1. Introduction

On November 8, 2012, “Beautiful China” appeared for the first time in the report of the 18th National Congress of the Communist Party of China (hereinafter referred to as the “Report”). In October 2015, at the Fifth Plenary Session of the 18th Central Committee, “Beautiful China” was included in the “13th Five-Year Plan”. On October 18, 2017, Comrade Xi Jinping pointed out in the report of the 19th National Congress of the CPC that we should accelerate the reform of the ecological civilization system and build a beautiful China. Environmental issues have risen to the level of national strategy, and become one of the issues that governments are most concerned about today. How to deal with environmental issues from the institutional and legislative level, alleviate public anxiety and strengthen trust in the government, has become one of the hotly debated topics. As early as 1979, the Standing Committee of the National People’s Congress passed and promulgated the Environmental Protection Law of the People’s Republic of China (Trial), and in 1989 the first Environmental Protection Law of the People’s Republic of China was officially promulgated. The amendments to the Environmental Protection Law of the People’s Republic of China in 2011 were included in the legislative plan of the Eleventh National People’s Congress, and after four reviews, two public consultations were conducted. Until April 24, 2014, the Eighth Meeting of the Standing Committee of the Twelfth National People’s Congress passed the Environmental Protection Law of the People’s Republic of China (hereinafter referred to as the new Environmental Protection Law), which will come into effect on January 1, 2015. So far, China’s basic environmental law has been revised for the first time in 25 years. The new Environmental Protection Law is called “the strictest environmental protection law in history”, which is mainly reflected in novel ideas, enhanced technology, regulatory transformation, tough means, public participation and severe punishment.

The Certified Public Accountant (hereinafter referred to as CPA), as the supervisor of the company’s financial accounting information disclosure, bears important supervision responsibilities for listed companies’ financial fraud and disclosure of financial information in violation of regulations. In the process of performing auditing business, CPA needs to screen, analyze, and evaluate the risks existing in listed companies. When the audited entity faces significant uncertainties such as large contingent liabilities and fines, the CPA will face higher audit risks. Risk-oriented auditing is the mainstream auditing method today. “Chinese Certified Public Accountant Auditing Standards No. 1631-Consideration of Environmental Matters in the Audit of Financial Statements” requires certified public accountants to consider environmental protection requirements and issues that have a significant impact on the industry and business of the audited entity when implementing the risk assessment process, such as environmental laws and regulations applicable to the audited entity. Some environmental matters have a direct impact on the determination of significant amounts and disclosures in the financial statements, and CPA needs to obtain sufficient and appropriate audit evidence on the matter.

At the same time, the new Environmental Protection Law adds a series of strict regulations. For example, Article 60, Chapter 4 stipulates that enterprises, institutions, and other operators exceed the pollutant emission standards or exceed the key pollutant emission control targets to discharge pollution. The competent department of environmental protection of the people’s government at or above the county level may order it to take measures to restrict production, suspend production and rectify; if the circumstances are serious, report it to the people’s government with the right of approval for order to suspend business or close it. Article 61 stipulates that if a construction unit fails to submit an environmental impact assessment document for a construction project or the environmental impact assessment document is started without approval in accordance with the law, the department in charge of environmental protection supervision and management shall order the construction to be stopped, fined, and ordered to return to its original state. It can be seen from the above-mentioned laws that most of the provisions of the Environmental Protection Law belong to other laws and regulations that do not have direct impact on the determination of the amounts and disclosures in the financial statements. However, violations of laws and regulations can have a significant impact on financial statements. This means that if CPA does not implement the necessary audit procedures, it may issue an inappropriate audit report. Therefore, when designing and implementing audit procedures and evaluating and reporting audit results, CPA should pay full attention to the significant impact that audited entities’ violations of environmental laws and regulations may have on the financial statements.

In addition, the reduction of environmental pollution requires large costs, which will affect investor decisions. All of these require the CPA to pay the necessary attention to the important environmental information that affects financial reporting from the perspective of materiality.

