Tax Base-Broadening a Light at the End of the Tunnel in the Fiscal Consolidation Dynamics ()

1. Introduction

The Global Financial Crisis (GFC) and COVID-19 have inserted immense pressure on many economies. Indebtedness (debt/GDP ratio) for many economies has jumped by 25% - 30% in the recent past. For instance, the indebtedness rose by 39%, 30%, 21%, 25%, 33%, 25%, 24.5%, and 19% from 2017 to 2020 among Australia, Canada, Italy, Mexico, Turkey, United Kingdom, India, and the United States of America, respectively (OECD, 2022). Rising debt levels are a point of concern for global institutions and the global economic system, especially when the cost of borrowing is on the higher side. In the wake of this dire situation, effective fiscal consolidation plan and its smart execution is the need of the hour. Erceg and Linde (2013) have suggested a framework for fiscal consolidation. This framework covers the dynamics of the size of adjustment needed in the debt/GDP ratio, the composition (tax based: lumpsum taxes and distortionary taxes) of this consolidation, speed of its implementation.

This study is a contribution to elaborate on the effects of tax-based consolidation. A closed economy DSGE model has been utilized to observe the implications of this particular type of consolidation. Furthermore, the model captures the dynamics of the Italian economy in this regard while considering the monetary policy of Italy as independent instead of the policy developed by the European Union (EU). The unique state, high degree of indebtedness and the existence of irregular/shadow segments, of Italian economy makes it an interesting case to investigate and confirm the role of tax base expansion in reducing indebtedness without reducing the public spending and hiking the rates of existing taxes.

2. Tax Base/Net Broadening

Tax base entails the components of tax revenues and tax expenditures; typically, on the expenditure side, governments make public transfers by providing financial support to specific segments such as low-income households, retired personnel, senior citizen, etc. On the revenue side, the public authorities can raise revenues by eliminating specific exemptions, e.g. products of category A are tax-exempt, or by increasing the existing tax rates such as the general sales tax are increased from 15% to 17% on all products and services (Freebairn, 2005). The same pillars of tax base broadening have been explored by a US-based institution “tax foundation” in its study, Options for Broadening the US Tax base has shed light on the aspects of this option as a remedy to tackle surging indebtedness (Greenberg, 2015). The findings of this study cover three directions; exclusion of employer-sponsored health insurance, removing the cap of the social security payroll tax and capping itemised deductions at a fixed dollar level. The study iterated that these directions have a significantly positive impact on the output if they are used with the combination of tax rate cuts. This intuition may work for almost every systematic economy for the expansion of the tax base/net.

Another option that may be exercised for the expansion of the tax net is by taxing the informal/irregular/shadow economic component. This component exists in both labour and firms segment (informal labour force and Informal firms/producers); it is pertinent to mention here that informal component has access to the same market as the tax-payer segment has. A concerned look at the literature about this segment can clarify the role of the informal/shadow segment in the economic dynamics. Nichter & Goldmark (2009: p. 1455) defined the informal segment as “businesses that are unregistered but derive income from the production of legal goods and services”. Schneider (2005) elaborated on the role of informal firms in developing economies as contributors to 40% - 60% of GDP. And in his earlier work of 2000, he presented that informal firms account for $70 billion in Africa, $531 billion in Asia and $353 billion in Latin America at the beginning of the 21st century.

The impact of informal firms in terms of employment is substantial in developing economies. The International Labor Organization reports that the informal economy’s share of the nonagricultural workforce is 55% in Latin America, 45% to 85% in Asia, and approximately 80% in Africa (ILO, 2004). A major portion of this employment falls under the category of self-employment. For instance, USAID estimated that self-employment represents 70% of informal employment in sub-Saharan Africa, 59% in Asia, and 60% in Latin America (USAID, 2006).

In this study, Italian time series data is utilised to observe the impact of tax base expansion on the output and debt/GDP ratio. The selection of Italy as a test case is based on some apparent realities, such as Italy being an entry point for the irregular/illegal workforce in Europe through the well-known international Mediterranean refugee phenomenon. The volume of cash transactions is also adding fuel to the fire. A significant portion of the informal economy (Bruton et al., 2012) is a driving element in the selection as well. More importantly, the rising indebtedness of the Italian economy demands the exploitation of all possible options that can help in the stabilisation of surging indebtedness.

The rest of the paper entails the sections such as research model dynamics, the method employed for solving the model, conclusion and discussion, references, and the appendices containing a graphical presentation of vital aspects of the model’s solution.

