Valuation of the Countries’ Conventional and Nonconventional Monetary Policy Tools in Shrinking Periods ()

1. Introduction

Expansionary monetary policy tools are widely used in periods when economies are shrinking. Although the two main policy tools are the interest rate channel and monetary expansion, implementation methods have increasingly diversified. Especially in the 2008 crisis and the following period, non-traditional policies were adopted while traditional policies were inadequate. However, many debates exist in the literature about whether monetary policy is pro-growth. This study aims to examine the growth effectiveness of monetary policy at the global level, both from a theoretical perspective and country practices.

The first section includes different views on the growth effectiveness of monetary policy. Although monetary policies diversify, the final impact is mainly through two channels. These are the interest rate channel and monetary expansion. While the interest channel directly affects pricing, all other indirect and direct policies that provide resource transfer provide monetary expansion. For this reason, this section seeks an answer to whether monetary policies are pro-growth through interest and monetary expansion. On the other hand, the initial inflation level and inflation growth trade-off are other issues.

The second part examines the expansionary policies implemented in a sample of developed and developing countries. Here, non-traditional policies are included, as well as traditional policies. Each type of policy is supported both conceptually and with data. The reflection of widely applied policies on country examples also provides information about the general outlook.

In summary, through theory and practical applications, this study seeks answers to the effectiveness of expansionary monetary policies implemented on global growth in periods of shrinking economies. The first part includes theoretical discussions. The second part examines traditional and non-traditional policies, which found different application areas, especially during the 2008 crisis and its aftermath, conceptually and with country examples. The general outlook shows that although policy sets are diversified, monetary policies at the global level are more harmonious and move in the same direction.

2. Literature Review

Monetary policy tools are used actively, especially in periods of economic contraction, and expansionary policy sets come to the fore. However, although the main tools are specific, it is observed that the variety of tools is gradually increasing to strengthen the functioning of the economy. Especially with the practices that started in the 2008 crisis and its aftermath, we have entered a period in which emphasis is given not only to traditional policies but also to non-traditional policies. However, when looking at the collective impact of the policies, they are implemented through two channels. The first is the interest rate policy, and the second is monetary expansion, the final result of many other policies implemented. For this reason, it is possible to say that all seemingly complex policies shift to the interest rate channel or monetary expansion in line with the countries’ priorities, even if the areas in which resources are directed differ.

The literature has many different perspectives on the growth effectiveness of interest and monetary expansion. Discussions about the effectiveness of policies are shaped around fundamental issues such as structural and country-specific differences and inflation.

Approaches that consider monetary policy adequate support the relationship between expansionary interest policies and growth because they support the increase in effective demand and facilitate investments. They have drawn a perspective considering structural factors, national differences, and sustainable growth. However, although they did not ignore the inflationary effect, they evaluated it as surmountable under certain conditions. Keynesian and Post-Keynesian approaches emphasize that interest rate cuts will support growth and investments by increasing effective demand. However, both perspectives argue that an interest level should encourage investments, increase the marginal efficiency of capital, and satisfy borrowers and lenders. (Keynes, 2010, pp. 177-181, 262; Kalecki, 1946, p. 82; Kalecki, 1937, p. 714; Figura, 2005, p. 23; Shackle, 1961, p. 247) Keynesians distinguish between high-income and low-income countries. By doing so, they argue that the effectiveness of interest policies will vary depending on the level of development, while Post Keynesians consider the structural problems of countries. (Keynes, 2010, p. 37; Shackle, 1961, p. 251) When we look at New Keynesian policies, it is seen that the approach, which also highlights the concept of sustainable production, adopts a structure that increases the average growth, not the variance of demand-increasing policies. For this reason, New Keynesians also considered long-term policy effectiveness. (Mankiw, Romer, Summers et al., 1988) While the New-Consensus approach states that short-term interest should be used as a policy tool in interest policies, they emphasize that long-term interest rates will shape investment and money demand. The New-Consensus perspective has adopted an interest rate policy that slows down the inflationary effect, keeps employment balanced, and overcomes price rigidities by sharing information with the public. (Goodfriend & King, 1997, pp. 231-234; Woodford, 2006; Gerlach, 2003) Approaches that argue that monetary policy has a limited effect have approached the effect of expansionary interest policies on growth more cautiously. While the classics associated interest policy with the credit channel, they evaluated the loans given to consumers as a transfer of resources to unproductive areas and emphasized the inflationary effect. On the other hand, they noted that the loans given to producers may turn into investments depending on the production return. (Mill, 2009, pp. 381-399) Conversely, monetarists have been critical because low-interest rates do not always mean expansion in monetary policy; on the other hand, their most noticeable effect is increased asset prices. (Friedman, 1969, p. 6) For this reason, perspectives on the adequate and limited effect of expansionary monetary policy also evaluated the effectiveness of interest policies differently.

Approaches in which monetary expansion is expected to be effective on growth indicate that interest rates will decrease simultaneously and argue that growth can be supported through effective demand increase, consumption, and investment channels. For this reason, it differs from other approaches that say that monetary expansion will not significantly affect growth in the long run, primarily due to the inflationary effect. However, approaches advocating efficiency also accept that growth, such as monetary expansion, will sometimes fail to be supported. For example, Keynesian and Post Keynesian perspectives were cautious about the inflationary effects of using money for transactional, precautionary, or speculative purposes, the risk of causing an increase in interest rates, and the possibility of reflecting the speculative deficit caused by changes in asset prices. (Keynes, 2010, pp. 316-317; Kalecki, 1955, pp. 19-22; Minsky, 1990) For this reason, they emphasized criteria such as monetary expansion not exceeding the national income, controlled distribution of loans, and the effect of the marginal efficiency of capital on investments will be decisive in growth. Opinions such as monetary expansion will not be effective in the long term emphasize that money not included in the production process will lose value and result in inflation. They prioritized reasons such as speculation, causing government expenditures and debt, increasing asset prices, and shifting money to unproductive areas. They advocated controlled monetary growth. For this reason, the literature, including Classical, Monetarist, and New Classics, has prioritized that there will be no positive effect between monetary expansion and growth, especially in the long run (Smith, 2015, pp. 314-351; Friedman, 1968; Friedman, 1969; Lucas, 1996; Sargent, Fand, & Goldfeld, 1973, pp. 439-463; Lucas & Stokey, 1987, pp. 500-512) .