However, according to the existing cases of violations of the new Environmental Protection Law, there have been no cases in which companies violated the new Environmental Protection Law and faced serious consequences and involved CPA. Moreover, in a series of environmental protection systems, the content related to environmental audit is very limited. In addition, due to the inherent limitations of audits, such as laws and regulations that cannot be obtained by financial-related information systems, violations of laws and regulations may involve intentional concealment, and whether an act is illegal can only be determined by a court. The CPA is not expected to find all the companies’ violations of laws and regulations. In addition, existing literature indicates that the audit market is in a fully competitive market. Audit fees should ultimately come out of a balanced price under market competition. But the reality is that audit fees have not completely changed with labor costs, workload, risks, and audit efficiency. Therefore, whether the new Environmental Protection Law can affect audit fees is still a topic worthy of study.

The first chapter is the introduction. It mainly expounds the background and significance of topic selection, and puts forward the research ideas, research methods and possible contributions of this article. The second chapter is the literature review and hypothesis development. It mainly summarizes and briefly reviews the literature on the influencing factors of audit fees, the economic consequences of environmental policies, and environmental factors and audit fees. Then put forward the assumption that after the implementation of the new Environmental Protection Law, the audit fees of heavy polluting enterprises will increase more significantly, and study the differences in the degree of impact of the new Environmental Protection Law on audit fees in different areas of legal environment and environmental regulation. The third chapter is research design and samples. This paper introduces DID method used to achieve the research purpose of this paper, the method of selecting samples, defining variables, analyzing the descriptive statistical results of variables, and Pearson correlation analysis. The fourth chapter is hypothesis testing. Taking the data of A-share listed companies in Shanghai and Shenzhen from 2012 to 2016 (excluding 2014) as a sample, using multiple regression analysis to verify the difference in the impact of audit fees between heavy polluting and non-heavy polluting companies after the implementation of the new Environmental Protection Law, and further analyze the impact of different legal environments and environmental regulatory regions. The following part is the robustness test. Endogenous tests and placebo tests are used to verify whether the conclusions drawn in the empirical analysis are reliable. Chapter 5 is the conclusion and prospect.

The innovation of this article is to use the new Environmental Protection Law as the “quasi-natural experiment” and the double difference method (DID) to study the impact of government laws and regulations on the increase of audit fees for heavy polluting enterprises, and enrich relevant literature about the impact of macro policies on audit fees and provide new perspectives for future research. It is helpful to evaluate the implementation effect and economic consequences of the new Environmental Protection Law from the perspective of the micro-level reflection of enterprises and accounting firms, which has certain reference significance for relevant regulatory departments and policy-making departments.

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.1.1. Influencing Factors of Audit Fees

Studies on the influencing factors of audit fees have been conducted for nearly 20 years. As the originator of audit fees, Simunic (1980) used multiple linear regression methods to find 10 important factors affect audit fees. It believes that the size of the audited unit’s assets is the most important factor in determining audit fees, followed by the type of industry in which the audited unit is located, the asset-liability ratio, the profit and loss status, the type of audit opinion issued by the certified public accountant, and the internal audit of the companies. While the accounting rate of return has no significant effect on audit fees. Firth (1985) studied the audit fee influencing factors of listed companies in New Zealand, and concluded that the total assets of the companies, the ratio of receivables to total assets, and non-systemic risk are the three most important variables that affect audit fees. Al-Harshani (2008) believes that the liquidity ratio and profitability have an important impact on audit costs. Schelleman & Knechel (2010) research found that whether the audited unit incurred losses and audit costs were positively significant.

Simunic (1980), Palmrose (1986), Simunic & Stein (1995) use the data from the United States as a sample to find that the audit fees of companies with high legal risks in the United States market are also relatively high. The empirical results support the above view. The research by Bell et al. (2001) shows that although the litigation risk perceived by the CPA does not affect the level of the unit hour charge, it is positively related to the total number of audit hours and thus positively related to the total audit cost. Seetharaman et al. (2002) clearly stated that the macro legal situation of a country affects audit risks. Its research found that CPA charge higher audit fees for companies listed in regions with more stringent legal regulations.

