Analysis on the Contribution of Agricultural Sector on the Economic Development of Ghana ()

1. Introduction

Agriculture plays a crucial role in contributing to socio-economic development in many countries. It is the primary source of employment, livelihood, and food security for the majority of rural people. In the year 2019, the agricultural sector contributed about 20% to Ghana’s gross domestic product (GDP). This sector does not only contribute to Ghana’s GDP but also absorbs a lot of labor forces and then provides raw materials for industrial growth and development. In Ghana, the GDP growth rate was 8.4%, while that of the agricultural growth rate was 6.3% in the year 2018. The overall economic growth and development of a country depend upon the health of the agricultural sector. The reasons are that it provides food, raw materials, and foreign exchange, which further pushed industrialization in Ghana (Johnston, 1970).

Many researchers have found evidence that either agriculture affects economic growth positively, negatively, or no evidence at all (Enu, 2014; Sertoğlu, Ugural, & Bekun, 2017; Subramaniam, 2010). For instance, Tiffin and Irz (2006) found that there is enough evidence that supports the conclusion that agricultural is the leading cause of the overall growth rate. Timmer (2005) also correlated poverty with growth in agricultural output and found out that at the provincial level, about two-thirds of the reduction in poverty was due to the growth of agricultural production.

In Ghana, the agricultural sector has been identified as a significant contributor to economic GDP growth. Unfortunately, studies on the impact of agriculture and sub-sectors of economic growth in Ghana are limited. As a result, this study seeks to investigate the effect of the agricultural sector on Ghana’s economic growth and determine which sub-sectors of the economy contribute significantly to GDP growth.

The rest of the paper is structured as follows: the second section presents the literature review and the third section describes the methodology and the data used in this study. In the fourth section, we discuss the results of the analysis. Section five concludes the study and gives recommendations.

2. Related Literatures

2.1. Agricultural Sector of Ghana

The agricultural sector is vital to economic growth and development of Ghana. In the national development agenda, agriculture is identified as a sector that can lead the growth and structural transformation of the economy to maximize the benefits of accelerated growth (MoFA, 2016). The agriculture is the largest employer, accounting for over 45.38 per cent of the total workforce, according to the Ghana Statistical Service (GSS), 2019 report. Figure 1 shows the national distributional share of employment by agricultural sector from 2009 to 2019.

![]()

Figure 1. National distributional share of employment by agricultural sector (2009-2019).

According to Figure 1, 51.3% of the national distributional share of employment came from the agricultural sector in the year 2009. Since 2009, the percentage share reduced each year by approximately 1% until 2014 which accounted for 40.44% after its share of 45.38% in 2013. From 2015, the national distributional share of employment by agricultural sector continued to decrease as the position of the agricultural sector was dislodged by the service sector which has the fastest growing sector until it was taken by the industrial sector. Agricultural crops, including yams, grains (cowpea, groundnut, maize, rice, soybean and millet), cocoa, oil palms, kola nuts, and timber form the basis of Ghana’s agricultural production.

2.2. Theories about the Contribution of Agricultural Development to Economic Output

The following are theories about the contribution of agricultural development to economic output; Structuration theory explains how farmers make use of both authoritative and allocative resources in their areas for agricultural activities. In this theory, allocative resources are those that the farmers have little or no control over, but it still a determinant for their success and examples are rain and roads. To facilitate the agricultural activities of subsistence farmers, roads serve as a bridge in facilitating easy access to agricultural inputs. Giddens was the one who identified these two types of resources, and they are authoritative and allocative resources (Zamora & Giddens, 1985). Peet (1998) explained authoritatively as capabilities that generate command over the human agent. Authoritative resources come in when you make use of status, power, rules, and norms. Bonsu (2014) used this theory to elaborate on why farmers produced staple crops despite roads giving access to market and farm inputs. In his analysis, he mentioned that structuration theory shows how farmers who stand for agent and resources which correspond to structures come together to explain human action.

