1. Introduction

The Consumer Price Index. In 1985 Nobel Laureates Samuelson and Nordhaus wrote “The most common way to measure the overall price level is the consumer price index…The CPI measures the cost of a fixed basket of goods (items like food, shelter, clothing, and medical care) bought by the typical urban consumer…The rate of inflation is the rate of growth or decline of the price level, say, from one year to the next…A frozen price structure would prevent the invisible hand of markets of allocating goods and inputs…Thus we seek a golden mean of price flexibility, perhaps tolerating a gentle inflation, as the best way to allow the price system to function efficiently” (Samuelson & Nordhaus, 1985: pp. 82-83).

The (CPI) averages the prices paid by consumers for goods and services. This index reflects spending patterns for all urban consumers who make up about 93 percent of the total U.S. population. It is based on the expenditures of almost all residents of urban or metropolitan areas, including professionals, the self-employed, the poor, the unemployed, and retired people, as well as urban wage earners and clerical workers. Not included are the Armed Forces, and those in institutions, such as prisons and mental hospitals.

The CPI is based on prices of food, clothing, shelter, fuels, transportation, doctor’s and dentist’s services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments). All taxes directly associated with the purchase of items are included in the index. Prices of fuels and a few other items are obtained every month in all 75 locations. Prices of most other commodities and services are collected every month in the three largest geographic areas and every other month in other areas. Prices of most goods and services are obtained by personal visit, telephone call, or web collection by trained representatives of the United States Bureau of Labor Statistics. In January of each year, Social Security recipients receive a cost-of-living adjustment (COLA) to ensure that the purchasing power of Social Security and Supplemental Security Income (SSI) benefits is not eroded by inflation. In recent years, inflation in health care has substantially exceeded inflation in the rest of the economy. In December 2021 the CPI reading hit 7%, the highest level in over 40 years.

Components of the CPI. The CPI is constructed from the prices of a sample of representative goods and services whose prices are collected periodically. Sub-indices can be computed for different categories of goods and services and combined to produce the overall index. This index is weighted to reflect the shares of these categories in the total of consumer expenditures covered by the index. The CPI is one of several price indices calculated by most national statistical agencies. The annual percentage change in the CPI is used as a measure of inflation. The CPI can be used to adjust the real value of wages, salaries, and pensions for the effect of inflation, regulate prices, and deflate monetary magnitudes to show changes in real values. In most countries, the CPI and the population census are the most closely watched statistics.

Strains of Inflation. “Like diseases, inflations show different levels of severity. It is useful to classify them into three categories: moderate, galloping, and hyperinflation. …Moderate inflation occurs when prices are rising slowly. We might arbitrarily classify this as single-digit annual inflation rates, those less than 10 percent annually. In conditions of moderate and stable inflation, relative prices do not get far out of line. …Galloping inflation occurs when prices start rising at double- or triple-digit rates of 20, 100, or 200 percent a year. …Hyperinflation…is a third and deadly strain…Fortunately, hyperinflations are extremely rare. They occur only during wartime or in the backwash of war and revolution. Galloping inflation, on the other hand, is not rare. The tendency in advanced economies like the United States is toward moderate inflation. By using the tools of modern macroeconomics, responding to signs of inflation by tightening the monetary and fiscal screws, nations are able to keep inflation at a moderate creep and hold its costs down to tolerable levels” (Samuelson & Nordhaus, 1985: pp. 229-232).

Innovations in the Present Article. We begin with an assessment of America’s economic health. The United States is the largest global economy, with the greatest effect on all other economies, itself beset by inflation, unemployment, the trade war with China, and the Russian assault on Ukraine. Thus, a contracting American economy endangers global prospects, as well as American livelihoods.