2.1.2. The Economic Consequences of Environmental Policies

Studies by Blacconiere & Patten (1994) and Patten & Nance (1999) point out that the introduction of environmental laws and regulations may bring negative effects to enterprises, and environmental information disclosure is conducive to weakening this effect, which in turn is beneficial to the market response of enterprises and affects stock price. Shang et al. (2007) and Yao & Zhou (2017) believe that the promulgation of environmental laws and regulations directly affects the level of environmental information disclosure of enterprises. Zhou & Tao (2012) showed that political factors play an important role in environmental information disclosure. Ge & Huang (2002) pointed out that when the cost of corporate information disclosure is greater than the revenue, the company has a fraudulent motive, reducing the level of information disclosure, and causing regulators to exert pressure on management. Related laws and regulations therefore form a “public contract” (Fang & Xiang, 2009) are particularly important to make up for the lack of corporate social responsibility. Tang, Li, & Wu (2013) found that the lack of investment in listed companies is common in China. Environmental protection investment is a “passive action”. The strength of government environmental regulation has a threshold effect on environmental protection investment of enterprises. Non-heavy polluting companies will invest more in environmental protection investment. Research by Du & Du (2014) shows that a sound legal environment is conducive to the promotion of corporate social responsibility. Research by Zheng & Xu (2018) shows that the new Environmental Protection Law has a positive impact on the quality of corporate environmental information disclosure and forms a complementary role with market mechanisms.

2.1.3. Environmental Factors and Audit Fees

Han et al. (2014) pointed out that in the audit of financial statements, CPA pays attention to the environmental issues of the audited entity. Disclosure of government environmental subsidies and social responsibility reports by the listed companies will reduce the information risk of the enterprise, thereby reducing audit costs. However, Chen & Seng (2016) found that the more detailed environmental information disclosure of heavily polluting listed companies, the greater the audit investment of CPA and the higher the audit fees. Li, Chen, & Wen (2018) found that the audit costs of heavy polluting companies were significantly higher than those of other companies after controlling company characteristics. At the same time, the audit costs of environmentally friendly companies were not significantly different from those of other companies. Yu, He, & Xia (2018) proposed that local government environmental regulations increase the audit fees of private companies in heavy polluting listed companies in their jurisdictions.

2.2. Hypothesis Development

It is generally believed that audit fees are composed of audit workload, risk costs, and the firm’s normal profits (Wu, 2003). The promulgation of the new Environmental Protection Law through strict legal supervision of the environment can increase the risk of environmental violations of the audited units, increase the cost of audit products and risk costs, and ultimately affect audit costs. Specifically, the impact comes from two sources.

First, it affects risk costs. The new Environmental Protection Law has improved the status of environmental protection responsibilities in the normal production and operation of enterprises. This means that the company’s production and operation activities will face higher risks of environmental violations, and increase the risk that the CPA will provide reasonable assurance that the listed company will not have significant misstatement. Under the new Environmental Protection Law, on the one hand, the risks of the audited entities are directly increased, thereby increasing the possibility of major misstatements in their financial reports. CPA needs to be familiar with the corresponding environmental laws and regulations to deal with more complex businesses, increasing the possibility of audit failure. On the other hand, in order to cope with the higher legal risks that may be faced, CPA needs to compensate for possible penalties and damages through high audit fees. Based on this, CPA needs to increase audit fees to cover the cost of risks.

Second, it affects audit workload. The new Environmental Protection Law requires companies to make more comprehensive and true environmental information disclosure and increases the impact of environmental protection incidents on corporate financial statements. This means that CPA needs to understand the environmental protection requirements affecting the industry and the audited unit’s business activities, and the impact of new laws and regulations on the audited unit. The promulgation of the new Environmental Protection Law requires that CPA becomes familiar with its laws and regulations, thereby increasing the complexity of auditing operations. It also requires CPA to have a stronger sense of environmental protection and higher professional skills, implement more audit procedures, expand the scope of substantive testing, increase the cost of audit products, thereby increasing audit fees. In addition, when considering whether an act of the audited entity violates relevant laws and regulations, the CPA should seek legal opinions and make use of the work of experts. Because judging whether certain actions are illegal or not requires legal rulings, it usually exceeds the professional competence of CPA. Although sometimes the knowledge obtained by CPA through training, personal practice experience, and understanding of the audited entity and its environment may provide a basis for determining whether a behavior that attracts its attention violates laws and regulations, this undoubtedly increases The time spent for the purpose.

