Strategies for Indexed Stock Option Hedgers with Loss-Risk-Minimizing Criterion Based on Monte-Carlo Method ()

1. Introduction

All kinds of contingent claims may be perfectly replicated by self-finance strategy if the market is complete, and the cost to replicate is the fair price of the contingent claim; in an incomplete market, investors may also perfectly replicate a contingent claim by super hedging strategy (Bayraktar & Zhou, 2017), however, with the exception of being costly, super hedging causes the loss of chance to get more profits, thus, many investors are unwilling to do this. In fact, most people only want to pay a small quantity of initial cost to hedge the terminal contingent claim, but they have to endure a level of risk, how to find the optimal hedging strategy for such kind of hedging has been a hot topic in finance. Before seeking for the optimal strategy, we should decide a criterion to measure the risk, a simple and exclusively accepted method is the minimal variance hedging (Last & Penrose, 2011; Makogin, Melnikov, & Mishura, 2017), even though it’s shortcoming to simultaneously punish the profit and the loss; another method to measure risk is VaR (Cong, Tan, & Weng, 2014; Soloviev, 2016; Capiński, 2015), which anticipates the heaviest lost under given criterion level, however, VaR may be given different value for different investors. As for hedging, only potential shortfall will be considered, with an example European claim, investors’ goal is to seek the optimal strategy to minimize the expected loss

, which had been originally researched by Follmer & Leukert (Follmer & Leukert, 2000), and many subsequently research results have achieved (Kim, 2012; Kabaila & Mainzer, 2018).

Unlike traditional options, indexed stock options use market performance as a benchmark reference index, and the option exercise price is a variable that changes with market performance, i.e.

, where IT represents the market performance, or the overall market trend of the stock market, or the performance of competitors in the same industry at the end of the hedging period, while S0 and I0 represent the initial price of the underlying stock and the initial market price, respectively. In this way, even in a bull market, a rise in the market will cause the benchmark reference index to rise, and drive the option exercise price to rise, thereby filter the stock price changes in the market due to non-manager efforts, if the performance level of the company is lower than the benchmark index, the value of stock options may still be zero in a bull market, and managers will not receive huge profits when they execute stock options; Conversely, even in a bear market, if the corporate performance is higher than the benchmark index, the option value can also be positive, and the manager can still get incentives for option returns.

This paper, by taking the expected loss i.e.

, at the end of the hedging period as a risk measure, and using the Monte Carlo method, conducts a study on the hedging strategies for indexed stock option hedgers. Enlightened by Longstaff and Schwartz (Longstaff & Schwartz, 2001), Potters M. et al. (Potters, Bouchaud, & Sestovic, 2001), who priced the option with numerical method, we firstly generate many asset price paths by Monte-Carlos simulation and look on the averaged terminal shortfall as the expected loss, then, basis functions are introduced to estimate hedging positions and finally the optimal strategy is achieved through an algorithm ( Seydel, 2017, Monte-Carlo-Simulation [M]).

2. Some Preliminaries

Assume there are two kinds of assets: risky asset (Security) and riskless asset (Bond). Let

be a complete probability space with filtration

, and the price of risky asset

and the market index (in this paper, which is CSI)

be nonnegative and adapted to F, satisfying:

, (1)

where

are standard Brownian motions,

are Poisson processes with Poisson strength

and respectively independent with

and

,

,

are amplitudes of price jumps and

,

.

Let

be riskless asset’s price process, satisfying:

, r denotes riskless interest rate. (2)

As for random sequence

, let

be a space consisting of all predictable sequences

which satisfies

.

Call a 2-demension stochastic process

be a investment strategy and

,

is an adapted process, satisfying:

,

, (3)

where

is the value of strategy

, when

denotes the hedging position held at time t.

Furthermore, we call it a self-finance strategy when

satisfies:

. (4)

As to strategy

, we define its shortfall risk as the following:

, (5)

where

denote the portfolio value and the stock price at time t respectively,

is a

-measurable and nonnegative random variable which denotes the hedger’s payment reliability at the expiration.