First, we demonstrate that five commodities account for 99.9% of the American Consumer Price Index over the period 1991-2017, and posit that CPI variation is an endemic and uncontrollable phenomenon caused by exogenous factors such as cyclicality and global warming. This induction is supported by the occurrence of runaway inflation in 2021 before the Covid19 pandemic and the Russian invasion of Ukraine. Second, we show that commodity prices have increased from 1991 to 2017 and hypothesize that these increases were due to rising consumer affluence and demand over this period. Third, our five commodities and the American CPI are measured on ratio scales, which are the most powerful calibrations. Finally, our method and findings generalize beyond inflation and commodities to all social and data science variates.

2. The Consumer Price Index: Remarks from the Federal Reserve

Federal Reserve Chairman Jay Powell is a disciple of Paul Volcker, his legendary predecessor who ended the high inflation that haunted the US economy from 1965 to 1982. In March, 2022 Powell was asked “if the Fed was prepared to do whatever it took to control inflation—even if it meant harming growth, as Mr. Volcker did. ‘I hope that history will record that the answer to your question is yes’ the Fed chair replied”. Powell’s resolute response also challenged the United Nation’s and the President of France’s book titled “Why GDP Doesn’t Add Up” (Sarkozy, 2010).

In May, 2022 Powell warned that getting inflation under control could cause some economic pain but remains his top priority. Powell said he could not promise a soft landing for the economy as the Fed raises interest rates to tamp down price increases, running near their fastest pace in more than 40 years. “So a soft landing is really just getting back to 2% inflation while keeping the labor market strong. And it’s quite challenging to accomplish that right now, for a couple of reasons,” the central bank chief said in an interview with Marketplace. He noted that with a tight labor market pushing up wages, avoiding a recession that often follows aggressive policy tightening will be a challenge. “So it will be challenging, it won’t be easy. No one here thinks that it will be easy,” he said. “Nonetheless, we think there are pathways… for us to get there.” The remarks were published the same day the Senate overwhelmingly confirmed Powell for a second term, a move that came nearly seven months after President Joe Biden first submitted the nomination. Since then the Fed has been criticized for its delay in raising interest rates by 75 basis points, and its reluctance in halting its bond-buying program, even as inflation mounted.

Also in 2022, Steve Liesman of CNBC asked chairman Powell about interest rates in controlling inflation: “Mr. Chairman, you talked about using 50-basis-point rate hikes or the possibility of them in coming meetings. Might there be something larger than 50? Is 75 or a percentage point possible? And perhaps you could walk us through your calibration. Why one month should—or one meeting should we expect a 50? Why something bigger? Why something smaller? What is the reasoning for the level of the amount of tightening?” Chairman Powell replied: “Sure. So a 75-basis-point increase is not something the Committee is actively considering. What we are doing is, we raised [the funds rate] by 50 basis points today. And we’ve said that, again, assuming that economic and financial conditions evolve in ways that are consistent with our expectations, there’s a broad sense on the Committee that additional 50-basis-point increases should be on the table for the next couple of meetings. So we’re going to make those decisions at the meetings, of course, and we’ll be paying close attention to the incoming data and the evolving outlook as well as to financial conditions. And, finally, of course, we will be communicating to the public about what our expectations will be as they evolve. So the test is really just as I laid it out, economic and financial conditions evolving broadly in line with expectations. And, you know, I think expectations are that we’ll start to see inflation, you know, flattening out—and not necessarily declining yet, but we’ll see more evidence. We’ve seen some evidence that core PCE inflation is perhaps either reaching a peak or flattening out. We’ll want to know more than just some evidence. We’ll want to really feel like we’re making some progress there. And we’re going to make these decisions, and there’ll be a lot more information. I just think we want to see that information as we get there. It’s a very difficult environment to try to give forward guidance 60, 90 days in advance. There are just so many things that can happen in the economy and around the world. So, you know, we’re leaving ourselves room to look at the data and make a decision as we get there.” Steve Leismen responded: “I’m sorry, but if inflation is lower one month and the unemployment rate higher, would there be something that we would calibrate toward a lower increase in the funds rate? Chair Powell indicated: I don’t think that one month is—no. No. One month’s reading doesn’t tell us much. You know, we’d want to see evidence that inflation is moving in a direction that gives us more comfort. As I said, we’ve got two months now where core inflation is a little lower, but we’re not looking at that as a reason to take some comfort. You know, I think we need to really see that our expectation is being fulfilled—that inflation, in fact, is under control and starting to come down. But, again, it’s not like we would stop. We would just go back to 25-basis-point increases. It’ll be a judgment call when these meetings arrive. But, again, our expectation is, if we see what we expect to see, then we would have 50-basis-point increases on the table at the next two meetings”.