Under the strict legislation standards of the new Environmental Protection Law, heavy polluting enterprises face higher operating risks and litigation risks than non-heavily polluting enterprises because they are more likely to violate Environmental Protection Laws, and they need to increase workload when CPA perform auditing operations under the same conditions. At the same time, heavy polluting companies have an incentive to pass high-quality signals to the capital market through high-quality financial reports. In order to obtain high-quality financial reports, heavy polluting companies may require CPA to increase audit input, and CPA may in turn charge higher audit fees. Therefore, this article proposes Hypothesis 1:

After the implementation of the new Environmental Protection Law, compared with non-heavy polluting enterprises, the audit fees of heavy polluting enterprises have increased significantly.

The legal environment is a variety of legal factors that affect corporate activities, including national legal norms, legal awareness of national judicial organs and social organizations. As China is a country with a transitional economy, the development of the audit market mainly depends on the promotion of the government, and the legal environment lags behind the development of economic construction, which makes the legal risks faced by certified public accountants relatively low (Liu & Xu, 2002). Coupled with the unobservability of specific operations using auditing standards in the audit process and the inherent limitations of auditing, the litigation risks faced by domestic CPAs are relatively low. In contrast, in the United States and other countries with more complete laws, the use of group lawsuits and inversion of evidence in combination with a strict law enforcement system has greatly increased the audit risk and corresponding legal costs of certified public accountants. This result not only guarantees the audit quality of its CPA, but also provides a good basis for its securities market development. The audit pricing model of Simunic (1980) pointed out that the high audit risks faced by the securities market will eventually be reflected in the high audit fees required by CPA. Specifically, in regions with good legal environments, the probability of audit failure being detected will increase. In order to reduce the risk of audit failure, the CPA needs to increase audit investment; in order to cope with the higher legal risks that may be faced, the CPA needs to make up for possible penalties and damages through high audit fees. In 2002, Seeharaman pointed out that the legal environment at the national level will affect audit fees, and countries with good legal environments will charge higher audit fees. Although China’s current legal system is still imperfect and the local differences in legal progress are greater (Wang et al., 2019), considerable progress has been made in the construction of the legal environment (Wang & Yu, 2006). Existing literature points out that Chinese CPAs have paid attention to legal environment risks in the course of their practice. And with the application of risk-oriented auditing and the promulgation of the “Several Provisions on the Trial of Civil Tort Compensation Cases Involving Accounting Firms in Auditing Business Activities” of the Supreme People’s Court in 2007, the CPA has a better understanding of the civil liabilities and litigation risks to be undertaken in the practice process. Following the “legal environment-audit risk-audit pricing” approach, this article proposes Hypothesis 2:

After the implementation of the new Environmental Protection Law, in areas with a good legal environment, the audit costs of heavy polluting enterprises have increased significantly.

Environmental regulation is a binding force that aims to protect the environment, targets individuals or organizations, and has tangible systems or intangible consciousness as its existence (Zhao, Zhu, & He, 2009). Tang et al. (2013) pointed out that when the cost of complying with environmental regulations is less than the factor endowment advantage, the company can obtain benefits. Therefore, with the increase of the government’s environmental regulations, the cost for companies to violate environmental protection policies will be higher, which will lead to enterprises to comply with environmental protection systems, improve environmental investment and transparency of environmental information. Han (2013) found that the level of detail in corporate environmental information disclosure is negatively related to the probability of non-standard audit opinions issued by certified public accountants, and positively related to audit fees. Yu, He, & Xia (2018) have empirically found that the stronger the local government’s environmental regulations, the greater the cost of audit procedures and risks faced by local companies, and the higher the audit fees. Based on this, this article proposes Hypothesis 3:

After the implementation of the new Environmental Protection Law, in areas with strong environmental regulations, the audit fees of heavy polluting enterprises will increase more significantly.