Suppose an investor has initially written a share of European Call Option with the exercising price K and T horizon, in order to minimize the terminal shortfall, he hedges the option by self-financing at discrete time

with

as his initial cost, thus, we can express the hedging model as following:

. (6)

3. Solution

3.1. The Parameter-Estimation of the Price Process

According to the expression (1):

, (7)

where

,

,

.

Let

,

,

be jump times and jump amplitude respectively, MCMC technology has been used to estimate all parameters, i.e. a Markovian chain of each parameter has been drawn from

with observations

and prior distribution

, and averaging the chain as estimator of parameter (Johannes & Polson, 2006).

With the estimated parameters we can produce:

. (8)

3.2. The Monte-Carlo Simulation of Price Process

Let

be the union density function of random vector

,

be conditional density function of

with

being known, according to the Bayesian theory:

.

Theoretically, we can draw

from the union density function

, but in fact, we do the following:

Firstly, drawing

; then,

and so on, drawing

, and we can deduce that the drawn sequence

has a union density function

.

3.3. Strategy Decision

On discrete time

, assuming Bond’s price

, the stock price has been discounted. Under the constraint of self-financing (4), we have:

, (9)

where

,

is the initial cost. Now, substituting (6) with (9), the optimizing problem (6) becoming into:

, (10)

Up to now, our goal is to find a self-financing strategy for optimization problem (10), however, it is a stochastic programming problem, and

depends on the whole price path, so, it is difficult to directly solve (10). Having generated M independent price paths by Monte-Carlo simulation method, solving problem (10) is equivalent to solving the following optimizing problem:

. (11)

Obviously, the unknown variables in (11) equal

, where M denotes the number of scenarios and T denotes the adjusting frequency, thus, it is computationally challenging to directly solve problem (11) when the number of scenarios is large and the adjusting is frequent. In order to simplify (11), we try to approximate holdings

by basis functions, having done this, the number of unknowns at each hedging time is reduced to the number of parameters in the basis functions, which is typically very small.

Assume that the holding

is decided by the underlying stock price at any time t, i.e.

, by definition 1,

, and the Hilbert space

is of countable orthonormal basis, so, the holding

can be linearly represented by basis functions (Potters, Bouchaud, & Sestovic, 2001):

, (12)

where

denotes basis function and

denotes the corresponding constant coefficients, p is the number of selected basis functions such as Hermite polynomial, Legendre polynomial, Chebyshev polynomial, Laguerre polynomial, hereafter we choose Laguerre polynomial as basis function which is formed as following:

.

After substituting (12) into (11), the optimizing problem (17) changes into:

. (13)

Comparing (13) with (11), we find the number of unknowns has greatly decreased, and the holding

may be deduced by (12) only with the selected basis functions and the simulated price scenarios, which is solved by the steepest descent method.

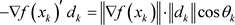

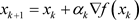

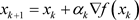

3.4. The Steepest Descent (Wahab & Khan, 2018)

Assuming objective function

,

, when

, at

, expressing

with:

. (14)

Denoting

, then the expression (20) can be expressed:

. (15)

We call

the descent direction of

when

. As to small

, there is

, and with smaller

,

has greater descent at

. denoting

as the plane included angle of

and , by

, by , when

, when , i.e.,

, i.e.,  ,

,  arrives at the smallest value, and

arrives at the smallest value, and  is called as the steepest descent direction,

is called as the steepest descent direction,  is the optimal searching direction. The iterative format of the steepest descent method is as following:

is the optimal searching direction. The iterative format of the steepest descent method is as following:

, (16)

, (16)

where  denotes the step length decided by linear searching method.

denotes the step length decided by linear searching method.

The process of the steepest descent method is as following:

Step 1: Given the initial  and the terminating error

and the terminating error , set

, set ;

;

Step 2: Calculating , stop when

, stop when  and

and  is the optimal solution;

is the optimal solution;

Step 3: Deciding the step length  by the linear searching method;

by the linear searching method;

Step 4: Setting ,

,  , transfer to the step 2.

, transfer to the step 2.