A week later, in a Marketplace interview, Powell opined that he’s not sure how much difference it would have made to act more quickly, adding, “we did the best we could. Now, we see the picture clearly and we’re determined to use our tools to get us back to price stability”. Nonetheless on June 15, 2022 Powell was forced to use his major tool, interest rates, which the Fed voted to raise by 75 basis points in order to control a runaway CPI. Throughout his remarks that day Powell stressed the Fed’s unwavering “data dependence” in rescinding it’s earlier judgement that inflation was transitory. This flexibility is in the spirit of John Maynard Keynes, who, in response to criticism for being inconsistent, retorted “when new information arrives I change my mind, and you?” New information did arrive on June, 19, 2022 when runaway inflation drove the election results in France and Belgium, signaling a dangerous politization of global economies. Also aware of this global danger, President Sri-Kumar of Global Strategies pleaded for a 125-basis-point rise in interest rates on September 19, 2022 (Sri-Kumar, 2022) (CNBC, Power Lunch).

3. Trans-Century Inflation

Franklin Delano Roosevelt. “In 1933 the newly elected President Franklin Roosevelt launched a barrage of new policies to try to end the Depression. Two were particularly important. First, FDR broke the link between the dollar and gold, which ended a U. S. deflation and allowed a nascent recovery, until premature monetary and fiscal tightening led to a new recession in 1937. Second Roosevelt declared a banking ‘holiday’, closing all banks and vowing to reopen only those banks that were solvent. Together with the creation of federal deposit insurance by congress, which protected small depositors from losses from bank failures, the holiday decisively ended the banking panics” (Bernanke, 2022: p. xvi).

Subsequently, World II put America back to work, ending the Great Depression and continuing FDR’s “New Deal for the American people”. The New Deal flourished throughout the 20th Century and preceded the taming of lengthy and stubborn late century inflation.

Paul Adolph Volcker Jr., an American economist who served as the 12th chairman of the Federal Reserve and ridded America of the gold standard in 1971. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s. He previously served as the president of the Federal Reserve Bank of New York from 1975 to 1979. President Jimmy Carter nominated him to succeed G. William Miller as Fed chairman and President Ronald Reagan renominated him once. Volcker did not seek a third term at the Fed and was succeeded by Alan Greenspan. After his retirement from the Board, he chaired the Economic Recovery Advisory Board under President Barack Obama from 2009 to 2011 during the subprime mortgage crisis (https://en.wikipedia.org/wiki/Paul_Volcker).

Ronald Ernest Paul. In the wake of Paul Volcker’s tenure at the Fed, Ron Paul argued that it is irresponsible, ineffective, and ultimately useless to have a serious economic debate without considering and challenging the role of the Federal Reserve. In End the Fed (Paul, 2009) Ron Paul argued that the Federal Reserve was created to bail out banks when they got into trouble. He said that this is bad for competition in banking, as it strengthens the big banks. Paul argued that the Fed is both corrupt and unconstitutional. He stated that the Federal Reserve System is inflating currency today at nearly a Weimar or Zimbabwe level, which he asserted is a practice that threatens to put the United States into an inflationary depression where the US dollar, which is the reserve currency of the world, would suffer severe devaluation. A major theme of Paul’s book is the idea of inflation as a hidden tax making warfare much easier to wage. Because people will reject the notion of increasing direct taxes, inflation is then used to help service the overwhelming debts incurred through warfare. In turn the purchasing power of the masses is diminished, yet most people are unaware. Under Ron Paul’s theory, this diminution has the biggest impact on low-income individuals since it is a regressive tax. Paul argued that the CPI presently does not include food and energy, yet these are the items on which the majority of poor people’s income is spent. He further maintained that most people are not aware that the Fed—created by the Morgens and Rockefellers at a private club off the coast of Georgia—is actually working against their own personal interests. Instead of protecting the people, Paul contended that the Fed now serves as a cartel where “the name of the game is bailout”, i.e. privatized profits but socialized losses. Paul also drew on what he argued are historical links between the creation of central banks and war, explaining how inflation and devaluations have been used as war financing tools in the past by many governments from monarchies to democracies.