Frontier Model is all about the opening up of forests and jungles, which have favorable soil conditions and closer to river basins and using these new places for cultivations. This can be seen in the village economies of Europe, Asia, and Africa, where there was the establishment of new villages in a series from the system of shifting cultivating to short fallow systems and then annual cropping (Udemezue & Osegbue, 2018). In the history of Western countries, one way of increasing agricultural production was the expansion of areas they cultivated, and this is witnessed in the opening up of new continents during the 18th and 19th centuries (Hayami & Ruttan, 1971).

Conservation Model is whereby there is a sequential use of labor-intensive cropping systems and the use of organic manures and other physical facilities to use land and water resources available for production effectively. The use of these organic manures and cropping systems will help preserve the land and always be able to produce a healthy and more abundant harvest. Researches show that agricultural development that happened with the conservation model was successful as there was a sustaining rate of growth around 1% per year in agricultural production (Udemezue & Osegbue, 2018).

2.3. Empirical Literatures

In the article by Bonsu (2014), he analyzed the influence of road access on agricultural production as well as its impact on the marketing of agricultural produce. In his study, he mentioned that getting access to roads enables easy and faster access to agricultural inputs and machines, which will allow farmers to produce at a convenient yet still a higher rate. He mentioned that inputs like agrochemicals are not only dependent on the access to roads but also on their effectiveness and adequacy. In this article, he made use of the structuration theory in explaining how farmers make use of both authoritative and allocative resources in their areas for agricultural activities. The results of his findings show that with both allocative and authoritative resources, farmers can promote agricultural production, which will then contribute to the growth of the country.

An analysis was made on the relationship between agricultural resources and economy in Nigeria by Olajide, Akinlabi, and Tijani (2010) using the least square regression method in analyzing the data. The results of his findings show that there is a positive relationship between the Gross Domestic Product and agricultural output in Nigeria. Multiple regression analysis was used by Oji-Okoro (2011)in examining the role that the agricultural sector has played in Nigeria’s economic development. In his study, there was a positive relationship between GDP, agriculture, and Foreign Direct Investment. Sertoğlu et al. (2017) also concluded in his paper that agriculture plays an essential role in developing countries. In his research, he used the Johansen multivariate cointegration test and also employed annual time series data in analyzing the long-run impact of the agricultural sector on the economic growth of Nigeria. The agricultural sector of Ghana and its economic impact on economic growth was analyzed by Enu (2014). He employed time series data on the three sectors in Ghana, which are service, industrial, and agriculture, as well as various sub-sectors of agriculture. He also used a regression model and OLS in estimating the respective impact of agriculture, service, and industry on GDP growth. The results of his findings showed that agricultural output has a positive impact on Ghana’s growth compared with the other sectors.

Self and Grabowski (2007) confirmed that agricultural technology and its modernization have a positive effect on economic growth and human development by the use of cross-country analysis on the role agricultural technology plays in economic development.

3. Methodology

3.1. Data Sources

Annual time-series data from 1984 to 2018 were collected from the World Bank. These data are used to identify the agricultural sector among different sectors (service, industrial) of Ghana on its economic growth. Subsequently, the various sub-sectors of the economy are also explored to identify their contributions to the overall sector of economic growth.

3.2. Analytical Framework

Unit root test

Empirical research based on time series presumes that observed data are stationary. That is, such a series has a mean; variance and autocovariance at several lags are time-invariant. However, most macroeconomic variables exhibit trends. That is, they grow over time. Thus, the implication of working with non-stationary series results in spurious regression, Granger and Newbold (1974), and Nelson and Plosser (1982). Therefore, forecasting and policy implications drawn from such spurious regression analysis would be misleading. A possible way out is to employ the use of unit root testing procedures to ascertain the stationarity of the series and order of integration of the series. This study employs the well-known tests, namely augmented Dickey-Fuller (ADF) propounded by Dickey and Fuller (1981) test, Phillip-Perron test by Phillip and Perron (1990). The general form of the unit root test is given below:

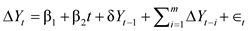

ADF equation:

(1)

