1. Introduction

Corporate risk-taking is a fundamental driver of profitability and growth. Adequate risk engagement is crucial for sustainable long-term development in businesses (Boubakri et al., 2013) . From an investment perspective, appropriate engagement with risk is essential for business longevity. The level of risk-taking within a firm, as reflected in its propensity to engage in high-return, high-risk projects, not only mirrors its strategic orientation but also shapes its future trajectory for survival and expansion. Companies that embrace risk-taking are more likely to actively pursue opportunities and implement bold strategies to enhance their performance (Bernile et al., 2017) . Conversely, an excessive aversion to risk can lead to missed growth opportunities and inefficient resource allocation. Agency theory posits that managerial inclinations not aligned with maximizing shareholder value may lead to a conservative approach, often resulting in the avoidance of potentially profitable investments. Such tendencies could suppress the firm’s inherent capacity for risk-taking (John et al., 2008; Wright et al., 1996) . Hence, understanding how managerial attitudes influence corporate risk-taking is vital for effective executive selection and formulating strategic investment decisions.

In the contemporary global business landscape, executives with foreign experience are highly prized for their broader perspectives and rich, diverse insights. Such individuals are sought after by corporations and are also the focus of governmental policies aimed at attracting top-level global talent. Initial studies, such as those by Guo (Guo, 2018) , have identified a positive correlation between executives with international experience and corporate risk levels. However, the robustness of this finding requires further investigation. A key concern is the potential endogeneity arising from risk-tolerant firms being more likely to appoint executives with foreign experience, which might exaggerate the perceived impact on corporate risk-taking. Additionally, unobserved variables that influence both executive appointments and risk levels could confound this relationship. To disentangle these intricate relationships, we employ advanced econometric techniques and a unique dataset. Understanding the precise nature of the link between foreign experience in executive leadership and corporate risk-taking, and its underlying mechanisms, especially under different governance structures, is vital for enhancing corporate risk management practices.

This paper specifically focuses on the impact of executives’ international experience on corporate risk-taking. To address endogeneity, in addition to introducing longitudinal data as instrumental variables, we also track firms that have transitioned from domestically-experienced to Foreign_experienced executives, forming the “treatment group”, and compare them with a “control group” of firms without such transitions. This approach allows for the creation of a refined sample while maintaining the timeline of these executive changes. Subsequently. employing a multi-period difference-in-differences methodology, the study compares risk-taking levels before and after these transitions, ensuring data consistency and continuity. This distinctive approach sheds light on the direct effects of executive foreign experience, isolating it from other confounding factors. The combination of PSM and multi-period DID facilitates a deeper understanding of the causal relationship between executives’ international experience and corporate risk-taking.

Furthermore, considering that corporate risk-taking is influenced by both current and past operational conditions, this study conducts a dynamic analysis of risk-taking levels, offering long-term, stable estimations. This longitudinal analysis provides a temporal dimension to the study, offering insights into the evolution of risk-taking behavior over time.

Additionally, the study’s comprehensive approach extends beyond mere correlation, probing the underlying mechanisms that drive this relationship, particularly focusing on corporate R&D expenditures. Empirical evidence suggests that foreign experience among executives promotes increased R&D investment, thus elevating corporate risk-taking levels. Additional analysis reveals that in companies where executives have greater decision-making autonomy, especially in firms with unified CEO-chairman roles and state-owned enterprises, the positive effects of international experience on risk-taking are more pronounced.

This study contributes significantly to the literature on corporate risk-taking and CEO characteristics. First, we introduce a novel perspective by examining the transition from CEOs without foreign experience to those with it. This distinction, not previously considered, allows for a more dynamic assessment using Difference-in-Differences (DID) analysis, enhancing our understanding of the impact of CEO attributes on corporate decisions.

Second, we address the issue of endogeneity in corporate risk-taking by using unique historical data as instrumental variables. Our approach, supported by a range of robust econometric methods like 2SLS, System-GMM, and PSM-MDID, strengthens our findings on the positive effects of CEOs’ foreign experience on risk-taking.

Third, our study goes beyond the usual focus on international operations to explore the relationship between executive traits and corporate behavior. We provide new insights into the value of Foreign_experienced CEOs and show how CEO characteristics influence variations in firm risk-taking. Additionally, we present evidence that executive decision-making, influenced by corporate governance structures, significantly impacts investment in research and development, particularly in innovative activities. This aspect offers a deeper understanding of how top management’s global experience and the firm’s governance framework interplay in shaping risk-taking and innovation strategies.