Paul is known for calling for auditing, and then ending—the Federal Reserve. He argued that with gold backing the value of the dollar, the Fed would be obsolete and unable to play a role in resolving credit bubbles that cause misery when they burst. He believes the Fed made money too easily available in recent years.

In his early years, Paul served on the House Banking Committee, where he blamed the Federal Reserve for inflation and spoke against the banking mismanagement that resulted in the savings and loan crisis. Paul argued for a return to the gold standard maintained by the U.S. from 1873 to 1933, and convinced the Congress to study the issue. During his first term, Paul founded the Foundation for Rational Economics and Education (FREE), a non-profit think tank dedicated to promoting principles of limited government and free-market economics. In 1984, Paul became the first chairman of the Citizens for a Sound Economy (CSE), a conservative political group founded by Charles and David Koch “to fight for less government, lower taxes, and less regulation.” CSE started a Tea Party protest against high taxes in 2002. In 2004, Citizens for a Sound Economy split into two new organizations, with Citizens for a Sound Economy being renamed as Freedom Works, and Citizens for a Sound Economy Foundation becoming Americans for Prosperity. The two organizations would become key players in the Tea Party movement from 2009 onward.” (https://en.wikipedia.org/wiki/Ron_Paul). In 1984, Paul retired from the House in order to run for the U.S. Senate. He lost the Republican primary to Phil Gramm, who had switched parties the previous year from Democrat to Republican.

Yanis Varoufakis. Despite advocating the dissolution of the Fed, Ron Paul had interrogated Fed Chair Paul Volcker. Before being appointed Fed Chair by President Carter, Volcker spoke at the University of Warwick. “Volcker’s Warwick Speech is relatively unknown but it must surely go down as probably the most significant ever in central banking history…A controlled disintegration in the world economy is a legitimate objective for the 1980s” (Varoufakis, 2016: pp. 70-71). …The trick for America to gain the power to recycle other country’s surpluses in the 1980s, Volcker believed…was to hit two usually contradictory targets at once: on the one hand, push American interest rates through the roof while on the other, ensuring that Wall Street offered a more lucrative market for investors than it’s equivalents in London, Frankfurt, Tokyo, Paris or anywhere else.

During his tenure as Fed Chairman Volker succeeded in reducing inflation by sharply raising interest rates. He also made expanding the money supply without increasing inflation his priority. His attention to structural reform of the Board of Governors involved protecting the Federal Reserve’s regulatory authority and restricting commercial banks’ activities that were considered risky. Volcker opposed giving commercial banks the ability to underwrite corporate securities and take part in real estate development. “The downside of Volker’s disintegration was not far off the horizon, though. By 1980 it was causing a global slowdown (Varoufakis, 2016: p. 100).”

Despite this trend lasting into the 21st Century, Yanis Varoufakis remains positive about resolving Europe’s crisis and America’s economic future. “When Ghandi was asked what he thought of Western civilization, he famously replied that ‘it would be a very good idea’. If asked what we think of the European Union today, we could do worse than remarking, what a splendid idea! If only we could it off! I think we can pull it off. But not without a break from Europe’s past and a large democratic stimulus that the fathers of our European Union might have disapproved of” (Varoufakis, Afterword, From Dissonance to Harmony, p. 251). Perhaps this trend from dissonance to harmony in Europe is the reason why Paul Volcker’s guidance of the Fed in America was implemented by his successor.

