Mathematical Modelling of Growth Dynamics of Infant Financial Markets ()

1. Introduction

Financial development is key to economic development [1] [2] and financial markets lie at the center of financial development [1] as most countries that have achieved economic development have literally built on their strong financial market bases [2] [3]. Assessments of the impact of financial (or otherwise called capital markets) have always been helpful in understanding as well as bettering the growth of struggling economies [2] [4]. Some studies have reflected as principally accepted, the normalcy of focusing on the moral aptitude of investing, than growing the investor base in infant financial markets [5]. Infant markets have somewhat not received so much attention in this line, especially those in the sub-Saharan African region. Some studies on modelling the growth dynamics of infant financial markets have been done using data driven models. These include but are not limited to autoregressive models [6] focusing on modelling of the equities on the market rather than the growth and structure of the market, networks models [7] focusing on links between assets and equities on different markets hence exposing loop holes in pricing and lastly computer-networks driven models [8] focusing on the factors to consider before choosing an algorithmic model for trading. Models of physical expansion of investor base on an infant financial market have not been explored, yet understanding the key factions of the population to focus on would ultimately grow trader numbers by overwhelming proportions. In most economies with infant financial markets, the one factor that cannot be skipped over is the ever increasing population sizes especially in Asia and Africa, specifically, sub-Saharan Africa. There is therefore a need to assess whether the growth in population is also representative of financial growth, and more particularly, the development of the financial markets, if the infant markets in some economies in that category are to develop as the already developed financial markets. Though on a more particular basis, it has been hinted on by some studies that growth of financial markets is somewhat linked to population growth in that same economy [1] [9]. Therefore, an understanding of whether financial markets growth is actually globally proportional to population growth will aid the infant markets to focus on what will boost their increase in number of traders as well as the developed markets on which they are heavily reliant [10]. In this work therefore, we focus on studying the growth dynamics of an infant financial market in regard to what may or may not induce the population to trade on the market. We employ a deterministic model, with three compartments i.e. the population proportion that are willing and can invest/trade on the market, which would be referred to as the susceptible group, those who are already actively trading on the market and those who have left off trading on the market due to various reasons. This model is intended to give a glimpse of the possibility of predicting future population behaviour so as to set up market structures and policies on the most suitable strategies that will optimise population participation in market activities. This allows for hypothesizing about what will and will not work for the market, which then improves the market performance through adjusting the necessary parameters in the model, having understood the interplay between the major factions.

2. The Structural Model

and for the growth of the population of participants on the infant financial market, either one or a combination of the following three conditions has to be fulfilled with

being the recruitment rate i.e. the rate at which people become susceptible. This is the rate at which people get to know of the existence and the operation of the stock market.

,

and

respectively represent the rates at which one transitions from just knowing about the market and chooses to become an investor, the rate at which people leave the securities market due to reasons other than investment-related frustrations and the rate at which people chose to give up investing due to investment-related issues. Firstly, the rate of growth of the susceptible group should be strictly positive i.e. the susceptible part of the population should be positive to ensure increase in the number of people with the ability to trade on the infant market i.e.

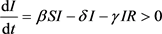

and this is true as developing economies tend to have highly growing population figures. It means that the eligible population to trade on infant market is ever growing. The question then should be is the general population increase reflective of the growth of number of traders in the infant market? If so, is it a proportionate increase? If not, what could be the reasons for that and the possible measures to mitigate this incapacitation of the infant market in an urge to achieve its effective contribution to the growth of that economy. Secondly, the rate of change of the size of the investment proportion of the population has to be steadily growing i.e.

Obviously the state of

is what we need and so that is trivial. However the mandate is then to ensure that the parameters satisfy the condition

for the size of the investment population to steadily grow over time. And thirdly, the rate of change of the population proportion that quit trading on the infant market should be realized as zero though it might take a relatively long time to achieve that. Nonetheless, the differential equation defining this population proportion must satisfy

since

does not help in this case as it would imply an increase in the population shunning the market.

