Received 30 March 2016; accepted 24 April 2016; published 27 April 2016

1. Introduction

In the last few years, India has been a bright spot in the pecking order of world economies and has been one of the fastest-growing economies in the world. Indian economy is 11th largest based on Nominal GDP terms and 3rd largest in terms of purchasing power parity terms according to International Monetary Fund. Stock markets and financial markets in India have performed remarkably well and have successfully engulfed the imagination and attention of both Indian domestic investors as well as foreign international investors. The co-movements of stock market prices with respect to industrial production (IIP) are enormously imperative for investors for making investment decisions and for policy makers to take a call on monetary policy. Relationship between stock prices and industrial production is crucial and critical from policy makers, investors and businesses’ perspective.

In this study we investigate whether stock prices and economic activity in India are co-integrated. In order to determine existence of long-term equilibrium among macro-economic variables, [1] and [2] have proposed co- integration analysis. The most frequently applied co-integration tests in literature are that of [3] and [4] . However, these tests are outmanoeuvred by high-powered co-integration tests which have an inherent advantage of permitting structural changes in the relationships being tested and in asymmetric co-integration. This is one of those few studies in literature which tries to address whether stock prices and economic activity in India are co- integrated by using monthly data from 1960 to 2013 and applying high-powered co-integration tests.

The results of the study provide empirical evidence to the fact that stock prices and economic activity in India are co-integrated and validate the prediction in financial economics literature from Indian context. The empirical findings of our study contradict results by [5] and [6] who did not find empirical evidence that stock prices and economic activity are co-integrated for US which is surprising to say the least. With a longer span of data from 1961-2013, we have taken cognizance of concerns raised by [7] who argued that span of data used for co-inte- gration tests is vital for power of co-integration tests. The rest of the paper proceeds as follows. In Section 2 we review the literature and discuss alternative co-integration tests which are useful in investigating whether stock prices and economic activity in India are co-integrated in Section 3. In Section 4 we discuss the data considered and present our empirical findings based on application of co-integration tests described in previous section and conclude our study in Section 5.

2. Literature Review

In literature we have studies analyzing relationships between financial and macroeconomic variables more specifically stock market returns and macroeconomic variables by [5] [8] and [9] while others have investigated possible long-run relationships between stock market prices and macro-economic variables like [5] and [6] [10] . In order to determine existence of long-term equilibrium among macro-economic variables, [1] and [2] have proposed co-integration analysis. The most frequently applied co-integration tests in literature are that of [3] and [4] . However, these tests are outmanoeuvred by high-powered co-integration tests which have an inherent advantage of permitting structural changes in the relationships being tested and in asymmetric co-integration.

[11] in their study investigated the relationship between stock market and aggregate economy for Mexican economy. [12] in their study found that there exists long-run relationships between Bombay Stock Exchange’s SENSEX and industrial production index in India. [13] in their study investigated the relationship between stock prices and industrial production for South Euro-zone and North of Euro-zone for the time period 2004 to 2013 and provided directions for policy makers especially for South of Euro-zone. [14] in their study analysed relationship between industrial production, money supply, inflation, exchange rate, oil prices, and global stock prices with respect to Saudi stock market. [15] in their study found that Ireland’s industrial production has a positive impact on economic growth (industrial production).

[16] in their study tried to find out whether Chinese domestic macroeconomic variables can explain Chinese stock market price fluctuations and found out that Industrial production and exports plays a significant role. [17] investigate the role of monetary aggregates including exchange rates as well as industrial production and its relationship with Bangladeshi Stock market (Dhaka Stock Exchange) returns and found out that there exists informational inefficiency in the market. [18] in their study found that money supply, consumer price index, interest rate and industrial production had a significant relationship with Thai Stock Exchange prices.

In this study we employ a few such techniques namely [19] - [21] . Asymmetric co-integration tests of TAR and MTAR with critical values drawn from [22] has also been conducted. The underlying hypothesis of the study is existence of co-integrating relationship between economic activity and stock prices. Literature has found evidence that stock prices are positively related to GDP or IIP which is a proxy for future level of real activity in any economy an off-shoot wile examining marketing efficiency ( [5] [6] [23] - [26] ). The rationale for this seems to be a common understanding that future stock returns is a function of performance in future. In such a backdrop, it makes logical sense to deem stock market prices/returns act in response to the current state of the economy. In this study we investigate whether stock prices and economic activity in India are co-integrated.