Alan Greenspan, who served as the 13th chairman of the Federal Reserve from 1987 to 2006. First nominated to the Federal Reserve by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor. Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a “rock star”. Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts. Many have argued that the “easy-money” policies of the Fed during Greenspan’s tenure, including the practice known as the “Greenspan put”, were a leading cause of the dot-com bubble and subprime mortgage crisis (the latter occurring within a year of his leaving the Fed), which, said The Wall Street Journal, “tarnished his reputation”. Yale economist Robert Shiller argues that “once stocks fell, real estate became the primary outlet for the speculative frenzy that the stock market had unleashed”. Greenspan argues that the housing bubble was not a result of low-interest short-term rates but rather a worldwide phenomenon caused by the progressive decline in long-term interest rates, a direct consequence of the relationship between high savings rates in the developing world and its inverse in the developed world. This rock star’s fame peaked in December 1996 when he asked “How do we know when irrational exuberance has unduly escalated asset values? …Greenspan wrote later that his tightening in March 1997 was motivated by his worry that a stock-market bubble might cause inflationary instability (Bernanke, 2022: p. 78).” Thus, Greenspan hypothesized the causes of inflation. In contrast, the correlations and R2s in Section 5 empirically verify the effects of inflation over the period 1995-2017 before the global shocks of Covid19, the Ukraine war, and recession.

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he is a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve’s response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the department of economics there from 1996 to September 2002, when he went on public service leave. From August 5, 2002, until June 21, 2005, he was a member of the Board of Governors of the Federal Reserve System, proposed the Bernanke doctrine, and first discussed “the Great Moderation”—the theory that traditional business cycles have declined in volatility in recent decades through structural changes that have occurred in the international economy, particularly increases in the economic stability of developing nations, diminishing the influence of macroeconomic (monetary and fiscal) policy. Bernanke then served as chairman of President George W. Bush’s Council of Economic Advisers before President Bush nominated him to succeed Alan Greenspan as chairman of the United States Federal Reserve. His first term began February 1, 2006. Bernanke was confirmed for a second term as chairman on January 28, 2010, after being renominated by President Barack Obama, who later referred to him as “the epitome of calm”. His second term ended January 31, 2014, when he was succeeded by Janet Yellen on February 3, 2014.

Preceding current Fed Chair Jay Powell (cf. Section 2), former Fed Chair Ben Bernanke recently traced the history of inflation from the “Great Depression of the 1930s to the Great Recession of 2007-2009. America’s great inflation, which lasted from the mid-1960s until the mid-1980s, inflicted less economic distress than the other two ‘Great’ episodes…As a childhood trauma shapes an adult’s personality, the Great Inflation shaped the theory and practice of monetary policy for years to come, both in the United States and around the world (Bernanke, 2022: p. 3).”

Janet Louise Yellen is an American economist serving as the 78th United States secretary of the treasury since January 26, 2021. A member of the Democratic Party, she previously served as the 15th chair of the Federal Reserve from 2014 to 2018. Yellen is the first woman to hold each of those posts and the first person to have led the White House Council of Economic Advisers, the Federal Reserve, and the Treasury Department. Yellen graduated from Brown University in 1967 and earned her PhD in economics from Yale University in 1971. She taught as an assistant professor at Harvard University from 1971 until 1976 when she began working for the Federal Reserve Board as an economist from 1977 to 1978 before joining the faculty of the London School of Economics from 1978 to 1980. Yellen is professor emeritus of the Haas School of Business at the University of California, Berkeley, where she has been a faculty member since 1980 and became the Eugene E. and Catherine M. Trefethen Professor of Business and Professor of Economics.