4. Numerical Example

4.1. The Parameter Deciding of the Price Model

In this subject, we sampled 11,598 high frequency history data of Shanghai Securities Complex Index and the stock ICBC from the 2nd, January to the 28th, December, 2018, and estimated the jump-diffusion process’s parameters in WinBugs1.4 by Monte Carlo technology, the estimating results are expressed in Table 1.

4.2. The Simulated Scenarios and Strategies

Firstly, according to the parameter values in Table 1, we simulated ![]() price scenarios for the underlying asset by the Monte-Carlo technology submitted in subsection 2.1; Then, deciding the number of basis function, since the computation result does not obviously improve when the number of basis function is more than 3, we choose the first 3 Lagurre polynomials as basis function to approximate the holding position; Finally, in the light of the optimization model (12), the optimal holdings are acquired through numerical algorithm presented in subsection 2.4 with the Matlab software.

price scenarios for the underlying asset by the Monte-Carlo technology submitted in subsection 2.1; Then, deciding the number of basis function, since the computation result does not obviously improve when the number of basis function is more than 3, we choose the first 3 Lagurre polynomials as basis function to approximate the holding position; Finally, in the light of the optimization model (12), the optimal holdings are acquired through numerical algorithm presented in subsection 2.4 with the Matlab software.

4.3. Analyzing Results

We assume that a hedger has written the 1-month and 3-month expiration indexed stock option based on the stock ICBC at the 28th, December, 2018, in order to minimize the terminal expected loss, he hedges the contingent claim with stock ICBC and Bond by self-financing with daily, weekly and biweekly

rebalancing frequency, the initial Index price and ICBC price are![]() ,

, ![]() , respectively, and the riskless interest rate is 0.30% equal to the current savings interest rate offered by the PBC in December, 2018 (http://www.pbc.gov.cn/), the transaction fee rate

, respectively, and the riskless interest rate is 0.30% equal to the current savings interest rate offered by the PBC in December, 2018 (http://www.pbc.gov.cn/), the transaction fee rate![]() , respectively.

, respectively.

As for all hedging cases, we calculate:

Total risk:

![]() . (17)

. (17)

Total cost:

![]() , (18)

, (18)

where ![]() is the initial cost;

is the initial cost; ![]() denotes the terminal portfolio valuation.

denotes the terminal portfolio valuation.

Substituting (12) into (18):

Total cost:

![]() . (19)

. (19)

As a matter of fact, with the exception![]() , transaction fee and the terminal

, transaction fee and the terminal![]() , no other hedging cost is required.

, no other hedging cost is required.

The averaged hedging cost and expected loss with different striking price and different strategy adjustment frequency are calculated in Table 2 and Table 3 with 10,000 price simulations.

Firstly, because the price fluctuation will be heavier if option’s expiration is longer, a European indexed stock option hedger may be faced with higher risk and must invest more to hedge possible loss risk, for example, in Table 3, the averaged hedging costs (with 3-month expiration) for all kinds of strategy adjustment frequencies and all kinds of transaction fee rates are more than those in Table 2 (with 1-month expiration), i.e., for daily hedging strategy adjustment frequency, 1.5011 is bigger than 1.3251, 2.7656 is bigger than 2.4930, 5.2962 is bigger than 4.6254, and for weekly and biweekly hedging strategy adjustment frequencies, there are similar results. Other more, We can also see that the expected loss may be smaller when the hedging strategy adjusting time step is shorter, for example, in Table 2, 0.702 is the least expected loss, which corresponds to daily hedging strategy adjustment frequency, while 0.8010 is the biggest expected loss, which corresponds to biweekly hedging strategy adjustment frequency, similar results in Table 3.

In addition, we can know by the expression ![]() that the higher the striking price is, the smaller the expected loss may be; and it is more impossible for the indexed stock option with higher striking price to be executed, which results in decreased hedging cost. In fact, Table 2 and Table 3 indicate the reverse relationship between expected loss with striking price, and the following Figure 1, indicating the relationship between the holding position at the middle time point with the terminal exercising price for the indexed stock

that the higher the striking price is, the smaller the expected loss may be; and it is more impossible for the indexed stock option with higher striking price to be executed, which results in decreased hedging cost. In fact, Table 2 and Table 3 indicate the reverse relationship between expected loss with striking price, and the following Figure 1, indicating the relationship between the holding position at the middle time point with the terminal exercising price for the indexed stock

![]()

Table 2. Averaged hedging cost and expected loss with 1-month expiration over 10,000 scenarios (![]() ).