Approaches advocating the effectiveness of monetary policy on the inflation-growth trade-off of implemented expansionary monetary policies have evaluated it more conditionally. Although the inflationary effect of expansionary policies is not rejected in the Keynesian, Post-Keynesian, New Keynesian, and New Consensus literature, it is emphasized that they can be overcome if certain conditions are met. For example, while Keynesians argue that monetary expansion will support production and investments through an increase in effective demand, they accept that if the marginal return and production increase is not at the desired level, it will be inflationary. Here, it is emphasized that the economic model will be effective in economies below the full employment level, where savings are equal to investment costs and new investment values, securities purchases, and sales are balanced, and that it will not be inflationary. However, both Keynesians and Post Keynesians argue that when expansionist policies do not support production and investment, they also accept that idle money from producers and consumers will be inflationary. (Keynes, 1914, pp. 147-149; Keynes, 2010, pp. 251-259; Kalecki, 1946, p. 82) In the New Keynesian and New Consensus approaches, there is a flexible price pass-through where price rigidities are overcome, and the initial level of inflation is relatively low. He argued that countries with low inflationary monetary policies can overcome expansionary monetary policies with less inflationary effects and may be pro-growth. (Akerlof, Dickens, Mankiw et al., 1996; Mankiw, 2001; Ball, Mankiw, Romer, Yellen et al., 1988) The New Consensus perspective is that the inflationary effect is since expansionary monetary policies implemented in a high inflation environment cause mark-ups reflected in prices by companies emphasize that it will be more obvious. For this reason, when the conditions are not met, the initial level of inflation becomes essential, and it is emphasized that price fluctuations should be prevented by stabilizing it. On the other hand, the New Consensus perspective is not only focused on monetary policy but also advocates that a long-term disinflationary policy combination compatible with fiscal policy should be determined to be pro-growth. (Goodfriend, 2004; Goodfriend & King, 1997) From this perspective, approaches backing the effectiveness of expansionary monetary policy also accept the growth-disrupting effect of inflation. They argued that it would be surmountable and pro-growth if certain conditions were met. In the Classical, Monetarist, and New Classical approaches, which accept the effect of monetary policy on growth as reasonably limited, the trade-off between inflation and growth is viewed as more confident. For this reason, while the Classics argue that monetary expansion will only be pro-growth if it shifts to investments, they focused more on the inflationary effect of the increase in money supply. (Mill, 2009, pp. 348-391, 418) On the other hand, the New Classics emphasized that monetary expansion is only likely to support production and growth in unexpected situations but will still result in inflation in the long run. However, the pioneers of monetarism argue that monetary expansion has no real effect because it directly increases wages and prices due to the transmission mechanism. (Sargent & Hall, 2018; Lucas, 1996) In other words, approaches that argue that monetary policy has a limited effect emphasize the inflationary impact of expansionary policies and say that they will not be pro-growth in the long run.

In summary, the literature has a vast area of evaluation on the growth effectiveness of expansionary monetary policies. However, the main policy components regarding interest rates and monetary expansion are explicitly discussed. This section includes views defending the efficacy of these two policy sets and arguing that they are limited effectiveness or may be pro-growth in certain conditions. When all discussions are examined, it concludes that the basic inflation level, country-specific differences, and choices in the transfer of resources are as important as the tools applied to the effectiveness of monetary policy.

3. Expansionary Monetary Policies and Country Examples

In its most general form, expansionary monetary policy is defined as increasing the money supply beyond the current situation or decreasing short-term interest rates. The most commonly used monetary policy tools are reducing required reserves, reducing policy interest, and purchasing securities. Paper purchases can be the purchase of treasury papers from traditional policies, or they can be implemented as the purchase of treasury papers or other papers from non-traditional policies in the open market with higher amounts and long terms (quantitative easing1). The most apparent effect of expansionary monetary policies is that they increase the quantity of loans that can be given because they reduce the banking sector’s funding costs and increase the available funds.

3.1. Required Reserve Policies

Required reserve policy is a policy tool that has been implemented since the 19th century to prevent excessive expansion of banks and to provide protection against sudden deposit outflows in case of shocks2. While the policy was determined based on a single rate when it was first implemented, rates began to be introduced according to limits that vary depending on differences such as currency, maturity, type of obligation, and whether the fund is domestic or foreign. Required reserves are implemented as a micro-prudential policy for monetary control and liquidity management. The primary purpose was to ensure that banks had sufficient liquid assets and was used as a regulatory micro-prudential policy. Monetary control was achieved by regulating credit growth by adjusting the provision amounts allocated. On the other hand, increasing required reserves indirectly causes an increase in loan interest, thus preventing capital inflows. It has been found that increasing required reserve ratios does not increase deposit interest rates but instead increases loan interest rates. For this reason, required reserve ratios are reduced to support growth and achieve an expansionary effect. On the other hand, it also provides liquidity control, thus balancing the pressures from inflation, exchange rate, and interest rates. (Gray, 2011; Montoro & Moreno, 2011; Federico, Vegh, & Vulletin, 2014)

Banks can keep required reserves in free and blocked accounts within the Central Banks for local and foreign currency liabilities within the specified balance sheet items in specified periods3. Required reserves can be established at different rates depending on the maturity and type of liabilities. Its implementation started in Türkiye in 2010. In the policy of required reserve needed, deposits, participation funds, funds obtained from the repo, loans used, securities issued, debt instruments not used in the capital account, liabilities to foreign headquarters, debts from credit card payments, and borrower funds are included in the definition of liability. However, in current practices, there are new practices in which the liability side of banks’ balance sheets is tried to be regulated by applying reserve requirements not only to liabilities but also to assets4.

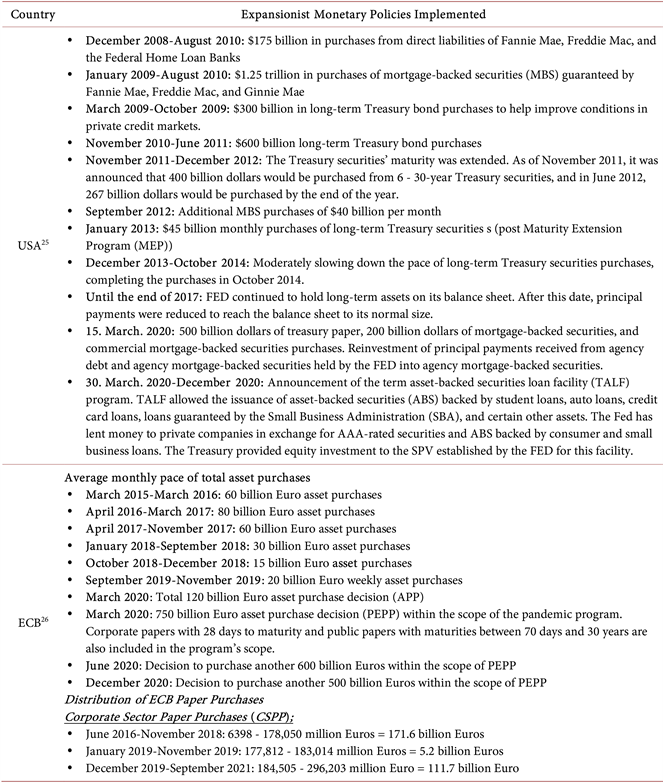

Although reserve requirement practices may vary from country to country, it is also seen that some countries do not implement the policy. For example, the FED has actively used the reserve requirement policy since the 1930s. In March 2020, it reset the required reserve ratios to zero and declared that they were unnecessary for monetary policy. (Bordo, 2011) The reserve requirement policy has been abolished in some countries, such as New Zealand (1985), Canada (1992), Australia (1988), and Sweden (1994)5. When we look at countries’ latest average required reserve ratios, they vary between 0% and 44%. (Figure 1) As such, it can be said that some countries already have a stringent reserve requirement policy, while others do not use it at all. In determining whether the reserve requirement policy is expansionary, deciding whether the rates are below the currently applied rates for each country rather than a specific rate becomes essential.