Yellen was a member of the Federal Reserve Board of Governors from 1994 to 1997 nominated to position by President Bill Clinton, who then named her chair of the Council of Economic Advisers from 1997 to 1999. Yellen later served as president and chief executive officer of the Federal Reserve Bank of San Francisco from 2004 to 2010. Afterwards, President Barack Obama appointed her to replace Donald Kohn as vice chair of the Federal Reserve from 2010 to 2014 before nominating her to succeed Ben Bernanke as chair of the Federal Reserve from 2014 to 2018. She had one of the shortest tenures in that position and was succeeded by Jerome Powell after President Donald Trump refused to renominate her for another term. Following resignation from the Federal Reserve, Yellen joined the Brookings Institution as a distinguished fellow in residence. She returned to government with appointment as secretary of the treasury under President Joe Biden since January 26, 2021. Secretary Yellen has been confirmed by the United States Senate on five separate occasions (Some of the text in this section has been drawn from https://en.wikipedia.org/wiki/Inflation).

4. Method: Quadratic-Fractional-Polynomial Regression

Our Q-F-P regressions are written in the following Stata syntax:

fracpoly regress AmericanCPI AmericanInterestRates, degree (2) noscaling.

fracpoly regress AmericanCPI cereals milk beef AmericanShelter gold, degree (2) noscaling (2).

The option degree (2) specifies a quadratic fractional polynomial regression. The option noscaling calls for all variables in both regressions to be scaled as in their 23 (years) × 7 spreadsheet. The commodity data in 5 columns of this spreadsheet, as well as the American CPI and interest-rate data in the other 2 columns, were supplied by the World Bank. The noscaling option in regressions (1) and (2) does not allow any of these 7 columns to be multiplied by a constant (cf. (Royston & Altman, 1994) and (StataCorp., 2011)).

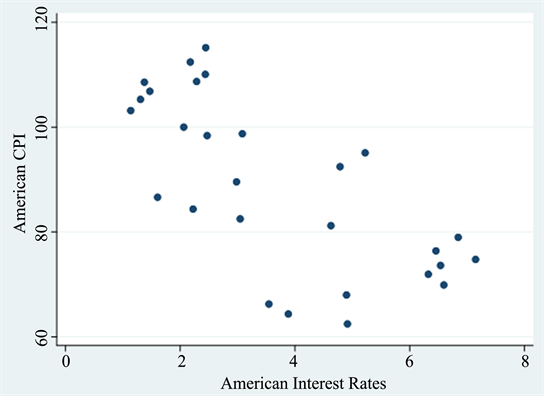

Our first regression returns a goodness-of-fit R2 of 0.5599 and a correlation of −0.7100 between the AmericanCPI and AmericanInterestRates, showing that rising interest rates do their job by lowering inflation.

Turning to the second regression, we first note that the periodicity of the data in Table 1 below suggests that exogenous causes such as cyclicality and global warming may account for these resulted coefficients. Economists and stock market traders have recently railed about the “the worst inflation in 100 years”. However, these coefficients were observed over the trans-century period 1991-2017 well before inflation broke out of control in 2022. This verifies our hypothesis that CPI variation is an endemic and uncontrollable phenomenon.

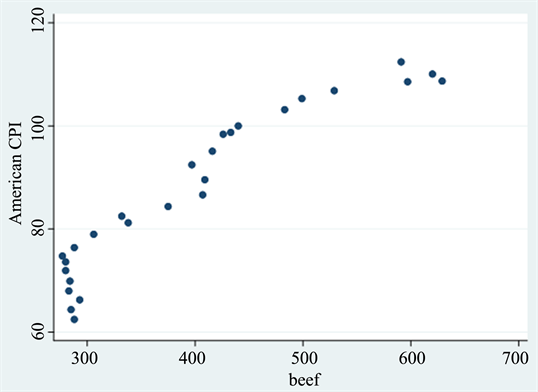

Each R2 in the righthand column of Table 1 was returned by a quadratic fractional polynomial regression of the American CPI on only the one commodity in it’s row. The scatter plots below demonstrate the closeness of fit demonstrated

![]()

Table 1. Commodities quadratically predicting inflation.

by the prices of beef and shelter. The quadratic R2 of 0.947 indicates that the price of beef alone strongly predicted the American CPI over the trans-century period 1991-2017. The predictive power of shelter prices, with a quadratic R2 of 0.993, is especially impressive. As shelter prices rose, so did the American CPI with nearly perfect quadratic shape. Both plots show downward quadratic curvature, with that of beef more marked than that of shelter.