Finally, by using the system dynamic generalized method of moments method, we assess risk-taking levels considering time-variant elements of risk. This approach allows a nuanced exploration of the causal relationship between global executive experience and corporate risk-taking, taking into account how past behaviors impact future investment decisions. This dynamic perspective enriches our understanding of the economic consequences of CEO characteristics, providing a comprehensive view of risk management in corporate settings.

This paper unfolds in a structured manner, starting with an Introduction (Chapter 1), which lays the foundation for our study. The subsequent section, Literature Review and Hypothesis Development (Chapter 2), is divided into three sub-sections (2.1 to 2.3), delving into the nexus between foreign experience, risk-taking, R & D investment, and corporate governance. The methodology is detailed in the Empirical Design (Chapter 3), where we outline our sample, data sources, variable definitions, and conduct descriptive statistics and correlation tests. In Chapter 4, Empirical Results, we present our core findings through regression analysis, 2SLS, and Dynamic System GMM. The Robustness Tests (Chapter 5) validate our findings using tracked samples and multi-period DID analysis. Chapter 6, Mechanism Test and Further Analysis, explores the mechanisms and further nuances of our study. Finally, the paper culminates in the Conclusion (Chapter 7), summarizing our key insights and suggesting avenues for future research.

2. Literature Review and Hypothesis Development

2.1. Foreign Experience and Risk-Taking

According to upper echelons theory, observable characteristics of CEOs, such as cognitive abilities, values, and expertise, are regarded as effective proxies for managerial cognition. These traits significantly influence corporate decision-making processes (Hambrick & Mason, 1984). However, the empirical examination of CEO personal traits as distinct subjects of study emerged only after Bertrand and Schoar (Bertrand & Schoar, 2003) . They validated the relationship between these traits and corporate decisions. Subsequently, a surge of empirical research has explored the impact of executive personal characteristics on firm operations. Studies have examined various aspects including gender (Faccio et al., 2016) , marital status (Hegde & Mishra, 2019) , political connections (Farag & Dickinson, 2020) and educational psychological traits (Deshmukh et al., 2021) . Beyond demographic traits, recent research has focused on experience-related attributes. These include experiences of disasters or poverty (Bernile et al., 2017; Dittmar & Duchin, 2016) and other extreme events (Kong et al., 2021) affecting firm operations. Initial studies on the foreign experience of executives linked it with global business operations, underscoring its impact on international business (Carpenter et al., 2001; Herrmann & Datta, 2006) . Current research primarily focuses on CEOs’ role in driving innovation investment levels, suggesting that foreign experience enhances executives’ risk tolerance. This experience is believed to provide advanced knowledge and skills, thereby fostering corporate innovation activities (Ren et al., 2021; Zhang et al., 2018) . Innovation, as a long-term investment, often requires a prolonged period to manifest tangible economic benefits.

Risk-taking willingness is an inherent characteristic that precedes corporate investment decisions. Companies inclined towards risk-taking actively pursue and invest in high-risk, high-return innovative ventures (Shane, 2000). Most existing research on risk-taking concentrates on determinants within financial institutions (Dias, 2021) , often neglecting general enterprises. A smaller body of literature examines the relationship between startups and risk-taking, which is linked to their strong entrepreneurial orientation (Stam & Elfring, 2008) . Moderate risk-taking is crucial for long-term stable corporate development. Excessive conservatism can lead to missed growth opportunities, while excessive risk-taking may result in instability and financial distress. In Chinese firms, executive risk aversion is a widespread phenomenon, making it important to explore ways to enhance risk-taking to drive business development.

Executives with foreign experience may boost their confidence in making future risky decisions, thereby enhancing the firm’s risk-taking level. Traditional decision-making theories, based on the rational economic agent assumption, often don’t account for the lack of accurate future information in the real world. Keynes (Keynes, 1937) highlighted that in the absence of predictable probabilities for future events, decisions are made based on subjective probabilities. Confidence, influenced by past experiences and social norms, affects these probabilities. We hypothesize that a CEO’s foreign experience enhances their confidence in making future risky decisions. Executives with foreign experience possess confident and optimistic traits. They optimistically estimate uncertainties in the innovation process, sometimes even overestimating their own project management capabilities ( Hirshleifer et al., 2012 ), leading to a preference for riskier investments.