3. Model

3.1. Historical Insight of DSGE Models

The abbreviation DSGE stands for Dynamic Stochastic General Equilibrium. They are macroeconomic models and shed light on the business cycle phenomenon of any economy. The factor which distinguishes them from other macroeconomic models is their derivation from the microeconomic fundamentals. Normally, there are optimisers, some time non-optimizers, in these models who are forming rational expectations and striving for the maximisation of their objective functions according to the corresponding budget constraints.

These models are the extended version of the Real Business cycle, RBC, models, and they are known as New Keynesian models. They entail the basic framework of RBCs and the addition of Keynesian assumptions such as monopolistic competition in the goods as well as labour markets, price stickiness, and wage stickiness, etc. This scientific framework has been attributed as “new neoclassical synthesis” by some experts, see Goodfriend and King (1997). New Keynesian models attain their differentiation from RBCs through the inclusion of price and wage stickiness because such addition alters the implication of the model. And short run neutrality of monetary policy ends in these models.

Price and wage stickiness has an extensive investigative foundation. These rigidities are expressed in DSGE models mostly through the adoption of two, Calvo (1983) and Rotemberg (1982), approaches. Both approaches pave the path for FOCs transformation into the New Keynesian Phillips curve. There are some vital applications of Calvo’s concept in the literature, Erceg et al. (2000), Gali and Gertler (1999). The model employed in this study proceeds along with these dynamic intuitions and an effort to present a scenario on the format of DSGE models.

The model employed in this study

It is a medium-scale NKDSGE (New Keynesian Dynamic Stochastic General Equilibrium) model (Eric, 2016), and it acts in accordance with the work of Smets and Wouters (2003, 2007); Gali (2012, 2015); Gali et al. (2001, 2007); which entails Ricardian/regular households, Non-Ricardian households (Shadow segment households), regular labor force and shadow segment labor force, Monopolistic competitive producer/firm, Fiscal Authority and Monetary authority. The model entails the frictions arising from the habit preference, adjustment costs, the utilisation of capital, stickiness of prices, stickiness of wages and the indexation of both (prices and wages) towards their past inflation rate.

The following segments shed light on the aspects and players of the model.

3.2. The Households

The economy entails the continuum of two categories of households. The share  is the category of households have absolute access to the financial components and capable to optimize their behavior intertemporarily and they are attributed as the Ricardian households in this study. The remaining households are accredited as the shadow segment or Non-Ricardian households; due to their irregular status they are assumed to have no participation in savings, and they have no access to borrowing as well.

is the category of households have absolute access to the financial components and capable to optimize their behavior intertemporarily and they are attributed as the Ricardian households in this study. The remaining households are accredited as the shadow segment or Non-Ricardian households; due to their irregular status they are assumed to have no participation in savings, and they have no access to borrowing as well.

3.3. Ricardian Households

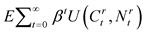

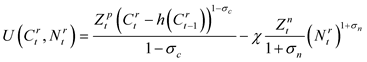

This segment exhibits an inclination to optimise its lifetime utility, and this ability is evident in the following expression.

(1)

(1)

Regular households’ utility is a function of  and leisure

and leisure  and it is expressed as:

and it is expressed as:

(2)

(2)

Here, h indicates the persistence of habit,  hours worked by the regular labour force, the symbol,

hours worked by the regular labour force, the symbol,  , represents the elasticity of substitution. The symbol,

, represents the elasticity of substitution. The symbol,  , is an indicator of inverse Frisch elasticity which sheds light on the disutility of labour.

, is an indicator of inverse Frisch elasticity which sheds light on the disutility of labour.  performs the job of the scaling parameter, which adjusts the labour supply’s steady state. The symbols,

performs the job of the scaling parameter, which adjusts the labour supply’s steady state. The symbols,

, are presenting shocks to consumer preference and labour supply, respectively. They are iid and follow the AR (1) process. Households earn wages

, are presenting shocks to consumer preference and labour supply, respectively. They are iid and follow the AR (1) process. Households earn wages  from the labour, interest from holding bonds

from the labour, interest from holding bonds  and earn rental rate,

and earn rental rate,  , by extending capital to the producers or firms. They also are the beneficiaries of public transfers

, by extending capital to the producers or firms. They also are the beneficiaries of public transfers . The households spending lands on two venues consumption

. The households spending lands on two venues consumption  and investment

and investment  in private capital

in private capital . The household budget constraint is of the following form.