![]()

Figure 1. Average reserve requirement ratios of selected countries. Source: http://www.centralbanknews.info/p/reserve-ratios.html, December 2023.

Keeping some of the liabilities included in the reserve requirement policy within the Central Banks instead of using them by banks affects the available funds. It thus also affects the amount of money released into the market. For this reason, when expansionary policy preferences come to the fore, reserve rates are reduced, and the money supply in the market is increased. As the funds that can be given through banking channels increase, an expansionary policy is also implemented through the credit mechanism.

3.2. Open Market Operations

Open market operations are transactions in which short-term treasury and other securities are bought and sold in the secondary market. Although they differ depending on whether they are permanent or temporary, temporary transactions are decisive in fluctuations in the money supply. In contrast, permanent transactions are used to provide long-term liquidity support.

The development of the Central Banks’ open market operations and buying and selling process started in the 1914s, and it is seen that the steps of today’s known practices were taken in the 1922s in America and some other countries. Initially, central banks provided liquidity flow in the market by meeting the demands of buyers and sellers in the bond markets. However, liquidity problems experienced due to World War I and banks’ inability to service their debts led to the use of new instruments. In this process that developed under the leadership of the FED, it can be seen that treasury securities started to be purchased, the liquidity flow to the market increased, and the credit channel was revived. In other words, the first phase of the implementation started with the inclusion of treasury bills, aiming to support the economies and the banking sector that were shrinking and experiencing liquidity problems due to the inadequacy of the bond markets. (Burgess, 1964; Hawtrey, 1933: 67-72) The fact that treasury securities can be bought and sold in the secondary market has indirectly enabled open market operations to impact fiscal policy. While these papers held by central banks support net government indebtedness, they also increase the market’s liquidity by reducing banks’ paper portfolios. (Toporowski, 2018: 23-25) When the amount of liquidity in the market is diminished due to previously implemented sterilization policies (for example, central banks may have adopted contractionary policies due to the excessive depreciation of money), if budget deficits are also evident, the amount of credit that can be given also decreases. In such environments, banks also give more space to government debt securities in their portfolios. (Souza, 2003) In other words, the increase in government debt securities and the decrease in loans and liquidity in bank portfolios may be due to the influence of internal policies and external factors. For this reason, when expansionary policy preferences come to the fore, central banks’ paper purchases support the amount of liquidity again.

It is known that traditional open market transactions are carried out by short-term buying and selling of treasury securities. Still, the different policy instruments, especially after the 2008 crisis, were also reflected in open market transactions. However, permanent paper purchases have also increased. For example, the FED tried to support liquidity in the market long-term by making paper purchases permanent, especially during the 2008 crisis6. While weekly short-term and 3-month long-term paper purchasing programs are implemented in the Euro system, nontraditional, longer-term programs have also become feasible7. However, there are practices where some central banks buy and sell their bonds in the open market. (Barth & Song, 2013: 360) In the European Central Bank, open market operations are carried out through standard and fast auctions. Standard tenders: while primary financing involves completing long-term, short-term, and structural operations within a day, fast tenders are implemented as fine-tuning tenders in approximately one and a half hours. Variable and fixed interest rates can be used in tenders. Still, with the 2008 crisis, a practice was introduced in which the variable interest application was canceled, and the fixed interest application was gradually reduced.

While asset purchases in open market operations expand the amount of liquidity and the monetary base, the growth reflection that can come with the credit mechanism may vary in countries where certain limits are imposed on bank deposit and loan interest rates. (Barth & Song, 2013: 360) In other words, how liquidity is directed becomes as essential as the liquidity given to the market. Although studies show that the effect of open market operations on growth is neutral, it is also possible that they can make a positive contribution compared to the impact of other variables in the economy. For example, in environments where nominal interest rates are high, conditions arise where banks turn to government debt instruments rather than actively using capital in financial markets and the credit channel. In such environments, the effect of nominal interest rates is also considered necessary, as open market operations providing liquidity to the market only increase the amount of liquidity held by banks and the real sector. (Smith & Screft, 1995)

3.3. Interest Rate Policies

Criticizing the monetarist approach for developing policies based on monetary aggregates resulted in the new consensus approach prioritizing interest policies. For this reason, central banks actively use interest policies in implementing expansionary and contractionary steps depending on the economy’s current situation.

Although the interest policies used by central banks vary, there are applications such as funds rate, policy rate, rediscount rate, and primary lending interest rate. The first effect of the interest rate channel occurs when banks determine the cost of deposits they use for borrowing in daily and overnight transactions within central banks. Although its applications are diverse, it also determines the pricing in the sector as it determines the first step of the funding cost. For example, while the Fed allows the federal funds rate and the overnight deposit borrowing cost of banks and other credit institutions to form around this rate, transactions are carried out in our country with a margin determined above and below the policy rate (1-week repo auction rate). When the amount of money in the market is increased, transaction costs approach the policy interest rate, and when it is decreased, they rise. Discount rates are those used directly by central banks when lending to banks and are usually set above the interbank borrowing rate. The interest rates used to direct loan interest are generally determined around overnight interest rates. For example, the Fed publishes its primary interest rate around the federal funds rate8. These interest rates are the interest rates that banks apply to their best commercial customers, and they ensure that other loans are formed around this rate, depending on the risk. In the European Central Bank, the interest rates that provide banks with overnight deposits, loan interest, primary financing, and liquidity differ. While the fixed rate tenders, which provide direct liquidity to the banking system and are used in open market transactions, have been 0 since 2016, there is a negative interest rate on the deposits brought by banks in overnight transactions. By applying negative interest on overnight deposits, it is aimed for banks to put their idle deposits into use. In this way, people are encouraged to spend and invest more instead of using deposits as a savings tool. Fixed-rate auction interest rates also provide liquidity to banks in basic one-week open market operations. For overnight loans (marginal lending facility), interest is applied at a low rate 0.259. Fixed and variable interest options that provide direct liquidity to the market have been introduced in auctions. Variable interest rates were allowed to be shaped around the interest rate given by banks due to the tender10. However, since variable interest rates approached 0 in practice, fixed-rate auction interest rates were switched to 0 and were determined as 0 in the last practice. During the 2008 crisis, variable interest rates were canceled, and the fixed interest rate was determined below the variable and was gradually reduced in this process. The marginal lending interest rate has also steadily declined since the same date11.

