System of Guarantees and Access to Leasing: the Case of Entreprises in the Republic of Congo ()

1. Introduction

The financing of enterprises has been the subject of considerable interest in recent years because it is vital given the growing needs firms are experiencing (Djimasra et al., 2013; Martinez, 2009). Without financial resources, a firm does not produce, does not sell, and can therefore only survive if it has managed to mobilize the resources needed to maintain its operating cycle and finance its investments (Berkal, 2012). Thus, with the acceleration of financial innovations, corporate financing can be channeled through different channels, such as leasing and bank loans (Neuberger & Rathke-döppner, 2012; Silivestru, 2012).

The granting of credit to a large, small, or micro business creates “counterparty risk”, the risk that the loan will fall into arrears and remain unpaid, causing a loss to the lender. The granting of a lease or rental agreement can cause losses to the lessor if leasing fees are not paid and the leased object is sold at a loss.

Many banks and lending/leasing companies in developing and emerging countries, as well as in industrialized countries, consider the counterparty risk for SMEs to be particularly high. To overcome the reluctance to provide credit/leasing to SMEs, several guarantee schemes have been attempted to promote a 100% counterparty risk coverage mechanism through guarantee schemes.

A guarantee is a commitment that facilitates access to financing (bank debt and/or leasing) for companies, particularly SMEs. The guarantee acts through the sharing of the risk borne by the bank or equity investor. Then, a state, through its guarantee systems, can support the financing requested by the SME by ensuring, in the event of loss, the partial reimbursement of the risk borne by the bank or investment fund. The guarantee thus benefits, on the one hand, the financial institution by enabling it to finance operations that it would have either been ruled out or financed on less attractive terms. On the other hand, it benefits the company by allowing it to access financing under better conditions (with interest rates being correlated with the risk taken, a decrease in risk leads to lower rates).

Within the framework of lease guarantee systems, the lessee confirms that he or she is familiar with the guarantee provisions for the object of the lease. The leasing company authorizes and obliges the lessee to assert, at his or her own expense and on behalf of the leasing company, all rights and claims that the leasing company has against the supplier or, if applicable, against the vehicle manufacturer under the manufacturer’s warranty and statutory provisions (in particular, the warranty for defects in the goods sold). The lessee is obligated to notify the supplier of any defects without delay and to inform the leasing company immediately if defects are not recognized or if problems arise in the course of eliminating the defects. During the warranty period, defects may only be rectified by competent persons in accordance with warranty provisions. Any liability of the leasing company for direct or indirect damages of any kind whatsoever is excluded.

The occurrence of defects of any kind or a defect in the leased object does not entitle the lessee to withdraw from the contract or to demand a reduction in or deferment of the leasing fee or a replacement object from the leasing company for the corresponding period. The leasing company is not liable for damages resulting from any loss of profit.

The economic literature has examined the important role of guarantee systems in providing access to business financing. According to agency theory, the creditor is confronted with two types of uncertainty in lending: the moral hazard arising from the fact that the debtor can modify the characteristics of his project once in possession of the loan and adverse selection concerning the creditor’s application and resulting in onerous loan conditions in terms of interest rate and/or collateral. However, the most appropriate mode of intervention consists of guaranteeing part of a bank loan.

Among the theoretical arguments advanced to justify the use of guarantees, two are particularly noteworthy. First, the guarantee reduces the loan loss in the event of a borrower’s default. Indeed, the guarantee gives the bank the right to specific assets. Second, the guarantee helps the bank resolve adverse selection problems related to the loan decision. The guarantee is a signal that provides information to the bank. Indeed, the guarantee helps the bank obtain private information held by the borrower, since high-quality borrowers have a greater incentive to agree to provide collateral in exchange for a low interest rate on the loan than low-quality borrowers (Blazy & Weill, 2006; Stiglitz & Weiss, 1981).

In this sense, economic theory considers guaranteed loans to be the most effective means of intervention in SME investment. Indeed, they have the advantage of linking the public incentive directly to the risk level of the firm. Subsidized loans and soft loans present a greater risk of generating “windfall effects” for banks (the banks simply reap the benefits of public aid by benefitting from loans that they would have granted in any case) or even distortions (public aid then allows banks to lend to projects that are insufficiently profitable).

