Managing Shipping Companies, the Way Their Pioneers Did: The Case-Studies of Vafias N Family and Aristotelis S. Onassis ()

1. Introduction

Greek shipowners owned (2020) 364 m dwt-1st global position and 4648 ships (av. size: 78,282 dwt), followed by Japan with 233 m (av. 59,591; 3910 ships) and China with 228.4 m (av. 33,251), according to figures released by UNCTAD (Maritime Transport Statistics, 2020). The competitive advantage of Greek owned shipping is its higher average size. In 2015-2016, Greeks spent $2.3b to buy 165 ships at about $14 m each (av.), and sold 105 ships at about $11 m each (av.), against $1.17b. The difference of the $3 m per ship between buying and selling is due to the fact that ships bought were larger and younger.

The past generations of Greek shipowners learned shipping business from their fathers, and taught it, in turn, to their children. They used to learn business of shipping in practice, and by spending a number of years on board (e.g. Panagopoulos Per.; Pappadakis N. and others). Education suitable for shipping endeavors was absent before 2nd World War, unlike the education of seamen provided since 1749 in Greece (“Hydra school of Greek seamen”) for the 1st time.

The past generations of shipowners realized that their children had to learn at least shipping finance from specialized educational institutions, like the department of Maritime studies (University of Piraeus), established as a specialization, in 1950s, the City of London ex CAS, Cardiff Business School and Bergen Institute (Norway). The remaining training took place in office, as fathers supervised and directed their children, even from a distance, up to the moment they passed-away (e.g. Niarchos St.) or retired (Martinos C. for Nicolaos) or remained active and stand-by (Tsakos Pan. for Nikos) (Photo 1).

Photo 1. Angelliki Frangou.

Older Greek shipowners faced difficulties in handling… money1. They considered it dangerous to borrow money from Banks and more so to borrow to build ships. This led the famous, late, shipowner-mentor, Em. Kulukundis/Culukundis M, to state that Greek shipowners “know about ships, but they do not know about money”.

Current shipowners, who took-over, and are now in their mature age, know well about both Money and Stock exchanges (e.g. Frangou A; Vafias H). This knowledge is very valuable as it creates a strong cost competitive advantage given the huge amounts, (say $250 m), which are now needed to buy or build a ship or a number of ships, and the vast interest charges involved…

The situation, however, is not as yet smoothed-out, i.e. studying “management of shipping companies, and of ships”, because shipping management is not taught everywhere, if at all, and when taught teachers have no prior-experience from inside. This situation is made more complicated as shipping companies are secretive.

The only source of information about shipping management comes now indirectly from listed shipping companies, where transparency is obligatory. Moreover, recent books on management of shipping companies in English are rare (only exception is Theotokas, 2018) or too old (Lorange, 1973; Downard, 1981; 1984; Buckley, 2008) or reflect personal experience (Lorange, 2009).

Last, but not least, is the fact that modern management, as argued by late Professor Drucker P (1954), (1909-2005), does not consider it as a personal property of some born for, as believed in the past. A Shipping Manager has simply to manage efficiently and effectively…

2. Purpose of Research

The purpose of this article, and the ones which will follow, have the purpose to teach present and future shipping managers by presenting, in a critical way, the main management philosophies and achievements of those top—past and present—Greek shipowners-managers. Interesting is that certain management principles remain unchanged, though almost 100 years have passed between the two generations of shipowners, who we present here—the old and the new in a sense of comparison. When we say “Managers”, we mean all managers: managing directors, divisional, departmental and operational (i.e. operators). Captains are also managers at factory’s level (vessel).

3. Literature Review

Buckley (2008) aimed at providing an accurate description of the length and breadth of maritime industry and an overview of the business side of the commercial maritime field. This work is very useful as it presents the empirical side of shipping industry, which is necessary to be known by managers as shipping is an accurate blend of theory and practice titled also: “The business of Shipping”.

Lorange (2001) asked to re-think shipping companies in a rather strategic way… (Graph 1).

Graph 1. The future successful management of shipping companies.

We agree with the contents of our above graph summarizing the directions of the paper of Lorange (2001), ex shipowner and Professor. A successful shipping company cares about its human capital (so that to possess know-how), and also about its ships; it has to be first in adopting proper software for ships, and managers (tailor-made) for the support (tools) for a more sophisticated decision-making. Expand fast: it rather means to exploit fast, appearing opportunities mainly in buying/building ships. Restructure means organizing in a network fashion using computers, and provide training to staff and crew.

Theotokas I (2018) analyzed the organization and management of shipping companies challenged by such developments like globalization, new technologies, structural changes in freight markets, need for effectiveness and quality, focus on human factor and companies’ social sensitivity. Experience and tradition may not be adequate anymore according to the author (Theotokas, p. 1).

4. What a Manager Has to Do?

A Manager has to co-ordinate and supervisethe work of his/her employees. This has to be done, however, in a special way:efficiently and effectively. This applies, as well to Captains. These terms need, however, clarification.

Efficiency means to derive the highest possible profit from least cost.Effectiveness means to bring results, or in other words to carry-out the actions that achieve company’s goals and objectives. This is the easy part of business management, as any result can be achieved, if available means (funds;people) are adequate! Managers have to realize, however, that the combination of efficiency and effectiveness is what is required… So, a manager must plan to get results at the highest possible profit, and at lowest possible cost, in order to be a (perfect) manager…

As we fear that the above (effectiveness-efficiency) mean different things to different people, we will give a shipping example: suppose that a vessel called in a S American port, found, by Port State Control-PSC2, to miss a number of maps. The vessel could not depart. The Captain had two options: to delay ship’s departure for 6 hours till maps are delivered to vessel from the marine bookshop in country’s capital, or to receive missing maps at next port of arrival (something allowed by PSC). Both options are effective, but the first option costs 6 hours (time of ship waiting) or a total cost of $2500. The decision to depart without waiting for the maps provides efficiency3.

Managers have to be skilled about 4 basic (continuous) functions: 1) organizing; 2) planning; 3) controlling and 4) leading.Company’s targets, however, come prior to 4 functions, as targets will determine the right emphasis that has to be put on. (Graph 2)

Graph 2. A shipping company’s targets.

