1. Introduction

Malliavin calculus is the infinite-dimensional differential calculus on the Wiener space in order to give a probabilistic proof of Hölmander’s theorem. It has been developed as a tool in mathematical finance. In 1999, Founié et al. [1] gave a new method for more efficient computation of Greeks which represent sensitivities of the derivative price to changes in parameters of a model under consideration, by using the integration by parts formula related to Malliavin calculus. Following their works, more general and efficient applications to computation of Greeks have been introduced by many authors (see [2] [3] [4]). They often considered this method for tractable models typified by the Black-Scholes model.

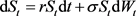

In the Black-Scholes model, an underlying asset  is assumed to follow the stochastic differential equation

is assumed to follow the stochastic differential equation , where r and

, where r and  respectively imply the risk free interest rate and the volatility. The Black-Scholes model seems standard in business. The reason is that this model has the analytic solution for famous options, so it is fast to calculate prices of derivatives and risk parameters (Greeks) and easy to evaluate a lot of deals and the whole portfolios and to manage the risk. However, the Black-Scholes model has a defect that this model assumes that volatility is a constant.

respectively imply the risk free interest rate and the volatility. The Black-Scholes model seems standard in business. The reason is that this model has the analytic solution for famous options, so it is fast to calculate prices of derivatives and risk parameters (Greeks) and easy to evaluate a lot of deals and the whole portfolios and to manage the risk. However, the Black-Scholes model has a defect that this model assumes that volatility is a constant.

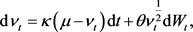

In the actual financial market, it is observed that volatility fluctuates. However, the Black-Scholes model does not suppose the prospective fluctuation of volatility, so when we use the model there is a problem that we would underestimate prices of options. Hence, more accurate models have been developed. One of the models is the stochastic volatility model. One of merits to consider this model is that even if prices of derivatives such as the European options are not given for any strike and maturity, we can grasp the volatility term structure. In particular, the Heston model, which is introduced in [5], is one of the most popular stochastic volatility models. This model assumes that the underlying asset  and the volatility

and the volatility  follow the stochastic differential equations

follow the stochastic differential equations

(1.1)

(1.1)

(1.2)

(1.2)

where  and

and  denote correlated Brownian motion s. In the Equation (1.2),

denote correlated Brownian motion s. In the Equation (1.2),  ,

,  and

and  imply respectively the rate of mean reversion (percentage drift), the long-run mean (equilibrium level) and the volatility of volatility. This volatility model is called the Cox-Ingersoll-Ross model and more complicated than the Black-Scholes model. We have not got the analytic solution yet.

imply respectively the rate of mean reversion (percentage drift), the long-run mean (equilibrium level) and the volatility of volatility. This volatility model is called the Cox-Ingersoll-Ross model and more complicated than the Black-Scholes model. We have not got the analytic solution yet.

However, even this model cannot grasp fluctuation of volatility accurately. In 2006 (see [6]), Andersen and Piterbarg generalized the Heston model. They extended the volatility process of (1.2) to

(1.3)

(1.3)

This model is called the constant elasticity of variance model (we will often shorten this model as the CEV model). Naturally, in the case , the volatility model (1.3) is more complicated than the volatility model (1.2).

, the volatility model (1.3) is more complicated than the volatility model (1.2).

Here, consider the European call option and let  is a payoff function. Then we can estimate the option price by the following formula

is a payoff function. Then we can estimate the option price by the following formula . However, the computation of Greeks is much important in the risk-management.

. However, the computation of Greeks is much important in the risk-management.

A Greek is given by  where

where  is one of parameters needed to compute

is one of parameters needed to compute

the price, such as the initial price, the risk free interest rate, the volatility and the maturity etc.. Most of financial institutions have calculated Greeks by using finite-difference methods but there are some demerits such that the results depend on the approximation parameters. More than anything, the methods need the assumption that the payoff function ![]() is differentiable. However, in business they often consider the payoff functions such as

is differentiable. However, in business they often consider the payoff functions such as ![]() or

or![]() . Here we need Malliavin calculus. In 1999 Founié et al. in [1] gave the new methods for Greeks. To come to the point, they calculated Greeks by the following

. Here we need Malliavin calculus. In 1999 Founié et al. in [1] gave the new methods for Greeks. To come to the point, they calculated Greeks by the following

formula![]() . We can calculate this even if

. We can calculate this even if ![]() is

is

polynomial growth. Instead, we need the Malliavin differentiability of![]() .

.

The solution ![]() satisfying the stochastic differential equation with Lipschitz continuous coefficients is known as Malliavin differentiable. Hence we can easily verify that the Black-Scholes model is Malliavin differentiable. However the

satisfying the stochastic differential equation with Lipschitz continuous coefficients is known as Malliavin differentiable. Hence we can easily verify that the Black-Scholes model is Malliavin differentiable. However the

diffusion coefficient ![]() is neither differentiable at

is neither differentiable at ![]() nor Lipschitz

nor Lipschitz

continuous and then we cannot find whether the CEV-type Heston model is Malliavin differentiable or not. In [7], Alos and Ewald proved that the volatility

process (1.2), that is the case where ![]() of (1.3), was Malliavin differentiable and gave the explicit expression for the derivative. However, in the case

of (1.3), was Malliavin differentiable and gave the explicit expression for the derivative. However, in the case![]() , we cannot simply prove the Malliavin differentiability in the exact same way.

, we cannot simply prove the Malliavin differentiability in the exact same way.

In this paper we concentrate on the case![]() , that is, we extend the

, that is, we extend the

results in [7] and give the explicit expression for the derivative. Moreover we consider the CEV-type Heston model and give the formula to compute Greeks.

2. Summary of Malliavin Calculus

We give the short introduction of Malliavin calculus on the Wiener space. For further details, refer to [8].

2.1. Malliavin Derivative

We consider a Brownian motion ![]() (in the sequel, we often denote

(in the sequel, we often denote ![]() by

by![]() ) on a complete filtered probability space

) on a complete filtered probability space ![]() where

where ![]() is the filtration generated by

is the filtration generated by![]() , and the Hilbert space

, and the Hilbert space![]() . When fixing

. When fixing![]() , we can consider

, we can consider![]() . Then the Itô integral of

. Then the Itô integral of

![]() is constructed as

is constructed as ![]() on

on![]() . We denote

. We denote

by ![]() the set of infinitely continuously differentiable functions

the set of infinitely continuously differentiable functions ![]() such that f and all its partial derivatives have polynomial growth. Let S be the space of smooth random variables expressed as

such that f and all its partial derivatives have polynomial growth. Let S be the space of smooth random variables expressed as

![]() (2.1)

(2.1)

where ![]() and

and ![]() where

where![]() ,

,![]() . We denote by

. We denote by ![]() the set of infinitely continuously differentiable functions

the set of infinitely continuously differentiable functions ![]() such that f has compact support. Moreover we denote by

such that f has compact support. Moreover we denote by ![]() the set of infinitely continuously differentiable functions

the set of infinitely continuously differentiable functions ![]() such that ƒ and all of its partial derivatives are bounded. Denote by

such that ƒ and all of its partial derivatives are bounded. Denote by ![]() and

and ![]() respectively, the spaces of smooth random variables of the form (2.1) such that

respectively, the spaces of smooth random variables of the form (2.1) such that ![]() and

and![]() . We can find that

. We can find that ![]() and

and ![]() is a linear subspace of and dense in

is a linear subspace of and dense in ![]() for all

for all![]() . We use the notation

. We use the notation ![]() in the

in the

sequal. We define the derivative operator D, so called the Malliavin derivative operator.