In many countries, policy interest rates approaching zero or switching to negative interest rates (Sweden, Switzerland, Denmark, Japan, Euro area, etc.) also appear as policy changes. However, whether the funding reaching this point supports growth by being reflected in loan interest rates at the same rate is also a matter of debate. While the negative funding cost generally reduces deposit interest rates to levels close to zero, studies show that banks do not reduce loan interest rates at the same rate in a homogeneous manner. In other words, the effect of the policy rate being negative is slower than if it starts to be reduced from zero. In this structuring, the loan-deposit interest rate difference almost did not change, but in some banks, it increased depending on the loan interest rates. Banks that prefer to fund with deposits do not reflect the policy interest rate on loan interest rates. On the other hand, if the banks’ reserves are with the central bank, the banks lose money with negative interest rates. During contractionary policy periods, loan interest rates do not decrease due to profitability pressure and narrow the growth more than the positive policy interest rate. In other words, it is not possible to say that negative policy interest rates are an expansionary policy since their support for growth through the credit pricing channel remains weak. (Eggertsson et al., 2017)

Interest rate changes are decisive by affecting factors such as other interest rates in economies, asset prices, household welfare, credit mechanisms, exchange rates, spending, and investment behavior. The first effect occurs when banks and, in some countries, deposit-holding institutions determine the cost of borrowing. Banks want to avoid lending among themselves at a rate below this cost. Interest rates on short-term loans provided to households, companies, and the government are also determined above this cost. Therefore, it is also reflected in borrowing costs. Long-term interest rates are mainly shaped by expectations of central banks’ policy rates. Asset and share prices also change according to interest policy and determine demand. Therefore, other factors being constant, the demand for the country’s assets due to the effect of interest also determines the exchange rates12.

When monetary policy is expanded by reducing policy interest rates, the credit channel is also expected to be expansionary, provided other conditions are compatible. With falling costs, consumer loans are becoming more attractive, and with the revived demand, movement is observed in many sectors. Increasing asset prices also increase the demand for these assets and support household welfare. This further increases the spending channel. Since interest determines the cost of investments, falling interest rates also accelerate investments, assuming other positive conditions. Since the value of the domestic currency will decrease relatively, it is expected to contribute to exports as the prices of domestic products will be more attractive abroad13.

3.4. Rediscount Loans

Rediscount loans are the policy of providing loans by Central Banks by taking the bills brought by banks or companies as collateral (by having them broken for the second time). Country examples vary. In Türkiye, the Central Bank provides loans through Eximbank to support exporting companies. In the current practice, foreign currency bills with a maximum of 360 days left to maturity are purchased, loans are given in TL, and returns are received in foreign currency. Depending on the current situation and conditions, rediscount loans can be provided with different applications. The Central Bank of China can also provide loans to financial institutions by discounting the stocks held by the financial institutions or the promissory notes appropriate to the collateral they receive from the banks they work with. (BIS, No: 54)

3.5. Asset Purchases

As non-traditional policies became important in crisis and economic management, asset purchases began to be used as a policy tool. Especially in the period led by the USA, the European Union, the UK, and Japan, the ineffectiveness of monetary policy due to short-term interest rates being close to zero brought about the search for new policies. (Fawley & Neely, 2013) Consumers’ increasing habit of keeping cash as interest rates approach zero has shown that monetary expansion and short-term asset purchases are insufficient to stimulate economies. For this reason, quantitative easing (QE) policies have gained momentum. While the 2008 crisis period stood out as the period in which this policy began to be used most widely and intensively, it continued to be implemented as needed after this period. In this process, Central Banks resorted to providing liquidity to the market by purchasing short- and especially long-term treasury and private-sector securities14. The 2008 crisis was a period in which mortgage-backed securities were purchased excessively. With the impact of COVID-19, since the first quarter of 2020, this policy has been implemented more strongly again, and the assets purchased have diversified. It is aimed that the purchases will be primarily long-term and that quantitative easing will support the long-term economy. Quantitative easing through asset purchases from banks has primarily two effects on the sector. First, when the economies are damaged, banking sector balance sheets deteriorate, causing trust problems and disrupting banking transactions. Taking these assets from bank balance sheets by central banks and providing liquidity instead primarily improves the trust channel and enhances the balance sheet outlook. The second effect is that, as a reflection of the deterioration in the balance sheet, the shrinking credit volume and the appetite for lending may increase again in banking. For this reason, in cases where monetary expansion is insufficient, it is desired to open a borrowing channel for households and companies. The fact that the real sector has become dysfunctional in exit strategies from contracting economies has led the Central Banks, who want to accelerate the monetary transmission mechanism in new applications and directly support the real sector, to purchase private sector papers. The fact that private sector papers have started to be bought signals that commercial and corporate companies will not have a liquidity problem and that their papers will be purchased if desired. For this reason, purchases have a liquidity-supporting

effect. Another effect of quantitative easing is through the price channel. Central Banks’ purchase of government bonds and bills, company papers, etc., from banks, other financial institutions, or pension funds also increases the value of these papers. The decrease in interest rates on securities with increasing value makes the cost of borrowing affordable for households and companies15. The increase in government borrowing requirement also increases costs for the sector directly and indirectly through this channel. Central Banks’ purchase of treasury securities through quantitative easing contributes to expansion in the fiscal policy channel and affects long-term interest rates. Announcing asset purchases as a permanent policy by Central Banks also ensures policy effectiveness in the long term. In this way, the expectations channel is also decisive in the decline in long-term interest rates. The asset purchase policy is thought to be effective in monetary transmission through the portfolio balance channel. According to this view, assets in different categories in the portfolio are not perfect substitutes for each other. Some assets are preferred because they are considered riskier, and some have higher transaction costs or due to certain legal limits. The portfolio balance channel predicts that if Central Banks buy certain assets from the market, investors will turn to other assets to increase their portfolios. Thus, as other asset purchases in the market increase, the prices of these assets increase, and their returns decrease. In this case, financial conditions are loosened widely throughout the economy through the asset prices channel. Purchases affect not only the amount but also the composition of assets held in the market. (Brainard & Tobin, 1963; Andrés et al., 2004; Yellen, 2011; Bernanke, 2012; Chen, Curdia et al., 2012; Harrison, 2012)

It has been observed that the effectiveness of quantitative easing practices is more evident, especially during crisis periods. In periods when markets do not function properly, the decisiveness of the quantitative easing policy on economies increases. Rapid and significant purchases in such periods also change the speed of the policy’s spread. The level of liquid demand is another factor. Purchases made in situations where investors widely hold government bonds and bills and a liquidity shortage provide liquidity to these investors and non-bank investors. This situation is explained through the portfolio balance channel. As a result, the change in borrowing costs with quantitative easing practices is expected to be reflected in inflation and growth through the expenditure and income channels.

