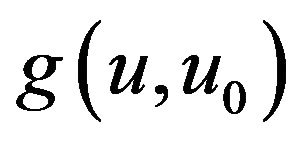

The Expected Discounted Tax Payments on Dual Risk Model under a Dividend Threshold ()

1. Introduction

Consider the surplus process of an insurance portfolio

(1.1)

(1.1)

which is dual to the classical Cramér-Lundberg model in risk theory that describes the surplus at time , where

, where  is the initial capital, the constant

is the initial capital, the constant  is the rate of expenses, and

is the rate of expenses, and  is aggregate profits process with the innovation number process

is aggregate profits process with the innovation number process  being a renewal process whose inter-innovation times

being a renewal process whose inter-innovation times  have common distribution

have common distribution . We also assume that the innovation sizes

. We also assume that the innovation sizes , independent of

, independent of , forms a sequence of i.i.d. exponentially distributed random variables with exponential parameter

, forms a sequence of i.i.d. exponentially distributed random variables with exponential parameter . There are many possible interpretations for this model. For example, we can treat the surplus as the amount of capital of a business engaged in research and development. The company pays expenses for research, and occasional profit of random amounts arises according to a Poisson process.

. There are many possible interpretations for this model. For example, we can treat the surplus as the amount of capital of a business engaged in research and development. The company pays expenses for research, and occasional profit of random amounts arises according to a Poisson process.

Due to its practical importance, the issue of dividend strategies has received remarkable attention in the literature. De Finetti [1] considered the surplus of the company that is a discrete process and showed that the optimal strategy to maximize the expectation of the discounted dividends must be a barrier strategy. Since then, researches on dividend strategies has been carried out extensively. For some related results, the reader may consult the following publications therein: Bühlmann [2], Gerber [3], Gerber and Shiu [4,5], Lin et al. [6], Lin and pavlova [7], Dickson and Waters [8], Albrecher et al. [9], Dong et al. [10] and Ng [11]. Recently, quite a few interesting papers have been discussing risk models with tax payments of loss carry forward type. Albrecher et al. [12] investigated how the loss-carry forward tax payments affect the behavior of the dual process (1.1) with general inter-innovation times and exponential innovation sizes. More results can be seen in Albrecher and Hipp [13], Albrecher et al. [14], Ming et al. [15], Wang and Hu [16] and Liu et al. [17,18].

Now, we consider the model (1.1) under the additional assumption that tax payments are deducted according to a loss-carry forward system and dividends are paid under a threshold strategy. We rewrite the objective process as . that is, the insurance company pays tax at rate

. that is, the insurance company pays tax at rate  on the excess of each new record high of the surplus over the previous one; at the same time, dividends are paid at a constant rate

on the excess of each new record high of the surplus over the previous one; at the same time, dividends are paid at a constant rate  whenever the surplus of an insurance portfolio is more than b and otherwise no dividends are paid. Then the surplus process of our model

whenever the surplus of an insurance portfolio is more than b and otherwise no dividends are paid. Then the surplus process of our model  can be expressed as

can be expressed as

(1.2)

(1.2)

for , with

, with . where

. where  is the indicator function of event

is the indicator function of event  and

and  is the surplus immediately before time

is the surplus immediately before time .

.

For practical consideration, we assume that the positive safety loading condition

(1.3)

(1.3)

holds all through this paper. The time of ruin is defined as  with

with  if

if

for all

for all .

.

For initial surplus , let

, let  be the present value of all dividends until ruin, and

be the present value of all dividends until ruin, and  is the discount factor. Denote by

is the discount factor. Denote by  the expectation of

the expectation of , that is,

, that is,

(1.4)

(1.4)

It needs to be mentioned that we shall drop the subscript  whenever

whenever  is zero.

is zero.

The rest of this paper is organized as follows. In Section 2, We derive the expression of  (i.e. the Laplace transform of the first upper exit time). We also discuss the expected discounted tax payments for this model and obtain its satisfied integro-differential equations. Finally, for Erlang (2) inter-innovation distribution, closed-form expressions for the the expected discounted tax payments are given.

(i.e. the Laplace transform of the first upper exit time). We also discuss the expected discounted tax payments for this model and obtain its satisfied integro-differential equations. Finally, for Erlang (2) inter-innovation distribution, closed-form expressions for the the expected discounted tax payments are given.

2. Main Results and Proofs

Let  denote the Laplace transform of the upper exit time

denote the Laplace transform of the upper exit time , which is the time until the risk process

, which is the time until the risk process  starting with initial capital

starting with initial capital  up-crosses the level

up-crosses the level  for the first time without leading to ruin before that event. In particular,

for the first time without leading to ruin before that event. In particular,  is the probability that the process

is the probability that the process  up-crosses the level

up-crosses the level  before ruin.

before ruin.