Foreign experience can also strengthen an executive’s labor market bargaining power, reducing career anxieties and the resulting risk-averse behavior. Career anxieties have been identified as a key reason for lower risk levels in firms ( Holmstrom & Costa, 1986 ). Fama (Fama, 1980) was the first to highlight how managerial career concerns impact firm performance. He found that managers with poor performance histories face higher unemployment risks. To maintain good performance records, executives often avoid high-risk investments. McClelland, Barker, and Oh (McClelland et al., 2012) further verified that career anxieties compel CEOs to adopt short-term risk-averse strategies. With foreign experience being highly valued, executives possessing it are in a buyer’s market for employment. Such experience serves as a positive signal of capability, alleviating career anxieties and mitigating the tendency towards lower risk-taking.

As a unique form of human capital, foreign experience is often seen as a symbol of quality education and managerial ability. Managerial capability is known to effectively reduce a company’s risk-taking level. On one hand, this stems from knowledge accumulation through overseas study or work. Knowledge spillover offers various solutions for risk management (Yuan & Wen, 2018) . Simultaneously, international social networks provide channels for information sharing, helping to hedge business risks (Ferris et al., 2017) , thus lowering the firm’s risk-taking level. Given the differing impacts of these mechanisms on corporate risk-taking, this paper proposes hypotheses:

Hypothesis 1: CEOs with foreign experience decrease the firm’s level of risk-taking.

2.2. Foreign Experience, R & D Investment, and Risk-Taking

Innovation activities, inherently linked with risk-taking, are pivotal for the growth and evolution of a company. The nature of innovation is closely associated with risk-taking due to the inherent uncertainty and high initial costs of R & D activities. Companies with a strong orientation towards innovation aggressively pursue potential investment opportunities. They continuously advance in their innovation efforts and willingly take on risks, aiming to strengthen their market competitiveness and enhance long-term returns (Hirshleifer et al., 2012) . However, the benefits of innovation, as Hall (Hall, 2002) notes, often have a delayed realization. Despite the potential for significant future returns, these often manifest only after an extended time, indicating a lag effect in the realization of innovation benefits. Moreover, the risks associated with innovation activities have a contagious effect, impacting not only technological advancement and product development but also influencing overall company operations. R & D activities, essential for innovation, require a steady and significant financial investment. The constraints of funding and the uncertainty of returns from these investments increase short-term financial risks and earnings volatility, leading to higher levels of risk-taking within the company.

The role of executives, especially those with foreign experience, is crucial in shaping a company’s approach to innovation and risk-taking. Executives’ willingness to take risks greatly influences their investment decision-making, particularly in the realm of innovation, which is characterized by high uncertainty (Li et al., 2008) . Executives with foreign experience typically exhibit a higher level of confidence and risk tolerance, aligning well with the demands of innovation activities, thereby potentially increasing the firm’s investment in R & D. Before undertaking R & D investment, companies generally evaluate the costs and potential benefits of innovation activities. The public goods nature of innovative technologies and products, which leads to spillover effects, can result in a situation where the full benefits of R & D are not entirely captured by the investing firm, leading to underinvestment in innovation activities. Conversely, executives who focus on building political connections may divert resources away from innovation, weakening the company’s innovative impetus. Executives with foreign experience, whose education and professional backgrounds are predominantly international, tend to focus more on internal capacity building, particularly in the development and protection of intellectual property rights (Yuan & Wen, 2018) . Strong intellectual property rights protection can increase the exclusivity of innovative technologies, enhancing expected returns for innovative enterprises and thus motivating further R & D investments.

Given the above considerations, executives with foreign experience are likely to influence a firm’s approach to innovation and risk-taking. They tend to have a greater propensity for risk-taking due to their confidence, focus on protecting intellectual property rights, and willingness to increase R & D investments to secure competitive advantages through technological innovations. However, the uncertainty and substantial investments associated with these activities can elevate the firm’s risk-taking levels in the short term. Therefore, this paper proposes the following hypothesis:

Hypothesis 2: Executives with foreign experience can enhance a company’s risk-taking by increasing R & D investments.

2.3. Foreign Experience, Corporate Governance, and Risk-Taking

In analyzing the impact of executive characteristics on corporate operations, a key influencing factor is the company’s governance environment. An executive’s impact on corporate operations is significantly influenced by the governance context, specifically their management discretionary power. This discretion determines the extent to which executives can shape organizational outcomes. A CEO’s management discretion, when expansive, minimizes external constraints on decision-making, thus amplifying their influence within the firm. In situations where an executive concurrently serves as the chairman, their formal authority is enhanced, facilitating the smoother implementation of their decisions, especially for those with foreign experience (Boyd et al., 2005; Dey et al., 2011) . This leads to the formulation of the following hypothesis:

Hypothesis 3: The impact of executives’ foreign experience on risk-taking is more significant in firms where executives have combined roles as CEO and chairman, indicating higher management discretion.