Definition 2.1. (Malliavin derivative) The Malliavin derivative ![]() of a smooth random variable expressed as (2.1) is defined as the H-valued random variable given by

of a smooth random variable expressed as (2.1) is defined as the H-valued random variable given by

![]() (2.2)

(2.2)

We sometimes omit to write the subscript t.

Since ![]() is dense in

is dense in![]() , we will define the Malliavin derivative of a general

, we will define the Malliavin derivative of a general ![]() by means of taking limits. We will now prove that the Malliavin derivative operator

by means of taking limits. We will now prove that the Malliavin derivative operator ![]() is closable. Please refer to [8] for proves of the following results.

is closable. Please refer to [8] for proves of the following results.

Lemma 2.1. We have![]() , for

, for ![]() and

and![]() .

.

Lemma 2.2. For any![]() , the Malliavin derivative operator

, the Malliavin derivative operator ![]() is closable.

is closable.

For any![]() , we denote by

, we denote by ![]() the domain of D in

the domain of D in ![]() and then it is the closure of

and then it is the closure of ![]() by the norm

by the norm

![]() (2.3)

(2.3)

Note that ![]() is a Hilbert space with the scalar product

is a Hilbert space with the scalar product ![]() . Moreover, the Malliavin derivative

. Moreover, the Malliavin derivative ![]() is regarded as a stochastic process defined almost surely with the measure

is regarded as a stochastic process defined almost surely with the measure ![]() where u is a Lebesgue measure in

where u is a Lebesgue measure in![]() . Indeed, we can observe

. Indeed, we can observe

![]() (2.4)

(2.4)

The following result will become a very important tool.

Lemma 2.3. Suppose that a sequence ![]() converges to F in

converges to F in![]() . Then F belongs to

. Then F belongs to ![]() and the sequence

and the sequence ![]() converges to DF in the weak topology of

converges to DF in the weak topology of![]() .

.

Similarly, we define the k-th Malliavin derivative of F, ![]() , as a

, as a ![]() -measurable stochastic process defined

-measurable stochastic process defined ![]() -almost surely and the operator

-almost surely and the operator ![]() is closable from

is closable from ![]() for any

for any ![]() and

and![]() . As with the Malliavin derivative D, from the closability of

. As with the Malliavin derivative D, from the closability of![]() , we can define the domain

, we can define the domain ![]() of the operator

of the operator ![]() in

in ![]() as the completion of

as the completion of ![]() with the norm

with the norm

![]() (2.5)

(2.5)

Moreover we define ![]() as

as![]() . We will now prove the chain rule and refer to the ( [8], Proposition 1.2.4) for details.

. We will now prove the chain rule and refer to the ( [8], Proposition 1.2.4) for details.

Lemma 2.4. For![]() , let

, let ![]() and

and ![]() be a Lipschitz function with bounded partial derivatives, and then we have

be a Lipschitz function with bounded partial derivatives, and then we have ![]() and

and

![]() (2.6)

(2.6)

2.2. Skorohod Integral

For ![]() satisfing

satisfing![]() , the adjoint

, the adjoint ![]() of the operator D which is closable and has the domain on

of the operator D which is closable and has the domain on ![]() should be closable but with the domain contained in

should be closable but with the domain contained in![]() . Focus on the case

. Focus on the case![]() . We can define the divergence operator

. We can define the divergence operator ![]() so called the Scorohod integral which is the adjoint of the operator D such as

so called the Scorohod integral which is the adjoint of the operator D such as

![]() (2.7)

(2.7)

Definition 2.2 (Skorohod integral). Let![]() . If for all

. If for all![]() , we can have

, we can have

![]() (2.8)

(2.8)

where c is some constant depending on u, then u is called to belong to the domain![]() . Moreover if

. Moreover if![]() , then we have that

, then we have that ![]() belongs to

belongs to ![]() and the duality relation

and the duality relation![]() , for all

, for all![]() .

.

We can get the following results.

Lemma 2.5. Let ![]() and

and ![]() satisfy

satisfy![]() . And then we have that

. And then we have that ![]() belongs to

belongs to ![]() and

and![]() .

.

Lemma 2.6. Let ![]() be an

be an ![]() -adapted stochastic process then

-adapted stochastic process then ![]() and

and![]() .

.

We give one of famous properties of![]() . The following property implies the relationship between the Malliavin derivative and the Skorohod integral. Denote by

. The following property implies the relationship between the Malliavin derivative and the Skorohod integral. Denote by ![]() the class of processes

the class of processes ![]() such that

such that

![]() for almost all t and there exists a measurable version of the two

for almost all t and there exists a measurable version of the two

variable processes ![]() satisfying

satisfying![]() .

.

Lemma 2.7. Let ![]() satisfy that

satisfy that ![]() and that

and that ![]() . We have then that

. We have then that ![]() belongs to

belongs to ![]() and

and

![]() (2.9)

(2.9)

The following result is applied to calculate Greeks. For further details, refer to ( [8], Chapter 6).

Lemma 2.8. Let![]() . Suppose that an random variable

. Suppose that an random variable ![]() satisfy

satisfy ![]() a.s. and

a.s. and![]() . For any continuously differentiable function f with bounded derivatives, we have

. For any continuously differentiable function f with bounded derivatives, we have

![]()

where![]() .

.

2.3. Malliavin Calculus for Stochastic Differential Equations

Consider ![]() and

and![]() . Let

. Let ![]() be the m-dimensional

be the m-dimensional

Brownian motion on filtered probability space ![]() where P is the n-dimensional Wiener measure and F is the completion of the σ-field of

where P is the n-dimensional Wiener measure and F is the completion of the σ-field of ![]() with P. And then

with P. And then ![]() is the underlying Hilbert space. We consider the solution

is the underlying Hilbert space. We consider the solution ![]() of the following n-dimensional stochastic differential equation for all

of the following n-dimensional stochastic differential equation for all ![]()

![]() (2.10)

(2.10)

where ![]() and

and ![]() satisfy the following : there is a positive constant

satisfy the following : there is a positive constant ![]() such that

such that

![]() (2.11)

(2.11)

![]() (2.12)

(2.12)

Here ![]() is the columns of the matrix

is the columns of the matrix![]() . We can have the following result related to the uniqueness and refer to ( [8], Lemma 2.2.1) for the detail.