. The household budget constraint is of the following form.

![]() (3)

(3)

Here, ![]() is the price level,

is the price level, ![]() ,

, ![]() , and

, and ![]() indicate the sales, capital and labor income tax,

indicate the sales, capital and labor income tax, ![]() is a single period nominal return for the local public bonds,

is a single period nominal return for the local public bonds, ![]() is an indicator of nominal wage,

is an indicator of nominal wage, ![]() shows the degree of capital utilization,

shows the degree of capital utilization, ![]() is an indicator of the cost associated with the variation in the degree of capital utilization. While considering the work of Christiano et al. (2001, 2005), it is assumed that on the path of equilibrium capital utilization is

is an indicator of the cost associated with the variation in the degree of capital utilization. While considering the work of Christiano et al. (2001, 2005), it is assumed that on the path of equilibrium capital utilization is![]() ,

,![]() . Private capital follows the following law of motion.

. Private capital follows the following law of motion.

![]() (4)

(4)

Here, ![]() Represents the investment adjustment cost function, and it has the following form.

Represents the investment adjustment cost function, and it has the following form.

![]() (5)

(5)

The above expression is the depiction of the fact that any adjustment in the capital stock to attain its optimum level is costly. And ![]() covers the investment adjustment cost in this expression. Ricardian households’ utility optimization happens within their budget constraints, capital aggregation in relation to consumption, labor, public bond holdings, investments, the volume of subsequent period’s capital stock and its frequency of utilization.

covers the investment adjustment cost in this expression. Ricardian households’ utility optimization happens within their budget constraints, capital aggregation in relation to consumption, labor, public bond holdings, investments, the volume of subsequent period’s capital stock and its frequency of utilization.

Optimal conditions/FOCs of the regular/optimising households concerning various components are as under.

FOC wrt. Consumption:

![]() (6)

(6)

FOC wrt. Investment:

![]() (7)

(7)

FOC wrt. Labor:

![]() (8)

(8)

FOC wrt. Public bond holdings:

![]() (9)

(9)

FOC wrt. Next period capital stock:

![]() (10)

(10)

FOC wrt. To capital utilisation:

![]() (11)

(11)

3.4. Non-Ricardian Shadow Segment Households

These households are unable to optimise their utility like Ricardian households because it is assumed that they are making investments, and they do not have regular access to the financial markets. Their income in its entirety entails what they earn against their labour services and what they receive in the form of public transfers, and this income entertains these households’ consumption necessities. This whole situation can be expressed in the following expression.

![]() (12)

(12)

3.5. Household Aggregation

Share of Non-Ricardian households has been presented with ![]() and the remaining share will cover Ricardian household. thus, the total private consumption will be as:

and the remaining share will cover Ricardian household. thus, the total private consumption will be as:

![]() (13)

(13)

3.6. Wage Setting

Households are the providers of differentiated labour services; this characteristic enables them to act as monopolistically competitive wage setters. In every period a particular segment ![]() gets the option of wage optimization whereas the remaining segment

gets the option of wage optimization whereas the remaining segment ![]() adjust its wages conferring to the simple indexation rule and its level of indexation is accounted by

adjust its wages conferring to the simple indexation rule and its level of indexation is accounted by![]() . A labor services providing body bundles up the distinguished labor services by following the principles of Dixit-Stiglitz type function. And these composite indexes are then made available for sale to the firms/production sector at a cumulative wage index

. A labor services providing body bundles up the distinguished labor services by following the principles of Dixit-Stiglitz type function. And these composite indexes are then made available for sale to the firms/production sector at a cumulative wage index![]() . Optimizer households will set their wages to

. Optimizer households will set their wages to ![]() while keeping in consideration the demand of their individual labor services and the likelihood of upcoming adjustments. Dynamics of cumulative wage index in this scenario can be expressed as:

while keeping in consideration the demand of their individual labor services and the likelihood of upcoming adjustments. Dynamics of cumulative wage index in this scenario can be expressed as:

![]() (14)

(14)

Here, ![]() is an indicator of the net wage markup.

is an indicator of the net wage markup.