The nature of the firm also plays a crucial role in determining the extent of managerial freedom and decision-making efficacy. Management discretion reflects the capacity of management to act according to their own judgment and strategic vision (Finkelstein, 1992) . The issue of “internal control” in Chinese state-owned enterprises (SOEs), where executives often wield substantial control due to the absence of active ownership. In the context of reforms granting more operational autonomy, SOE executives have gained increased levels of actual control. In such environments, executives with foreign experience, especially in SOEs, are likely to exercise greater management discretion in their strategic decisions. Consequently, this paper proposes the next hypothesis:

Hypothesis 4: The influence of executives’ foreign experience on risk-taking is more pronounced in state-owned holding companies, where executives typically have higher management discretion.

3. Empirical Design

3.1. Sample and Data Source

This study utilizes data from non-financial companies listed on China’s A-share market from 2008 to 2021. Due to the methodology employed for calculating the level of corporate risk-taking, which involves using a 5-year future return on assets (ROA), the final sample comprises companies from 2008 to 2016. After excluding companies with missing financial and executive information, a total of 21,392 observations were obtained. The financial data, stock data, and executive personal data used in this study were sourced from the CSMAR (China Stock Market & Accounting Research) database. CSMAR stands as one of the most comprehensive and authoritative sources of financial and economic data in China, and provides exhaustive data on stock, bond, fund, and derivatives markets. This includes individual stock trading data, market indices, financial reports of listed companies, shareholder structures, and executive information. The information on the number of Christian schools and colonial ports mentioned as instrumental variables is derived from the book The Christian Occupation of China, 1901-1920.

3.2. Variable Definition

3.2.1. Dependent Variable: Corporate Risk-Taking

Corporate risk-taking reflects the company’s engagement in risk-bearing activities. Some studies view corporate risk-taking as the probability of survival in the face of unexpected shocks, such as financial conditions or profitability sustainability (Acharya et al., 2011; John et al., 2008) . Others define it as a strategic variable reflecting the company’s willingness to assume risks. Higher risk-taking companies experience greater fluctuations in their capital returns. This study employs an industry-adjusted ROA volatility, as proposed by John et al. (John et al., 2008), to reflect operational risk, using a 5-year rolling window and calculating the standard deviation of the deviation of ROA for the next 20 quarters. Firstly, we compute the deviation of a firm’s ROA from the industry average in the corresponding quarter,

(1)

where

is the industry-adjusted ROA of firm i in industry c on quarter t,

is the ratio of net profits to total assets of firm i in industry c on quarter t,

is the number of firms in i industry c on quarter t.

Then, we calculate the standard deviation of

as the proxy of corporate risk-taking. Especially, we think managerial decisions only have an impact on future company outcomes. The calculation equation is:

(2)

where

is the standard deviation of i firm’s industry-adjusted ROA over the rolling window over the future 5 years, T means the number of quarters over the window period and

is the industry-adjusted ROA of firm i in industry c on quarter t.

3.2.2. Independent Variable: Executives’ Foreign Experience

In China, there is no traditional position specifically designated as CEO; positions such as President or General Manager are generally considered equivalent. In this study, such senior executives are considered CEOs, responsible for the company’s daily operational management. Executives’ foreign experience in this study includes both overseas employment and education.

3.3. Other Variables

Concerning control variables, this study includes demographic characteristics such as the CEO’s age, gender, and education level, along with other company-level variables to control their impact on corporate risk-taking. The age and size of the company are included to control for the impact of the company’s life cycle on risk-taking. The book-to-market ratio and sales growth rate are included to control for potential growth and investment opportunities. Fixed asset ratio, Tobin’s Q, and cash flow are used to control for operational and investment financial conditions. At the corporate governance level, the number of female directors is included to reflect board structure diversity, and the executive shareholding percentage is used to control for differences in equity incentives across companies. Given the prominence of the second type of agency problem in Chinese enterprises, the largest shareholder’s shareholding situation is included to describe this issue, and the separation of two rights is used to capture the diversity of ownership structure. Table 1 lists the descriptions and calculation information of these and other key variables.