Imagine the fact that decision-making must be fast, as fast is also shipping business life, changing also unexpectedly and suddenly. Should then a shipping company have a multi-member board of directors4 to take all major decisions? The answer is no. This reflects also the competitive advantage that personal (one-man) shipping companies have, like the Greek ones!

Organizing: the manager arranges and structures the work of its staff in such a way so that firm’s goals/targets are achieved. In shipping companies is customary to have departmentalization5. If an organizing scheme, in whatever time, does not serve company’s targets, it must change. So, managers’ job is continuous, as also technology changes and this too modifies organizing!

In order to combine targets with management functions to get fast decisions, it is apparent that: managers adopt simple organizational schemes, use computerized/digitalized means and establish few hierarchical levels6. Manager’s job is to choose the most efficient and effective organizing structure, which serves company’s targets. Given that the schemes in theory are more than one, and have to change, as reality changes, this function is at least challenging.

We saw shipping companies to have to change their organizing scheme as they became larger. Important, however, is to consider that organizing, as well the other 3 functions, arenot ends in itself, but means to an end. Even perfect organizing, if it does not help in achieving company’s targets, has to change (“organizational change7”).

An organizing scheme in theory—which helps also control—is to create more than 30 departments: a tall pyramid. This is suitable in organizing Armies8, but not shipping companies… In a shipping company we need fast travel of information/decision-making to those concerned, and immediate execution (thanks God for e-mails and mobile phones). When are many “filters” (= hierarchical levels), action is delayed or distorted as in between managers will want to contribute9.

4.1. Changes Occurred in Shipping Management

As in all companies, if one disregards/by-passes hierarchy commits a crime, the same happens in shipping companies. In the case of a tall organization it is needed 3 times more time, we reckon, for instructions to reach executives, i.e. those that will implement them. Thanks God, computers dis-regard hierarchy and made organizations simpler with fewer levels, except for the speed and the directness of transmitting orders, which they provided.

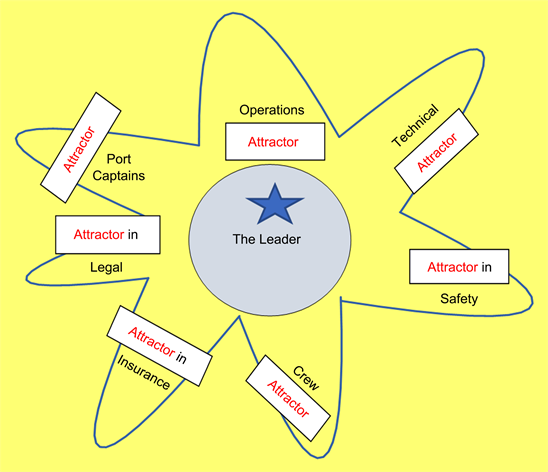

Moreover, Chaos Theory (Goulielmos, 2019a) enabled us to vision a different management, we will call it management by… attractors (expanded below). Attractors are… employees who have the answer to all problems by: ability, personality or experience, regardless their hierarchical position. Attractors may be found also among divisional-departmental managers, operators, and Captains, no doubt. This means that companies have to train managers to become attractors… in their field of specialization. This further means to train people to focus exclusively on providing solutions to all emerging problems, in other words to be useful… The scan below (Figure 1) indicates that what we ask is not easy!

To be an attractor, one has to get heads or tails out of the situations. Figure 1 indicates that what we ask is not easy! This is because an attractor has to get-out heads or tails of an emerging situation! Is this possible?

An attractor is a model representation of the behavioral results of a system (Battram A., 1998: p. 149). Some believe that attractors are passive (Lissack, 1996). This tells us that top-managers have to discover them. Others believe that an attractor means someone attracting something or somebody. McMaster, M. (1996) argued that the attractor is “someone with a clear intention, a great deal of energy, etc.” Our attractor is “human”.

Attractors e.g., for weather, and for freight markets, are shown in Figure 2.

The attractor (left) is… strange. The shipping markets attractor (right)—let us call it “spider”—is… stranger10. The left is known as “owl’s eyes” or the “butterfly’s wings”.

![]()

Figure 1. This illustrates the complexity of freight markets and the difficulty of shipowners to foresee or even understand them. Source: not recorded.

4.2. Managing by Attractors

Figure 3 indicates that for problem-solving and decision-making processes in shipping, the leader has to organize a meeting, where attractors only from relevant departments participate. The deeper meaning of Figure 3 is that in a shipping problem-solving process, the top-manager, through his/her leader (aide), needs recommendation from all relevant departments11. The leader holds the top hierarchical position. He is the one who will transmit to top-management the recommended solution.

The difference of the above from what is really happening now, is that the team-members (managers of the departments usually) are all of equal rank, and thus they have difficulty in cooperating. In such a scheme the (Greek) participants most probably will argue indefinitely… The attractors know the solution to the problem, within their specialty. The meeting acts as a holistic environment. The final decision will be in line with all those taking part (operators, lawyers, safety, crew, insurance, port captains and engineers).

![]()

Figure 3. A proposed system of problem-solving/decision-making in shipping companies: “the propeller-attractor method”-PAM. Source: author.

4.3. Controlling

A manager has to monitor, compare and correct company’s work performance. This function is most difficult, and it is more difficult if it is done from a distance, as in shipping. Decision-making in shipping as far as vessel is concerned is in Captain’s hands… This delegation, which has to be implemented, whether shore managers like it or not, due to distance, is a crucial one and regrets occurred. For the time being, we can say that formalization12 and advanced communications13 created serious hopes for shore-managers to manage ships effectively and efficiently. Surely this style of management is more expensive and more complex, requiring selection of best Captains and providing motives… A step near a better control is management by walking around14 and the reports of travelling personnel from shore office visiting company’s ships15.

Control is useless if red lines are not drawn by planning. This is so as without knowing what has to be done, especially in costs (budget16), a manager cannot “see” the deviations and cannot proceed to corrections. A new management is also emerging i.e. “managing by digitalization” (Goulielmos, 2020a).

4.4. Leading

A manager… has to lead, meaning to inspire. It is a sociological fact that working people do not give 100% of what they can, provided their salaries are fair. A leader has the task to convince employees to give the maximum of what they are able to. Leaders have to “influence” staff and Captains towards achieving company’s goals and objectives.