3. The Equilibrium

Now the next question to answer would be the possibility of having bounds for the model parameters within which the growth of trading populations at USE would be ensured. This can be attained through the idea of mathematical equilibrium points. At an equilibrium point, we expect either constant population sizes i.e. one or many of the rates of population change to entirely be resulting into constant population sizes for any of the model compartments. Constant population sizes may also result into changes in the number of people who invest, susceptible to invest or leave investing but it will mostly influence those that would translate into growing the trading populations. So to have the equilibrium points, we solve the model equations seeking for the points that would tale the model to zero. Firstly, when there is no investor population or in other words there are no people trading on the infant market i.e.

then;

which implies that

and hence the equilibrium is at the point where

thereby forming the equilibrium point as

When there is no one leaving trading on the infant market i.e. the population of people forsaking trading on the infant market is identically zero, i.e.

then;

which implies that

and thus from

, we have that;

since

yields the same equilibrium point obtained in case I above. Also, note that the value of

will be useful in obtaining the value for

as we do not intend to have

in two equilibrium points. Thus,

thereby having the equilibrium point as;

Finally, the last equilibrium would be obtained from solving the system as a whole so as to have;

which implies that

thus

and since

, then with

, we have that;

and with this value of S, we use

to obtain a value for

as;

thereby generating the equilibrium point as;

Therefore the three obtained equilibrium points are;

·

·

·

In regard to the financial markets, these equilibrium points reflect the points at which the participation of the population in market activities can be optimised. Notice that there are three equilibrium points but there is need to establish which of these three obtained equilibrium points is actually mathematically consistent with what’s happening in the financial markets. At such a point, the results would be reliable to apply to any infant market, yet without such a point, the dynamics remain totally inapplicable. Through the concept of stability of an equilibrium point, we can assess the applicability of an equilibrium point to the infant market. This follows in section 0

4. Stability of the Equilibrium

For the stability analysis of the model at the obtained equilibrium points, we will employ the Jacobian matrix which for a 3-by-3 model system would be defined as;

with

being defined as

The characteristic equation of the Jacobian would then be obtained from taking the determinant of

being the Eigen values of the obtained system, and I being an identity matrix of the similar order as J. From the functions

and

, the Jacobian then becomes

and so analyzed at each equilibrium point we have that;

1)

which shows that;

and the characteristic equation then becomes

which becomes;

which means that the point

is stable when

because

in any case. Also the point can be stable when

Otherwise the point

is unstable.

2)

which shows that;

and the characteristic equation then becomes

which becomes;

which means that the point

is stable for

when

otherwise unstable. For

, the point is stable when

or

but

cannot satisfy both conditions since they are the same interval. So the point is stable on one case and unstable elsewhere depending on the nature of

.

3)

which shows that;

and the characteristic equation then becomes

which becomes;

which means that the point

is a saddle point i.e. no conclusion about stability can be made from it.

5. Impact of a Single Trader

This is the influence a single trader would have on the growth or decline of market activities and popularity among the population of the economy in questions. In other words, the impact that is brought about by one individual who trades on the infant market. Now note that the impact of those who are not already actively trading on the market is vast and all negative. This section therefore does not delve into that but rather the quantification of the effect of one trader pulling out from the investor base of a growing financial market. This impact parameter can involve numerous sub-parameters yet for purposes of simplicity, we will just summarize all of them under a single value, which we will refer to as

so as not to defer much from the conventional way of understanding of mathematical deterministic models. This impact will be there when

the number of people trading on the infant market is increasing i.e.

thus from the model;

it implies that;

but at the initial time of the model, we except that all people would be susceptible and therefore willing to trade on the infant market (i.e. ) and also that there will be no people who will quit trading (i.e.

) and also that there will be no people who will quit trading (i.e. ) and thus the basic impact number would be:

) and thus the basic impact number would be:

6. Discussion & Conclusion

We have studied a deterministic compartmental model of primarily three sects involved in the growth of a financial market. The results obtained show that the impact of single investor on the market is dependent on the rate at which people choose to invest and the rate at which people leave the market due to non investment-related issues. Some of these issues may include policy on the markets, socio-political and investment environment among others [11]. This means that all the three factions of the model need to be attended to rather than the usual and most expected way of just strategizing to increase market awareness and therefore boost the investor base, that is, looking for ways to increase the susceptible population (those who intend to invest in securities). There are very many readily available substitutes for capital and securities investment [12]. Growing markets have to compete with already developed markets [13], indicating that risk of negligence both to the susceptible, investing and removed portions of the economy can drastically affect the market growth and perhaps lead to its fall.