The Empirical Study on Margin Trading and Pricing Efficiency—Evidence from Natural Experiment ()

Received 16 December 2015; accepted 11 January 2016; published 14 January 2016

1. Introduction

Margin trading, also known as credit transactions, refers to the securities market participants deliver collateral, including a certain proportion of cash or cash equivalents such as securities, to the securities companies qualified for margin trading to finance and purchase securities or borrow securities and sell out. Developed countries such as Britain, the United States, and France, were allowed for margin trading in the securities market as early as the 18th century. Compared with the developed securities market, the China Securities Regulatory Commission announced the formal start of the pilot margin trading relatively late on October 5, 2008. The first batches of underlying stocks were only 90. In the process of the development of more than 5 years, margin trading market has experienced five big events expanding the scope of the underlying stocks. According to the Wind database, as of June 17, 2015, underlying stocks had increased to 893; margin balance in Shanghai and Shenzhen had reached to 2 trillion yuan; on that day financing purchases were 162.9 billion yuan, which accounted for 10.61% of the total turnover in A-share stock market.

The margin trading provides investors with new trade channels and investment philosophy, and the securities business has broken short-selling constraints. It is worthwhile to learn about the relationship between margin trading and pricing efficiency. Does the margin trading improve the pricing efficiency of underlying stocks as expected? This paper will use this natural experiment―the expansion event of underlying stocks, by methods of event study and panel data to analyze the influence of the margin trading on the underlying stocks pricing efficiency.

2. Literature Review

Western scholars had made much research on this topic and their studies were mainly based on two theoretical models: overvaluation hypothesis and rational expectation model, which actually analyzed the relationship between margin trading and pricing efficiency from completely different perspectives. The former focused on price adjustment or excess returns, and the latter emphasized response speed.

Miller (1977) [1] famously theorized the overvaluation hypothesis. When security market was under short- sale constraint, that was to say, investors were not allowed to trade stocks by selling short, bearish investors could not do any operation to reflect pessimistic expectations or negative information on stock prices. Meanwhile, optimistic investors were very easy to push up prices, resulting in the deviation from its intrinsic value. Lack of appropriate data to test the hypothesis, apart from researching effects on securities market, 2009 and before previous study focused on the recognition and evaluation of the short-selling constraint. The U.S. subprime crises in 2008 brought about the global financial crisis. The United States, Canada, France, Belgium and other countries had taken short-selling restrictions to protect the interests of investors. Short-selling restriction policies provided scholars with a good opportunity and wealth of data. The SEC had halted short sales on 19 financial institutions on July 15, 2008, and this restriction was lifted on August 12, 2008. Boulton & Braga (2010) [2] took these 19 financial institutions and other 17 companies which were not affected by the event as study subjects, using event study and comparative method to research the influence of short-selling constraint on stock prices. The empirical study showed that, after July 15, 2008, excess returns of 19 restricted short-selling institutions were significantly higher than other 17 companies whose short selling were allowed. However, the results worked in reverse when the injunction was lifted after August 12, 2008. The results of other scholars’ research, such as Alex & Steven (2011) [3] , using empirical study or other methods, proved that overvaluation hypothesis was true. Stock prices are overvalued by short-selling restrictions, which show that excess yields are greater than zero.

As the representative theory to study the speed of stock price reaction to information, rational expectation model was set up by Diamond and Verrecchia in 1987 [4] . Based on the assumption of efficient markets and rational investors, this theory explained that short-selling restrictions not only slowed down the stock prices reaction to open information especially bad news, also slowed down the prices reaction to inside information. Lack of direct measure and sample data, early empirical studies about the relationship between short-selling restrictions and share price reaction speed had focused on short selling tools being introduced on the market, such as futures and options, etc. Some stocks on the NASDAQ and New York Stock Exchange had been suspended from selling short on May 2, 2005. With this opportunity, Diether and Lee (2009) [5] discovered that short-selling restrictions reduced the speed of stock price reactions to information. Chen and Rhee (2010) [6] analyzed the underlying stocks on Hong Kong securities market from 2001 to 2004 and finally found that, whether the volume, options trading, company scale was controlled or not, no matter the market rose or declined, short selling could significantly speed up the reaction of stock price.

Domestic research are mainly concentrated in the topics that how the margin trading affect the volatility and liquidity of the stock market, relatively a few research on pricing efficiency. Based on the exchange data about 250 days before and after March 31, 2010 that margin trading was introduced to the market, Hongwei Xu and Xin Chen (2012) [7] employed the difference-in-differences model to study the change of returns distribution and effect on pricing efficiency. Zhisheng Li and Chen Chen (2015) [8] studied stocks data in A-share stock market from April 2009 to December 2013, and found that margin trading significantly improved the pricing efficiency. Meanwhile, results indicated that there was a positive correlation between share liquidity and pricing efficiency.