. We can have the following result related to the uniqueness and refer to ( [8], Lemma 2.2.1) for the detail.

Theorem 2.1. There is a unique n-dimensional, continuous and ![]() -adapted stochastic process

-adapted stochastic process ![]() satisfying the stochastic differential Equation (2.10) with

satisfying the stochastic differential Equation (2.10) with![]() , for all

, for all![]() .

.

In the case the coefficients are Lipschitz, the solution ![]() belongs to

belongs to![]() .

.

Theorem 2.2. Assume that coefficients are Lipschitz continuous of the stochastic differential Equation (2.10). Then the solution ![]() belongs to

belongs to ![]() for all

for all ![]() and

and ![]() and satisfies

and satisfies

![]() (2.13)

(2.13)

Moreover the derivative ![]() satisfies the following

satisfies the following

![]() (2.14)

(2.14)

for ![]() a.e., and

a.e., and ![]() for

for ![]() a.e.. Here

a.e.. Here ![]() denotes the Malliavin derivative for

denotes the Malliavin derivative for![]() .

.

Let ![]() be the solution of the following stochastic differential equation

be the solution of the following stochastic differential equation

![]() (2.15)

(2.15)

where ![]() denotes a 1-dimensional Brownian motion. Assume that

denotes a 1-dimensional Brownian motion. Assume that![]() . We let

. We let ![]() be the first variation of

be the first variation of![]() , that is,

, that is,![]() . We can easily have that

. We can easily have that ![]() satisfies the folloing

satisfies the folloing

![]() (2.16)

(2.16)

Considering this as a stochastic differential equation for![]() , we can have the following solution

, we can have the following solution

![]() (2.17)

(2.17)

The following results will also be useful to calculate Greeks later.

Lemma 2.9. Under the above conditions, we can have ![]() .

.

Let ![]() be a continuous function in H such that

be a continuous function in H such that![]() .

.

Lemma 2.10. Under the above conditions, we can have ![]() .

.

Theorem 2.3. For any ![]() of polynomial growth, we have

of polynomial growth, we have ![]() where

where![]() .

.

For the more general case, the same result is proved as below. Let ![]() denote the solution of the following n-dimensional stochastic differential equation just like as (2.10)

denote the solution of the following n-dimensional stochastic differential equation just like as (2.10)

![]() (2.18)

(2.18)

where ![]() denotes m-dimensional Brownian motion. For the sake of simplification, we assume that

denotes m-dimensional Brownian motion. For the sake of simplification, we assume that![]() .

.

Theorem 2.4. Suppose that the diffusion coefficient ![]() is invertible and that

is invertible and that![]() , for some

, for some![]() , where Y denotes the first variation

, where Y denotes the first variation

process, that is,![]() . Let

. Let ![]() be a random variable which does not depend on the initial condition x. Then for all measurable function

be a random variable which does not depend on the initial condition x. Then for all measurable function ![]() with polynomial growth we have

with polynomial growth we have![]() , where

, where ![]() is an

is an ![]() -adapted process satisfying

-adapted process satisfying![]() ,

,

![]() (2.19)

(2.19)

and ![]() denotes the adjoint to the Malliavin derivative with respect to a Brownian motion

denotes the adjoint to the Malliavin derivative with respect to a Brownian motion![]() .

.

The following theorem introduced in [9] is useful. From now on, we will now denote by ![]() the once derivative with respect to t, by

the once derivative with respect to t, by ![]() the once derivative with respect to x and by

the once derivative with respect to x and by ![]() the second derivative with respect to x.

the second derivative with respect to x.

Theorem 2.5. Consider a stochastic process ![]() satisfying the 1-dimensional stochastic differential equation

satisfying the 1-dimensional stochastic differential equation

![]() (2.20)

(2.20)

where ![]() denotes a Brownian motion and the coefficients

denotes a Brownian motion and the coefficients ![]() and

and ![]() satisfy the linear growth condition and the Lipschitz condition. Moreover, we assume that

satisfy the linear growth condition and the Lipschitz condition. Moreover, we assume that ![]() is positive and bounded away from 0, and that

is positive and bounded away from 0, and that ![]() and

and ![]() are bounded for all

are bounded for all![]() . Then

. Then ![]() belongs to

belongs to ![]() and the derivative is given by

and the derivative is given by

![]() (2.21)

(2.21)

for ![]() and

and ![]() for

for![]() .

.

Proof. We omit the proof. For further details, refer to (Theorem 2.1 [9]).

3. Mean-Reverting CEV Model

Following the construction in [7], we will now prove that the mean-reverting constant elasticity of variance model is Malliavin differentiable. The mean-reverting CEV model follows the stochastic differential equation

![]() (3.1)

(3.1)

with ![]() and where

and where![]() ,

, ![]() and

and![]() . In [7], Alos and Ewald proved the Malliavin differentiability of the case

. In [7], Alos and Ewald proved the Malliavin differentiability of the case ![]() of (3.1). In the case, the function

of (3.1). In the case, the function

![]() is neither continuously differentiable in 0 nor Lipschitz continuous so they circumvented various problems by some transforming and approximating.

is neither continuously differentiable in 0 nor Lipschitz continuous so they circumvented various problems by some transforming and approximating.

However, in the case![]() , there are more complex problems. Following [7], we will extend their results.

, there are more complex problems. Following [7], we will extend their results.

3.1. Existence and Uniqueness

We will now prove that the solution to (3.1) not only exists uniquely but is also positive a.s.

Lemma 3.1. There exists a unique strong solution to (3.1) which satisfies![]() . Moreover, let

. Moreover, let ![]() with

with![]() . Then we have

. Then we have![]() .

.

Proof. Instead of (3.1), consider the following

![]() (3.2)

(3.2)

If we have concluded that the unique strong solution of (3.2) is positive a.s., then (3.2) coincides with (3.1). The existence of non-explosive weak solution for (3.2) follows from the continuity and the sub-linear growth condition of drift and diffusion coefficients. Moreover, from ( [10], Proposition 5.3.20, Corollary 5.3.23), we have the pathwise uniqueness. From ( [10], Proposition 5.2.13), we can verify that the pathwise uniqueness holds for (3.2).