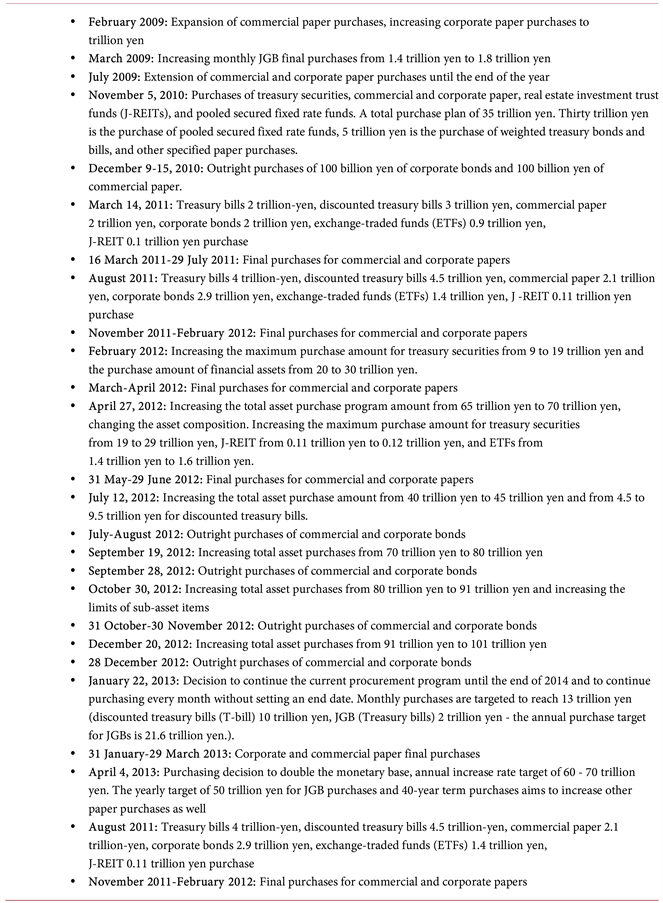

It is observed that asset purchases increased significantly during the 2008 crisis and subsequent recession periods. For example, FED balance sheet assets, approximately $870 billion in August 2007, reached $4.5 trillion at the end of 2014. Another breaking point is the period that started with the COVID-19 pandemic. Especially since the first quarter of 2020, asset purchases have almost doubled. It can be said that total assets within the FED have reached approximately $8.2 trillion as of August 2021. (Figure 2) While the Fed’s total assets reached its highest level in April 2022 with the effect of purchases to $8.9 trillion, it can be said that its total assets decreased to $7.7 trillion for the December 2023 data16.

The course of asset purchase programs during the exit processes from contracting economies within Europe can also be seen in the European Central Bank (ECB) balance sheet. The primary purpose is to accelerate the transmission of monetary policy. The aim was to facilitate the borrowing level of non-financial institutions and households by expanding the monetary and financial situation17.

![]()

Figure 2. Amount of FED total balance sheet assets (Billion Dolar). Sources: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm, https://www.ecb.europa.eu/pub/annual/balance/html/index.en.html.

In this way, it was desired to ensure a positive spread in other markets. It is aimed to keep inflation balanced by increasing total consumption and investment expenditures by facilitating the credit channel. In line with this purpose, the tools have been expanded, the types of asset purchases have increased, and the units purchased have also accelerated. Asset purchases are made in primary and secondary market transactions and are not limited to a specific market.

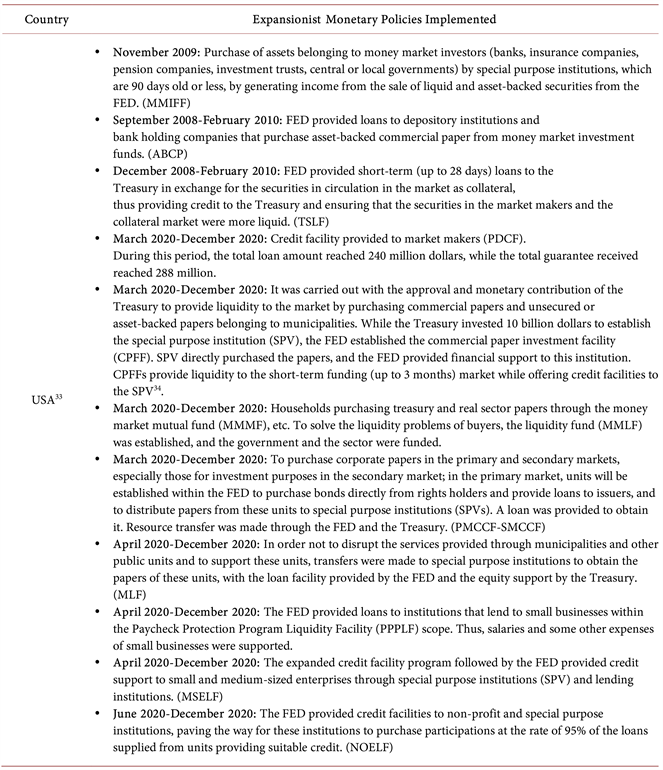

The programs that started to be implemented with the 2008 crisis were re-implemented more strongly, especially in 2014 and beyond. Looking at annual totals, total asset purchases (APP), which reached 274 billion Euros in 2011 with purchases after the 2008 crisis, increased almost 14 times, reaching 3.694 billion Euros by the end of 2020. (Figure 3) The total assets of the ECB, which announced many asset purchase programs during the pandemic and post-pandemic period, were 4.713 billion Euros as of December 202118 and reached 4.937 billion in December 202219.

Recently, corporate sector paper purchases (CSPP), public asset purchases (PSPP), paper purchases for asset-backed securities (ABSPP20), and third-covered bond purchase programs (CBPP3) have come to the fore in practice21. In particular, the share of public asset purchases is considerably higher than others. The ECB started asset-backed securities purchases and third-covered bond purchase programs in the last quarter of 2014. Public asset purchases have been implemented since 2015, and private-sector asset purchase programs have been implemented since 2016. The public asset purchase program is not limited to nominal and inflation-indexed government bonds and bills. A comprehensive purchasing program includes debt securities of approved institutions within the

![]()

Figure 3. ECB total balance sheet asset purchases amount (Billion, Euro). Sources: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm, https://www.ecb.europa.eu/pub/annual/balance/html/index.en.html.

euro area, local and central governments, international organizations, and multilateral development banks. However, the share of purchases made by international organizations and multilateral development banks is approximately 10%22.

Asset-based loan requests within the ECB started in the first quarter of 2013 (473 billion Euros) and reached 883 billion Euros by the second quarter of 2021. This situation also indicates that the asset-based loan instrument has begun to be used more intensively. On the other hand, the assets accepted as collateral have diversified, and the share of some of them has increased. For example, the share of secured bank bonds and non-marketable bonds has increased significantly23.

The situation is similar in the Bank of England data. Considering asset purchases between November 2009 and December 2020, there has been an increase of almost five times, 200 billion pounds to 895 billion pounds. (Figure 4) The UK started its asset purchase programs in January 2009 through a fund established within the Bank of England. The Treasury has authorized the Bank to purchase high-quality private sector assets, bonds issued under the credit guarantee scheme (CGS), corporate bonds, commercial paper, syndicated loans, and a limited number of applicable asset-backed securities. In practice, it was decided to finance these purchases by issuing Treasury bills24. In later periods, purchases were also made from the Central Bank reserves. However, the UK has continued its asset purchases in the corporate and commercial areas, with the highest purchases made through treasury securities. It is seen that asset purchases were stopped in the 2013-2016 period (Figure 5).

Although the total assets of the Bank of Japan have reached 726.71 trillion Yen as of August 2021, a new policy has been determined, and asset purchases have been increased since 2013. While government bonds and bills and the amount of loans against collateral were decisive, other asset purchases remained limited.

![]()

Figure 4. Bank of England asset purchase amounts (Billion Pound). Sources: https://www.bankofengland.co.uk/monetary-policy/quantitative-easing.