At the beginning of margin trading being introduced to the market, securities financing mechanism was not available and trading philosophy that participants harbored was immaturity. However, the data domestic scholars used to study the margin trading and pricing efficiency were mostly from this period, and thus the results could be a distortion of reality. Based on the data collected after February 28, 2013, when securities financing mechanism was introduced to the market and we were well into short-sale era, results of this paper will be of great practical significance and reference value.

3. Research Design

3.1. Research Hypothesis

Through the relevant research literature at home and abroad, this paper put forward the following hypotheses:

Hypothesis 1: Short-selling constraints overvalue stock prices. After stocks become margin targets, the extent to overestimate will decrease, that is, excess returns are significantly less than zero.

Hypothesis 2: Short-selling constraints hinder the reaction speed of stock prices to information. After stocks become margin targets, the reaction of stock prices to information significantly speed up.

3.2. Empirical Models

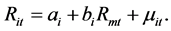

By event study method, this paper takes the excess return as main index to verify the hypothesis 1. An event study attempts to measure the valuation effects of an event, such as a merger or earnings announcement, by examining the response of the stock price around the announcement of the event. The excess return can be estimated by market model. For each stock i, market model assumes that returns are given by:

(1)

(1)

In this model, Rit is the return on the stock i at t, Rmt is the return on the market portfolio at t. According to a series of data collected in the estimation period, we can get the estimate parameters. With the market model, estimate parameters and a set of data obtained in the event window, we can estimate the expected returns in the event window.

(2)

(2)

(3)

(3)

In model (2), ARit is called the abnormal return, which assumes that the unexplained part is due to some “abnormal” event that is not captured by the model. If CAR of underlying stocks we calculate, which mean the cumulative abnormal returns, are obviously less than zero, we can verify hypothesis 1. Meanwhile, make a robustness test to the non-target stocks: if the CAR we get based on non-target stocks are not obviously less than zero, we prove hypothesis 1 further.

We introduce D1 and D2, which are called the price lag indicators, to express the reaction speed of stock prices to information. If the related information is not reflected on the prices timely and fully, they will be absorbed gradually to form a price lag reaction. We get D1 and D2 in the following way:

(4)

(4)

Model (4) expresses the extended market model. Choose the proper lag length (after calculating the related data, we select three in this paper), run regressions on general and extended MM respectively, and finally obtain the fitting optimization indexes R2 and . With the following formulas, we can get D1 and D2.

. With the following formulas, we can get D1 and D2.

(5)

(5)

(6)

(6)

The smaller the value of D1 is, the lower degree of dependence on historical information. The value of D2 once we get is small indicates that lag parameters comprise a small proportion in all parameters and as in the above case, meaning prices reaction to information is faster.

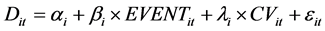

Assuming D1 and D2 as the explained variable respectively, we set up the plural linear regression model (7).

(7)

(7)

Specify EVENT as the dummy variable. If the evaluation objects are underlying stocks, EVENT equals 1, otherwise, it is 0. CV represent a series of control variables, including exchange (dummy variable; if Shanghai, exchange is 1; if Shenzhen, it is 0), turnover, price earning and circulation value.

Firstly, take underlying and non-target stocks as dummy variables to estimate parameters. If β is negative, the empirical result shows that prices reaction speed of underlying stocks to information is faster than that of non- target stocks. Then take underlying stocks before and after margin trading event as dummy variables (before being the underlying stock, event is 0; introduced to the margin trading, event is 1) to run the regression model. If β is negative, result means that once stocks become margin targets, the reaction of stock prices to information significantly speed up.

4. Empirical Analysis

4.1. Data Sources and Processing Method

We were well into the short-sale era on February 28, 2013, when securities financing policy was introduced to the market. This paper chooses 206 stocks being allowed to margin trading on September 16, 2013 as research objects, 205 stocks added to target list on September 22, 2014 as reference objects and uses the data of sample period (February 28 from 2013 to 2014) to study the topic. All sample data are collected or calculated from Wind database.