We will now prove that the second claim is true. Let

![]() with

with![]() . In order to use ( [10], Theorem 5.5.29), we verify that for a fixed number

. In order to use ( [10], Theorem 5.5.29), we verify that for a fixed number![]() ,

, ![]() where

where

![]() is defined as

is defined as![]() . Since we have known

. Since we have known

that the solution ![]() of (3.2) does not explode at

of (3.2) does not explode at![]() , if we could prove that the above formula holds, we can claim that

, if we could prove that the above formula holds, we can claim that![]() , that is,

, that is,![]() . We can assume without restriction that

. We can assume without restriction that ![]() and let

and let![]() . Then we have

. Then we have

![]() (3.3)

(3.3)

Letting![]() , we can calculate

, we can calculate![]() . From the last inequality, there exists a constant

. From the last inequality, there exists a constant ![]() satisfying the following inequality and then we have as

satisfying the following inequality and then we have as![]() ,

,

![]() (3.4)

(3.4)

3.2. Lp-Integrability

Consider the Stochastic Differential Equation

![]() (3.5)

(3.5)

with![]() , where b is such that

, where b is such that ![]() and satisfies the Lipschitz condition,

and satisfies the Lipschitz condition, ![]() and

and![]() . The following lemma ensures the existence of its moments of any order.

. The following lemma ensures the existence of its moments of any order.

Lemma 3.2. Consider the solution of the (3.5). For any![]() , we have

, we have ![]() and

and![]() .

.

Proof. At first we consider the positive moments. We define the stopping time ![]() with

with![]() . By Itô’s formula,

. By Itô’s formula,

![]() (3.6)

(3.6)

From the Lipschitz condition of the drift function![]() , there exists a positive constant K which satisfies

, there exists a positive constant K which satisfies![]() . By the above inequality and Young’s inequality, we have

. By the above inequality and Young’s inequality, we have

![]() (3.7)

(3.7)

By Gronwall’s lemma, we can have![]() , where both C and

, where both C and ![]() do not depend on n. As

do not depend on n. As![]() , we can obtain the result. Next we consider

, we can obtain the result. Next we consider

the negative moments. Define the stopping time as![]() , with

, with![]() . By Itô’s formula, we have

. By Itô’s formula, we have

![]() (3.8)

(3.8)

Taking the expectation and using the Fubini’s theorem, we have

![]() (3.9)

(3.9)

Here let![]() , then we can easily evaluate the boundedness for any

, then we can easily evaluate the boundedness for any ![]()

![]() (3.10)

(3.10)

Summarizing the calculation, we have![]() , and from Gronwall’s lemma we finally have

, and from Gronwall’s lemma we finally have![]() . Taking the limit

. Taking the limit![]() , then

, then ![]() so we have

so we have ![]() . Hence we can deduce the result.

. Hence we can deduce the result.

Remark 1. Since the CEV model satisfies the assumptions of Lemma 3.2, so the result holds for the CEV model.

3.3. Transformation and Approximation

We consider the process transformed as![]() . By Itô’s formula, we have

. By Itô’s formula, we have

![]() (3.11)

(3.11)

with![]() . If

. If ![]() is the solution of the stochastic differential Equation (3.11), then we can prove that

is the solution of the stochastic differential Equation (3.11), then we can prove that ![]() is also the solution of the stochastic differential Equation (3.1) satisfying the initial condition

is also the solution of the stochastic differential Equation (3.1) satisfying the initial condition![]() . By this transformation, we can replace (3.1) by (3.11) with the constant volatility term. In order to use Theorem 2.5, we must approximate

. By this transformation, we can replace (3.1) by (3.11) with the constant volatility term. In order to use Theorem 2.5, we must approximate ![]() and

and ![]() by the Lipschitz

by the Lipschitz

continuous functions, respectively. For all![]() , define the continuously differentiable functions

, define the continuously differentiable functions ![]() and

and ![]() as

as

![]() (3.12)

(3.12)

![]() (3.13)

(3.13)

For the functions ![]() and

and![]() , we can easily verify that for all

, we can easily verify that for all![]() ,

, ![]() and

and ![]() and then we have that for all

and then we have that for all![]() ,

, ![]() and

and![]() . Moreover, note that for all

. Moreover, note that for all![]() ,

, ![]() and

and![]() . Define our approximations

. Define our approximations ![]() as the stochastic process following the stochastic differential equation

as the stochastic process following the stochastic differential equation

![]() (3.14)

(3.14)

with ![]() for all

for all![]() . The coefficients of the Equation (3.14) are Lipschitz continuous because we can have for all

. The coefficients of the Equation (3.14) are Lipschitz continuous because we can have for all![]() ,

,

![]() (3.15)

(3.15)

We will prove that ![]() converges to

converges to ![]() in

in![]() . First we prove that

. First we prove that ![]() converges to

converges to ![]() pointwise.

pointwise.

Lemma 3.3. The sequence ![]() converges to

converges to ![]() a.s., for all

a.s., for all![]() .

.

Proof. Define for all ![]() the stopping time as

the stopping time as ![]() with

with![]() . By the definition of

. By the definition of![]() ,

, ![]() , and

, and![]() , we have

, we have

![]() (3.16)

(3.16)

By Gronwall’s lemma, ![]() for

for ![]() and by Lemma 3.1 and the fact that

and by Lemma 3.1 and the fact that ![]() for

for![]() , we have

, we have ![]() a.s. so

a.s. so ![]() for all

for all![]() .

.

Next we prove that there exist square integrable processes ![]() and

and ![]() with

with ![]() for all

for all![]() . Actually, we will see that

. Actually, we will see that ![]() is

is![]() . Before starting with the proof, we prove the following inequality.

. Before starting with the proof, we prove the following inequality.

Lemma 3.4. For ![]() and

and![]() , let

, let![]() . We have, for

. We have, for![]() ,

,

![]() (3.17)

(3.17)

Proof. By differentiating![]() , we can easily have the result.

, we can easily have the result.

Consider ![]() and

and ![]() in the above inequality, then we can have the below result.

in the above inequality, then we can have the below result.

Lemma 3.5. Let ![]() be the solution of the following stochastic differential equation

be the solution of the following stochastic differential equation

![]() (3.18)

(3.18)

with![]() , where

, where![]() . Then

. Then ![]() a.s. for all

a.s. for all![]() .

.

Proof. From the definitions of ![]() and

and![]() ,

, ![]() for all

for all

![]() , that is, the drift coefficient of

, that is, the drift coefficient of ![]() is smaller than one of

is smaller than one of![]() . By Yamada-Watanabe’s comparison lemma (see [10], Proposition 5.2.18) and Lemma 3.1, we have

. By Yamada-Watanabe’s comparison lemma (see [10], Proposition 5.2.18) and Lemma 3.1, we have ![]() a.s.

a.s.