Sometimes managers put the right amount of responsibility on the shoulders of someone, who they know that he/she will carry it out successfully, if challenged, (called in Greek shipping “patent-finder”). Certain leaders provide participation of Captains in company’s profits. Leadership is an important property for Captains as well.

4.5. Planning (Goulielmos, 2019b)

Planning is easier in shipping compared with other industries, as Revenue (price times quantity: R = Q * P: given distances) is not possible to be planned. This is so as what voyages will be undertaken by company’s ships next year is not pre-known. Planning in shipping is exhausted by working-out next year’s budget17. Managers have to give their utmost attention for an accurate budget—a responsibility of company’s Finance Manager and Chief Accountant.

Planning is the weak point of management emanating from the fact that forecasting is… not possible. This is also manifested by the existence of 9 different plans in management theory. This is also shown by the suggestion of theory to narrow down planning horizons from 7 years to 3, as time goes by. Greek shipowners, however, have found the proper strategy for growth of their companies, which showed elsewhere (Goulielmos, 2020b), and is successful with no forecasting, but simply identifying the rock bottom ship prices.

5. How Pioneer Shipping Managers Managed or Manage?

5.1. The “Vafias Group” (1972)

In 2016, “Vafias” group, owned18 83 vessels of 2.9 m dwt, holding the 32nd position among Greek-owned fleets, (4 positions up since 2014).

Photo 2. Father & Son.

Graph 3. The Vafias group, 2006.

As shown (Graph 3), the Group had a sense of a clear specialization over 3 market sectors, and 1 common service. However, is common among Greek shipowners to establish separate companies for specific business. The initiative to enter into shipping was due to N. Vafias19—the father—who in 1974 bought a general cargo vessel of 3500 dwt (with a partner). He founded “Brave Maritime” Shipping Company (in 1972). The father (Photo 2) was also active in 1985-1986 in the 2nd hand ship market. “Eco Dry Ventures’’ is also one of his subsequent companies, who bought 2 Capes in 2016—alleged at rock bottom prices—one being the cheapest one over the last 15 years or so.

The Stealth Maritime established (in 1980) as a result of owning 1 “Aframax” tanker, a trade in which the company later specialized, attempting also a number of renewal strategies. It owned originally 15 vessels, and in 2006 7: 2 Capes, 1 Panamax, 1 handy (built 1981-1983), (from prior fleet), 1 Panamax (built in 1977); and 2 handy (built in 1999). Company’s vision was, in 2006, to own 15 ships as in the past. Company, clearly, adopted a “tonnage maximization strategy”. “Stealth Maritime” decided to sell all “single skin” ships, and 4 Aframax, built in 2001-2004, in anticipation of their phasing-out by IMO of these tankers.

The “StealthGas Maritime” (2004) specialized in LPGs, where the group owned 26 ships (July 2006), where 4 were under construction. In 2005 (Oct.) “StealthGas” listed in NASDAQ—in a rather bad timing—because many companies listed one year before. The fourth company: “Brave bulk transport”, dealt with chartering cargoes of grain, fertilizers and other bulks, using also chartered-in vessels.

5.2. Group’s Policy in Front of Global Financial Crisis-GFC (End-2008)

In October 2009—following the GFC—“Brave Maritime”20 sold all its dry cargo ships, during prior 3 years, excluding 2 under construction. “Stealth Maritime” chartered all its tankers to long time charters (3 - 8 years). The “StealthGas Inc.” postponed delivery of 5 new-building gas carriers (to 2011 and 2012), and chartered 70% of the fleet for 12 months. Twelve expensive orders of new-buildings cancelled. Mr H Vafias - Harry, admitted that the end-2008 crisis was not expected. All above actions are classical among Greek shipowners during a crisis. Table 1 presents the history of the Vafias Group from 1999 to 2016.

![]()

Table 1. History of Vafias Companies, 1999-2016.

Sources: As shown in footnotes.

5.3. Group’s Vision

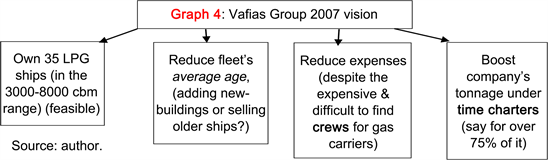

The group had, in 2007, the following vision (Graph 4):

Graph 4. Vafias group 2007 vision.

Harry admitted that in end-2005, at the time of IPO, he promised investors that he would triple existing fleet from 9 tankers—in 6 months—to 27, but he did not… The share price went up from $12 to $14 at that time, despite his failed promise. Investors forgave him.

5.4. Flags Used; Crew Nationality; Technology; Average Fleet Age; Cost & Fleet’s Geography

Company’s flags23 were those of: Panama, Bahamas, Marshall Islands, Cyprus and Malta, with Filipino and Latvian seafarers. Moreover, company incorporated technology (computers etc., latest IT) into operations to keep-up with competition, and stay on top, using information. Company had all vessels with e-mail facilities and the shore-office departments were interlinked (Dec. 2005).

Company’s vessels (42 vessels plus new-buildings; May 2006)—of 9 years average age vis-à-vis 15 years of company’s competitors—geographically, specialized, in Far East (75%). Important matter is that company achieved a cost of $500 per vessel/day, which was 1/3 and 1/2 of company’s competitors! Company had few executives, a lean organization, and a family structure (with cousins in finance and purchasing departments), and father in charge of dry bulk division.

5.5. Third-Party Management (Goulielmos et al., 2011)

Clever is for the company to use (May 2006) 5 different 3rd-party ship managers: “V. Ships”; “Hanseatic”; “TESMA”; “Stealth Maritime” and “Swan”! It could compare own, and managers’ performance; also, the fee could be negotiated. Company was thinking in concentrating eventually to only 2 managers. Harry argued that the 3rd-party managers are promising, and experienced, if ships are of high technology and complicated, like chemical tankers, LPGs and LNGs.

Harry argued that there is a lot of emphasis in family structures, where Greeks refuse to lose their commercial and technical control of ships. Since 2003-2004 certain Greek shipping companies expanded and developed further by resorting to “USA capital markets”—requiring a non-old fashion and non-traditional way of company running. The successful modern competence is based on concepts like: greater transparency and efficient corporate structure, while the industry is moving towards more openness, to convince investors to trust company’s managerial decisions.