Regarding instrumental variables, the study selects historical data from China during the late Qing period (1910-1920). The first instrumental variable is the number of universities established by Christian missions in each province, as compiled missionaries. The second instrumental variable is whether the CEO’s birth province was a leased territory. Evidently, the more Christian colleges and universities are established in a province, the greater the likelihood of local people going abroad for study or work. The number of universities in a CEO’s birthplace over 100 years ago is unlikely to directly affect a company’s current risk-taking level, satisfying the condition of being related to the independent

the dependent variable. Further details on the validity of the instrumental variables can be found in Table 1.

3.4. Descriptive Statistics and Correlation Test

Table 2 presents the descriptive statistics for the main variables. A univariate

![]()

Table 2. Descriptive statistic. This table presents a descriptive statistic of main variables. We report the basic statistical magnitude for the full sample on the left side of the table. Since the independent variable is an unbalance data, we carried out a grouping statistic analysis according to “Foreign_experience”.

analysis of group differences was conducted based on the dummy variable for foreign experience. The average risk-taking for the group “Foreign_experience = 0” is higher than that for “Foreign_experience = 1”, but the difference is not statistically significant. This might be attributed to the fact that executives with foreign experience constitute less than 10% of the total sample, resulting in unbalanced data. Further empirical analysis is required to explore the real impact of foreign experience on corporate risk-taking. In the left column of Table 3, descriptive statistics for all variables involved in the analysis are presented for the full sample. Notably, the average value for risk-taking is 1.431. In the right column of Table 3, using foreign experience as a categorical variable, we observe significant differences in Gender, Age, Degree, Firm-age, Managerholding,

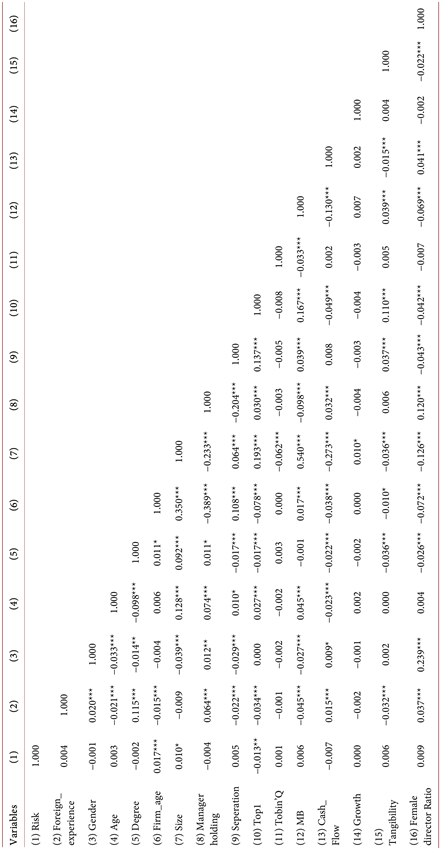

Table 3. Pairwise correlations. This table presents the correlation coefficient matrix of main variables. In the title of column, we replaced the variable names with numbers listed in the first column.

Seperation, Top1, MB, Cash_Flow, Tangibility and FemaledirectorRatio characteristics between the two groups. These variables encompass multiple aspects, including demographic characteristics, company ownership structure, and governance conditions. It is essential to consider these disparities in the subsequent multivariate analyses.

Table 3 reports the correlation test among the variables. The Variance Inflation Factor (VIF) being lower than 10 indicates that there is no multicollinearity issue among the regression variables.

4. Empirical Results

4.1. Regression Analysis

To test Hypothesis 1, the following model was designed to examine the relationship between a CEO’s foreign experience and corporate risk-taking:

(3)

where

is the volatility of ROA, i indicates firms,

is a dummy variable that equals to 1 if CEO has been abroad to work or study,

is a vector of CEO characteristics and firm characteristics, and

is the error term adjusted for firm-level clustering.

Column (1) of Table 4 reports the results of the mixed regression based on panel data. The regression coefficient for the CEO’s foreign experience is 1.354, significant at the 1% level. This indicates that a CEO’s foreign experience increases the level of corporate risk-taking, supporting Hypothesis 1. This suggests that executives with foreign experience alleviate career anxieties and have greater confidence in risky projects, thus enhancing corporate risk-taking. Personal attitudes towards risk may be related to experience (Douglas & Wildavsky, 1982).