We prove the second inequality. In order to use Yamada-Watanabe’s comparison lemma, we must prove that, for![]() ,

, ![]() . Let

. Let ![]() . We can easily verify

. We can easily verify ![]() , for

, for ![]() and

and ![]() for

for![]() . For all

. For all![]() , we have

, we have

![]() (3.19)

(3.19)

![]() (3.20)

(3.20)

Then there is a constant ![]() with

with ![]() for all

for all ![]() and

and ![]() for all

for all![]() . For

. For![]() ,

, ![]() is decreasing for all

is decreasing for all![]() . Then

. Then ![]() and

and ![]() imply for all

imply for all![]() ,

, ![]() , that is, for

, that is, for ![]()

![]() (3.21)

(3.21)

By Yamada-Watanabe’s comparison lemma, we have ![]() a.s.

a.s.

Theorem 3.1. For all![]() , the sequence

, the sequence ![]() converges to

converges to ![]() in

in![]() .

.

Proof. From Lemma 3.5, we have![]() . Lemma 3.2 implies

. Lemma 3.2 implies![]() . Moreover, the Ornstein-Uhlenbeck process

. Moreover, the Ornstein-Uhlenbeck process![]() . By the dominated convergence theorem we can have the convergence.

. By the dominated convergence theorem we can have the convergence.

3.4. Malliavin Differentiability

We will prove the Malliavin differentiability of both ![]() and

and![]() . To do this, we consider our approximation sequence

. To do this, we consider our approximation sequence![]() . The approximating stochastic differential Equation (3.14) of

. The approximating stochastic differential Equation (3.14) of ![]() satisfies the assumption of Theorem 2.5, so we can prove the Malliavin differentiability of

satisfies the assumption of Theorem 2.5, so we can prove the Malliavin differentiability of![]() .

.

Lemma 3.6. ![]() belongs to

belongs to ![]() and we have

and we have

![]() (3.22)

(3.22)

for![]() , and

, and ![]() for

for![]() .

.

Proof. By Theorem 2.5, we have the result.

We will now prove the Malliavin differentiability of![]() . To start with, we prove some useful lemmas.

. To start with, we prove some useful lemmas.

Lemma 3.7. For ![]() and

and![]() , let

, let![]() , then for

, then for ![]() we have

we have

![]() (3.23)

(3.23)

Proof. By differentiating ![]() we can easily have the result.

we can easily have the result.

By Lemma 3.7, considering the case where ![]() and

and![]() , we have for

, we have for![]() ,

,

![]() (3.24)

(3.24)

We have for![]() ,

,

![]() (3.25)

(3.25)

so there exists a constant ![]() such that for all

such that for all![]() ,

, ![]() . Hence, for

. Hence, for![]() , we have

, we have![]() , for all

, for all![]() . Note that

. Note that ![]() is independent of

is independent of![]() . By this inequality, we have the following result.

. By this inequality, we have the following result.

Lemma 3.8. We have for all ![]() and

and![]() ,

,

![]() (3.26)

(3.26)

Proof. When![]() ,

, ![]() so the result follows. Moreover when

so the result follows. Moreover when![]() , putting above results together, we obtain the result.

, putting above results together, we obtain the result.

Putting the scenarios together, we can prove the following.

Theorem 3.2. ![]() belongs to

belongs to ![]() and we have

and we have

![]() (3.27)

(3.27)

for![]() , and

, and ![]() for

for![]() .

.

Proof. We have proved that ![]() in

in ![]() and

and![]() . Moreover, by Lemma 3.8, we have

. Moreover, by Lemma 3.8, we have![]() . Here

. Here ![]() converges to

converges to ![]() also pointwise, we can conclude that

also pointwise, we can conclude that ![]() converges to

converges to

![]() . Using the bounded

. Using the bounded

convergence theorem, we can have that ![]() converges to G in

converges to G in![]() . Hence by Lemma 2.4, we can conclude that

. Hence by Lemma 2.4, we can conclude that ![]() and

and![]() .

.

Moreover we can prove the following Malliavin differentiability in more detail.

Theorem 3.3. For all![]() ,

, ![]() belongs to

belongs to![]() , that is,

, that is, ![]() belongs to

belongs to![]() .

.

Proof. We only have to prove that![]() . We have

. We have

![]() (3.28)

(3.28)

Hence we can conclude that![]() .

.

By the chain rule, we can conclude that ![]() is also Malliavin differentiable.

is also Malliavin differentiable.

Theorem 3.4. For all![]() ,

, ![]() belongs to

belongs to ![]() and the Malliavin derivative is given by

and the Malliavin derivative is given by

![]() (3.29)

(3.29)

for![]() , and

, and ![]() for

for![]() .

.

Proof. Consider only the case where![]() . Similarly, we can easily prove the case where

. Similarly, we can easily prove the case where![]() . We have shown that

. We have shown that ![]() and

and![]() . By Lemma 2.5, we have

. By Lemma 2.5, we have

![]() (3.30)

(3.30)

For all![]() , using Young’s inequality and the fact

, using Young’s inequality and the fact ![]() and

and![]() , we can prove that

, we can prove that ![]() belongs to

belongs to![]() . Indeed, we have

. Indeed, we have

![]() (3.31)

(3.31)

4. CEV-Type Heston Model and Greeks

We will now consider the CEV-type Heston model and Greeks. Fournié et al. introduced new numerical methods for calculating Greeks using Malliavin calculus for the first time in 1999 (see [1]). We call this methods Malliavin Monte-Carlo methods. They focused on models with Lipschitz continuous coefficients, and then a lot of researchers have considered Malliavin Monte-Carlo methods to compute Greeks. However, lately, there is need to focus on models with non-Lipschitz coefficients such as stochastic volatility models. In 2008, Alos and Ewald proved that the Cox-Ingersoll-Ross model was Malliavin differentiable (see [7]). We apply Malliavin calculus for calculating Greeks of the CEV-type Heston model which is one of the important in business but mathematically complex models. Basically, we consider the European option but we can easily extend this result to other options.

4.1. Greeks

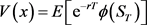

We introduce the concept of Greeks. For example, consider a European option with payoff function ![]() depending on the final value of the underlying asset

depending on the final value of the underlying asset ![]() where

where ![]() denotes a stochastic process expressing the asset and T denotes the maturity of the option. The price V is given by

denotes a stochastic process expressing the asset and T denotes the maturity of the option. The price V is given by ![]() where r is the risk-free rate. We can estimate this by Monte-Carlo simulations. Greeks are derivatives of the option price V with respect to the parameters of the model. Greeks are the useful measure for the portfolio risk management by traders in financial institutions. Most of financial institutions estimate Greeks by finite difference methods. However, there are some demerits. For examples, the numerical results depend on the approximation parameters and, in the case where

where r is the risk-free rate. We can estimate this by Monte-Carlo simulations. Greeks are derivatives of the option price V with respect to the parameters of the model. Greeks are the useful measure for the portfolio risk management by traders in financial institutions. Most of financial institutions estimate Greeks by finite difference methods. However, there are some demerits. For examples, the numerical results depend on the approximation parameters and, in the case where ![]() is not differentiable, this methods do not work well. In [1], Founié et al. gave the new methods to circumvent these problems. The idea is that we calculate Greeks by multiplying the weight, so-called Malliavin weight, as following

is not differentiable, this methods do not work well. In [1], Founié et al. gave the new methods to circumvent these problems. The idea is that we calculate Greeks by multiplying the weight, so-called Malliavin weight, as following