3. Co-Integration Tests

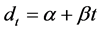

The Engle-Granger test [3] is one of the most generally betrothed single equation method for analysing co-integration in econometrics literature. Given 2 variables  and

and  for which co-integrating relationship is being analyzed, first step of EG test involves estimation of static co-integrating regression as given in Equation (1) where the deterministic trend is given by

for which co-integrating relationship is being analyzed, first step of EG test involves estimation of static co-integrating regression as given in Equation (1) where the deterministic trend is given by  which can comprise of an intercept (

which can comprise of an intercept ( ); or linear trend with intercept (

); or linear trend with intercept ( ):

):

(1)

(1)

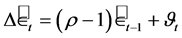

The next stage involves analyzing order of integration of residuals  obtained from potential co-integration relationship between the considered variables

obtained from potential co-integration relationship between the considered variables  and

and  using Dickey and Fuller test [27] as given in Equation (2). The null hypothesis being examined is that of no co-integration by using t-test statistic for

using Dickey and Fuller test [27] as given in Equation (2). The null hypothesis being examined is that of no co-integration by using t-test statistic for . We augment Equation (2) as obligated by including lagged values of dependent variable.

. We augment Equation (2) as obligated by including lagged values of dependent variable.

(2)

(2)

Basing on vector error correction model (VECM) frameworks as given in Equation (3), Johansen [4] approach can be employed for analyzing co-integration relationship.  is the vector containing I (1) variables which is being investigated and

is the vector containing I (1) variables which is being investigated and ,

,  represent coefficient matrices. Eigen values of long-run coefficient matrix

represent coefficient matrices. Eigen values of long-run coefficient matrix  using maximal and trace eigen value test statistic helps in analyzing the extent of co-integration existing between the considered variables. Terms which need to be included in VAR and co-integrating term of Equation (3) is very crucial while empirically applying Johansen’s procedure.

using maximal and trace eigen value test statistic helps in analyzing the extent of co-integration existing between the considered variables. Terms which need to be included in VAR and co-integrating term of Equation (3) is very crucial while empirically applying Johansen’s procedure.

![]() (3)

(3)

Kanioura and Turner’s [20] study provides an alternative higher-powered when compared to EG test. F-test of [20] is based on significance of lagged level terms in the below mentioned error correction model (ECM) as given in Equation (4). Null hypothesis considered is![]() . Similar to previous discussed tests of co- integration, empirical application of Kanioura and Turner’s [20] F test requires inclusion of lagged values of de- pendent variables in-order to circumvent issues of serial correlation.

. Similar to previous discussed tests of co- integration, empirical application of Kanioura and Turner’s [20] F test requires inclusion of lagged values of de- pendent variables in-order to circumvent issues of serial correlation.

![]() (4)

(4)

Monte Carlo analysis as presented by [28] highlight that power of Engle-Granger test substantially reduces when EG test is applied to a series which is co-integrated. To combat this, [21] broaden Engle-Granger test for explicitly allowing breaks in either intercept or intercept and co-integrating coefficient at unknown point of time. The Equation (1) used in Engle-Granger test is modified as given below in Equation (4) for the following three models:

Model C: Level shift ![]()

Model C/T: Level shift with trend ![]() (5)

(5)

Model C/S: Regime Shift ![]()

All the three Models of Equation (5) allow structural change via ![]() which is the dummy variable.

which is the dummy variable. ![]() is defined as follows:

is defined as follows:

![]() (6)

(6)

![]() denotes the juncture where the break in sample occurs. [21] suggest grid search technique for determining the value of

denotes the juncture where the break in sample occurs. [21] suggest grid search technique for determining the value of ![]() by taking into consideration all values in middle 70% of sample being considered. For each value of

by taking into consideration all values in middle 70% of sample being considered. For each value of![]() , Equation (5) models are estimated and residuals are extracted

, Equation (5) models are estimated and residuals are extracted ![]() which is used in Equation (6)’s Dickey-Fuller test as given below which may be augmented as deemed necessary by incorporation of lagged values of

which is used in Equation (6)’s Dickey-Fuller test as given below which may be augmented as deemed necessary by incorporation of lagged values of![]() . The test statistic obtained for each of the three models is further given as minimum value obtained for t-ratio of

. The test statistic obtained for each of the three models is further given as minimum value obtained for t-ratio of![]() .

.

![]() (7)

(7)

Engle-Granger test of Equation (2) make a tacit underlying assumption of symmetry implying a single speed of adjustment to equilibrium which is extended by [22] by permitting differing speeds of adjustment to take place. With the basis of TAR method given by [29] and [30] , he Equation (2) used in EG test are extended by using Heaviside indicator function ![]() as below with necessary augmentation incorporated:

as below with necessary augmentation incorporated:

![]() (8)

(8)

The Heaviside indicator functions ![]() as proposed by [22] for TAR and MTAR co-integration tests are given below:

as proposed by [22] for TAR and MTAR co-integration tests are given below:

![]() (9)

(9)

![]() (10)

(10)

Null hypothesis of no co-integration is examined under both TAR and MTAR specification by employing joint hypothesis of![]() . Statistically significant difference in the asymmetric adjustment coefficients i.e.

. Statistically significant difference in the asymmetric adjustment coefficients i.e. ![]() and

and ![]() indicates existence of long-run relationship but the reversion occurs at differing speeds owing to the indicator function used.

indicates existence of long-run relationship but the reversion occurs at differing speeds owing to the indicator function used.