5.6. Commercial Banks or Stock Exchange?

Interesting is to be informed from first-hand (Harry) the advantages and disadvantages of listed companies (Table 2), presumably in NASDAQ.

Harry’s competitors, defining those, who in end-2015, ordered LPG ships were (Table 3).

![]()

Table 2. Disadvantages and Advantages for a shipping company to be listed.

Source: author; data from one of Harry’s interviews.

![]()

Table 3. Orders of Harry’s competitors, 2015.

Source: “Naftiliaki” journal, 2016.

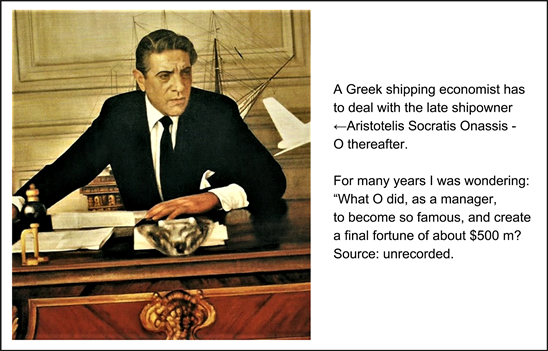

6. Onassis’ Case Study (1900-1975)

We will deal only with O’s business related to shipping. The story will be as short as required so that not to exceed available space. We will finish this analysis in a 2nd paper.

6.1. Onassis: A Poor Immigrant & Start-Up Merchant (Argentina)

O travelled in 1923 to Buenos Aires24 from Athens. His tobacco-dealing family lost everything—except family’s savings—when Smyrni burned-out by Turks, in 1922. O became a superstitious person brought-up in Turkish kismet25. In Argentina, O worked during nights, (earning a better salary of ~$100/month), in the “British United River Plate” - Telephone company26.

He imported oriental27 tobacco, during the day, and managed to increase it (25%). He adopted Hellenic nationality by alleging that he came from Thessaloniki. After 2 years in Argentina, O earned $100,000 from commissions (5%) on tobacco sales. Then he dealt with cigarette manufacturing28 and commodity trading (leather, linseed). He made a small profit by speculating also on commodities. By the age of 31, he had made his 1st million $! He also acquired Argentinian nationality.

6.2. Onassis: A Shipowner29 (at 32) for the 2nd Time

“Onassi Socratis” was the name of his “1st” ship30 afloat in 1932. He bought 6 ships in fact, (10,000 tons each; built in 1914-1918), from a Canadian company for $120,000. O attracted to shipping mainly—we believe—by industry’s ability to create millionaires… His close friend Gratsos31 (1902-1981)—a charismatic shipowner—surely fed his imagination.

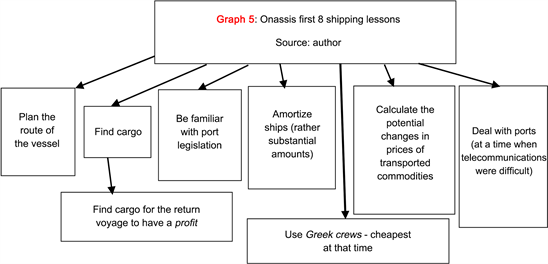

In 1932, in London, O tipped-off that the “Canadian National Steamship Company” had 10 cargo ships, tied-up in St. Lawrence River, selling 2 of them at $30,000 each (presumably a price near scrap value). O hired a naval architect and inspected the ships personally, for 3 continuous days, from head to tail, under a severe weather with thick snow… The psychological pressure exerted by O on sellers by his daily findings written-down in his notebook, reduced price to 1/3… This indicates a good negotiation skill, based on knowing human psychology. The 3 out of 6 ships named: “Penelope Onassi”, “Socratis Onassi” and “Canadian Spinner”. O learned, that in shipping, he had to32 (Graph 5):

Graph 5. Onassis first 8 shipping lessons.

O’s desk, at “Leadenhall Street”, was in the office of Dracoulis shipbroking firm. There O was reading any shipping information coming-in… He struck by the “Great Depression” in 1929-1933, as everybody else. In Argentina, (ally of Germans), O’s non-shipping business subsidized his shipping ones during those difficult days for shipping, and not only.

6.3. O Turns from Greek Flag to Panamanian!

Vessel “Onassis Penelope” was stuck in Rotterdam, as her cook fell ill and another from Greece had to come. She had to deliver cargo next in Copenhagen, and also to follow-up a subsequent charter. The loss from delays was substantial. The Greek consul insisted: “the ship has to follow the law”. O decided to replace Greek flag with that of Panama… working overnight with lawyers and agents.

6.4. Onassis: A “Tanker Owner” (1938). The Great Leap Forward (Aged: 38)

The real great leap forward for O took place in 1938. O built then his 1st tanker, and newbuilding, and a giant (for her time): the “M/T Ariston33”—which slid down at Gothenburg’s shipyard. A Sweden shipyard has “agreed” to build M/T Ariston, finally, for: 25% of the price to be paid in 3 installments—during building, and the remaining 75% in 10 years at 4.5% interest. This was the world’s largest tanker in water in 1938 of 15,000 dwt (1.71 times larger than any other tanker; in fact, she was 15,360 dwt).

6.5. The M/T Ariston Building; the Role of Public Relations; the Split of Merchants from Shipowners

The shipyard, which built M/T Ariston, felt as taking a high risk by building this large tanker for the 1st time, for one unknown and… perhaps crazy—Greek shipowner, and thus charged a rather high price (= $800,000) … Also, O did not have—as most Greeks shipowners—the best credit rating,and the initial terms for “M/T Ariston” were tough (e.g. 50% of vessel’s price in cash). O, however, insisted in building her, convincing—his hesitant shipbuilders—out… They were challenged by ship’s goliath size—a double size of what has been built so far—leading them to unknown territories…!

O knew that Ariston would earn more than 2 times any other, i.e. compared with any existing tanker of any other owner and under the same hire. He was right. This was the 1st time when a businessman obliged naval architects, ship designers and ship engineers alike, to go beyond their limits… The “M/T Ariston” obtained a year charter from “J P Getty’s Tidewater Oil”34 company.