![]() (4.1)

(4.1)

This methods are much useful since we do not require the differentiability of the payoff function![]() . Instead, there is need to assume that the underlying assert

. Instead, there is need to assume that the underlying assert ![]() is Malliavin differentiable. From Theorem 2.2, we find that the solution of the stochastic differential equation with Lipschitz continuous coefficients are Malliavin differentiable. However, if a model under consideration becomes more complex just like the CEV-type Heston model, we could not apply this Malliavin methods. Through Section 4, we consider the Malliavin differentiability of the CEV-type Heston model in order to give formulas for Greeks, in particular, Delta and Rho. Here, Delta

is Malliavin differentiable. From Theorem 2.2, we find that the solution of the stochastic differential equation with Lipschitz continuous coefficients are Malliavin differentiable. However, if a model under consideration becomes more complex just like the CEV-type Heston model, we could not apply this Malliavin methods. Through Section 4, we consider the Malliavin differentiability of the CEV-type Heston model in order to give formulas for Greeks, in particular, Delta and Rho. Here, Delta ![]() and Rho

and Rho ![]() respectively measure the sensitivity of the option price with respect to the initial price and the risk-free rate. In particular,

respectively measure the sensitivity of the option price with respect to the initial price and the risk-free rate. In particular, ![]() is one of the most important Greeks which also describes the replicating portfolio.

is one of the most important Greeks which also describes the replicating portfolio.

4.2. CEV-Type Heston Model

In [5], Heston supposed that the stock price ![]() follows the stochastic differential equation

follows the stochastic differential equation

![]() (4.2)

(4.2)

where![]() , r and

, r and ![]() respectively mean a Brownian motion , the risk-free rate and the volatility. Moreover Heston assumed that the volatility process

respectively mean a Brownian motion , the risk-free rate and the volatility. Moreover Heston assumed that the volatility process ![]() becomes a mean-reverting stochastic process of the form

becomes a mean-reverting stochastic process of the form

![]() (4.3)

(4.3)

where![]() ,

, ![]() ,

, ![]() and

and ![]() respetively mean a Brownian motion , the long-run mean, the rate of mean reversion and the volatility of volatility. This model is called the Cox-Ingersoll-Ross model. Here

respetively mean a Brownian motion , the long-run mean, the rate of mean reversion and the volatility of volatility. This model is called the Cox-Ingersoll-Ross model. Here ![]() and

and ![]() are two correlated Brownian motion s with

are two correlated Brownian motion s with

![]() (4.4)

(4.4)

where ![]() is the correlation coefficient between two Brownian motion s. Moreover we assume that the dynamics following stochastic differential Equations (4.1), (4.2), and (4.3) are satisfied under the risk neutral measure. However even the Heston model cannot grasp the fluctuation of the volatility accurately. In [6], Andersen and Piterbarg extended the Heston model to the model of which dynamics follow

is the correlation coefficient between two Brownian motion s. Moreover we assume that the dynamics following stochastic differential Equations (4.1), (4.2), and (4.3) are satisfied under the risk neutral measure. However even the Heston model cannot grasp the fluctuation of the volatility accurately. In [6], Andersen and Piterbarg extended the Heston model to the model of which dynamics follow

![]() (4.5)

(4.5)

![]() (4.6)

(4.6)

![]() (4.7)

(4.7)

with the initial conditions ![]() and

and![]() . We call this model the CEV-type Heston model. For the Equation (4.5) with

. We call this model the CEV-type Heston model. For the Equation (4.5) with![]() , the Malliavin differentiability

, the Malliavin differentiability

obviously follows by Theorem 2.2. In the case![]() , Alos and Ewald proved

, Alos and Ewald proved

the Malliavin differentiability in [7]. In Section 3, we have proved the Malliavin

differentiability in the case![]() . Fron now on, we concentrate on

. Fron now on, we concentrate on![]() .

.

In order to give the formulas for the CEV-type Heston model, we will now prove

the Malliavin differentiability of the model. Before considering the Malliavin differentiability, we now prove that there is a following Brownian motion ![]() which will become useful later.

which will become useful later.

Lemma 4.1. There exists a Brownian motion ![]() independent of

independent of ![]() with

with![]() .

.

Proof. From the definition of![]() , we have

, we have![]() . At

. At

first we prove that ![]() is independent of

is independent of![]() . Since we easily have

. Since we easily have![]() , so

, so ![]() is independent of

is independent of![]() . Using Lêby’s theorem, we conclude

. Using Lêby’s theorem, we conclude ![]() is a Brownian motion. We can easily verify that

is a Brownian motion. We can easily verify that ![]() is also martingale. Consider the quadratic variation

is also martingale. Consider the quadratic variation ![]() of

of![]() . Then we have

. Then we have

![]() (4.8)

(4.8)

Hence by the Lêvy’s theorem, ![]() is a Brownian motion.

is a Brownian motion.

Instead of the dynamics (4.5), (4.6) and (4.7), replacing ![]() by

by![]() , then we can consider the following

, then we can consider the following

![]() (4.9)

(4.9)

![]() (4.10)

(4.10)

where ![]() and

and ![]() are independent. Note that we assume that

are independent. Note that we assume that ![]() and

and ![]() follow the dynamics (4.7) and (4.8) under the risk neutral measure.

follow the dynamics (4.7) and (4.8) under the risk neutral measure.

4.3. Arbitrage

Under the real measure, the CEV-type Heston model follows the following dynamics

![]() (4.11)

(4.11)

![]() (4.12)

(4.12)

where ![]() and

and ![]() are independent. Here u denotes the expected return of

are independent. Here u denotes the expected return of![]() . In business, u is assumed to equal to the risk free rate. In order to do this, we will change the real measure P to the measure Q called the risk-neutral measure. We consider the arbitrage but this problem is complicated, since the volatility is not tractable. However, we obtain the following theorem.

. In business, u is assumed to equal to the risk free rate. In order to do this, we will change the real measure P to the measure Q called the risk-neutral measure. We consider the arbitrage but this problem is complicated, since the volatility is not tractable. However, we obtain the following theorem.