It is assumed that non-Ricardian/irregular households will fix their wages approximately around the average wage of the optimiser/regular/Ricardian households and according to their labour force demand. Labour force demand for irregular households has been considered similar to Ricardian households. Resultantly, labour hours worked, and the wages will be indistinguishable for both types of consumers, and this is of the following form:

![]() (15)

(15)

3.7. Firms/Producers

There is a continuum of firms in the economy, and it is introduced as ![]() and each firm has the tendency to yield differentiated goods by following a Cobb-Douglas style production function:

and each firm has the tendency to yield differentiated goods by following a Cobb-Douglas style production function:

![]() (16)

(16)

Here, ![]() is a depiction of a shock to the total factor productivity (TFP) and it follows the AR(1) process:

is a depiction of a shock to the total factor productivity (TFP) and it follows the AR(1) process: ![]() where,

where,![]() .

. ![]() indicates public capital stock and F is an indicator of the fixed cost associated with production. Factor prices are taken by the firms as they are given. And firms attempt to minimize the cost of a certain output level. Labor demand is similar for all firms/producers and it is presented as:

indicates public capital stock and F is an indicator of the fixed cost associated with production. Factor prices are taken by the firms as they are given. And firms attempt to minimize the cost of a certain output level. Labor demand is similar for all firms/producers and it is presented as:

![]() (17)

(17)

The marginal costs (MC) have the following form:

![]() (18)

(18)

Consequent profits are considered as distributable dividends among the optimiser households.

3.8. Price Setting

He firms set prices according to the principles of Calvo (1983). In each period a segment ![]() gets the opportunity of price adjustment in a manner to optimize price level

gets the opportunity of price adjustment in a manner to optimize price level![]() . The segment

. The segment ![]() which doesn’t get the price optimization opportunity; index its prices according to the past inflation and its degree of indexation is specified by

which doesn’t get the price optimization opportunity; index its prices according to the past inflation and its degree of indexation is specified by![]() . And monopolistic competition generates the gross markup

. And monopolistic competition generates the gross markup ![]() of optimal price over the marginal cost for every firm f. Competitive retail firms accumulate the individual firms’ productions into a final goods index, and they do this job according to the principles of Dixit-Stiglitz function. Aggregate price index relies on the demand of individual goods in the index. And price adjustment dynamics will be in the following form:

of optimal price over the marginal cost for every firm f. Competitive retail firms accumulate the individual firms’ productions into a final goods index, and they do this job according to the principles of Dixit-Stiglitz function. Aggregate price index relies on the demand of individual goods in the index. And price adjustment dynamics will be in the following form:

![]() (19)

(19)

3.9. Government/Fiscal Authority

Fiscal authority entails the variables such as public consumption![]() , public investment

, public investment![]() , Sales tax

, Sales tax![]() , private capital tax

, private capital tax![]() , regular labor income tax

, regular labor income tax![]() , shadow/irregular labor income tax

, shadow/irregular labor income tax![]() , transfer payments

, transfer payments ![]() and the stock of issued public bonds

and the stock of issued public bonds![]() . Public capital’s accumulation follows the same law of motion as the private capital does.

. Public capital’s accumulation follows the same law of motion as the private capital does.

![]() (20)

(20)

The government has the following form of budget constraints.

![]() (21)

(21)

In expenses, the government has the public transfers![]() , public consumption

, public consumption![]() , public investment

, public investment![]() , debt payment and interest. While on the revenue side the government relies on the sales tax

, debt payment and interest. While on the revenue side the government relies on the sales tax![]() , tax on private capital

, tax on private capital![]() , tax on the income of regular labor

, tax on the income of regular labor![]() , as a tax base broadening measure tax on the labor income of shadow/irregular labor force and wealth generated from presently issued bonds.

, as a tax base broadening measure tax on the labor income of shadow/irregular labor force and wealth generated from presently issued bonds.

A broader application of Leeper (2010a, 2010b) has employed in the elaboration of expense and revenue rules for the fiscal authority. It is assumed that the fiscal authority’s consumption and investment follow a countercyclical path as a reaction to the deviations of output and debt from their corresponding equilibrium states. To address the implementation delays due to the economic developments; respective lagged values have been instituted. Public transfers do not face such interruptions. That’s why the rule for transfers presents the response to a contemporaneous cyclical segment of hours served. Expenditure rules are in the log-linear approximation, and they are as follows:

![]() (22)

(22)

![]() (23)

(23)

![]() (24)

(24)

Here, ![]() ,

, ![]() , and

, and ![]() with i.i.d. shocks

with i.i.d. shocks![]() ,

, ![]() ,

, ![]() having zero mean and variances

having zero mean and variances![]() ,

, ![]() ,

,![]() .

.