For general innovation waiting times distribution, one can derive the integral equations for . When

. When ,

,

(2.1)

(2.1)

When ,

,

(2.2)

(2.2)

It follows from Equation (2.1) and from Equation (2.2) that  is continuous on

is continuous on  as a function of

as a function of  and that

and that

(2.3)

(2.3)

For certain distributions , one can derive integrodifferential equations for

, one can derive integrodifferential equations for  and

and . Let us assume that the i.i.d innovation waiting times have a common generalized Erlang

. Let us assume that the i.i.d innovation waiting times have a common generalized Erlang distribution, i.e. the

distribution, i.e. the ’s are distributed as the sum of n independent and exponentially distributed r.v.’s

’s are distributed as the sum of n independent and exponentially distributed r.v.’s  with

with  having exponential parameters

having exponential parameters .

.

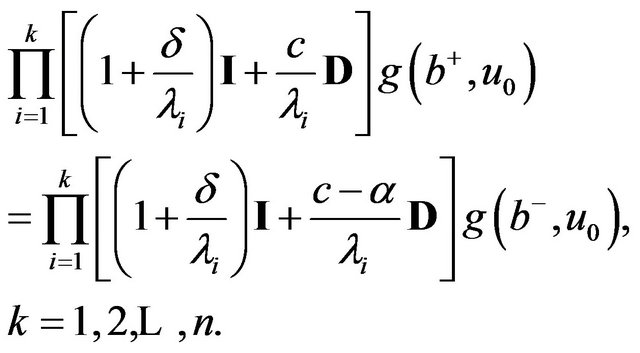

The following theorem 2.1 gives the integro-differential equations for  when

when ’s have a generalized Erlang

’s have a generalized Erlang distribution.

distribution.

Theorem 2.1 Let  and

and  denote the identity operator and differentiation operator respectively. Then

denote the identity operator and differentiation operator respectively. Then  satisfies the following equation for

satisfies the following equation for

(2.4)

(2.4)

and

(2.5)

(2.5)

for .

.

Proof First, we rewrite  as

as  when

when

with

with  in the surplus process (1.2)

in the surplus process (1.2)

with . Thus, we have

. Thus, we have . When

. When ,

,

(2.6)

(2.6)

for , and

, and

(2.7)

(2.7)

By changing variables in from Equation (2.6) and from Equation (2.7), we have for ,

,

(2.8)

(2.8)

for , and

, and

(2.9)

(2.9)

Then, differentiating both sides of from Equation (2.8) and from Equation (2.9) with respect to , one gets

, one gets

(2.10)

(2.10)

for , and

, and

(2.11)

(2.11)

Using from Equation (2.10) and from Equation (2.11), we can derive from Equation (2.4) for  on

on .

.

Similar to from Equation (2.6) and Equation (2.7), we have for

(2.12)

(2.12)

for , and

, and

(2.13)

(2.13)

Again, by changing variables in Equation (2.12) and Equation (2.13) and then differentiating them with respect to , we obtain for

, we obtain for

(2.14)

(2.14)

for , and

, and

(2.15)

(2.15)

Using Equation (2.14) and Equation (2.15), we obtain Equation (2.5) for  on

on .□

.□

It needs to be mentioned that from the proof of Lemma 2.1, we know that

Therefore, Equations (2.10), (2.11), (2.14) and (2.15) yield

(2.16)

(2.16)

Remark 2.1 Using a similar argument to the one used in Lemma 2.1, one can get that when the innovation waiting times follow a common generalized Erlang distribution, the expected discounted dividend payments

distribution, the expected discounted dividend payments  satisfies the following integro-differential equation (see Liu et al. [17]).

satisfies the following integro-differential equation (see Liu et al. [17]).

(2.17)

(2.17)

and

(2.18)

(2.18)

with

(2.19)

(2.19)

In addition, the boundary conditions for  are as follows:

are as follows:

(2.20)

(2.20)

(2.21)

(2.21)

with Equation (2.19).

With the preparations made above, we can now derive analytic expressions of the expected  -th moment of the accumulated discounted tax payments for the surplus process

-th moment of the accumulated discounted tax payments for the surplus process . We claim that the process

. We claim that the process

shall up-cross the initial surplus level

shall up-cross the initial surplus level  at least once to avoid ruin.

at least once to avoid ruin.

Now, let

(2.22)

(2.22)

denote the Laplace transform of the first upper exit time , which is the time until the risk process

, which is the time until the risk process

starting with initial capital

starting with initial capital  reaches a new record high for the first time without leading to ruin before that event. In particular,

reaches a new record high for the first time without leading to ruin before that event. In particular,  is the probability that the process

is the probability that the process  reaches a new record high before ruin. Then the closed-form expression of the quantity

reaches a new record high before ruin. Then the closed-form expression of the quantity  can be calculated as follows.

can be calculated as follows.