Theorem 4.1. The CEV-type Heston model following (4.9) and (4.10) is free of arbitrage and there is a risk-neutral measure Q

![]() (4.13)

(4.13)

![]() (4.14)

(4.14)

Proof. We consider the interval![]() . First we solve the equation

. First we solve the equation

![]() . In order to solve this, we put

. In order to solve this, we put![]() . From

. From

Lemma 3.1, ![]() is positive a.s. so we have

is positive a.s. so we have![]() . Here

. Here ![]() is obviously progressively measurable. Moreover, we can easily see that

is obviously progressively measurable. Moreover, we can easily see that ![]() is locally bounded and in

is locally bounded and in![]() . Let

. Let ![]() where

where![]() .

.

It is well-known that if we can prove that ![]() is a martingale, then the market is free of arbitrage and under the risk neutral measure Q with

is a martingale, then the market is free of arbitrage and under the risk neutral measure Q with ![]() . Note that

. Note that ![]() is replaced by

is replaced by ![]() which is a Brownian motion under Q. Here we must prove that for all

which is a Brownian motion under Q. Here we must prove that for all![]() ,

,![]() . Fix

. Fix ![]() and let

and let ![]() with

with![]() . Here

. Here ![]() is bounded, so we have

is bounded, so we have ![]() is bounded. From Novikov’s criteria, we have that

is bounded. From Novikov’s criteria, we have that ![]() is a uniformly integrable martingale for any

is a uniformly integrable martingale for any![]() . Moreover, from the continuity of

. Moreover, from the continuity of ![]() and Lemma 3.1,

and Lemma 3.1, ![]() increases to infinity. Since

increases to infinity. Since ![]() is positive a.s.,

is positive a.s., ![]() converges to

converges to ![]() as

as![]() , and then by using the monotone convergence theorem

, and then by using the monotone convergence theorem

![]() (4.15)

(4.15)

Here we have![]() , so letting

, so letting ![]() be the measure satisfying

be the measure satisfying![]() , and then we have

, and then we have

![]() (4.16)

(4.16)

We must prove![]() . First we prove

. First we prove![]() . From Girsanov’s theorem, the processes

. From Girsanov’s theorem, the processes ![]() and

and ![]() are

are ![]() -Brownian motion s under the measure

-Brownian motion s under the measure![]() . Note that

. Note that ![]() is an

is an ![]() -adapted Brownian motion under

-adapted Brownian motion under ![]() for all n. We have known that under the measure P,

for all n. We have known that under the measure P, ![]() follows the equation

follows the equation

![]() (4.17)

(4.17)

Integrals under P and ![]() are the same, so

are the same, so ![]() also satisfies the above stochastic differential equation under

also satisfies the above stochastic differential equation under![]() . From Lemma 3.1, the solution

. From Lemma 3.1, the solution ![]() is unique. Hence the distribution of

is unique. Hence the distribution of ![]() under the measure

under the measure ![]() must be the same as the distribution of

must be the same as the distribution of ![]() under the measure P, and then we can conclude that the distribution

under the measure P, and then we can conclude that the distribution ![]() is the same under P and

is the same under P and![]() , that is,

, that is,![]() . Since

. Since ![]() tends to

tends to ![]() a.s.,

a.s.,![]() . Hence we can conclude

. Hence we can conclude ![]() and

and ![]() is a martingale. Then the market is free of arbitrage.

is a martingale. Then the market is free of arbitrage.

This theorem implies that the dynamics for the volatility process is preserved, and the drift term of the underlying asset is changed from u to r. In the sequel, we will consider the CEV-type Heston model under the risk-neutral measure denoted by P not by Q.

4.4. Malliavin Differentiability of the CEV-Type Heston Model (Logarithmic Price)

From now on, we denote by D and ![]() two Malliavin derivatives with respect to

two Malliavin derivatives with respect to ![]() and

and![]() , respectively. We now consider the logarithmic price

, respectively. We now consider the logarithmic price![]() . First, we will prove that

. First, we will prove that ![]() is Malliavin differentiable. By Itô’s formula, we have

is Malliavin differentiable. By Itô’s formula, we have

![]() (4.18)

(4.18)

with![]() . Here

. Here ![]() is neither differentiable at

is neither differentiable at ![]() in 0 nor Lipschitz continuous. Hence we will now approximate this stochastic differential equation by one with Lipschitz continuous coefficients and prove the Malliavin differentiability of

in 0 nor Lipschitz continuous. Hence we will now approximate this stochastic differential equation by one with Lipschitz continuous coefficients and prove the Malliavin differentiability of![]() . Let

. Let

![]() (4.19)

(4.19)

Here we can easily verify that ![]() is bounded and continuously differentiable. Moreover we can verify that both

is bounded and continuously differentiable. Moreover we can verify that both ![]() and

and ![]() are Lipschitz

are Lipschitz

continuous. In Section 3, we have used the stochastic process ![]() with Lipschitz continuous coefficients, instead of

with Lipschitz continuous coefficients, instead of![]() . We will now prove the Malliavin differentiability of the two stochastic processes

. We will now prove the Malliavin differentiability of the two stochastic processes ![]() and the following approximation process

and the following approximation process ![]() of X with Lipschitz coefficients. Naturally, instead of

of X with Lipschitz coefficients. Naturally, instead of![]() , we consider the following stochastic differential equation

, we consider the following stochastic differential equation

![]() (4.20)

(4.20)

with![]() .

.

Lemma 4.2. We have ![]() in

in![]() .

.

Proof. From the inquality![]() , we have

, we have

![]() (4.21)

(4.21)

We have using Cauchy-Schwarz’s inequality and Itô’s isometry,

![]() (4.22)

(4.22)

For the second term, since both ![]() and

and ![]() are positive a.s. and for

are positive a.s. and for![]() ,

, ![]() , we have

, we have

![]() (4.23)

(4.23)

By the scenarios in Subsection 3.3 and Subsection 3.4, we have that for almost all ![]() there exists a positive constant

there exists a positive constant ![]() such that for all

such that for all![]() ,

,![]() . For such

. For such![]() , let

, let

![]() (4.24)

(4.24)

with![]() , then we have

, then we have ![]() for

for![]() . Hence we can have

. Hence we can have![]() , for

, for![]() . And then we can have

. And then we can have ![]() as

as ![]() ,

, ![]() for all

for all![]() . Since

. Since ![]() and

and ![]() ,

,![]() . Here

. Here ![]() is

is ![]() -integrable for all

-integrable for all ![]() so we can conclude that for all

so we can conclude that for all![]() ,

, ![]() in

in![]() . We have from Fubini’s theorem,

. We have from Fubini’s theorem, ![]() in

in![]() .

.

The following theorem implies that ![]() is Malliavin differentiable.

is Malliavin differentiable.

Theorem 4.2. ![]() belongs to

belongs to ![]() and the Malliavin derivatives are given by

and the Malliavin derivatives are given by

![]() (4.25)

(4.25)

![]() (4.26)

(4.26)

for![]() , and

, and ![]() for

for![]() .

