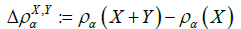

We study the asymptotic behavior of the difference

as

, where

is a risk measure equipped with a confidence level parameter

, and where

X and

Y are non-negative random variables whose tail probability functions are regularly varying. The case where is the value-at-risk (VaR) at

α, is treated in [

1]. This paper investigates the case where

is a spectral risk measure that converges to the worst-case risk measure as

. We give the asymptotic behavior of the difference between the marginal risk contribution

and the Euler contribution

of

Y to the portfolio

X+

Y . Similarly to [

1], our results depend primarily on the relative magnitudes of the thicknesses of the tails of

X and

Y. Especially, we find that

is asymptotically equivalent to the expectation (expected loss) of

Y if the tail of

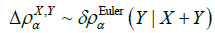

Y is sufficiently thinner than that of X. Moreover, we obtain the asymptotic relationship

as

, where

is a constant whose value likewise changes according to the relative magnitudes of the thicknesses of the tails of

X and

Y. We also conducted a numerical experiment, finding that when the tail of

X is sufficiently thicker than that of

Y,

does not increase monotonically with

α and takes a maximum at a confidence level strictly less than 1.