When . When

. When , using a simple sample path argument, we immediately have,

, using a simple sample path argument, we immediately have,

or, equivalently

(2.23)

(2.23)

Let  and define

and define

(2.24)

(2.24)

to be the  -th taxation time point. Thus,

-th taxation time point. Thus,

(2.25)

denotes the  -th moment of the accumulated discounted tax payments over the life time of the surplus process

-th moment of the accumulated discounted tax payments over the life time of the surplus process .

.

We will consider a recursive formula of  in the following theorem 2.2.

in the following theorem 2.2.

Theorem 2.2 When , we have

, we have

(2.26)

(2.26)

and when , we have

, we have

(2.27)

(2.27)

Proof Given that the after-tax excess of the surplus level over  at time

at time  is exponentially distributed with mean

is exponentially distributed with mean  due to the memoryless property of the exponential distribution. By a probabilistic argument, one easily shows that for

due to the memoryless property of the exponential distribution. By a probabilistic argument, one easily shows that for

(2.28)

Differentiating with respect to  yields

yields

(2.29)

When , we have

, we have

(2.30)

(2.30)

When , the general solution of Equation (3.20) can be expressed as

, the general solution of Equation (3.20) can be expressed as

(2.31)

Due to the facts that  and

and  , we have for

, we have for

(2.32)

(2.32)

Now, it remains to determine the unknown constant C in Equation (3.20). The continuity of  on

on  and Equation (3.22) lead to

and Equation (3.22) lead to

(2.33)

(2.33)

Plugging Equation (2.33) into Equation (2.30), we arrive at Equation (2.26). □

The special case  leads to an expression for the expected discounted total sum of tax payments over the life time of the risk process

leads to an expression for the expected discounted total sum of tax payments over the life time of the risk process

(2.34)

(2.34)

for all .

.

3. Explicit Results for Erlang(2) Innovation Waiting Times

In this section, we assume that ’s are Erlang(2) distributed with parameters

’s are Erlang(2) distributed with parameters  and

and . We also assume that

. We also assume that  (without loss of generality).

(without loss of generality).

Example 3.1 Note that

(3.1)

(3.1)

Applying the operator  to Equations (2.4) and (2.5) gives

to Equations (2.4) and (2.5) gives

(3.2)

and

(3.3)

The characteristic equation for Equation (3.2) is

(3.4)

(3.4)

without loss of generality, we assume that . We know that Equation (3.4) has three real roots, say

. We know that Equation (3.4) has three real roots, say  and

and  which satisfies

which satisfies

With  replace

replace  in Equation (3.4), we get the characteristic equation of Equation (3.3), whose roots are denoted by

in Equation (3.4), we get the characteristic equation of Equation (3.3), whose roots are denoted by  and

and  with

with

Thus, we have

(3.5)

(3.5)

and

(3.6)

(3.6)

where  are arbitrary constants. To determine the arbitrary constants, we insert Equations (3.5) and (3.6) into Equation (2.3) and obtain

are arbitrary constants. To determine the arbitrary constants, we insert Equations (3.5) and (3.6) into Equation (2.3) and obtain

(3.7)

(3.7)

and

(3.8)

(3.8)

Apply Equation (2.10) together with Equations (2.3) and (3.5) when , we get

, we get

(3.9)

(3.9)

Insert Equation (3.5) into Equation (2.4), we have

(3.10)

(3.10)

In addition, plugging Equations (3.5) and (3.6) into Equation (2.16) yields

(3.11)

(3.11)

and

(3.12)

(3.12)

Some calculations give

(3.13)

(3.13)

with

(3.14)

(3.14)

Remark 3.1 Now, we give the explicit results for

By Equations (3.6) and (3.13), we have for

By Equations (3.6) and (3.13), we have for

(3.15)

(3.15)

with

(3.16)

(3.16)

For , using the explicit expressions of

, using the explicit expressions of  in Liu et al. [17], we obtain

in Liu et al. [17], we obtain

(3.17)

(3.17)

with

(3.18)

(3.18)

where

and

We point out that when the innovation times are exponentially distributed, one can follow the same steps to get the explicit expressions of , which coincide with the results in Albrecher et al. (2008).

, which coincide with the results in Albrecher et al. (2008).

Example 3.2 (The expected discounted tax payments.) Following from Equation (2.34) of Theorem 2.2 and Remark 3.1, we have for ,

,

(3.19)

(3.19)

And, for , we have

, we have

(3.20)

(3.20)

Then we can get that when ’s are Erlang (2) distributed with parameters

’s are Erlang (2) distributed with parameters  and

and , the expresses of

, the expresses of  can be given by Equations (3.15) and (3.17) and the expected discounted tax payments can be given by Equation (3.20).

can be given by Equations (3.15) and (3.17) and the expected discounted tax payments can be given by Equation (3.20).

4. Acknowledgements

The author would like to thank Professor Ruixing Ming and Professor Guiying Fang for their useful discussions and valuable suggestions.

NOTES

#Corresponding author.