For the other control variables, it is observed that higher educational levels among executives significantly reduce the company’s risk-taking level. This correlation may be attributed to individuals with higher education possessing extensive financial knowledge and management skills. Companies with a longer established history tend to exhibit lower levels of risk-taking. Additionally, firms with a higher proportion of female directors are observed to have better internal governance, which also contributes to a reduction in their risk-taking levels. Companies with larger sizes tend to have higher risk-taking, which may be related to their greater capacity for resource allocation and a higher tolerance for risk, often attributed to diversified operations and more robust financial backing. Larger firms might engage in riskier projects or investments, leveraging their scale and market presence.

4.2. Two-Stage Least Squares (2SLS)

There is a strong endogeneity between a CEO’s foreign experience and risk-taking. Two instrumental variables are introduced for 2SLS estimation. The

![]()

Table 4. Baseline regression. This table presents the results of corporate risk-taking on CEO foreign experience. We estimate t-statistics (in parentheses) using robust standard errors clustered at the firm level. ***, **and * indicate significance at the 1%, 5% and 10% level, respectively. We use 3 different regression methods. In column (1), we list the ols estimated outcome in pooled regression models. Then, we induce two instrument variables to reduce sample selection bias, including Christian colleges and British settlement. the first stage estimated result on column (2), the second stage estimated result on column (3), The test of instrument validity was passed. Finally, we use the system Generalized Method of Moments to solve heteroscedasticity or autocorrelation. In the dynamic equation, we add a one-period lagged term of risk referring to function (4). The estimated results are listed in column (4), and the equation satisfy the AR (1), AR (2) conditions.

results of various tests for instrument validity are shown below Column (2) of Table 4. The F-value is greater than 10, the Cragg-Donald Wald F statistic is 21.07, and the p-value for Anderson canon is 0. The number of instrumental variables is greater than endogenous variables, and the p-value for the Kleibergen-Paap rk LM statistic is 0, rejecting the null hypothesis of underidentification. Based on these tests, the two instrumental variables are deemed effective and used in 2SLS. Due to missing information on some executives’ birthplaces, the number of observations decreased to 5012 after matching with instrumental variables. Column (2) of Table 4 reports the first-stage regression results of 2SLS, where coefficients for Christian universities and British concessions are positive and statistically significant, indicating a positive correlation with CEOs’ foreign experience. Column (3) of Table 4 reports the second-stage estimates of 2SLS, where the regression coefficient for Foreign_experience is significantly positive at 25.36 and significant at the 1% level. This confirms the positive impact of a CEO’s foreign experience on corporate risk-taking, supporting Hypothesis 1a, and the effect size is greater than the pooled regression result in Column (1).

4.3. Dynamic System Generalized Method of Moments (GMM)

Although the 2SLS instrumental variables address some endogeneity issues, they cannot handle heteroscedasticity in the data. The dynamic system GMM analysis is utilized here, which not only avoids estimation biases caused by heteroscedasticity but also incorporates the lagged dependent variable into the model, considering the dynamic aspects of corporate risk-taking. The specific estimation equation is as follows:

(4)

where

is the volatility of ROA, i indicates firms,

is the lagged item of

;

is a dummy variable that equals to 1 if CEO has been abroad to work or study,

is a vector of CEO characteristics and firm characteristics, and

is the error term.

Including industry and time-fixed effects in Model (4) leads to a large number of instrumental variables relative to the number of observations, precluding reporting of the Hansen test. Therefore, industry and time-fixed effects are not considered in Model (4). Column (4) of Table 4 reports the regression results of the dynamic system GMM. The p-value for the AR (1) Arellano-Bond test is less than 0.1, the p-value for the AR (2) Arellano-Bond test is 0.974 (greater than 0.1), and the p-value for the Hansen test of overidentification is 0.570. All test results meet the model requirements, confirming the validity of the estimates. The regression coefficient for Foreign_experience is 6.594, significantly positive at the 10% level, supporting Hypothesis 1a. Furthermore, the lagged variable L.Risk is 0.987, significantly positive at the 1% level. This indicates a strong autocorrelation in the company’s risk-taking level, suggesting that previous risk levels highly predict current values. In other words, a company’s risk-taking level exhibits a high degree of “path dependence,” indicating stability in corporate risk strategy. In conclusion, including the lagged risk factor, executives’ foreign experience continues to have a significant positive effect on corporate risk-taking, and the risk-taking level exhibits dynamic consistency.

5. Robustness Tests

5.1. Construction of a Tracked Sample and Propensity Score Matching

To mitigate endogeneity issues arising from self-selection bias, this study reselected data within the panel dataset. Companies that transitioned from domestic to Foreign_experienced executives (“transition” companies) were designated as the treatment group. These were then matched with companies managed by CEOs without foreign experience to construct a new subsample for subsequent multi-period DID analysis. Due to the scarcity of companies transitioning from foreign to domestic experience executives, and hence not meeting the sample size requirements for statistical estimation, reverse transition companies were not included in the analysis.