It is considered that the revenue side of fiscal authority tends to adjust consumption/sales, private capital, regular labour income, and irregular labour income taxes to attain economic stability. Thus, the fiscal rules in this segment can be defined to portray the reaction towards the deviation of output and debt from their corresponding equilibrium states. The log-linear approximation of these rules has the following form:

![]() (25)

(25)

![]() (26)

(26)

![]() (27)

(27)

![]() (28)

(28)

Here, ![]() ,

, ![]() ,

, ![]() ,

, ![]() with i.i.d. (zero mean and variances such as:

with i.i.d. (zero mean and variances such as:![]() ,

, ![]() ,

, ![]() ,

, ![]() , and shocks

, and shocks![]() ,

, ![]() ,

, ![]() ,

,![]() .

.

3.10. Monetary Policy

The monetary policy serves on the guidelines of Taylor’s (1993) rule. Interest rate smoothing engages, according to Clarida et al. (2001). Here, Taylor (1993) rule acts as a response function of the GDP-weighted inflation rate and output gaps.

![]() (29)

(29)

Here, ![]() covers the non-systematic aberrations of interest rate from the monetary policy rule.

covers the non-systematic aberrations of interest rate from the monetary policy rule. ![]() and

and ![]() represent the steady state interest rate and weighted average inflation rate; whereas

represent the steady state interest rate and weighted average inflation rate; whereas ![]() is the presenter of the output gap. The coefficients

is the presenter of the output gap. The coefficients ![]() and

and ![]() are positive and are considered in a way that the economy stays in the determinacy region.

are positive and are considered in a way that the economy stays in the determinacy region.

3.11. Goods Market Equilibrium

This equilibrium stresses that the output after the adjustments of utilisation cost should be equal to private consumption, private investment, public consumption, and public investment. To establish the linkage between the model equations and experimental data series the equilibrium function is in the following form:

![]() (30)

(30)

3.12. Dynamic Insight of Fiscal Policy Channels

Broadly speaking Government usually has two kinds of policy measures. One where public spending is the acts as a measure and the other in which revenue manoeuvring leads the way. In this study government consumption, government investment and public transfers fell under the umbrella of spending policy measures whereas the sales/consumption tax, tax on the regular labour income, tax on the private capital and as a tax-base broadening measure introduction of a tax on the irregular labour income are the revenue-based policy initiatives.

There will be an eventual impact on the Ricardian households, Non-Ricardian households, economic output, and debt/GDP ratio when these (spending or revenue) measures change. These measures’ direct impact on the economy can be witnessed through the households’ budget. For instance, a decrease in the sales/consumption tax will generate a rise in the real income of both (Ricardian and Non-Ricardian) types of households. And a decrease in the labour income tax has a vital impact on a budget of both types of households. A similar impact can be witnessed when the government enhances public transfer payments.

4. Log Linearized Equations of the Model

4.1. Households

Consumption in Euler equation form for regular households:

![]() (31)

(31)

Consumption of Non-Ricardian households:

![]() (32)

(32)

Aggregate consumption will be as:

![]() (33)

(33)

Wage dynamics can be expressed as:

![]() (34)

(34)

The marginal rate of substitution ![]() between consumption and labor will be.

between consumption and labor will be.

![]() (35)

(35)

Private investment Euler equation:

![]() (36)

(36)

Here,![]() .

.

Shadow cost of private capital is expressed as:

![]() (37)

(37)

Capital utilisation is expressed as:

![]() (38)

(38)

where,![]() . Law of motion of private capital:

. Law of motion of private capital:

![]() (39)

(39)

4.2. Firms/Producers

Marginal cost:

![]() (40)

(40)

Labor demand:

![]() (41)

(41)

![]() (42)

(42)

Phillips curve is expressed as:

![]() (43)

(43)

4.3. Fiscal Authority/Government

Public/government consumption:

![]() (44)

(44)

Public/government investment:

![]() (45)

(45)

Public transfers:

![]() (46)

(46)

Consumption/sales tax rate:

![]() (47)

(47)

Capital tax rate:

![]() (48)

(48)

Regular labor income tax rate:

![]() (49)

(49)

Shadow labour income tax rate:

![]() (50)

(50)

Public capital law pf motion:

![]() (51)

(51)

Government/Fiscal authority budget constraint:

![]() (52)

(52)

4.4. Monetary Authority/Central Bank

It revolves around the Tylor rule:

![]() (53)

(53)

4.5. Aggregation and Market Clearing

Production Function:

![]() (54)

(54)

Here,![]() .

.