).

![]()

Table 3. Averaged hedging cost expected loss with 3-month expiration over 10,000 scenarios (![]() ).

).

![]()

Figure 1. Relationship between holdings and striking prices at middle time point.

option with single month expiration. In Figure 1, the horizontal axis data shows the end-of-period execution prices, while the data on the vertical axis represent the hedging positions that need to be held for 1 share of stock to be hedged at the middle time point with 1-month hedging period. Taking the hedging practice for the ICBC stock as an example, if the terminal exercising price is 5.2CNY, the optimal hedging position is 0.522 shares of stock index futures contract, while the terminal exercising price is 5.68CNY, the optimal hedging position is 0.496 shares of stock index futures contract.

Figure 2 illustrates the relationship between holding positions and different executing prices for 1-month time limit indexed stock option with daily hedging

![]()

Figure 2. Monthly adjusting position plot with different striking prices.

strategy adjusting frequency. As a whole, the reverse relationship between holding position with striking price can still be found; what’s more, the three dash dot lines denoting holding position changing in Figure 2 all rightward incline, which explains that the required holding position may be decreased with time’s going by. it is well known that the indexed stock option will be executed at the maturity date, because the farer away the maturity date is, the more heavily the underlying asset’s price fluctuates, therefore, more hedging cost must be invested to acquire the same hedging efficiency.

Finally, it is obvious that the lowest line in Figure 2 fluctuate mildly, especially when ![]() equals to 5.56, the curve almost fluctuates around a line, however, the upper two curves denoting

equals to 5.56, the curve almost fluctuates around a line, however, the upper two curves denoting![]() , the option being in the money, fluctuate more heavily than the lowest curve, the option being out of the money, which correspond to the third column in Table 2, the hedging cost of option in the money augments more heavily than option out of the money corresponding to the augment of striking price

, the option being in the money, fluctuate more heavily than the lowest curve, the option being out of the money, which correspond to the third column in Table 2, the hedging cost of option in the money augments more heavily than option out of the money corresponding to the augment of striking price![]() .

.

5. Conclusion

It is well-known that the goal of hedging is to decrease the risk arising from the price fluctuating, the core objective of hedging is to ascertain reasonable hedging strategies. In this paper, we construct the optimizing model to minimize the terminal shortfall risk under the constraint of self-financing, by Monte-Carlo simulation, many price scenarios are generated and are averaged to estimate the expected shortfall, then, basis functions are imported to approximate the holding positions, finally, the optimal hedging positions are acquired by numerical technology. Table 2, Table 3, Figure 1 and Figure 2 indicate: the technique put forward in this paper is feasible and valuable for investors to hedge risk.

1) Table 2 and Table 3 illustrate, the higher the hedging strategy adjusting frequency is, the more superior the hedging efficiency is.

2) Figure 1 and Figure 2 indicate, the holding position is in inverse proportion to the striking price, i.e., the higher executing price the European call option has, the lower holding position may be held, vice versa. In this way, we can hedge risk and save cost at the same time.

In conclusion, because the market is changing rapidly, in order to obtain better hedging results, it is necessary to make reasonable adjustments for hedging positions based on market changes. In other words, frequent hedging strategy adjustments can reduce period-end losses, but because of the existence of transaction costs, excessively frequent hedging strategy adjustments may not be desirable, conversely, if the adjustment frequency of the hedging strategy is too low, it is difficult to achieve expected hedging effect.

Relative to existing research results, in this paper, there are two innovations and main contribution, the first is to expand the application of indexed stock options in the field of hedging, the second is to propose a solution for the nonlinear optimization problem (As shown in expression 6). However, the relevant conclusions of this study are all based on simulation data. Whether different simulated data have influence on the conclusion has not been explained theoretically. This is also our future research direction.

Acknowledgements

The study was supported by the Hunan provincial social science fund project of China (Project Number: 17YBA354).