However, unlike others, the Bank of Japan’s asset purchase policies are limited (although the purchase of government securities in 2012-2017 was relatively intense), and loans given against collateral are preferred. Loans against collateral are the dominant policy during and after COVID-19 (starting from the first quarter of 2020). (Figure 6) (Table 1)

![]()

Figure 5. Distribution of bank of England stock asset purchases (Billion Pounds). Sources: https://www.bankofengland.co.uk/boeapps/database/.

![]()

Figure 6. Bank of Japan asset purchase amounts (100 Billion Yen). Sources: https://www.stat-search.boj.or.jp/index_en.html.

Table 1. Bank of Japan asset purchase amounts (100 Billion Yen).

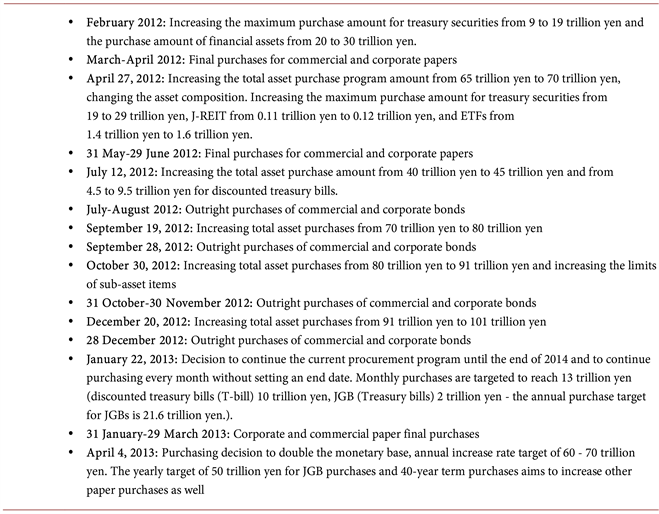

3.6. Other Policies

• Asset Purchases from Money Market Investors by Special Purpose Institutions

It is the purchase of assets belonging to banks, insurance companies, pension companies, investment trusts, and central or local governments for 90 days or less by special purpose institutions (SPV) in return for the liquidity they provide from central banks and the cash they obtain by selling asset-backed papers30. (November 2009, Fed, MMIFF)

• Credit Facility for Purchase of Asset-Backed Commercial Papers

It is the provision of loans by central banks to depository institutions and bank-holding companies that purchase asset-backed commercial paper from money market investment funds. (September 2008-February 2010, Fed, ABCP)

• Term Securities Loan

Central banks provided a short-term exchange of treasury securities with other securities through auctions to support market makers, the Treasury, and collateral markets. In the treasury basket, treasury bills, bonds, and inflation-indexed securities, short-term loans were provided against corporate, municipal, mortgage-backed, and asset-backed securities. This way, the transformation rate of papers in the market into liquidity was accelerated, and liquidity support was provided to the Treasury. (December 2008-February 2010, Fed, TSLF31)

• Loans Provided to Market Makers

These loans are provided to market makers who buy and sell treasury and other securities. It is possible to define these institutions as organizations that buy and sell for central banks through open market operations. Due to the liquidity problems of primary sellers during periods of crisis and contraction in economies, loans were generally provided with maturities of up to 90 days in return for certain guarantees. Loans are given against collateral. Efforts were made to increase the amount of liquidity by expanding the scope of assets accepted as collateral. For example, in addition to the collateral accepted for open market transactions, many assets such as corporate and commercial papers, assets and mortgage-related securities, stocks, and municipal securities have become collateral. (March-December 2020, Fed, PDCF)

A fixed interest rate has been introduced in applying unlimited credit facilities to market makers, especially banks. For example, while the European Union provides fixed-rate full allocation, on the one hand, it has extended the maturities. On the other hand, it has also expanded the pool of assets accepted as collateral32. (ECB, November 2008-March 2009)

• Financing of Commercial Papers and Municipalities

Another practice is the creation of special units where unsecured or asset-based commercial papers and municipal papers can be purchased, and liquidity is provided. When the risk of commercial companies and municipalities being unable to sell their papers becomes evident, as well as the real sector, it has been observed that work such as transport and health are also disrupted. The disruption of processes in the markets where asset-backed commercial papers are bought and sold has led to the need to establish different units. These papers were purchased by the units that the Treasury provided resources to and approved, thus providing liquidity to the market. Maturities are limited to three months. (March-December 2020, Fed, CPFF)

• Money Market Investment Fund Liquidity Facility

The problems in the “mutual fund money markets,” where papers belonging to the treasury, municipalities, and companies are purchased for investment purposes, have been solved by providing liquidity to those accessing these markets. Households, companies, and other organizations that buy paper for investment purposes also offer financing to the institutions and organizations that sell these papers. However, due to liquidity shortages during contraction and crisis periods, early redemption requests also bring about liquidity problems in these institutions. To solve this problem, some countries have established institutions that provide direct credit to investors and ensure that asset purchases continue. (March-December 2020, Fed, MMFF)

• Corporate Credit Opportunity in Primary and Secondary Markets

With the primary and secondary market corporate credit facility units established within the Central Bank, loans were provided to issuers or for the purchase of corporate papers in these markets, corporate papers for investment purposes, or bonds from their rights holders. Loans were provided to special purpose entities (SPVs) for the purchase of papers through these units. At the same time, cash was transferred to these institutions from the Treasury. (March-December 2020-Fed, PMCCF-SMCCF)

• Credit Opportunity Provided to Municipalities

Public papers were obtained by supporting special purpose institutions with loans from the Central Banks and equity investment from the Treasury. In this way, services provided by municipalities and other administrations were supported. (April-December 2020, Fed, MLF)

• Paycheck Protection Program Liquidity Facility

It is the provision of loans by central banks to institutions from which small businesses will receive loans within the scope of the salary protection program and other purposes. It is aimed to support small businesses in this way. (April-December 2020, Fed, PPPMF)

• Credit Facility Provided to Small and Medium-Sized Enterprises

Central banks have provided credit support to small and medium-sized enterprises through special-purpose institutions, banks, and other institutions that can provide loans. Special purpose institutions have received participation from financial institutions offering loans in exchange for a large portion of the loan. (April-December 2020, Fed, MSELF)

• Credit Facility Provided to Non-Profit Organizations

Loans were also provided to non-profit organizations through central banks. Institutions that can provide loans were supported by providing loans to special purpose institutions and acting as guarantors to the institutions. (June-December 2020, Fed, NOELF)

• Increasing the Credit Capacity of Banks

The capital ratios that banks must hold limit the amount of loans that can be given. For this reason, some countries have increased the loan rate by introducing flexibility in capital adequacy ratios, such as the capital buffer and the capital ratio that must be kept within the scope of Pillar 2. (ECB, March 2020; UK, March 2020)

Flexibility in liquidity ratios also expanded credit capacity. In this way, the ratio of liquid assets was temporarily relaxed so that the resource could be given to the loan. (ECB, March 2020; UK, March 2020)

Another practice for banks is the option to postpone dividend payments. In this way, it is aimed to transfer the remaining resources to loans. (ECB, March 2020; UK, March 2020)