Empirically, Aubier and Cherbonnier (2007) show that several types of guarantee systems are implemented to better facilitate access to business financing. In France, the guarantee offered by Oséoaux banks covers 40% to 70% of the loan amount and is priced at 0.6%, 0.7% or 0.9% of the total amount depending on whether it covers 40%, 50% or 70% of the loan. As a result, the outstanding amount guaranteed represents 150 bps, 140 bps and 130 bps, respectively. The beneficiaries are companies in creation, transmission and development selected by banks.

According to a study conducted in the United States by the Small Business Administration, the guarantee covers up to 85% of loans under $150,000 and up to 75% of loans over $15,000,011 through the SBA. The relatively low pricing consists of a one-time premium paid at the time the loan is taken out, ranging from 2% to 3.5% of the guaranteed amount, plus a 0.545% annual fee on the guaranteed portion. The program is very broad since it is designed to finance very risky and/or long-term projects, start-ups, very young companies, and companies that have no collateral.

The deadweight effects are, however, severely limited by the requirement that recipient firms must demonstrate that they could not obtain credit directly from banks.

The guarantee offered by an English program (SFLG) is distinguished by uniform coverage (75%) and a high premium (2% per year of the total amount). It is targeted exclusively at small businesses without collateral selected by banks. This very high selectivity in favor of risky companies presents a risk of moral hazard, as entrepreneurs are encouraged to increase their risk taking to benefit from the guarantee.

Therefore, it is important to ask the following question: does the implementation of guarantee systems facilitate the access of companies to bank credit and/or leasing in Congo?

The Republic of Congo has a banking system composed of a dozen banking institutions dominated by commercial banks. In 2009, Congolese banks posted a permanent capital surplus of 36 billion in relation to fixed assets. The coverage of loans by deposits stood at 256.1 percent compared to 300.5 percent in 2008. The sector’s excess liquidity is 398 billion. However, a lack of financing is the main challenge for Congolese companies. This can be explained, in large part, by the fact that the majority of these companies are unable to meet the conditions required by banks, such as guarantees. Indeed, the fundamental reason for the lack of access to financing for businesses is essentially related to the unreliable guarantees that businesses present to banks.

In addition, 84.2% of the financing of all these companies is consists of equity capital. Only 3.4% have access to bank loans, while the percentage of companies with a line of credit from other suppliers (including leasing) is 9.2%. Financing by nonbank financial institutions is below 4%. This problem is justified by the fact that banks are reluctant to grant credit because their clients do not present them with credible and solvent applications (or reliable guarantees). Indeed, many of the applications submitted by Congolese households are often far-fetched and do not meet minimum solvency requirements. Similarly, the applications submitted by companies are not credible, and the business plans do not demonstrate the profitability of the projects to be financed. To address this problem, the Republic of Congo has implemented several types of guarantees to facilitate access to financing for businesses. These include bid or tender guarantees, advance payment guarantees, performance guarantees and bank guarantees. In addition, there are the Guarantee and Support Funds for SMEs (FGS) and the Business Impulse, Guarantee and Support Funds (FIGA).

The objective of this article is to analyze the empirical validity of two arguments advanced in the literature on the use of guarantees in access to bank credit and/or leasing for Congolese firms.

The article first proceeds to the development of a review of the literature on access to bank credit and/or leasing, then to a presentation of the methodology, and finally, to the interpretation of the results.

2. Literature Review

The issue of access to finance for SMEs in developing countries has always been at the heart of theoretical debates and has been the subject of much empirical work.

2.1. Theoretical Review

2.1.1. Role of Collateral in Bank Loans and Leasing Contracts in the Economic Literature

SMEs are perceived by bankers as being so risky that higher interest rates are not sufficient to protect them, and they may invite their clients to provide guarantees as part of a banking-type financing project (Vigneron, 2009).

Even if the risk is minimal, banks always ask for guarantees to protect themselves. This can be a mortgage on property belonging to the company or to a third party, a pledge of goodwill, tools and equipment, personal and joint property and several types of guarantees. These guarantees enable banks to reduce the risk of nonrepayment.