3. Research Design and Samples

3.1. Research Design

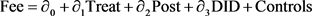

When testing the impact of policy implementation effects, the DID method is usually used for regression analysis. This paper draws on the research of Bertrand et al. (2004). The core of the DID is to construct an “experimental group” formed by heavy polluting listed companies and a “control group” formed by non-heavy polluting listed companies and compares the differences between the experimental group and the control group before and after the implementation of stricter environmental laws and regulations, thereby testing the effect of the new Environmental Protection Law. This article uses audit fees (Fee) as explanatory variables. The interpretation variable heavy pollution (Treat) indicates whether the enterprise concerned is a highly polluting enterprise. If the enterprise is a highly polluting enterprise, the value is 1; otherwise, it is 0. The introduction of the variable time (Post) measures the progress of policy implementation. If it is the year of enactment of the policy law and thereafter, the value is 1; otherwise, it is 0. In order to test the effect of policy implementation, this article sets up a crossover term “DID”, which is a crossover term between “Treat” and “Post”. Only when the two variables Treat and Post are set to 1 at the same time, DID is set to 1, and other cases are set to 0. This indicator is used to measure the impact of strict environmental protection laws on audit risks. Using this form, the observations can be divided into 4 groups: the experimental group before the reform (Treat = 1, Post = 0), the experimental group after the reform (Treat = 1, Post = 1), and the control group before the reform (Treat = 0, Post = 0), the control group after reform (Treat = 0, Post = 1). Then the DID model is as follows:

As can be seen from the above formula, the ultimate impact of the implementation of stricter environmental protection laws is the coefficient of the crossover term α3. If the implementation of stricter environmental laws has a positive effect on audit risk, the sign is positive, otherwise it is negative. After dealing with the DID method, those general factors that affect audit risks will be eliminated. This article can also more accurately study the impact of strict environmental protection laws on audit risks.

3.2. Samples

This article takes 2015 as the starting year, and selects two years before and after the implementation of the new Environmental Protection Law as the window of research. As the audit fees may be determined before the firm and the audited entity enter the substantive cooperation stage, or before or after the audit report is issued, there is uncertainty in the timing of the 2014 annual report audit fees. That is, it cannot be determined whether it is before the policy implementation. At the same time, the new Environmental Protection Law was passed on April 24, 2014. Although not implemented, it may have an impact on the audit fees in 2014. In order to eliminate the bias caused by uncertainty, the sample in 2014 is excluded, so the sample interval before implementation is actually 2012-2013, and the sample interval after implementation is 2015-2016. Taking the Shanghai and Shenzhen A-share listed companies as the research sample, after excluding ST, * ST, financial companies with missing data, 8403 observations were finally obtained. Among them, the classification of heavy polluting enterprises is based on the classification of heavy polluting industries by the Guide to Environmental Information Disclosure of Listed Companies (Draft for Soliciting Opinions) published by the former Ministry of Environmental Protection in 2010, and referring to the Regulations on Environmental Protection Verification by Enterprises and Companies Applying for Refinancing and the List of Classified Management of Environmental Protection Verification Industry of Listed Companies issued in 2008. According to the above-mentioned guidelines, regulations and management list, a total of 15 industries including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemicals, petrochemicals, building materials, papermaking, brewing, pharmaceuticals, textiles, mining, and tanning are classified as heavy pollution industry. According to the industry name and classification, this article matches the heavily polluted listed companies from the CSMAR database according to the 2012 industry classification standards of the CSRC. The data in this article are derived from the following three ways: 1) The amount of investment completed in regional industrial pollution control and the value-added of regional industry are manually extracted from the statistical yearbook on the website of the National Bureau of Statistics. 2) The original data of the legal environment, that is, “the development of market intermediary organizations and the environment of the rule of law”, is extracted from the Report on Marketization Index of China by Province (2018) (Wang, Fan, & Hu, 2019). 3) All other data are derived from the CSMAR Database. In order to overcome the influence of outliers on the conclusions of the study, the extreme values of the main continuity variables (1% at the beginning and end) were treated with Winsorize. The data processing software used in this article is Excel 2010 and Stata 12.

3.3. Variable Definitions

The variable definitions are shown in Table 1.

3.4. Descriptive Statistics

The main descriptive statistical results are shown in Table 2. According to the results, the number of samples before and after the implementation of the policy is equal, with an average value of 0.5; the number of heavy polluting enterprises is smaller than that of non-heavy polluting enterprises, with an average value of 0.30, which is consistent with the descriptive statistics of existing literature. Compare relevant literature, control variables-change of firm, audit opinion, profitability, quick ratio, financial leverage, size of audited unit, loss, type of accounting firm, business complexity, market value book value, and audited unit’s The data characteristics of property rights are similar.