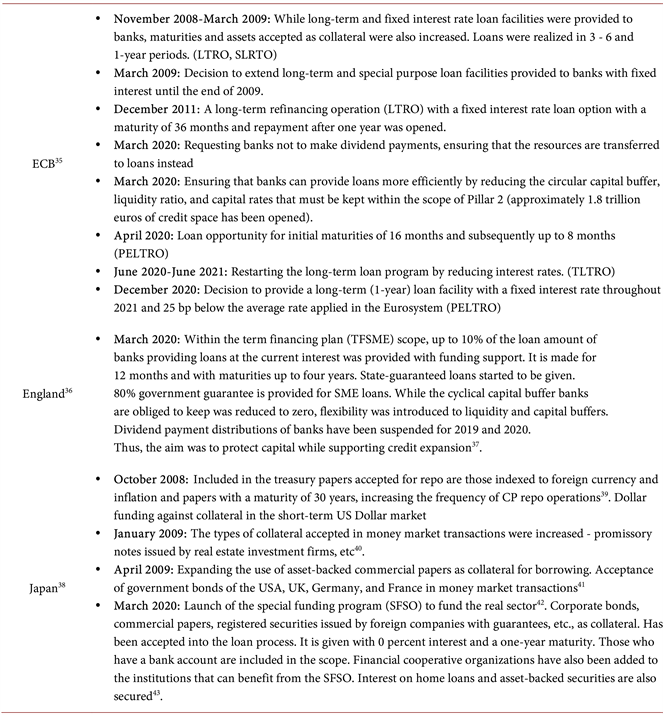

Table 2. Other expansionary monetary policy implementations and country examples.

• Providing Fund Support to Lending Banks

The existence of particularly high interest rates in some countries directs banks that want to collect deposits to higher interest rates, but it does not allow loan interest rates to fall below these levels. For this reason, the loans given are costly for the borrower and provide limited expansion in contracting economies. Some countries facing a high-interest rate environment have tried to support the sector by providing funding support up to a certain amount of the loan given (which may vary depending on the type of loan). For example, the UK increased credit expansion by providing funding support of up to 10% of loans within the scope of the term financing plan49.

• Government Guaranteed Credit Support

Policies are also supported by providing government guarantees for certain amounts of loans to provide credit incentives. For example, there are many practices where credit guarantees are provided for SME loans as incentives. In March 2020, the UK granted an 80% government guarantee for SME loans. Since no capital provision is allocated for government-guaranteed loans, it opens up extra space for banks for new loans.

• Helicopter Money

Helicopter money is seen as an alternative to the quantitative easing program and is especially preferred in cases where interest rates approach zero, but the recession cannot be overcome. Although helicopter money is defined as making payments directly to individuals, it is also expressed more broadly. Tax deductions and transfers can also be evaluated in this category. Supporting the budget deficit by purchasing government securities directly from central banks, providing direct loans to the real sector, or providing liquidity also falls into helicopter money50. In the most general definition, all liquidity support methods directly transferred to households and the real sector are considered helicopter money51. In this way, it aims to reach the target audience directly and revitalize the economy through production and consumption channels (Table 2).

4. Conclusion

This study examined the expansionary monetary policies implemented in countries when economies shrank and analyzed new methods, similarities, and differences. Thus, while observing the holistic picture, the effectiveness of global growth can be understood. How countries use policies, as well as policies, determines whether policies are expansionist or not. However, since the perspective on traditional monetary policy changed, especially after the 2008 crisis, many non-traditional policy tools have come into play and brought a new perspective to the current understanding of monetary policy. On the other hand, it is also useful to examine monetary policy and growth efficiency in the literature to understand the theoretical part. No matter how diverse policies are, their final impact directs two channels. These are the interest rate channel and monetary expansion. For this reason, opinions on the growth efficiency of these two channels were also examined in the literature.

In their most basic approach, expansionary monetary policies appear as all kinds of policies and interest rate cuts that increase the money supply in the system. While policies such as required reserves, open market operations, interest rate cuts, and rediscount loans can be cited as examples of traditional policies, asset purchases, helicopter money, and credit methods, including central banks, etc. practices can be shown as examples of non-traditional policies. All these practices aim to relax the credit mechanism and increase the amount of liquidity by reducing interest rates while increasing the money supply in the system. Required reserve practices provide the opportunity to control the amount of liquidity in the system and shape interest rates. The methods and rates used vary in the countries where they are implemented. In the sample consisting of developed and developing countries, it is seen that an average reserve requirement of 9.5% is applied. Central banks’ open market operations and purchases of paper from the secondary market have an expansionary effect on the monetary base and the amount of liquidity, and if other conditions in the market are positive, it can also have an expansionary impact through the credit channel. The interest policies used by central banks also determine the loan interest rates in the system, as they determine the funding and deposit costs. In many countries, funding rates have reached zero or even negative levels. However, it has also been determined that this policy is not very pro-growth and needs to be reflected in loan interest rates at the same rate. However, in cases where policy interest rates are reduced, the credit channel is expected to be expansionary. On the other hand, rediscount loans are loans provided directly to the sector by central banks by having the bills brought by companies or financial institutions written off. Since these applications directly transfer liquidity to the targeted area, they can be expected to be pro-growth. In addition, with the introduction of non-traditional policies, quantitative easing policies have gained momentum, and asset purchases have found an extensive application. Central banks have the high-money and long-term private sector, treasury papers, financial institution papers, pension funds, etc. While providing targeted liquidity to the system, interest rates are aimed to decrease through expectations and valuation of the purchased papers. Asset purchases are expected to support growth by reducing borrowing costs and increasing spending. The policy composition is examined by including some countries’ asset purchases and diversity, especially in the 2008 crisis and its aftermath, when economies shrank. Apart from these, many non-traditional policy instruments also came into play during this period. It is seen that the instruments that provide liquidity and credit to the market are also diversified. Central banks provide credit and liquidity opportunities to intermediary institutions, organizations, and market makers that offer paper purchases. Many non-traditional policies such as support provided to municipalities, provision of loans to small and medium-sized enterprises, state-guaranteed loan support, and helicopter money application have also found application areas. While all these policy components increase the money supply in the system during periods when economies shrink, they also enable the transfer of resources supported by low-interest rates to certain areas. However, since each country’s resource distribution mechanism, the sectors it prioritizes, the way the money released to the market is used, and the interest transfer channel are different, its effects on growth can be expected to differ. In this section, country differences and policy diversity were examined, and the aim was to determine the country-specific variability in how monetary policy transfers liquidity within itself.

In summary, in this section, expansionary monetary policies are examined conceptually and in terms of their application areas in countries while an attempt is made to evaluate the situation. While monetary policies are shifting towards non-traditional and traditional monetary policies, they present a more harmonious outlook when considered country-specifically. Especially when we look at the policies implemented in the 2008-2009 period, although the applicability of the policies varies, the primary trend is to increase the amount of liquidity and money supply in the market and to reduce interest rates. For this reason, even from the total sample of countries examined, the global monetary policies implemented at the global level were in the same direction in these periods. For this reason, it is understood that monetary policies support global growth more holistically compared to other policies implemented under the assumption that other conditions are similar.

NOTES

1https://www.investopedia.com/terms/q/quantitative-easing.asp.

