure. Typically, the budget can be modified one year throughout the fiscal period depending on the circumstances. A performance review is conducted for control purposes and future improvement initiatives. Negotiations and collaborations occur during each step of the budgeting process. For example, stakeholders will lobby the executive to influence its decision on priority at the planning stage. Before the legislature’s appropriation, the executive and legislature must debate and reach a compromise to guide the budget.

Critical decisions on the execution of contracts and programs are executed through negotiation. Different disciplines view public budgets differently, e.g., a politician might view them as a means of attaining a political motive. A public administrator might view it as a means to implement public policies. In contrast, an economist might view it as allocating limited resources to satisfy unlimited human needs. Regardless of an individual’s view, budgeting is more of a political than a technical process (Oyakojo, 2015) . In her publication, “In Public Administration: Concepts and Cases”, Professor Irene Rubin identified critical conceptualizations of the budgetary process’s politics, including policymaking (Oyakojo, 2015) . From this perspective, it can be deduced that public policies are politically motivated strategies.

It is important to note that states are differently structured regarding the governance of the budgetary process. For example, in states such as Connecticut, Georgia, Idaho, Kentucky, and Minnesota, the governor is the central authority to make critical budgetary decisions. In states such as Utah and Mississippi, the legislature has substantial power in the fiscal process. In contrast, the executive is the primary budgetary decision-maker in Ohio, Illinois, and California. However, some economists have argued that this power division will not maximize government interventions. According to the critics, the power divisions emphasize the federal program’s economic impact and the expense of the intangible benefits.

3. Public Policy: Impacting the Public Budgetary Decision Process

The public budgeting process has undergone a significant evolution since its inception. Traditionally, the budget was solely an instrument to indicate or highlight a state’s earnings. However, the enactment of the Magna-Carta Law in the 17th century developed the public’s entitlements to be involved in the budgetary process (İpek, 2018) . Furthermore, after the economic depression, the theory of a functional state led to the transformation of the budget into a tool that the government could use to meet its fundamental roles and responsibilities to the public cost-effectively. As a result, accountability is now a key concept and the central tenet of modern budget systems.

Policies have been enacted to allow relevant individuals to assume and fulfill their roles in financing public services regarding the benefits delivered to the whole society. The new approach in the budgetary systems’ primary goal is to increase oversight of the budget’s impact on financing public services and rationalize the decision-making process. Since the current budget system focuses on cost-effectiveness and cost-efficiency, an investigation must determine how the target society members will benefit from the program. This approach calls for collaboration with various stakeholders to comprehensively understand the scope of the problem.

The budgetary process in the traditional context only requires an analysis of the program’s actual cost; hence, only a few stakeholders participating in the fiscal process are needed. Because novel policies emphasize accountability and transparency, public participation is warranted. The assumption is that public participation has a value proposition that can enhance decision-making, transparency, and accountability. This stance is supported by a study conducted by Abdullah (2016) . This survey that engages individuals during this particular procedure fosters good governance and minimizes the likelihood of corruption and misrepresentation of the budget. At each stage of the budgetary process, public participation opportunities are created.

The law requires the public to be informed and their input and opinion be sought before critical decisions. For example, in Mexico, a law has been passed that mandates the involvement of citizens in the planning, development, and implementation process of the budget (Marchessault, n.d.) . The new regulation requires that the executive promote citizen participation in public expenditure. The members can track, evaluate, and give feedback on the budgetary process by availing relevant information to the public. In South Africa, the national treasury has established a consultative approach that engages citizens during the fiscal process’s planning phase (Marchessault, n.d.) . The treasury then ensures that budgetary priorities are aligned with the needs of stakeholders. In South Korea, citizens formulate budgets to help the government develop and enforce budget ceilings (Marchessault, n.d.) . Policies that mandate public participation have gained widespread recognition in the budgetary process in various countries.

4. Complications: Budget and Policy-Related Decisions

Whether private or public, the budgeting process is based on choosing between expenditures. In this regard, comparing relevant categories becomes critical in determining which is more important. The decision-making process can be straightforward as long as there is a consensus between the major stakeholders on desired goals. However, budgeting sometimes involves comparing two incomparable elements. For example, policymakers may need to weigh the significance of providing shelter to the homeless and buying more supplies for the navy. In hindsight, budgeting decisions can only be achieved if consensus or compromise is made. When necessary, stakeholders must complete a common comparison point, and reaching an agreement may be difficult.