To achieve the above O mobilized his good public relations, which he cultivated in Argentina (1934), with Miss I. Dedichen—the daughter of a leading Norwegian shipowner, and a Swedish socialite. “International public relations”were indeed a way for entrepreneurial success for O,and for others,indeed few,Greek shipowners (e.g.the late D.Manios;late Niarchos St.).The excellent international public relations were crystalized by O by using a beautiful small island the Scorpios, and an exceptional yacht (the M/Y Christina)…

Shipowners are of 2 types: those who wait businesses to come-in to them by cargo brokers via e-mail, and those that go-out and find the cargoes. The first I call managers. The second I call entrepreneurs…

Matters changed from the past; in old times, shipowners were merchants, which means that they owned cargoes, and they had then to become shipowners to transport them where they could be sold. Specialization then introduced. Specialization harmed Greek shipowners, and at the same time benefitted them. As a result, shipowners had to seek for cargoes… Modern owners had, as a result, to concentrate to chartering. Chartering is what are the sales for non-shipping companies, and good - profitable - companies are distinguished by the good chartering brokers they have.

6.6. Coincidences Feed a Man’s Superstition!

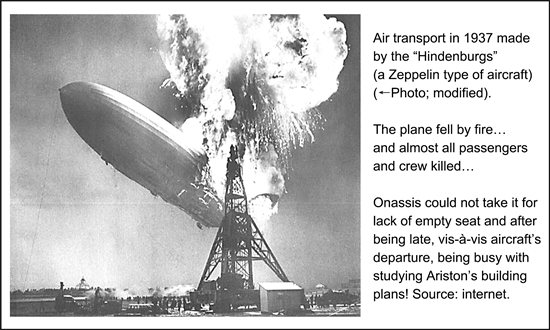

Onassis observed that “M/T Ariston”s building was in delay and he had to travel to Sweden to speed it up! How on earth one—superstitious man—could not believe that she was (“M/T Ariston”) the reason, which saved his life? (Photo 3)

Photo 3. Air transport.

6.7. Onassis during 2nd World War (1940-1944)

The M/T “Aristophanis”, 15,000 dwt, delivered during the outbreak of the 2nd World War to O, was chartered under Norwegian flag. Also, the larger M/T “Buenos Aires”, 17,500 dwt, was near completion at “Gotaverken yard”. The “M/T Ariston” was impounded in Stockholm; 2/3 of O’s tankers served Allies in convoys in Atlantic Ocean.

In 1940, O travelled to NY. UK had to be, sooner or later, the target of Germans… The “M/T Aristophanis” finally “arrested” (…by Onassis) when called to “Rio de Janeiro” (!). Norwegians compelled to pay O $1m for her contribution to war… Moreover, 3 of O’s ships were chartered by USA Navy, earning $750,000 p.a. In 2nd World War O lost no ship or crew… A “star”, i.e. O’s star, could be responsible for it? He believed so.

6.8. Onassis and the 107 Ships for “Liberty” (1946)

O was not allowed35 to buy any of the 107 wartime surplus ships built by USA for world’s Liberty (Appendix 1), which “Fed maritime commission” allocated to Greece for its wartime toll, paid by country’s merchant marine! O applied for 20;he received none. The reasons were: his ships were not under Greek flag; he was not a member of Greek shipowners Union and he had no ship lost (during 2nd World War)… This was the price O paid for not using Greek flag,but this, however,was only 1reason…

O saw that there was an opportunity to transport coal to America, France and Germany, if he had 16 Liberties—for which he made the calculations—but… he did not have the ships… (!). In fact, O had a wishful thinking… He applied to First National City Bank for a loan, but the bank gave him only 1/2 of total amount. He then wanted (1947) to acquire certain T2 tankers—priced at $1.5 m each—considered by him as an opportunity—each being able to carry 16,000 tons, or 6 m gallons, of oil. This caused O troubles.

6.9. Onassis after Ships for Liberty (1946-1947) Allocated to Greek Shipowners

O felt that he has been treated unfairly over the allocation of the 107 Liberty ships by his Greek colleagues, and so he decided to obtain them from market… O’s bitter feelings were manifested in his open letter36, published in 1947, where he wrote: “I, the victim of being Greek, began from zero, without being the offspring of a shipowner… I worked, and I succeeded, without exploiting: either the name, or the flag, or the guarantee of Greek people, or of Greek Embassy, during my residence in USA. I am proud of that, in contrast to you37, who enjoyed capital from your parents, the opportunities of 2 wars, and the scandalous leniency from Greek state in order for you to succeed”.

O was a newcomer to the profession (mainly since 1938), where his competitors were there since early 18th century or even before. They regarded themselves as the “Aristocracy of Shipping”. Moreover, while O became a shipowner before the 2nd World War, he was mal-treated, because he lacked tradition and his riches were newly obtained (Harlaftis, 1993)—he was called in Greek: “Νεόπλουτος” (the new rich). O found, however, the way to gain his admission into the club of Greek traditional shipowners. He married the daughter of a prominent traditional shipowner, i.e. of Stavros Livanos.

O dared then to make an offer for 16 liberties… he did not have, to carry coal to N America. O had the entrepreneurial inclination to know that to find cargoes was more important than owning ships! Using the charter parties as collateral, O easily raised finally the funds to… buy these 16 Liberties, which he has dreamed of…

The post-2nd WW recovery favored—no doubt—the dry cargo ships38 as well, as far as size is concerned. O still believed in tankers, where he used to be the leader since 1938.

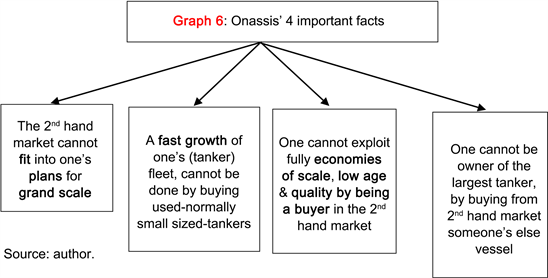

As the war-US T2-tankers could not be allocated to non-US citizens, O… established an American corporation39—where US citizens had the majority of shares and obtained40 4-T2 tankers from “US Maritime Commission”, at a time when a severe winter intensified demand for oil (1947)—“his star” favored him! O eventually gained the 49% stake in this company… This whole project was, however, an entrepreneurial mistake, we believe, mobilizing the whole official USA against O… O new 4 (Graph 6) important facts.