Technology dynamics:

![]() (55)

(55)

Goods market-clearing:

![]() (56)

(56)

4.6. Shocks

Investment shock:

![]() (57)

(57)

Preference shock:

![]() (58)

(58)

Labour supply shock:

![]() (59)

(59)

Government/public consumption shock:

![]() (60)

(60)

Government/public investment shock:

![]() (61)

(61)

Public transfers shock:

![]() (62)

(62)

Consumption/sales tax rate shock:

![]() (63)

(63)

Private capital tax rate shock:

![]() (64)

(64)

Regular labour income tax rate shock:

![]() (65)

(65)

Shadow labour income tax rate shock:

![]() (66)

(66)

4.7. Steady States

Interest rate is considered as:

![]() (67)

(67)

The marginal cost has been expressed as:

![]() (68)

(68)

Labour force supply in this state is considered as:

![]() (69)

(69)

Mark-up has the following form in a stable state:

![]() (70)

(70)

Private rental rate of capital:

![]() (71)

(71)

Wage Dynamics:

![]() (72)

(72)

Private capital stock:

![]() (73)

(73)

Production:

![]() (74)

(74)

Consumption of regular/optimizing household:

![]() (75)

(75)

Consumption of irregular/shadow household:

![]() (76)

(76)

Aggregate private consumption:

![]() (77)

(77)

Public capital stock:

![]() (78)

(78)

5. Solution Method

It is comparatively a novice approach nowadays in the macroeconomics to estimate the parameters of the model. And one can perform this job in a range of manners Francisco (2007), Andrai (2016). Francisco Ruge-Murcia’s paper, “Methods to estimate Dynamic Stochastic General Equilibrium Models”, is a serious effort in this regard.

5.1. Moment Matching

Estimation can be done by moment matching, which is an extended version of the method of moments. In this particular technique, some particular moments are specified first, and then they can be matched with the model parameters.

5.2. Maximum Likelihood

Estimation milestones can also be approached through the method of maximum likelihood. Concisely, a linear model allows us to employ Kalman filter for the approximation of likelihood function through observed data but here emerges the limitation in the form of a maximum number of observable variables’ restriction which should not exceed the number of structural shocks in the model. There are a few remedies for this issue, such as the extension of the model to let additional structural shocks in; this strategy has been supported by Leeper and Sims (1994) and Ingram et al. (1994). The introduction of measurement error is another fix for this situation.

5.3. Bayesian Maximum Likelihood

The bayesian maximum likelihood method is also in play for the estimation of DSGE models (Pablo, 2012; Francisco, 2007; Andrai, 2016). It is comparatively an innovative approach which allows the injection of prior values(values from literature) in the process of likelihood maximisation, and it generates the probability density functions instead of a single point as in conventional Maximum likelihood Function.

The usage of Dynare in the Matlab environment Dynare makes it quite easy to employ different approaches; It usually provides the model solution either as per the conventional maximum likelihood approach or it does its operations as per the Bayesian Maximum likelihood method. Nowadays, Most researchers are employing the Bayesian approach in their investigation. This study is also relying upon the Bayesian method for model estimation.

5.4. Data and Priors for Estimation

The first step in the model estimation is data which we use for comparison with the model. For conventional maximum likelihood estimation and Bayesian maximum likelihood estimation, the number of observable variables will be the same as of shocks in the model. In the under investigation model, we have fourteen shocks, and we can use the same number of time series in our estimation. The time series which we are using for the estimation are GDP(it does not contain the trade balance impact), government consumption, private investments, effective: consumption/sales tax rate, regular labour income tax rate, capital income tax rate,wages, and Debt/GDP ratio.

The data series have a quarterly frequency and cover the 1996Q2-2019Q1 period. These series are obtained from the Istat, Eurostat, OECD, and Fred. st. Louis databases. We are considering the following variables as observed; log first difference of output (GDP), Government Consumptions, Private Investments, real wages, and Debt/GDP ratio. Also, the taxes (Sales/consumption, Labour income, and Capital) are among the observed variables. These are eight observables, and we will employ at least eight shocks in our estimation.

Why are we taking the growth rates as observables here in the estimation? This technique liberates us from worrying about the exact source of growth trends and another obvious reason for this technique’s deployment is of its abundant usage for the Bayesian maximum likelihood estimation.

The parameters and the particular values which are hard to estimate; they are established based on sample means or the widely employed respective literature (Table 1). The public and private capital depreciation rate is the same ![]() in the study which indicates an annual depriciation of 10 percent.

in the study which indicates an annual depriciation of 10 percent.