(1)

where  denotes Gaussians white noise that is assumed to have a mean value of zero, and possible autocorrelation represents series to be regressed on time t. The ADF has two hypotheses. Where the null state’s series has the unit root and the alternative states stationary. The study also engages an alternative test for unit root propounded by PP in 1988. The PP test is semi-parametric and has similar hypotheses to the ADF. This study for the validity of the stationarity properties of the series uses the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test to confirm the outcome of the ADF and PP test.

denotes Gaussians white noise that is assumed to have a mean value of zero, and possible autocorrelation represents series to be regressed on time t. The ADF has two hypotheses. Where the null state’s series has the unit root and the alternative states stationary. The study also engages an alternative test for unit root propounded by PP in 1988. The PP test is semi-parametric and has similar hypotheses to the ADF. This study for the validity of the stationarity properties of the series uses the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test to confirm the outcome of the ADF and PP test.

Cointegration test

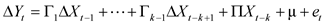

Most macroeconomic variables like economic growth in terms of GDP, agricultural output, service output, and industrial output are not stationary at their levels form since they exhibit trend or/and seasonality. To analyze the long-run relationship between the variables in the model, a cointegration test is employed. Granger (1981) and Engle and Granger (1987) recommended a cointegration test to determine the long-run relationship among the series. The Johansen (1988) cointegration test with lags is defined below;

(2)

(2)

Error correction model

For a long-run association, variables have to be integrated at the same order. Cointegration depicts that there exists a possible convergence in the long-run among series. Series reach their equilibrium level in the long-run by adjustment with time. The vector error correction term procedure is employed with the error correction term. The error correction term coefficient is required to be negative and statistically different from zero, indicating the functionality of the error correction mechanism. It shows the speed of adjustment of the variable toward their long-run values.

Empirical model

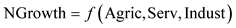

The following endogenous growth model is specified to achieve the objectives of the study.

(3)

(3)

where  is the national economic growth of Ghana,

is the national economic growth of Ghana,  is the log of agricultural sector output, Serv is the log of the service output, and Indust is the log of industrial output. All these are expressed as a percentage of GDP growth.

is the log of agricultural sector output, Serv is the log of the service output, and Indust is the log of industrial output. All these are expressed as a percentage of GDP growth.

Data analysis

The study will employ both descriptive and inferential analysis in achieving the objectives of the study. The descriptive statistics will include mean and standard deviation and correlational analysis. The inferential analysis will entail the analytical methods described. The econometric software Stata 15 was used for the analysis.

4. Results and Discussions

The results of the trends and impact of the agricultural sector on economic growth in Ghana from the period 1984 to 2018 are discussed here. It encompasses the descriptive statistics of the variables employed and their trends over the years. The subsequent sections present the results of the econometric analysis for the main objective to test the causal linkage between the overall GDP growth and agricultural GDP of Ghana.

4.1. Data Presentation

This study made use of annual time series data which were collected for a period of 34 years from 1984 to 2018. The data is presented in Table 1.

4.2. Descriptive Statistics

From Table 2, it is observed that overall GDP has a positive relationship with the agricultural sector GDP (r = 0.2921, P < 0.10), industrial sector (r = 0.8142, P < 0.001) and service sector GDP (r = 0.5030, P < 0.05). The summary statistics of the variables indicate that the industrial sector had the highest mean GDP growth followed by the service and the agricultural sector between the period 1984 and 2018. However, notwithstanding their magnitude all the sectors contributed positively to the overall GDP growth of the country. The agricultural sector has been major contributor to overall GDP and is the backbone of the country, its impact on the economic growth is the least. This is because the GDP

![]()

Table 1. GDP growth figures by sectors (%) (1984-2018).

Source: World Bank Sub-Sahara Africa data & Ghana Statistical Service, 2020.

growth is based on the differences in yearly values expressed as percentage and if the change or the difference is insignificant the growth will be low and vice versa.