4. Empirical Findings

Relationship between Stock Prices and Industrial Production is crucial and critical from Policy makers, Investors and businesses perspective. In this study we investigate whether stock prices and economic activity are co-integrated for India. We use monthly data extracted from Bloomberg database from January 1960 to July 2013 for stock prices of Bombay Stock Exchange (BSE) of India and industrial production (IIP). Natural logarithmic is applied for both stock prices and IIP time-series. Investigation of presence of unit root test to the series shows that both the series are not stationary at level however the series become stationary after first difference as given in the Unit root test results of Table 1 implying both stock prices and IIP series are I (1) processes. Impending co-integration between the two series is examined by applying co-integration tests discussed in previous section and the results are presented in Table 2 and Table 3.

As seen from Table 2, Engle and Granger test fails to reject null hypothesis of no co-integration between both the series at 5% critical value level for both the conditions of considering only intercept or intercept and trend. It has been found that the calculated test statistics of −3.197909 and −3.161978 are not sufficiently large enough in absolute terms to reject the null hypothesis against 5% critical values of 0.0717 and 0.2018 according to EG test. The degree of augmentation for EG was determined using Akaike’s Information Criterion under the condition that there is no serial correlation by using LM test. The results for [19] is similar to the one obtained for EG test. The results for Johansen’s procedure using VAR lead to rejection of null hypothesis of no co-integration between the series for India with maximum Eigen value and trace test statistic of 38.81014 and 46.55772 overshadowing the 5% critical values of 19.38704 and 25.87211 respectively.

Calculated statistic for higher-powered co-integration test of Kanioura and Turner’s (2005) 4.735876 fails to surpass the 5% critical value of 5.83. We followed a similar approach for the other residual-based tests and for Kanioura and Turner (2005)’s F-test and in all cases a lag length of zero was found. Based on the results of Gregory-Hansen test for any of the Models (C, C/T, C/S), we cannot reject the null hypothesis of no co integration. It appears that failure of EG and Phillips-Ouliaris tests to detect co-integration between stock prices and industrial production may not be due to lack of power of the co-integration test. Testimony to this fact is that higher-powered Kanioura and Turner (2005)’s F-test also leads to similar conclusion. To scrutinize whether no co-integration is due to utilization of inappropriate alternative hypothesis, our analysis is extended to authorize possibilities of structural change in the co-integrating relationships and asymmetric adjustment.

Note: Significance at the 1% level.

![]()

Table 2. Co-integration test results.

Note: The tabulated test statistics and critical values for alternative co-integration tests have been calculated as discussed in Section 3. The critical values for the EG, Johansen, F-test and Gregory-Hansen tests have been drawn from [5] [20] [21] [31] - [33] .

![]()

Table 3. Asymmetric co-integration tests for de-trended series.

Note: The tabulated test statistics and critical values for TAR and MTAR co-integration tests been calculated as discussed in Section 3. The critical values are drawn from [5] [21] .

Table 3 presents results from asymmetric co-integration tests. TAR model shows adjustment parameters![]() ,

,![]() to take on different values. These calculated values are indicative of asymmetric co-integration between the two series. Comparing calculated and critical values leads to rejection of null at 5% critical value. We find similar findings for MTAR-based co-integration test with the calculated statistic being higher than the 5% critical value leading to rejection of null hypothesis that there is no co-integration.

to take on different values. These calculated values are indicative of asymmetric co-integration between the two series. Comparing calculated and critical values leads to rejection of null at 5% critical value. We find similar findings for MTAR-based co-integration test with the calculated statistic being higher than the 5% critical value leading to rejection of null hypothesis that there is no co-integration.

The results of Engle and Granger test, Phillips-Ouliaris test, Kanioura and Turner’s test and Gregory-Hansen test leads to the conclusion that stock prices and industrial production in India are not co-integrated. However, Johansen’s co-integration test based on maximum Eigen value and trace statistic lead to a conclusion that stock prices and industrial production in India are co-integrated. Asymmetric Co-integration Tests for de-trended series using TAR and MTAR lead to the conclusion that there exists co-integration between stock prices and industrial production (IIP) for India.

5. Conclusion

The relationship between stock prices and industrial production is crucial and critical from policy makers, investors and businesses’ perspective. In this study we investigated whether stock prices and economic activity in India are co-integrated by using monthly data from 1960 to 2013. In order to determine existence of long-term equilibrium among macro-economic variables, we applied high-powered co-integration tests which have an inherent advantage of permitting structural changes in the relationships being tested and in asymmetric co-inte- gration by employing Engle and Granger’s test, Phillips-Ouliaris test, Kanioura and Turner’s test, Gregory- Hansen’s test and asymmetric co-integration tests of TAR and MTAR with critical values drawn from Enders and Siklos. Though we get mixed results, based on empirical evidence of Johansen’s test and Asymmetric Co- integration test results for de-trended series using TAR and MTAR, we can reasonably say that stock prices and economic activity in India are co-integrated and validate the prediction in financial economics literature from Indian context.

NOTES

![]()

*Corresponding author.