During the matching process, 1:1 matching was employed using random sorting, with 500 Bootstrap samples drawn to calculate the standard deviation. Covariates included CEO age, gender, education, company size, growth rate, R & D ratio, MB, separation of two rights, managerial shareholding ratio, Top1, and the proportion of female directors. The balance test results after matching indicated that the standard deviations were all less than 10%. Table 6 reports the Average Treatment Effect on the Treated (ATT), which is 3.238 and significantly positive at the 1% level. The ATT remained significant even after changing the matching method. This suggests that the treatment effect after matching is not dependent on a specific matching method and is robust in terms of average effect. The study then refined the analysis of executives’ foreign experience, differentiating between overseas study and work experience. It was found that the average treatment effects for these two categories were distinct, as detailed in Table 5. The average treatment effect for overseas work experience is 3.729, significant at the 5% level. In contrast, the average treatment effect for overseas study experience is 3.002, less than that for overseas work experience, but not statistically significant. Therefore, it can be inferred that the positive effect of foreign experience on corporate risk-taking is primarily driven by overseas work experience.

5.2. Multi-Period Difference-in-Differences Analysis

The multi-period DID model, compared to the traditional DID approach, accounts

![]()

Table 5. ATT effect by bootstrap of different Independent Variable. In this table, we use propensity score matching to calculate the average treatment effect of CEO’s foreign experience on risk-taking. Furthermore, we concerned about whether foreign working experience and foreign studying experience have treatment effects. In the matching process, we use 500 bootstrap sampling and report the corresponding outcome. Based on the matching subsample of Foreign_experience, we performed an endogeneity analysis in subsequent chapters.

![]()

Table 6. Multi-period DID This table reports the multi-period DID outcome based on by function (5). In this part, the sample is a matched sample that only include the firms change the CEO form domestic to foreign experience and the firms always employ domestic CEO. We have identified the transform time of transition firms and use the variable called Period to capture this variation trend. Meanwhile, the matched sample meet the dynamic parallel trend hypothesis in Figure 1.

![]()

Figure 1. Parallel trend test of multi-period DID.

for the temporal variability in individuals’ exposure to policy impacts. In this model, entities in the treatment group can be affected by policy changes at different times. In this study, the “transition” companies hiring executives with foreign experience did so at varying times, reflecting individual corporate behaviors. Hence, we retained the timing of each “transition” company’s executive change and generated a “post” variable. The “post” takes a value of 1 if the company’s CEO has been replaced with one having foreign experience, and 0 otherwise. Similar to the traditional DID method, a parallel trends test between the treatment and control groups is required before estimation. Figure 1 presents the time trend for the multi-period DID parallel trends test, where period 0 represents the transition period. Prior to this period, the risk-taking effect of the CEO was zero within the 95% confidence interval. After this point, it differs significantly from zero within the 95% confidence interval. In other words, before the transition to a CEO with foreign experience in the treatment group, there was no significant difference in risk-taking levels between the treatment and control groups. However, after the transition, the risk-taking level in the treatment group was significantly higher than in the control group, satisfying the parallel trends assumption. Based on this, the multi-period DID model is constructed as shown in Equation (5), with specific regression results presented in Table 6:

(5)

The key parameter of interest is α1. This parameter measures the effect of risk-taking on the foreign-native experience gap of CEO. Table 6 presents the results from estimating multi-period differences-in-differences model. This regression includes industry-year fixed effects. Our key parameter of interest α1 is a significant positive coefficient, suggesting that the difference between the change in risk-taking of the transition firms and that of the control group is statistically significant.

6. Mechanism Test and Further Analysis

6.1. R & D Investment Channel

Innovation often involves substantial initial R & D investment, and the high uncertainty inherent in the innovation process makes it difficult for companies to predict specific outcomes. The potential future benefits of innovation typically require a long investment period to materialize, making innovative R & D projects high-risk activities. A vast amount of literature has confirmed that R & D investments increase a company’s risk-taking level. Therefore, this study focuses on reporting the impact of executives’ foreign experience on corporate R & D investments. As shown in Column (1) of Table 7, when the dependent variable is the firm’s R & D expenses, the coefficient for Foreign_experience is significantly positive at the 5% level. Executives with foreign experience, possessing greater confidence and risk tolerance, actively promote the company’s innovation activities, positively influencing R & D investments. Hypothesis 2 is thus validated.