4. Hypothesis Testing

4.1. Regression Analysis

Table 3, column 1 reports the test of Hypothesis 1 for the entire sample, showing the changes in audit fees before and after the implementation of the new Environmental Protection Law. After adding a series of control variables, the DID term most concerned in this paper is significantly positive, which validates Hypothesis 1. After the implementation of the new Environmental Protection Law, the audit fees of heavy polluting companies are significantly higher than those of non-heavy polluting companies.

It can also be seen from the regression results in Table 3, column 2 and 3 that after the implementation of the new Environmental Protection Law in areas with a good legal environment, the increase in audit fees paid by heavy polluting companies is significantly higher than the increase in audit fees paid by non-heavy polluting companies. Indicating that in a relatively good legal environment, the possibility of effective implementation of the law is greater. The greater the litigation risks faced by the heavy polluting companies for violating the new Environmental Protection Law, the greater the audit risk and corresponding workload of the CPA, so higher audit fees will be charged to deal with them. In areas where the legal environment is relatively poor, there is no significant difference between the increase in audit fees of heavy polluting companies and the increase in audit fees paid by non-heavy polluting companies, which is basically consistent with the assumption of Hypothesis 2. The impact of the new Environmental Protection Law may be limited by the effective implementation of local laws, or there may be a series of other complex reasons.

In areas with strong environmental regulations, the government pays more attention to environmental protection matters and adopts a series of orders-controlled environmental regulations. The market also pays attention to environmental-related matters, promotes the implementation of market-based environmental regulatory measures, and promotes the implementation of certain voluntary actions by companies to pass their compliance with laws and regulations related to environmental protection and fulfill their social responsibili-

ties. In areas with low environmental regulations, environmental protection-related matters may not be valued, and the high risks of heavily polluting companies under similar conditions may not be passed on to the audit practice. It can be seen from Table 3, column 4 and 5 that in areas with strong environmental regulations, after the implementation of the new Environmental Protection Law, the audit fee increase of heavy polluting enterprises is significantly higher than that of non-heavy polluting enterprises; while in areas with less environmental regulation This difference is not significant, and the results verify the rationality of Hypothesis 3. Looking at the control variables, it is roughly similar to the conclusions of the existing literature.

4.2. Robustness Tests

In order to accurately identify the impact of the new Environmental Protection Law on audit fees, this article uses the propensity score matching method to find a control group for heavy polluting enterprises and re-examine. This article selects whether it is a heavy polluting company, year, change of accounting firm, audit opinion, profitability, quick ratio, asset-liability ratio, company size, profitability, business complexity, book to market value ratio, property rights, type of accounting firm. Radius caliper matching was performed for the standard, and the research results were re-examined.

The regression results obtained by the radius caliper matching method are shown in Table 4. Three pieces of data were not successfully matched, and the remaining 8401 pieces of data were matched to become the experimental group or the control group. Among the matching full samples, the DID term is significantly positive, indicating that the added value of audit fees before and after the implementation of the policy is higher for heavy polluting companies than for non-heavy polluting companies. And in the group with good legal environment and strong environmental regulation, the explanatory variable DID coefficient is significantly positive, indicating that the impact of legal environment and environmental regulation on audit costs is consistent with the subject’s regression conclusion. Observing the control variables, it was found to be the same as the previous and existing conclusions.

Because exogenous events may not be unique, the impact of the new Environmental Protection Law on audit costs may not be a fact, that is, there is no special point in time that results in an increase in audit fees. With reference to Chen et al. (2015), this paper uses a placebo test to find out whether the new

![]()

Table 4. Regression results of PSM method.

Environmental Protection Law has unique impact on audit quality. Assume that the new Environmental Protection Law will be implemented in 2016, that is, 2016 will be determined as the year after the implementation of the new Environmental Protection Law. The value will be 1 and the rest will be 0. The regression results showed that the double difference term (DID) was not significant. Looking at other variables, the audit costs of heavy polluting companies are significantly higher than those of non-heavy polluting companies; there is no significant difference between the audit fees after the implementation of the policy and the pre-implementation of the policy. The data results are in line with existing literature and previous data. Further analysis shows that under different regional legal environments and regulatory efforts, the double difference terms are not significant (Table 5).