Indeed, if the borrower does not repay, the bank can sell the pledged assets and recover part or all of the outstanding loan. In response to SME risk, banks add a risk premium to the base rate offered to their best customers, which is included in the loan agreement. In addition, they may seek to minimize the risk that arises in the event of bankruptcy by covering loans with business assets and the personal property of the business owner (Storey et al., 1996). In addition, with high interest rates and substantial collateral requirements, bankers may seek to add covenants to contracts to limit the owner-manager’s freedom to use the firm’s cash flow.

According to Blazy and Weill (2006), there are two major reasons for the use of collateral in bank loan agreements proposed in the economic literature. First, a bank may have an incentive to require collateral because it reduces the loan loss in the event of borrower default. Indeed, a guarantee confers on the bank a right to specific assets. An internal guarantee is useful for the bank because it improves its priority ranking in the event of borrower default. An external guarantee has the advantage of suspending the limited liability of the owners, as it gives the bank ownership of an asset outside the firm.

Second, a guarantee may address the problem of adverse selection that arises from the borrower holding superior private information about its status than the bank prior to the lending decision. This asymmetry of information can lead to credit rationing because of the bank’s inability to price the loan according to the borrower’s quality (Stiglitz & Weiss, 1981). As a result, high-quality borrowers have an incentive to disclose their quality through the use of a credible signal, that is, a signal that cannot be provided by low-quality borrowers. Collateral is such a signal because it is more costly for low-quality borrowers, who have a higher probability of defaulting but also of losing collateral (Bester, 1985; Chan & Kanatas, 1985; Besanko & Thakor, 1987).

Thus, through its role as a signal, a guarantee enables the transmission to the bank of credible information about the borrower that helps avoid credit rationing and allows better pricing of borrowers according to their quality (Stiglitz & Weiss, 1981). A bank can thus discriminate between borrowers by offering them a choice between a secured loan with a low interest rate and an unsecured loan with a high interest rate. A high-quality borrower then has an incentive to choose the secured loan because its lower risk of default means a lower probability of losing collateral and a higher probability of interest repayment.

This tradeoff between interest rate and collateral is particularly relevant in the case of external guarantees because the cost to the borrower of providing such guarantees is obvious. It also plays a role in internal guarantees because of their costs. The latter are costly to the borrower because their use makes subsequent loans more expensive by reducing the assets available as collateral.

His argument thus assumes a negative relationship between collateral and credit risk, just as a secured loan is associated with higher quality borrowers. However, Berger & Udell (1990) and Jimenez & Saurida (2004) refer to the commonly held view among bankers that the presence of a guarantee is associated with greater credit risk. Banks would indeed be able to discriminate between borrowers based on the information about borrower quality they have ex ante. As a result, they would charge higher rates to riskier borrowers and require them to provide more collateral in accordance with the first reason given for the use of collateral: since collateral reduces the loss in the event of default, the bank has an incentive, other things being equal, to require more collateral from customers with higher credit risk. This argument is commonly referred to in the literature as the observed risk hypothesis.

2.1.2. Guarantee System Models in the Economic Literature

Two models of compensation through guarantee systems have also been developed to explain the importance of guarantees in access to business financing. These are the “joint and several with the banker” model and the model of “loss sharing” (Douette, Lesaffre, & Siebeke, 2012).

1) “Joint and several with the banker” model

According to Douette, Lesaffre and Siebeke (2012), in the “joint and several with the banker” model, the guarantor indemnifies a pre-agreed percentage of the outstanding credit balance at the time the credit is declared. Once indemnified, the lender can sue the final debtor on the basis of the securities it has constituted for its sole benefit.

In this model, the lender is tempted to create security only for the part that corresponds to its “dry” risk. The partnership between guarantor and lender is exposed to perverse practices because the guarantor risks being the sole bearer of risk. Moreover, if the guarantor is the only party exposed, it will also attempt to cover itself with security on the debtor, no doubt of lesser quality than that applied by the lender. However, double pressure will then be exerted on the borrower to grant security, which is contrary to the spirit of facilitating access to credit.

In this sense, each party separately attempts to form its own opinion on its own probability of loss and recovery. Guarantor and lender each seek their own truth about the unpaid amount at stake. On the other hand, in a “loss sharing” guarantee, both parties know that they will be jointly liable for losses and beneficiaries of recoveries. They will collaborate better in decision making.