6.2. CEO Duality

The ability of an executive’s personal decision to be effectively transmitted to the company level is closely related to their managerial autonomy. Here, the duality of the CEO also serving as chairman is used as a measure of executive power. The study further explores whether this governance structure influences the risk effect of foreign experience. After centralizing the CEO-Chairman Duality variable and interacting it with foreign experience, the regression results are presented in Column (2) of Table 7. The results indicate that the coefficient for the interaction variable Foreign_experience*Duality is positive and significant at the 5% level, supporting Hypothesis 3. This suggests that in companies where the CEO also serves as chairman, executives with foreign experience have greater managerial autonomy, and their risk effect is more pronounced.

6.3. SoEs Firm

Following the reform granting operational autonomy, executives of state-owned enterprises (SOEs) in China have gained higher actual control and, consequently, increased managerial autonomy. Considering this difference, the study interacts the nature of the firm with executives’ foreign experience to further analyze whether there is a differential impact based on the type of enterprise. The regression results reported in Column (4) of Table 7 show that the coefficient for the interaction variable Foreign_experience*SOE is 2.680, significant at the 1% level, supporting Hypothesis 4. Additionally, the coefficient for SOE is significantly positive, confirming that the fixed effect of firm nature is positive. This indicates that in companies without executives with foreign experience, the level of risk-taking in state-owned enterprises is significantly higher than in non-state-owned enterprises.

![]()

Table 7. Moderating effects. This table reports some further analysis of foreign experience in risk-taking. We mainly use interaction terms to capture the moderating effects. In this part, we use the fixed effects model based on panel data.

7. Conclusion

Utilizing data from non-financial A-share listed companies in China from 2008 to 2021, this study empirically investigates the impact of executives’ foreign experience on corporate risk-taking, using risk-taking level as an entry point to examine corporate operational status. The findings are as follows: Firstly, executives with foreign experience significantly increase the company’s risk-taking level. This suggests that foreign experience enhances managers’ confidence and tolerance towards risky projects, mitigating risk-averse behavior stemming from career anxieties. This hypothesis remains supported even after employing two-stage least squares estimation. Secondly, mechanism analysis indicates that executives with foreign experience promote corporate risk-taking primarily through increased R & D investments. Furthermore, the degree of managerial freedom, as a crucial factor affecting the transmission of individual decisions to the corporate level, moderates the risk effect of foreign experience. In companies where executives hold dual roles as CEO and chairman and in state-owned enterprises, the positive impact of foreign experience on corporate risk-taking is more pronounced. Thirdly, analysis of risk dynamic effects using dynamic system generalized method of moments (GMM) reveals that the lagged term of risk-taking is significantly positive and close to 1, and the regression coefficient for foreign experience is also significantly positive. This indicates a strong autocorrelation in corporate risk-taking levels, suggesting a high degree of “path dependence.” The company’s past risk-taking decisions largely determine its current risk-taking strategy. Fourthly, robustness analysis using a tracked sample combined with propensity score matching and multi-period difference-in-differences (PSM-MDID) reveals more direct treatment effects, with empirical results supporting the notion that foreign experience promotes corporate risk-taking levels.

The conclusions of this study highlight that executive characteristics are crucial in influencing corporate risk-taking levels. The positive impact of executives’ foreign experience on corporate risk-taking is not detrimental. The enhanced managerial ability and confidence associated with foreign experience can alleviate risk-averse tendencies caused by career anxieties, enabling companies to better identify and utilize valuable investment projects, thus providing more room for sustainable development. Mechanism analysis shows that this positive effect is mainly achieved through increased R & D investment, with executives having foreign experience excelling in focusing on enhancing the company’s innovative capabilities. The consistency in risk-taking levels indicates that corporate risk decisions are influenced not only by the current management team but are also closely linked to previous decisions. For managers, changing the company’s risk-taking level may require more assertive measures to break the entrenched risk orientation. Additionally, the effectiveness of executive decision-making is closely tied to the governance environment, necessitating an analysis of corporate governance structures when considering the impact of executive characteristics on corporate operations.

Formatting of Funding Sources

The work is supported by the National Natural Science Foundation of China [grant number: 72271090]; Scientific Research Fund of Hunan Provincial Education Department of China [grant number: 21A0029]; Hunan Key Laboratory of Macroeconomic Big Data Mining and its Application.