5. Conclusion

A lot of researches have been done on the influencing factors of audit fees, but few articles have studied the impact on audit fees from the perspective of environmental protection laws and regulations, especially a specific law. The new Environmental Protection Law, as the “most stringent environmental protection law

![]()

Table 5. Regression results of different policy implementation year.

in history”, studies its impact on CPA, which not only can be used to transmit empirical evidence for the effects of the new Environmental Protection Law on companies, but also to formulate relevant policies The department provides the basis for evaluating the effectiveness of the policy.

This article takes 2012-2016 (excluding 2014) A-share listed companies in Shanghai and Shenzhen as a sample, and divides them into experimental and control groups according to whether they belong to heavy polluting industries. The DID method was used to test the impact of the new Environmental Protection Law on audit costs of heavy polluting enterprises. The research in this paper finds that after the implementation of the new Environmental Protection Law, the increase in audit fees of heavy polluting enterprises is significantly higher than that of non-heavy polluting enterprises. Further research found that this phenomenon is more pronounced in areas with good legal environments and strong environmental regulations. This conclusion also reflects the distinct characteristics of the environmental protection cause from a level. The effective implementation of a national environmental protection law depends on the local legal environment and environmental regulation. In order to ensure the reliability of the conclusions, a series of robustness tests were performed in this paper. First, the PSM method was used to match the radius of the experimental group with the control group to resolve possible endogenous problems. After that, this article postponed the implementation time of the new Environmental Protection Law and conducted a placebo test to prove the uniqueness of the policy implementation point. Finally, the paper finds that the conclusions are still valid.

The research in this article shows that the promulgation of the new Environmental Protection Law has aroused the concern of CPA, focusing on the increase in audit costs. However, the new Environmental Protection Law, as a basic law on environmental protection, has a wide scope but does not go into details. Therefore, the new Environmental Protection Law has a limited impact on a specific environmental protection area (air, water, soil, etc.). Although this article concludes that the new Environmental Protection Law has an impact on audit costs, it is undeniable that this impact is still limited. To fully implement the spirit embodied in the Environmental Protection Law, the active cooperation of various departments, central and local institutions is still needed. The effective implementation of a specific legal policy is inseparable from the fertile soil of the macro legal environment and the attention and support of the public, including many stakeholders, including the government, enterprises, and investors.

At present, there are few laws and regulations on environmental auditing in China, which makes environmental auditing impossible due to lack of theoretical basis. In recent years, the environmental protection department has directly affected enterprises through cooperation with a series of departments, and then passed on the impact on accounting firms. For example, on December 26, 2017, the China Securities Regulatory Commission (hereinafter referred to as the “SFC”) issued CSRC Announcements [2017] Nos. 17 and 18 (hereinafter referred to as “Announcements”) to the annual reports and semi-annual reports of listed companies. The content and format of the report information disclosure have been revised uniformly. The announcement clearly requires listed companies to disclose their main environmental information in the company’s annual report and semi-annual report. According to the requirements of the announcement, the key pollutant discharge units or their important subsidiaries announced by the environmental protection department shall disclose the following main environmental information in the company’s annual report and semi-annual report in accordance with the laws, regulations and departmental regulations: pollution information; prevention and control Construction and operation of pollution facilities; environmental impact assessment of construction projects and other environmental protection administrative permits; emergency plans for environmental emergencies; self-monitoring programs for the environment; other environmental information that should be made public. These policy trends undoubtedly affect the audit judgments of accounting firms, but the lack of clear judgment standards and specific issues still need to be resolved by the auditing practice community. It is gratifying that over time, more and more companies have joined the ranks of voluntary disclosure of corporate social responsibility and environmental information. Check out some corporate social responsibility reports and environmental reports, which clearly set out the company’s environmental management situation, environmental insurance, environmental protection law situation, current year and next year’s environmental protection work focus. Promoting economic development and promoting the development of environmental protection are two seemingly contradictory but symbiotic causes. Although the process is difficult and tortuous, the correct goals have been set. It is believed that China’s environmental protection cause will have both “current benefit” and “benefit long-term” effect.