![]()

Table 1. Steady-state values and the calibrated parameters.

The net wage mark-up is![]() . The discount factor

. The discount factor ![]() is set to equate it with the quarterly averaged real interest rate over the period of study. In a similar fashion; we have assigned the values to steady state tax rates, and ratios of the GDP equal to their average trend ratios. Steady-state government transfers came from the public/government budget constraints, whereas private capital to GDP ratio rise from the its law of motion. The equilibrium value of return on private capital, rk, reveals the equilibrium values for capital tax rate,

is set to equate it with the quarterly averaged real interest rate over the period of study. In a similar fashion; we have assigned the values to steady state tax rates, and ratios of the GDP equal to their average trend ratios. Steady-state government transfers came from the public/government budget constraints, whereas private capital to GDP ratio rise from the its law of motion. The equilibrium value of return on private capital, rk, reveals the equilibrium values for capital tax rate, ![]() , depriciation rate for private capital, kp, and the discount factor

, depriciation rate for private capital, kp, and the discount factor![]() . The private and public capital shares in the production function are set 0.32 and 0.10, respectively to match the equilibrium path share of labour income to GDP to its sample average of 66 percent. At the end, the marginal cost’s calibrated value is set to be 0.80, which indicates a steady state price mark-up, on production costs, of 25 percent. Other steady-state values are attained from the estimated parameters. The prior distribution choices are based on the standard literature approaches and are presented in Table 2.

. The private and public capital shares in the production function are set 0.32 and 0.10, respectively to match the equilibrium path share of labour income to GDP to its sample average of 66 percent. At the end, the marginal cost’s calibrated value is set to be 0.80, which indicates a steady state price mark-up, on production costs, of 25 percent. Other steady-state values are attained from the estimated parameters. The prior distribution choices are based on the standard literature approaches and are presented in Table 2.

5.5. Caliberated Impulse Response

Impulse Response generated by the model caliberation has the following form: (Figure 1).

The above impulse response function of an orthogonalized shock to the sto

![]()

Figure 1. Impulse response function shadow tax IRF shadow tax.

chastic element of the shadow tax evidently explains the phenomenon which has been reported in many studies Tha in the independent monetary policy set-up if tax is in use as an instrument of fiscal consolidation it has encouraging outcomes in the form of putting restraint for the surging debt/GDP ratio. From the above plot, we can see the initial two quarters don’t show any significant impact, but the impact picks a little pace from the third quarter, and it presents a sharp decline in the debt/GDP ratio.

And after the fifth quarter, it starts its journey towards the steady-path. And to reach there, it takes almost fifteen quarters. This pace of travel towards the steady path is also in line with the existing finding by many experts on the same topic. The steady state for the Italian debt/GDP ratio is set at 121%, which is below about 15% than the actual (2018) debt/GDP ratio of 136%. It is also a positive sign that the tax base expansion measure is taking the debt/GDP towards a reduced, percentage-wise, steady-state path and this finding is in line with the finding of US tax foundation where this measure, in the long run, generates positive impact for the Italian economy.

Bayesian estimated impulse responses for the output gap and debt/GDP ratio are available in Appendix A. The same pattern as of the calibrated impulse response can be witnessed there. The difference which is evident there is of the time which both output gap and debt/GDP ratio are taking in reaching their steady-path.

5.6. Posterior Means

The posterior distribution of estimated parameters and the variances of shocks are available in Table 2. Most of the results are in an acceptable range. An enhanced focus on the analysis of fiscal policy reveals that the non-Ricardian portion is well above the 1/5 of the total households, and it is in aligned with the outcomes of other research papers for advanced/developed economies (Bhattarai & Trzeciakiewiez, 2012; Iwata, 2009).

The Posterior means of reaction coefficients in the fiscal policy rules represent

![]()

Table 2. Priors and posteriors of estimated model parameters, and standard deviations of the shocks.

strong contemplations of the business cycle standing for almost all seven instruments. The spending instruments’ reaction is countercyclical. Public transfers have a strong impact on both the debt and output gap (Cyclical employment), and it makes sense as well in economic theory terms and terms of this study. Public transfers are ending up with the Non-Ricardian households, and in this study, it is considered that these households are the epicentre for the irregular/shadow labour force. On one side, these households are the beneficiaries of public assistance, and on the other side, their irregular labour engagement immune them from labour income taxes. On the spending side, a similar impact behaviour is being depicted by public consumption as well. Whereas, public investment has more impact on the output gap instead of debt level, which is aligned with the economic intuition and this type of spending is usually a driving force in every fiscal stimulation.