2) Loss sharing model

On the other hand, in the “loss sharing” model, the guarantor can intervene by applying the contractually agreed percentage of the amount of the final loss after termination (cancellation of the credit) and realization of the securities granted by the borrower. It provides that the sale of the securities granted on assets provided by the borrower benefits both parties in proportion to their respective rates of intervention. They therefore act as partners.

However, the “loss sharing” mechanism does not oblige the lender to wait until the end of the procedure to receive a payment from the guarantor. It may receive a provisional amount at the time of default and then a payment adjustment when the final loss is determined.

2.2. Empirical Review

Few studies have analyzed the reasons for the use of collateral in bank loans. Two major papers can be directly linked to our work in that they directly analyze theoretical arguments about the use of collateral in bank loans (Blazy & Weill, 2006).

Berger and Udell (1990) study the relationship between collateral and credit risk on one million loans made by U.S. banks. They first test the hypothesis that adverse selection plays a role in the use of collateral. To do so, they regress the risk premium on a set of loan characteristics that includes a dummy variable that takes into account whether the loan is secured or unsecured. Their conclusion does not support the adverse selection argument as a reason for using collateral, since they observe a positive and significant relationship between collateral and the risk premium. This result is consistent with the observed risk hypothesis.

In the second part, several measures of ex post risk are regressed on a set of borrower characteristics that aggregate information by loan, such that this regression is performed at the borrower level. The authors then observe that collateral is positively associated with credit risk. This work thus concludes that there is a positive relationship between collateral and credit risk, which leads banks to demand more collateral from riskier firms and to charge higher loan rates. In summary, Berger and Udell (1990) conclude that 53% of corporate credit in the United States is secured by guarantees.

Jimenez and Saurina (2004) study the determinants of the probability of default on three million loans granted by Spanish banks. The probability of default is considered an ex post measure of credit risk. They then test whether the presence of collateral reduces the probability of default. The probability of default is explained by a set of loan characteristics that includes information about the collateral. Three dummy variables that depend on the secured portion of the loan are included jointly in the model: they are equal to one if the secured portion is 100%, between 50% and 100%, and less than 50%. They then find that the probability of default is greater for secured loans. This work thus concludes in favor of the observed risk hypothesis.

In addition, guarantee systems to facilitate SME access to leasing are developing throughout Africa and are producing satisfactory results.

According to a study conducted by the IFC (2013) in sub-Saharan Africa, the Ghana Guarantee Registry facilitated, between 2010 and 2013, financing of US$6 billion. This amount covers 45,000 loans granted to more than 9000 SMEs and 30,000 microenterprises and individual entrepreneurs, including 7000 women.

According to the study, the African Leasing Facility program, covering 15 countries during its five years of existence, mobilized investment in five leasing projects worth a total of almost US$ 27 million and facilitated the training of more than 10,000 small entrepreneurs.

In conclusion, the IFC (2013) shows that 22% of SMEs have borrowed or leased in Africa. In addition, 10,000 small entrepreneurs were trained in leasing in 2013.

In addition, the US SBA (Small Business Administration) guarantee system covers up to 85% of loans under $150,000 and up to 75% of loans over $150,000. The relatively low pricing consists of a one-time premium paid at the time the loan is contracted, ranging from 2% to 3.5% of the guaranteed amount, plus a 0.545% annual fee on the guaranteed portion. The program is very broad since it is designed to finance very risky and/or long-term projects, start-ups, very young companies, and companies that have no collateral. However, the windfall effects are strongly limited by the obligation imposed on beneficiary companies to demonstrate that they could not obtain credit directly from banks.

3. Methodology

To obtain highly conclusive results, a binomial logit model will be used to identify the factors influencing the decision to grant access to a bank loan and/or leasing.

3.1. Presentation of the Theoretical Model

In this article, a simple arbitration model will be used based on the assumption that either an individual either does or does not make use of a bank loan. This dichotomy between these two states is analyzed empirically using a binomial logit model where the dependent variable is equal to 1 if the individual uses leasing and bank loans and 0 otherwise. It also identifies the variables that influence the decision to take out a bank loan.