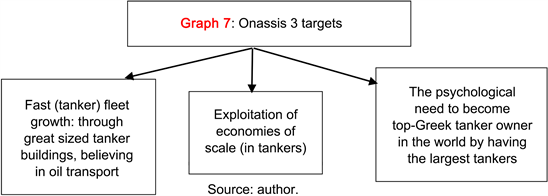

O was right41. Moreover, O believed that a newbuilding could have the superior quality an owner wanted, and more so it could be ordered in numbers. Growth for O had no limits if aided by finance. Finance is the necessary, but not the sufficient condition to become a shipowner, and grow fast, as economists say. O had 3 targets (Graph 7).

Graph 6. Onassis’ 4 important facts.

Graph 7. Onassis 3 targets.

7. Paper’s Research Significance in Theory and Practice

Theoretically, the targets and the functions of a manager and of a shipping manager were presented. More important was our theory of “managing by attractors”, replacing the old-fashioned theory of “managing by hierarchy”. In fact, we have demonstrated the chaotic environment of maritime industry warning that understanding and predicting maritime markets is impossible.

Empirically, there are several aspects: one aspect is to see the changes occurred between the time of Onassis (1900-1975) and the time of a young shipowner, (H Vafias-HV; 1974-?), for the sources of finance (banks versus stock exchange). The concept of niche applied only by HV. Both, however, worked under a vision: dominant oil for Onassis, dominant LPG for HV for small consumers.

Both worked with economies of scale: Onassis by leaps and bounds owning the largest tanker in water, HV in a very conservative way, timidly… by just 4 times. Both entered into the shipping sector through 2nd hand market, where initial capital is small.

Onassis started from zero, while HV based on his father-shipowner. In fact, Onassis based on his father’s trade—a tobacco merchant, and on his savings of $100,000 and $1 m! HV diversified his father’s fleet, and business, in oil and gas, while Onassis locked-in mainly in giant tankers. Onassis put all his eggs in 1.5 basket. Vafias N welcome his son in his companies, unlike Onassis! Onassis managed his companies personally, consulting Gratsos C., while HV shared it with 3rd party managers! Thus, shipping managers can be hired on a fee. To become a shipowner does not need to know shipping management!

Onassis learned shipping in practice, while HV by education and then in practice. Onassis changed ship owning practices used hitherto: by using other people’s money; grow fast by leaps and bounds with new larger ships in series; make win-win deals, public relations, stretch shipbuilding capacity, exploit opportunities where you find them globally, achieve low cost. HV had to prove himself to his father, to charterers, and remove the suspicions over his low age and not be known. Onassis had to prove himself to his father, to his colleagues, to USA, and to his self.

8. Concluding Remarks

The Vafias Group’s vision is common among Greeks: they diversify over 2 at least market sectors; they improve fleet with younger/larger ships; they prefer time charters if times are difficult and ships have loans, and reduce operating costs, so that to create a margin between freight rate and cost. What is also common among the majority of Greeks is… not to have a vision… Company’s vision is related to company’s size, but Harry cleared-up that size has to be connected with market and profitability. Harry is an enthusiastic young man, who led his father’s traditional company into new types of ships for the group for the 1st time: Aframax tankers first (1999-2003), VLCCs tankers (2003) next, and LPGs carriers (2004) finally. He had (2006) an 11% stake in the company.

Harry said42 that luck probably accounted for more than 50% of his success, together with dedication and courage! He entered into a segment with no prior experience, where big competitors existed in a closed club and he faced the refusal of charterers to use company’s ships, as he was the “unknown”. The innovative characteristics of Harry are: to be listed to NY stock exchange in 2005 and to appoint 3rd-party managers. This was a clever combination, as the 3rd party managers were trusted by charterers… Moreover, owners… do not need to know how to manage ships in high specialized trades, like LPGs. Moreover, shore office can monitor the actions of 3rd-party managers… and learn the proper operations from them to take-over, as the case may be, and the proper time comes!

StealthGas Inc. exploited a market niche using smaller vessels for regional trades43 for gas, primarily used for household consumption. In such a market, the dangers are: a fall in crude oil price, and subsequently cheaper petroleum products-alternatives to LPG; freight rates, for hydrocarbons, to drop and an owner with newly built ships to have to compete fleets of old ships (over 20 years). The “Vafias group” needed a minimum oil price of $65 per barrel to feel secure. In 2020 this, however, was $40… The niche is a segment of a larger market: the liquefied gas carriers’ market. Ship sizes vary from 5000 cm to over 100,000. This niche market has its own unique needs, preferences, or identity, making it different from the market at large.

The group resorted also to bank financing for the 5 new-buildings mentioned above (Table 1) for $140 m repayable in 8 years. This was due to company’s low LTV ratio (= loan-to-value). Also, a strategy emerged due to company’s low capitalization; the discount to NAV was 65% (NAV = net asset value) in mid-2016, something which forbids a company to resort to new-buildings. In owning ships, scale is the critical economic success factor, and also to be competitive, while the existing culture is that of cost control. In operations, the strategic economic focus is on costs; the culture is a teamwork. Harry used to specialize in ship sizes of < 8000 cbm; but in 2015 tried larger sizes of 26,000. Thus, company’s mission changed. Management is not clear whether a company’s mission is or has to change!

When Onassis obtained his first $1 m, we consider it to be his most crucial phase, as Theory of Chaos argues that the 1st million is the more difficult. Onassis was a problem-solver, and conceived well the value of time in shipping… He wanted to be the owner of the larger tanker in water. A position O tried to keep till his death, i.e. over a period of almost 4 decades. This distinguished Onassis.

We believe, that O felt he had to prove himself—first to his father, (which finally he did it in Argentina in latter’s visit); then to his colleagues, who treated him unfairly, by becoming a “Golden Greek” and to the whole world, after his death, by his public benefit foundation, following a very clever will. He liked to show off. He needed recognition, and par excellence from his only son Alexandros, which he never had, due to his divorce with Alexandros’ mother Tina… when Alexandros was 13 years old.

O realized that oil will replace coal as a source of energy. He believed that tankers were the future. But also, he believed in economies of scale. He was right (only till end 197344)! At his time, a 9000-dwt vessel was, in 1938, top size. This, we believe, is the greatest business achievement of O…, i.e. his pursue of gigantic economies of scale, following, with courage and spite, only his common sense and his simple arithmetic!