On the revenue side, which is the main focus of this study, the measure which has been introduced here as an instrument of tax base expansion is the shadow/irregular labour income tax. And for convenience, it is supposed that this labour force segment is only present in the Non-Ricardian households. This tax has its impact on both the output gap and the debt level of the economy; it is impacting more on the output gap deviation than the debt level. A tax instrument’s such impact in fiscal consolidation measures, under the specification of the monetary policy as independent, is aligned with the findings of Erceg and Linde (2013, 2010).

Moreover, Some valuable plots of estimated model are present in the Appendices. Appendix A contains the plots for smooth shocks, Appendix B. has the plots of smooth variables, Appendix C. has the presentation of multivariate convergence dynamics, and Appendix D. entails the insight into Bayesian impulse response functions.

5.7. Shocks Capture

The estimation has generated the smooth shocks for all seven fiscal variables, and they are available in Appendix A1. The spending variables are portraying the consolidation measures during the time of fiscal consolidation. But, the measures which are contributing to the governmental investments, and transfers are exceeding the long-run expected levels. Whereas government consumption is within the expected level in the long-run. The revenue segment has similar depiction sales/consumption tax is well within the expected level; capital tax is almost within the expected level except for a couple of quarters. Shadow segment tax and the labour income tax both are way above the expected levels.

6. Conclusion and Discussion

Like many developed economies, the Italian administration has also deployed several measures to tackle the aftershocks of the global financial recession. In this study, we have tried to put an enhanced focus on the broadly advocated measure by the global financial institutions, which is of the tax base expansion as a substitute for tax rate hikes. We have performed this task in an estimated DSGE framework. We have injected seven fiscal variables in this structure to capture the fiscal dynamics of both the spending and revenues sides, but the main focus of this study is to analyze the revenue side. Especially, the tax base expansion measure which has been portrayed by the shadow/irregular tax. The expansion of tax base by introducing tax measures for the shadow/irregular segment has generated positive impact on the output and created a restraint for the rising indebtedness which is in line with the existing fiscal consolidation literature (Blanchard et al., 2002) where the monetary policy is independent, and tax is used as an instrument; but the distinction of our work from the extant literature is that we have obtained favourable results for the output and the indebtedness by introducing the tax on the shadow segment of the economy, and we have kept the already existing taxes and public transfers on the same levels.

In this study, there are several limitations for starters; we have not captured the whole outlook of irregular/shadow/informal economic segment. And why is that? The availability of the valid data on this subject remains the main factor; how valid is this reason it can be discussed, but we are not going to get into this at the moment. Maybe later in some other article. And the other limitation is the supposition that irregular labour force only exists in the Non-Ricardian households. We did this to check the waters around the idea of tax base expansion. In future studies, the researchers can focus on the presence of irregular/shadow/informal elements in the regular producers and the evaluation of informal producers which offer the competitive products as the regular/formal producers do can be an interesting addition in the literature as well.

One other element which we tried in this study is of treating the Italian monetary policy as independent monetary policy; there is no zero lower bound restriction in our analysis; the reason behind this is the presence of all ingredients of an indebted developed economy. And the surging indebtedness around the globe is a serious threat to the stability of our economic system according to the global financial institutions. The tax base expansion measure of our study has presented a positive impact on the output of the economy, and this impact is neutralising the rising debt level as well. The same measure is also taking both the debt level and the output towards the steady path in the long-run.

Appendices

A1. Smooth Shocks’ Plots

![]()

Figure A1. Smooth shooks model’s estimated shocks.

![]()

Figure A2. Smooth shooks2 model’s estimated shocks.

A2. Smooth Variables’ Plots

![]()

Figure A3. Smooth Variables Model generated Smooth Variable Plots

A3. Multivariate Convergence Dynamics Plot

![]()

Figure A4. Convergence plot model generated multivariate convergence dynamics.

A4. Bayesian IRFs’ Plots

![]()

Figure A5. Productivity IRF Bayesian IRF productivity.

![]()

Figure A6. Consumption tax IRF Bayesian IRF Consumption tax.

![]()

Figure A7. Labour income Tax IRF Bayesian IRF Labour income tax.

![]()

Figure A8. Shadow tax IRF Bayesian IRF shadow tax.

![]()

Figure A9. Capital tax IRF Bayesian IRF capital tax.