Another complication that may emerge relates to balancing budgets and borrowing. Complications can arise when the expenditure plan needs a reasonable method of paying back the borrowing. Although there are some critical differences between the budgetary process in the public and private sectors, unsatisfactory budgetary processes will trigger similar effects. A study by Pimpong and Ghana (2016) showed that long-term budgeting impacts a firm’s financial outcomes. Similarly, substandard budgetary processes can have long-term economic effects on the government’s budget. This stance can be illustrated by a budgetary gaffe made by President Regan in 1981 (Bineham, 1991) . According to Bineham (1991) , the head of state approved a budget based on faulty and inconsistent numbers. Months after the budget were signed into law, the annual deficits spike. By the time the budget was balanced, the country had amassed considerable debt. During that period, the obligations incurred constrained policy development initiatives, increased partisan conflict, and significant interference with the country’s budget institution and process.

In institutions that have adopted the traditional budgeting approach, the lack of an in-depth analysis may lead to limited oversight of any business line’s real ROI. There is also a risk of the budgetary process focusing on satisfying competing stakeholders’ needs at the expense of long-term goals and the organization’s vision. While public participation is vital during the policymaking and budgetary process, more emphasis on the same can increase the risk of basing budgetary decisions on inaccurate assumptions.

5. Conclusion

Policymaking depends on people who formulate alternatives between procedures, those who need to administer the policy, and those likely to be impacted by it. Everyone in society has a collective role in the policy formulation process. Through dialogue, individual community members can influence the budgetary process by contributing to the policymaking process through conversation.

A budget is a financial statement that will help to predict the expenditure and revenues for a course of action or strategy for a given period. The mechanism through which the budgeting process affects policies includes activities of political parties and interest groups and the public’s wants and needs. The socio-economic and political environment of policy development is critical to the nature and type of procedures that will be formulated. Budgeting decisions can only be achieved if consensus or compromise is made. States are differently structured when it comes to governance of the budgetary process.

Recently developed laws demand that the executive promote citizen participation in public expenditure. Since the fiscal process exists to serve the people’s demands, the budgeting process will focus on how it will improve such outcomes. This approach leads to the creation of people-centered policies. In addition, blueprints that mandate transparency and accountability in the budgeting process have allowed civil society to contribute to policy development processes.

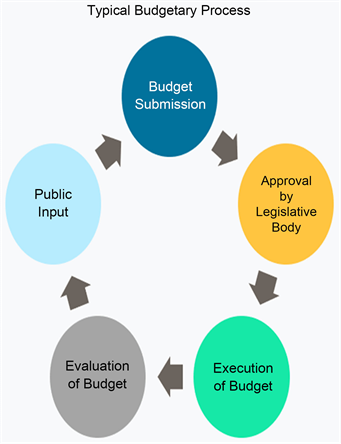

Appendix A. Public Budgetary Process

Note. Adapted from Kentucky League of Cities— InfoCentral. (n.d.) . Www.klc.org; Kentucky League of Cities. Retrieved February 4, 2023, from https://www.klc.org/InfoCentral/Detail/36/budgetary-process.

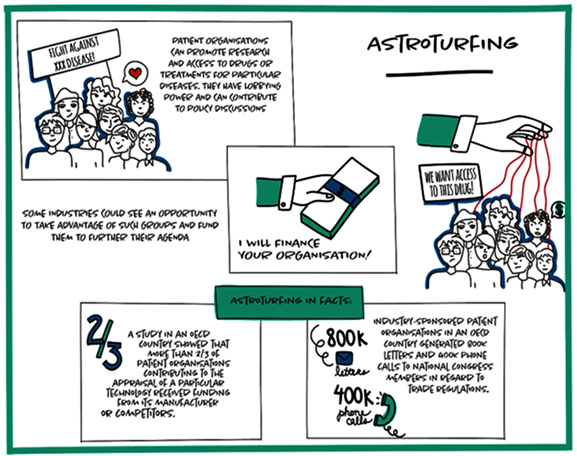

Appendix B. Public Budgetary Decisions Process Impacts Policy

Note. Adapted from Integrity and Influence in Policy-Making— OECD. (n.d.). Www.oecd.org; Organisation for Economic Co-operation and Development. Retrieved February 4, 2023, from https://www.oecd.org/gov/ethics/influence/.