O believed strongly in himself45. The size of his ships was about two times larger than any other. Also, he ordered a number of ships… (pursuing “economies of mass production”). O also credited for establishing thereafter a more credit-worthy image. O adopted the policy: maximize the number of newly-built tankers. He passed well the 2nd World War period, and the 1929-1933 crisis. He had his shipping businesses moving ahead, with a small number of sales, and certain purchases of ships (1946). O reversed the traditional process of obtaining ships. He applied the British motto: “when there is a will, there is a way”…

O started from scratch, poor, sharing a single bed, living abroad, working at nights, without being the successor of any great Greek traditional shipowner, but being the son of a ruined tobacco-merchant, outside Greece’s borders, and to whom, his colleagues, did not give him not even 1 Liberty ship… to play with! O was a person who learned shipping management by himself (and by the discussions with Gratsos); he was never admitted by the closed club of traditional Greek shipowners, who by majority (72% by GT in 1958) came from specific Aegean islands…

Appendix 1: The Ships Built for the Liberty of World from AXIS, 1946

Greek shipowners are lucky despite their 2nd WW losses, (~32% of Greek fleet left in dwt, out of 1.83 m; 6000 seamen dead). The luck came with the provision of 98 WW II Liberty ships under a lend-lease, at attractive price, to Greek Government to help the Allied cause (“Foundation of the modern Greek merchant marine”: by Daniel F. Kelly, published in Surveyor, 2014?). This fleet, of 107 units (98 + 2 C-M-AVIs 3810 GRT + 7 T-2 tankers), of over 1.06 m dwt made-up war losses of 1.25 m! This marked the 1st step towards the creation of the modern Hellenic maritime industry.

The Liberties transported coal, ore, grain, fertilizers and Marshall Plan’s cargoes to the war-damaged Europe and Orient, over new routes. Profits during this time contributed to Greek new-buildings (1950-1970). The liberties introduced Greeks to NY banks, used to deal with London ones. US faced a decision to dispose 258046 Liberty ships built in 1941-1945, 2.5 years old. Greeks and other nations petitioned to US Maritime Commission-MC to help them restoring their pre-war status. US Congress approved the liberty ships and T-2 tankers sale by the “Merchant Ship Sales 1946 Act”. The Greek47 argument, forwarded to Admiral Smith W W, Chairman of MC, was that Greeks needed 100 Liberties to provide employment to Greek crews scattered in US, Canadian and British ports! Greeks, however, faced a problem as their funds were in £, mainly coming from war insurance compensations, while Congress required $. Negotiations led to the sale of the liberties on credit for $138,000 cash, with 3.5% interest rate, with the balance payable in 32 - 34 six monthly installments with a Greek Government guarantee! Shipowners put their sterling cash as collateral, but they had to use Greek flag and Greek crew.

Greek shipowners did not rush48 to buy the Liberties till Stavros Livanos bought 11 (TableA1)! Greeks had a fear for a re-coming crisis 1929-33 type; considered Liberties as one trip ship; ship’s plates were joined by welding than riveting as hitherto; & water-tube boilers were oil fired. Liberties drove Greek shipowners away from UK shipbuilding to US one. NY banks financed ships differently than London ones, i.e. on charter than on mortgage.

The “ticket” to get part in the first 15 (1 lost in war) liberties’ “allocation lottery” was to have ships lost during war. The remaining 84 were assigned by the US Maritime Commission on the principle “first applied, first served” plus a recommendation of Greek Government! Fortunately, the freight rate was pre-paid then. A liberty gained $106,000 from Hampton Roads to Antwerp.

Moreover, Liberties…were like “five-star hotels” for Greek Crews!

TableA1 presents the 66 Greek shipowners who got the 98 Liberties.

![]()

Table A1. The list of Greek Shipowners who bought 98 Liberties, 1946.

Source: author; data ARGO shipping journal, 1977 Jan.; pp. 103-107.

One liberty out of 98 is shown below: “Alexandros Koryzis”, launched in 1944, passed to Greek hands in 1947. Source: Unrecorded; modified. (Photo A1)

Photo A1. One liberty out of 98.

NOTES

1Ships became larger & the amounts involved in a finance deal became also higher in 1980s and thereafter, say $100 m, it was absolutely necessary for both banks, and more so for shipowners, to know finance. Later became necessary to know about stock exchanges in 2004-5 for Greeks.

2Based on a memorandum of understanding (MOU) concluded in 1982 in Paris. This signed by 14 European initial nations, but extended everywhere. Port authorities can inspect (and detain) all ships for compliance with a number of IMO and ILO conventions and ISM Code. This is what we call a “Port Traffic Police”.

3This is so as the ship has a continuous running cost assumed here equal to $10,000/day.

4An UK large oil company once had to decide to build 5 tankers (at that time oil companies were shipowners). This decision had to be taken by company’s board of directors some of which were Lords. The price of each vessel was then $20 m. The decision finally was taken 3 months later. The ship price, however, increased to $40 m!

5The central organizing characteristic of a company is to group staff round similar jobs on the basis of common knowledge, education, experience, and practical targets, etc. in separate units the departments, with own hierarchy and structure-a rather closed society.

6Or having no hierarchy.

7We change people, structure or technology.

8This is a form of organization characterized by division of labor, clearly defined hierarchy, detailed rules & regulations & impersonal relationships, known as bureaucracy. Proposed by Max Weber in his 1946 book “the theory of social and economic organizations”, Free Press, translated from German in 1947.

9There is always the misunderstanding or misinterpretation of top management’s commands! Effective communications are a difficult chapter in all companies, but more so in shipping and particularly with Captains and Chief Engineers.

10This is made up by 996 weekly freight rates, 1989-2008, using MATLAB.

11Every departmental manager has to identify the attractor(s) in his/her department prior to the meeting and send him/her to take part there.

12This is a characteristic of shipping companies, having standardized jobs, where employees & crews have to follow rules & procedures in their behavior & work. Some call shipping as over-regulated. Indeed, shipping has to comply with over 100 rules, conventions and procedures coming from professional, national, international & industry’s initiatives. E.g. UN established a number of organizations like UNCTAD, IMO, ILO and others, and EU has by now its shipping policy. A vast job surely is ahead to collect all maritime conventions etc. so that to lighten the burden that falls on crew to understand thousand pages of rules and procedures (non-digitalized).