.

Proof. Since the coefficients of stochastic differential equations for ![]() and

and ![]() are Lipschitz continuous, we can use Theorem 2.2. At first, we can conclude that

are Lipschitz continuous, we can use Theorem 2.2. At first, we can conclude that ![]() and the derivatives are given by

and the derivatives are given by

![]() (4.27)

(4.27)

![]() (4.28)

(4.28)

for ![]() and

and ![]() for

for![]() .

.

Moreover we can also conclude that ![]() and the derivatives are given by the following

and the derivatives are given by the following

![]() (4.29)

(4.29)

![]() (4.30)

(4.30)

for![]() , and

, and ![]() for

for![]() .

.

We only consider the case![]() . First we consider the Malliavin derivative

. First we consider the Malliavin derivative![]() . By Lemma 4.2 and the proof, we have

. By Lemma 4.2 and the proof, we have ![]() in

in ![]() and

and ![]() in

in![]() . Moreover,

. Moreover, ![]() is bounded, so we can use Lemma 2.4. Hence we can conclude

is bounded, so we can use Lemma 2.4. Hence we can conclude![]() . We consider the Malliavin derivative

. We consider the Malliavin derivative![]() . For the first term, we need prove

. For the first term, we need prove

![]() (4.31)

(4.31)

Here we have that

![]() (4.32)

(4.32)

This converges to 0 in ![]() by the proof of Lemma 4.2, Lemma 3.8, Theorem 3.2, and Lemma 3.1. Hence we can conclude

by the proof of Lemma 4.2, Lemma 3.8, Theorem 3.2, and Lemma 3.1. Hence we can conclude ![]() in

in![]() . For the second term, as well as the case for

. For the second term, as well as the case for![]() , we can prove that

, we can prove that ![]() in

in![]() . For the third term, we will prove

. For the third term, we will prove ![]() in

in![]() . We have from Itô’s isometry,

. We have from Itô’s isometry,

![]() (4.33)

(4.33)

This converges to 0 in ![]() as well as the first term, so we can conclude that

as well as the first term, so we can conclude that

![]() (4.34)

(4.34)

By Lemma 2.4, we have

![]() (4.35)

(4.35)

Remark 2. For![]() , as well as Theorem 4.1, we can more easily prove

, as well as Theorem 4.1, we can more easily prove

![]() (4.36)

(4.36)

![]() (4.37)

(4.37)

for![]() , and

, and ![]() for

for![]() .

.

4.5. Malliavin Differentiability of the CEV-Type Heston Model (Actual Price)

From now on, we will concentrate on the underlying asset ![]() and the volatility

and the volatility![]() .

.

In Subsection 4.4, we proved the Malliavin differentiability of the logarithmic price ![]() and the transformed volatility

and the transformed volatility![]() . Here we can prove that both of the underlying asset

. Here we can prove that both of the underlying asset ![]() and the volatility

and the volatility ![]() are Malliavin differentiabile by the chain rule.

are Malliavin differentiabile by the chain rule.

Theorem 4.3. ![]() and

and ![]() belong to

belong to ![]() and we have

and we have

![]() (4.38)

(4.38)

![]() (4.39)

(4.39)

![]() (4.40)

(4.40)

![]() (4.41)

(4.41)

for![]() , and

, and ![]() for

for![]() .

.

Proof. First we consider the Malliavin derivative for![]() . By Lemma 2.5, we have

. By Lemma 2.5, we have

![]() (4.42)

(4.42)

![]() (4.43)

(4.43)

We have by Theorem 4.2

![]() (4.44)

(4.44)

![]() (4.45)

(4.45)

for![]() , and

, and ![]() for

for![]() . Next, we consider the Malliavin derivative for

. Next, we consider the Malliavin derivative for![]() . By Lemma 2.5, we have

. By Lemma 2.5, we have

![]() (4.46)

(4.46)

![]() (4.47)

(4.47)

Hence by Theorem 4.2, we have

![]() (4.48)

(4.48)

![]() (4.49)

(4.49)

for ![]() and

and ![]() for

for![]() .

.

4.6. Delta and Rho

Using Theorem 2.4 and Theorem 4.4, we can calculate Greeks of![]() . We now consider the following stochastic differential equations

. We now consider the following stochastic differential equations

![]() (4.50)

(4.50)

![]() (4.51)

(4.51)

Rewrite the stochastic differential Equations (4.15) and (4.16) as the integral form, and then we have

![]() (4.52)

(4.52)

We now give the formula for Delta of this model.

Theorem 4.4. Consider the CEV-type Heston model following the dynamics (4.15) and (4.16). We have for any funtion with polynomial growth ![]()

![]() (4.53)

(4.53)

Proof. Let ![]() be the diffusion matrix

be the diffusion matrix![]() , then we can have the inverse

, then we can have the inverse![]() . We can have from the Itô’s formula

. We can have from the Itô’s formula

![]() (4.54)

(4.54)

Hence we can directly calculate the first variation process ![]() of

of ![]() as

as![]() . Then we can have

. Then we can have

![]() (4.55)

(4.55)

By Lemma 3.2, we have![]() . As with Theorem 4.3, let

. As with Theorem 4.3, let ![]() be the column with the form

be the column with the form![]() . Since

. Since ![]() and

and ![]() are Malliavin differentiable we have from Theorem 2.4

are Malliavin differentiable we have from Theorem 2.4

![]() (4.56)

(4.56)

Moreover we can calculate a Greek, Rho![]() .

.

Theorem 4.5. Consider the CEV-type Heston model following the dynamics (4.15) and (4.16). Then for any ![]() of polynomial growth, we have

of polynomial growth, we have

![]() (4.57)

(4.57)

Proof. By the definition of![]() , we have

, we have

![]() (4.58)

(4.58)

and ![]() as

as![]() . Here we have

. Here we have

![]() (4.59)

(4.59)

By the above formula, we have

![]() (4.60)

(4.60)

5. Conclusions

From Sections 3 and 4, it is proved by using unique transformation and approximation that we can apply Malliavin calculus to the CEV model and the CEV-type Heston model both of which have non-Lipschitz coefficients in their processes. Then we can provide the formulas to calculate important Greeks as Delta and Rho of these models and contribute to finance, in particular for traders in financial institutions to measure market risks and hedge their portfolios in terms of Delta Hedge.

In the future, it will be required how to calculate the Vega, one of the most important Greeks, for general stochastic volatility models including the CEV-type Heston model. Vega is the sensitivity for volatility but it is difficult to measure Vega for the stochastic volatility models since the volatility is also stochastic process. After the financial crisis, the necessity to grasp the behavior of volatility is increasing. We believe that we can calculate the vega of some important stochastic volatility models such as the Heston model or the CEV-type Heston model by using our results in Sections 3 and 4.