2https://en.wikipedia.org/wiki/Monetary_policy.

3https://www.tcmb.gov.tr/wps/wcm/connect/TR/TCMB+TR/Main+Menu/Temel+Faaliyetler/Para+Politikasi/Zorunlu+Karsilik+Oranlari/, 25 Aralık 2013 tarihli 28862 sayılı “Zorunlu Karşılıklar Hakkında Tebliğ”.

4https://www.tcmb.gov.tr/wps/wcm/connect/994eeecf-2a8d-48bc-91b6-81450a2866e6/1.Tam+Metin.pdf?MOD=AJPERES&CACHEID=ROOTWORKSPACE-994eeecf-2a8d-48bc-91b6-81450a2866e6-oldp8SF.

5https://www.federalreserve.gov/monetarypolicy/reservereq.htm, https://en.wikipedia.org/wiki/Reserve_requirement#cite_ref-monetary-economics_11-0. https://www.hkma.gov.hk/eng/news-and-media/insight/2009/08/20090813/.

6https://www.federalreserve.gov/monetarypolicy/bst_openmarketops.htm.

7https://www.ecb.europa.eu/mopo/implement/omo/html/index.en.html.

8https://www.tcmb.gov.tr/wps/wcm/connect/tr/tcmb+tr/main+menu/temel+faaliyetler/para+politikasi/merkez+bankasi+faiz+oranlari. https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications.htm.

9https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html.

10https://www.ecb.europa.eu/ecb/educational/explainers/tell-me-more/html/why-negative-interest-rate.en.html.

11https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html.

12https://www.federalreserve.gov/monetarypolicy/monetary-policy-what-are-its-goals-how-does-it-work.htm.

13https://www.federalreserve.gov/monetarypolicy/monetary-policy-what-are-its-goals-how-does-it-work.htm.

14https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1593530521495&uri=CELEX:32016D0016.

15https://www.bankofengland.co.uk/monetary-policy/quantitative-easing.

16https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm.

17https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32017D0004&qid=1598887522263.

18Consolidated balance sheet of the Eurosystem as at 31 December 2021 (europa.eu).

19Consolidated balance sheet of the Eurosystem as at 31 December 2022 (europa.eu).

20https://www.ecb.europa.eu/press/pr/date/2014/html/pr141002_1_Annex_1.pdf.

21https://www.ecb.europa.eu/mopo/implement/app/html/index.en.html.

22https://www.ecb.europa.eu/mopo/implement/app/html/index.en.html.

23https://www.ecb.europa.eu/paym/coll/charts/html/index.en.html.

24https://www.bankofengland.co.uk/asset-purchase-facility/2021/2021-q3.

25https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm. https://www.federalreserve.gov/newsevents/pressreleases.htm. https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315a.htm. https://www.federalreserve.gov/monetarypolicy/talf.htm. https://www.federalreserve.gov/monetarypolicy/bst_openmarketops.htm.

26https://www.ecb.europa.eu/mopo/implement/app/html/index.en.html.

27https://www.ecb.europa.eu/pub/pdf/other/mb201209_focus01.en.pdf. https://www.ecb.europa.eu/mopo/decisions/html/index.en.html.

28https://www.bankofengland.co.uk/asset-purchase-facility/2021/2021-q3. https://www.bankofengland.co.uk/news?NewsTypes = ce90163e489841e0b66d06243d35d5cb&Taxonomies = 96247fc30a8d4688804201c24bc22a40&InfiniteScrolling = False&Direction = Latest.

29https://www.boj.or.jp/en/mopo/measures/mkt_ope/ope_m/index.htm/. https://www.boj.or.jp/en/mopo/outline/cfc.htm/.

30https://www.newyorkfed.org/markets/mmiff_terms.html.

31https://www.federalreserve.gov/monetarypolicy/tslf.htm.

32https://www.ecb.europa.eu/mopo/decisions/html/index.en.html. https://www.ecb.europa.eu/press/pr/date/2008/html/pr081015.en.html.

33https://www.federalreserve.gov/publications/files/pdcf-mmlf-cpff-pmccf-smccf-talf-mlf-ppplf-msnlf-mself-msplf-nonlf-noelf-12-11-20.pdf, https://www.federalreserve.gov/publications/2020-reports-to-congress-in-response-to-covid-19.htm, https://www.federalreserve.gov/publications/files/commercial-paper-funding-facility-3-25-20.pdf.

34https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20201130a1.pdf, https://www.federalreserve.gov/monetarypolicy/expiredtools.htm.

35https://www.ecb.europa.eu/mopo/decisions/html/index.en.html, https://www.ecb.europa.eu/home/search/coronavirus/html/index.en.html.

36https://www.bankofengland.co.uk/coronavirus.

37https://www.bankofengland.co.uk/prudential-regulation/publication/2020/pra-statement-on-deposit-takers-approach-to-dividend-payments-share-buybacks-and-cash-bonuses.

38https://www.boj.or.jp/en/mopo/outline/cfc.htm/, https://www.boj.or.jp/en/mopo/measures/mkt_ope/ope_v/index.htm/.

39https://www.boj.or.jp/en/announcements/release_2008/un0810d.pdf.

40https://www.boj.or.jp/en/announcements/release_2009/mok0901e.pdf.

41https://www.boj.or.jp/en/announcements/release_2009/mok0905a.pdf.

42https://www.boj.or.jp/en/announcements/release_2020/rel200316e.pdf.

43https://www.boj.or.jp/en/announcements/release_2020/rel200427b.pdf.

44Impact of the Crisis on African Economies–Sustaining Growth and Poverty Reduction, African Perspectives and Recommendations to the G20 (afdb.org).

45https://www.afdb.org/fileadmin/uploads/afdb/Documents/Generic-Documents/impact%20of%20the%20crisis%20and%20recommendations%20to%20the%20G20%20-%20March%2021.pdf. Impact of the Crisis on African Economies–Sustaining Growth and Poverty Reduction, African Perspectives and Recommendations to the G20 (afdb.org). Mauritius to keep economic stimulus|Reuters.

46Impact of the Crisis on African Economies–Sustaining Growth and Poverty Reduction, African Perspectives and Recommendations to the G20 (afdb.org).

47Impact of the Crisis on African Economies–Sustaining Growth and Poverty Reduction, African Perspectives and Recommendations to the G20 (afdb.org). Media statement by President JG Zuma following the report back by the leadership group of the framework response to the economic crisis, Presidential Guesthouse, Pretoria|South African Government (https://www.gov.za).

48Impact of the Crisis on African Economies–Sustaining Growth and Poverty Reduction, African Perspectives and Recommendations to the G20 (afdb.org).

49https://www.bankofengland.co.uk/markets/market-notices/2020/term-funding-scheme-market-notice-mar-2020.

50https://www.federalreserve.gov/boarddocs/Speeches/2002/20021121/default.htm. https://www.investopedia.com/articles/personal-finance/082216/what-difference-between-helicopter-money-and-qe.asp.

51https://www.veblen-institute.org/Helicopter-money-to-combat-economic-depression-in-the-wake-of-the-Covid-19.html.