4.3. Sectoral and Overall GDP Trend of Ghana (1984-2018)

Figure 2 shows the pattern of the variables studied in terms of GDP growth over the years. From panel A, the overall GDP growth saw a drop from 1984 going and an oscillating movement till is saw a rise in 2008. It subsequently declined and saw a big jump and a fall thereafter. The agricultural GDP growth (Panel B) also saw a sharp decline from 1984 and witness and oscillating movement with a sharp drop in 2011 and 2014. The poor performance of the agricultural sector could be explained by the decline in government allocation of resources to the sector over the years that is mostly dominated by smallholder

![]()

Table 2. Correlation matrix and descriptive statistics.

![]()

Figure 2. Percentage sectoral and overall GDP growth of Ghana (1984-2018).

farmers who are mainly subsistence by nature. However, it was observed that the industrial sector (Panel C) witnessed a steady growth in terms of GDP over the years.

4.4. Regression Analysis

Before analyzing the relationship between overall GDP growth and the independent variables multiple tests were executed to ensure the suitability of the data for regression analysis.

Test for Multicollinearity

Following Ahsan, Abdullah, Fie, and Alam, (2009), Tolerance Level and Variance Inflation Factor (VIF) were examined to determine the presence of multicollinearity among the independent variables. In order to determine the existence of multicollinearity for a particular variable, tolerance level should be more than or equal to 0.01 and VIF values well below 10. As shown in Table 3, all the variables met the tolerance level and variance inflation factor. This suggests that there’s no multicollinearity among the explanatory variables.

Test of Linear Regression Assumptions

A plot of the standardized residuals (Figure 3) shows a normally distributed residual error. Also, a normal probability plot (Figure 4) of standardized residuals with the observed cumulative probabilities of occurrence against expected

![]()

Table 3. Multicollinearity of diagnostics.

![]()

Figure 3. A plot of the standardized residual.

![]()

Figure 4. Normal P-P plot of standardized residual.

![]()

Table 4. Regression estimates of the relationship between overall GDP growth and sectoral growth.

***, **, and * indicate statistical significance at 1%, 5% and 10% level.

normal probabilities show approximately linear plots, which conforms that the error terms are normally distributed.

Regression Results

To analyze the relationship between the various sectoral GDP growth and the overall GDP, the parameters of the estimates are presented in Table 4. The R-squared explains the proportion of variation in the observed values of the response variable explained by the regression. It summarizes the proportion of variance in the dependent variable associated with the independent variables, with larger R-squared values indicating that more of the variation is explained by the model. A R-squared of 0.8617 was obtained suggesting that the degree of correlation between the dependent variable and the independent variable is 86.17%.

The agricultural sector had a positive and significant effect on the overall GDP growth. This result is consistent with the findings of (Özel & Okine, 2018) who had similar results in a study in Ghana. Besides, the industrial and service sector also contributed positively to the Overall GDP growth of the country.

Unit root test and order integration

The unit root test for the variables employed in this study is presented in Table 5 using the ADF and PP criteria. All the variables are not stationary at their level forms. I can reject the null hypothesis of ADF and PP and conclude that not all the variables are non-stationary.

To establish stationarity properties of the variables, I proceeded to differentiate the series. After first differencing all the variables except Service GDP become stationary, that is to say, and I can reject the null hypothesis of ADF and PP are different. Table 5 shows that all the series used in this study are all also not stationary after the first difference, and they are integrated of order I(1). Since some of the series are of order I(I), this necessitates us to carry out the Johansen cointegration test. This is done to investigate, if there is a possibility of long-run relationship among the series.

4.5. Test for Co-Integration

The order of integration, which enters the specified economic growth model, is already specified for each variable. All the variables are integrated of order one I (1). The next step is to estimate the long-run relationship between economic GDP growth and agricultural growth in Ghana using Johansson’s maximum likelihood methods and the two steps Engel and Granger procedure. To proceed with the Johansen cointegration technique, the lag order and deterministic trend assumption for the VAR should be specified.

During the unit root test, the assumption of including constant but no trend was accepted.