13All manners/devices for sending & receiving a message from one to the other no matter distance or volume of information or place of sender or receiver, using wires or not. We identified several revolutions connected also with computerization, 5G and Cloud. Shipping as having to manage by a distance through tele-communications was affected deeply by these great advances.

14When a manager is out—in the work area—interacting with employees. Management now is accessible and interactive. Closed offices are rather a past habit.

15Senior staff from shore office visit ships and report what they see…

16Shipping companies in end of the previous year plan their expenses -except voyage ones- for the coming year.

17The importance of an accurate budget is great and it concerns vessels’ running costs, excluding voyage cost, which is unknown.

18“Naftiliaki”, Summer 2016.

19Graduate of Economic University of Athens, who used to deal professionally with meat trade.

20Interview of H Vafias (President and Executive Director of Stealthgas Group of Vafias) given to “Naftika Chronika” journal.

21BA and MA graduate from London; considered as efficient and innovator, who made a dynamic entry in 1999.

22LPG market is a by-product of the LNG market.

23Company was satisfied from the measure of Greek Merchant Marine Ministry to make Greek flag more competitive than that of Malta, Cyprus, Bahamas, Marshall Islands, Panama etc., by making Greek crew complements more elastic (in 2007).

24O travelled in 3rd class for $75 on steamship “Tommaso di Savoia” after he decided to provoke his luck.

25Feroudi (2011)—his secretary—argued that Onassis believed in kismet (p. 83).

26O helped by a Greek Apostolidis to find a job—after obtaining a work permit adding to his age 3 years! He rent a room with a single bed, shared with Konialidis N (*), and with one of his aides. He worked from 11 pm to 7 am, and read financial pages. O was a hard-working person with long hours. (*) Konialidis married O’s sister, Meropi, in 1938. Frequent changes of O’s age made his year of birth uncertain. Here we used 1900…

27O “conceived” the idea to import milder oriental tobacco for an emerging market of “well-to-do” women - smokers in Argentina…

28He created 2 cigarette brands, securing a loan from “1st National City Bank”… with his father’s bills of lading as collateral…

29O knew that his oriental manners may be excused, if one has enough money. Also, he learned that his lack of maritime tradition could be excused, if he succeeded to marry a daughter of a traditional shipowner…

30O’s 1st ship was “Maria Protopappa”, 7000 tons, “as was where she was” in “Rio de la Plata”; O spent a small fortune to repair her. The ship sunk under bad weather in Montevideo port (Evans P (1988)).

31Gratsos’ father George D (1870-1931) in 1902 bought a vessel named “Odysseus”, in cooperation—till 1924—with “Drakoulis” family. Gratsos’ mother came from the well-known “Dracoulis” ship-owning family.

32At that early time a shipowner was also a merchant. He/she had to have or buy the cargo at the port of production & transport this to the place/port of consumption/sale—after say 30 days or so (= the estimated duration of a one-way trip)—during the trip prices might have changed against/favor.

33The ship’s name had a dual meaning. Ariston from Aristotelis, and in Greek this means “Excellent”. She was scrapped at her advanced age of 35! The superstition of O forbidden him to scrap her, repairing her time after time.

34He was another faithful lover of money, like Stavros Livanos.

35A case of what tradition and family pride together with “grandfather rights” mean… the traditional shipowners in 1940s, who suffered losses from the 2nd World War, could not consider O as equal. This attitude “obliged” O, psychologically, to “revenge”… O “revenged” Americans as well, by marrying their ex first Lady (1968). O by the power of his money secured the respect of and the equality to his peers.

36“Our post-war shipping, the State and the shipowners”, an Onassis memo to Press, openly addressed to President of NY Greek shipowners, M. Kulukundis, in 1947, which appeared in “Ethnikos Kyrix, 8 - 25 March, 1953, and quoted by Harlaftis, 1993. For those interested to read this in full, and know the Greek language, see Aridotelis Onassi (2017).

37Meaning the NY Greek shipowners.

38Economies of scale applied to bulkers, reaching 60,000 dwt; the 10,000 GRT Liberties saw their destiny to come to an end. Liberties not only helped the world to be liberated from Axis, but also to serve world trade for 40 years… (till 1986). Greeks benefitted from the efforts of other nations in building/owning ships in plethora, but they did know what to do with them after wars. This happened also when Japanese wanted to monopolize world ship owning by building massively ships for Japanese owners…These ships bought, eventually, over by majority by Greeks. The same happened under the 40-40-20 rule. The same happened after the end of the Great War where Greeks obtained a great number of the 4,000 or so sailing ships laid-up in rivers in Europe!

39“US Petroleum Carriers Inc.”

40‘‘Olympic Mariner’’. There was a public accusation against O in USA. USA law declared as illegal for foreigners to buy American ships, built during war, without a permission from USA government. O charged with illegal control of ships owned by State and flying American flag. The conflict resolved by negotiations where O had to build ships in USA, and then he would be allowed to use flags of convenience (Harlaftis, 1993: p. 133).

41As mentioned, traditional Greek shipowners used profits to buy 1 vessel at a time, and avoided new-buildings, as they believed to be: an “economic adventure”… or an economic “speculation” and a rather dangerous “business game…” They saw many colleagues to become bankrupt of an ill-timed new-building (1830s-1850s). Colocotronis’ was a recent case, who fell victim of his 2 new-buildings of large tankers in 1975, but the cause was not their size, but ill-timing (Couper, 1999).

42Interview given to Mr. Conway M in May 2006.

43“TradeWinds” (03/06/2016); article by H Papachristou; interview with H Vafias.

44O died before the oil shipping crisis, due to Yom Kippur war in 1973, hit tankers. The 1979-1987 period indeed was a disaster for tanker owners.

45This leads managers at times to mistakes, if not consulting one’s co-workers, like Gratsos. O believed that the 1st Suez Canal will be long, unlike Gratsos, who was right.

46The US Class argued that they were 2742. Officially were 2751.

47The persons involved in the appeal were: Venizelos S (Vice Premier); Avraam N, Merchant Marine Minister; M Kulukundis, Vice president of the “United Greek shipowners Corporation”; D. D. Stathatos, president of this last non-profit corporation; M. C. Lemos, Managing Director responsible for crewing and operating Liberties.

48Greeks spent from $50,000 to $150,000 to reactivate Liberties.