5. Summary

Measurement. The variates in Table 1 are all measured on ratio scales, which exceed interval scales in the hierarchy of scientific measurement (Stevens, 1946). For almost half a century interval scales have been beset with skepticism about their incremental benefits over and above ratio scales already in use (Shapiro, 1972: p. 373). The subjectivity associated with interval scaling, i.e. survey sampling, questionnaire interrogation, probabilistic inference, and significance testing, are absent from the commodities measured here in mass and dollars. In addition, the host of long-standing, and now acute, issues daunting micro-data collection and analysis are evaded by the R2s and correlations in Table 1, which rest on ratio-scaled variables.

Global Implications of Measurement. In 2020 the IMF’s Chief Economist Gita Gopinath predicted a drop in global economic outlook. In the second quarter the American economy, at an annualized rate, contracted by one third of its value. The United Nations humanitarian agency then alerted the United States, the IMF, and the World Bank that mitigating economic contraction is crucial for endangered poor nations. Section 4 provides data-driven support for this UN alert.

The United States has the world’s largest national economy, with the greatest impact on all other national economies. Thus, a contracting American economy endangers global prospects, as well as American livelihoods. This endangerment has been stressed by Pew Research: “Barely 10 years past the end of the Great Recession in 2009, the U.S. economy is doing well on several fronts. The labor market is on a job-creating streak that has rung up more than 110 months straight of employment growth, a record for the post-World War II era. The unemployment rate in November 2019 was 3.5%, a level not seen since the 1960s. Gains on the jobs front are also reflected in household incomes, which have rebounded in recent years. But not all economic indicators appear promising. Household incomes have grown only modestly in this century, and household wealth has not returned to its pre-recession level. Economic inequality, whether measured through the gaps in income or wealth between richer and poorer households, continues to widen.”

Indonesia has warned the G20 nations that worldwide inflation and food shortages are the worst threats to the planet. The United Nations, the United States, the IMF, the World Bank, and the BRICS nations may survive these threats through the dissolution of corporate capitalism and state socialism. The transformation of these global giants was suggested in 2022 by Scott Wahler of CNBC who ventured the “end of globalization as we know it”. In this same year Mohamed El-Erain reflected this concern, indicating that “The Fed is losing total control of inflation” (El-Erian, 2022). Also in 2022 runaway inflation drove the election results in France and Belgium, signaling a dangerous politization of global economies. Well aware of this global danger, President Sri-Kumar of Global Strategies pleaded for a 125-basis-point rise in interest rates on September 19, 2022 (Sri-Kumar, 2022) (CNBC, Power Lunch), and Fed Chair Powell stressed that the Russian assault on Ukraine has implications for the global economies that are highly disturbing. Globalization again arose on November 30, 2022, when the Fed revealed an elaborate model addressing the global effects of American inflation, with Powell stressing “We want the world to be better off” (The Brookings Institution, 2022).

Future Directions. The major contribution of this article, i.e., the finding that five commodities perfectly predict inflation, is fraught by the deficiency that commodities are only one pathway to the perfect prediction of inflation. Bechtel (2022) has shown that human development and life expectancy perfectly predict inflation. Future research may also demonstrate that various global assets also predict inflation.

Acknowledgements

This article is dedicated to the memories of the author’s best critic, Maria Cohn Bechtel, and his mentor, Clyde Hamilton Coombs. The author thanks Aryil Bechtel for his contribution to the concept of parsimonious prediction, Timothy Bechtel for describing the global milieu surrounding inflation, and Dr. Bethany Bechtel for her insistence on monitoring inflation over time.