![]()

Table 5. Unit Root for RealGDP, AgricGDP, IndusGDP and ServGDP.

lnRealGDP is the natural log of Real GDP of Ghana, lnAgrGDP is the natural log of agricultural GDP, lnIndGDP is the natural log of industry GDP, and lnSerGDP is the natural log of service GDP.  represents a commonly used model with drift and trend; τ represents the rarely used model without drift and trend. ***, **, and * indicate statistical significance at 1%, 5% and 10% level.

represents a commonly used model with drift and trend; τ represents the rarely used model without drift and trend. ***, **, and * indicate statistical significance at 1%, 5% and 10% level.

Therefore, the deterministic trend assumption for the VAR excludes trends and includes constant. For the selection of the lag order, there are different types of lag selection criteria, which includes the sequentially modified likelihood ratio (LR), Akaike information criteria (AIC), Final prediction error (FPE), Schwarz information criterion (SC) and Hannan-Quinn information criterion (HQIC). However, it is not unusual that different criteria give a different number of maximum lag lengths. The problem is the choice of criteria to use. To overcome this problem, the model is run with different lag orders, chosen by different criteria and the LR test, and then implement the residual serial correlation and the residual normality test (Lütkepohl, 2005). An appropriate lag order needs to satisfy those tests. Therefore, in this study, the lag length selected by the Schwarz information criterion and Sequential Modified Likelihood Ratio approach fulfills these requirements, as well as prior knowledge of economic theory, are used. Table 6 shows the lag length chosen by different information criteria.

Table 7 presents the cointegration results for the series. From Table 7, we found one cointegrating vector for the model. We could reject the null hypothesis of no cointegrating vector. Thus, we accept the alternative hypothesis one cointegrating vector using Johansen trace statistic. This implies the non-existence of a long-run causality relationship between overall GDP growth, agricultural GDP, Service GDP, and industry GDP. Therefore, this does not qualify to run the restricted VECM.

![]()

Table 6. Results of the lag order selection criteria.

*indicates the lag length selected by the criteria; LR: Sequential Modified likelihood; FPE: Final Prediction Error; AIC: Akaike Information Criterion; SBIC: Schwarz Bayesian Information Criterion; HQIC: Hannan-Quinn Information Criterion; ***, **, and * indicate statistical significance at 1%, 5% and 10% level.

![]()

Table 7. Johnsen multivariate cointegration results.

***, **, and * indicate statistical significance at 1%, 5% and 10% level.

5. Conclusion and Recommendations

5.1. Conclusion

It can be concluded that there’s a positive relationship between agricultural GDP growth and overall GDP growth in Ghana. Again, the industrial and service sector contributes positively to the economic GDP growth of Ghana. The results of the unit-roots test indicated that all the variables are not stationary in first differences-I (1), therefore, I (1) series were adopted to test for cointegration and causality between overall economic GDP and agricultural GDP growth. The cointegration test results showed that there are no long-run relationships existing between the overall GDP and agricultural GDP growth and the other sectors.

5.2. Recommendation

The pressing policy recommendation that emerges from this study is that: the government should attempt to diversify and promote exports, especially agricultural exports, to fully exploit the benefits of the sector and promote economic growth. The government can do this by attracting new investment to the country through the provision of conducive and favorable environment for investors. Favorable environment can be in the form of good tax treatment to firms or the introduction of subsidies to firms in the form of cash incentive.

Again, the government should channel a lot of resources such as agricultural input interventions to boost smallholder production as they dominate the agricultural sector while at the same time encouraging them to be agribusiness minded.

The government of Ghana should improve resources and development investment in agricultural research and extension services to enhance the use of modern agricultural inputs. Finally, the government should exploit the other sectors to ensure the holistic contribution of the other sectors to the overall economic GDP growth of the country. The sectors that can be exploited can be either the service or industrial sector. These sectors dislodged the agricultural sector after 2018 and as such can be areas the government can exploit to help contribute to the overall economic GDP growth of the country.

Acknowledgements

Special thanks to Dr. Kwabena Nyarko Addai, Dr. Sunday Adiyoh Imanche, Dr. Israel Adikah for their immense contribution to this work.