To verify hypothesis 1, we choose February 16, 2013 as the event date, within 10 days of the date as event window, and from February 28, 2013 to August 30, 2013 as the estimation window. We get 73 underlying stocks and 105 non-target stocks from all sample data after selecting in accordance with the relevant principles: daily trading data must be continuous; the fitting effect is perfect when run a regression to the estimation window. By adding “average price earnings must be positive” to the basic principles, we finally obtain 71 underlying stocks and 84 non-target stocks to test hypothesis two.

4.2. Descriptive Statistics of Variables

Price lag indicators D1 and D2 fluctuate substantially during the sample period, whose standard deviation is 27.19% and 19.21% respectively. The maximum values of both are close to 1, but the minimum values are different between the two. Meanwhile, it is essential to introduce control variables like turnover, circulation value and price earning to the empirical model, because of high volatility the data show (see in the Table 1).

4.3. Test for Margin Trading and Price Adjustment

According to the data we have processed above, we run models and formulas described in part 3 with Stata software package. Abnormal returns and cumulative abnormal returns are shown in Table 2, as well as one-sided t-test related to every series of returns.

![]()

Table 1. Descriptive statistics of variables.

![]()

Table 2. (Based on MM) test for returns of underlying stocks.

*Significant at 10% level; **Significant at 5% level; ***Significant at 1% level.

First day after stocks being allowed to margin trading, mean value of the cumulative abnormal returns is −3.004% and one-sided t-test value is −2.32618 which indicates the result is significant at 1% level. Within 10 days of event date, mean value of the CAR is −5.066% and t value is −2.32618 that mean effect is serious at 5% level but not 1% level. Results are similar before and after 10 days of the event date, showing that t value of both is near −2.0, significant at 5% level the same as the above case. Therefore, we verify the hypothesis 1. Short-selling constraints overvalue stock prices. After stocks become margin targets, the extent to overestimate will decrease, that is, excess returns are significantly less than zero. In order to enhance the credible ability of the results, we make a robustness test to the returns of non-target stocks. As expected, CAR calculated based on non-target stocks is not obviously less than zero.

4.4. Test for Margin Trading and Price Reaction to Information

The specific form of the model, whether fixed effect or random effect, can be determined by Housman Test. No matter the research object groups are underlying and non-target stocks or stocks before and after event, the tests prove that the random effect model is superior to the fixed effect model.

Take regression test on Panel 1, which is composed of a series of data about underlying and non-target stocks, and then get the variable coefficients and p values. Whether the explained variable is D1 or D2, coefficient of dummy variable is negative and significant at 1% level, which means the value of price lag indicator when event is 1 is smaller than that of when event is 0. In other words, price of underlying stocks reaction to information is faster than that of non-target stocks.

In the meantime, coefficient of exchange is negative when explained variable is D1 or D2, and significant at 10% level. That is, pricing efficiency of stocks trading in Shanghai is higher than those of trading in Shenzhen. In addition, coefficient of turnover and ln (value) is significant at 1% level, showing that the higher the turnover and the greater the circulation value, the lower the price reaction to information.

Maybe prices of underlying stocks response to the information rapidly before them being allowed to margin trading. In order to rule out such a possibility, we analyze data of stocks before and after event (Panel 2), checking conclusions obtained from Panel 1 at the same time. Coefficient of event is negative and significant at 1% level, as shown in the Table 3, which indicates that after stocks become margin targets, the reaction of stock prices to information significantly speed up. The signs of coefficients like exchange, turnover and ln (value) are identical to the results from Panel 1, once again confirming the negative correlation between price reaction to information and turnover or circulation value.

![]()

Table 3. Regression results based on price lag indicators.

5. Conclusions

By using event study method and panel data results, this paper shows the influence of margin trading on pricing efficiency. Firstly, we described how margin trading works on overvaluing. According to overvaluation hypothesis, stocks without short selling tend to reflect optimistic sentiment of investors and thus the prices will be overvalued. Compared the excess returns of underlying stocks and other stocks before and after margin trading, we proved overvaluation hypothesis and the extent to overestimate would decrease with short selling. Secondly, we introduced price lag indicators to illustrate the changing in information content of price. With regression results based on panel data, we found that short-selling constraints hinder the reaction speed of stock prices to information.

Results that this paper has achieved provide overvaluation hypothesis and rational expectation model with proofs from emerging market. Margin trading not only perfects exchange mechanism, but also improves the pricing efficiency of underlying stocks. Due to the conditions that the efficiency of our securities market is low and prices fluctuate wildly, it is increasingly important to expand the size of underlying stocks, reduce transaction costs and barriers to entry, and thus perform the price discovery function to an extreme.

NOTES

![]()

*Corresponding author.