For this modeling, part of the data (a training sample) is used to build the models (parameter estimates), and the other part is used for model validation (test sample). If there are a large number of variables, a step-by-step selection of variables will be made using backward, forward and backward/forward methods. In these procedures, the selection of variables will be made on the basis of Akaike’s AIC and Schwartz’s BIC criteria.

In nonordered models, the dependent variable represents the choice probabilities of an individual among K + 1 possibilities (modalities), hence why they are also called random utility models.

Let Y be the variable to be explained taking modalities 0, 1, 2, ..., K. and Uij be the utility that individual i derives from the choice of alternative J (j = 0, 1, 2, ..., K). Individual i operates on the choice of modality j of Y if the utility he or she derives from it is maximal. We then have:

If

It then compares the different levels of utility associated with the various choices and then selects the one that maximizes utility among the J possibilities. This utility is represented as follows:

where zij is a vector of individual characteristics that includes the set of variables intended to capture productivity potential and family characteristics that have an impact on individual decisions to use bank loans or leasing, α is a vector of parameters to be estimated, and εij is a random error term.

Assume that individual ihas to choose between the following two alternatives (j = 0 to 1): 1 = bank loan or leasing and 0 = otherwise.

Individual i will compare the different levels of utility associated with the various choices and choose the one that maximizes his or her utility Uij. Then, participating in segment j assumes that the probability that the utility associated with the choice in this segment is higher than that associated with all other segments.

We have:

, for

;

Replacing the Ui term for utility by its expression above, we have:

If we assume that errors are independently and identically distributed according to Weibull’s law, then their difference follows a logistic distribution. In the binomial logit model, the probability that individual i chooses option j is given by:

, with

3.2. Presentation of the Empirical Model

Each probability is between 0 and 1, and their sum is equal to one. However, this formula generates indeterminacy (the vectors αj and αj+c yield the same result) that can be eliminated by normalizing α0 = 0. As a result, we have:

, with

The estimation of the model parameters is performed by the error correction method. In our model, the Z vector is composed of all the explanatory variables.

In accordance with the work of Marie-Christine et al., we retain one dependent variable and five exogenous variables in our model.

Access to bank credit and leasing: This is the dependent variable of the model. It takes the values 1 and 0 in the opposite case.

Age group: The youngest population is captured. This choice is based on the fact that because of their lack of experience, they have more difficulty benefiting from bank credit or leasing.

Education level: This variable is captured by the highest level of diploma or certification obtained by the individual.

Gender: Generally, men are more likely than women to have access to bank credit and leasing.

Modern small business: These are small businesses that are innovative in their production process.

Sector of activity: It corresponds to the different sectors of activity of the Congolese economy.

The data used in this study come mainly from the database of the Bank of Central African States (BEAC).

4. Results on Factors Related to the Use of Credit and/or Leasing

4.1. Descriptive Statistics of Model Variables

The descriptive approach is essentially based on the construction of tables and graphs to assess the extent to which individuals use leasing and credit institutions (banks) according to socioeconomic and demographic characteristics (Annexes 1-3). It will also be useful to highlight the profile of individuals who use bank loans via Multiple Correspondence Analysis (MCA).

4.1.1. Multivariate Analysis

This section is devoted to multivariate analysis, specifically Multiple Correspondence Analysis (MCA). This method consists of studying the relationship between at least three (03) qualitative variables and the similarity between the different individuals who are the subject of this study. Thus, the application of this method requires the presence of a dichotomous variable of interest that allows us to appreciate the similarity of the modalities of the other variables compared to those of this variable. To appreciate such resemblance between individuals, there are a certain number of indicators that make it possible to appreciate the quality of representation of individuals and their contribution to the different factorial axes. Thus, the square cosine is used to determine whether individuals are well represented. Then, the contribution and the test value (v-test) are also used to determine whether the individual contributes significantly to the formation of the axis to which he or she belongs.

Concerning the realization of the ACM, all the qualitative variables are considered active dummy variables, with the exception of the variable of interest (access to credit: which has two modalities, i.e., recourse to credit, no access to credit), which does not contribute to the formation of the factor axes. However, to make this analysis more refined, the use of the credit variable was employed as an illustrative dummy variable. All individuals are active with a uniform weight.

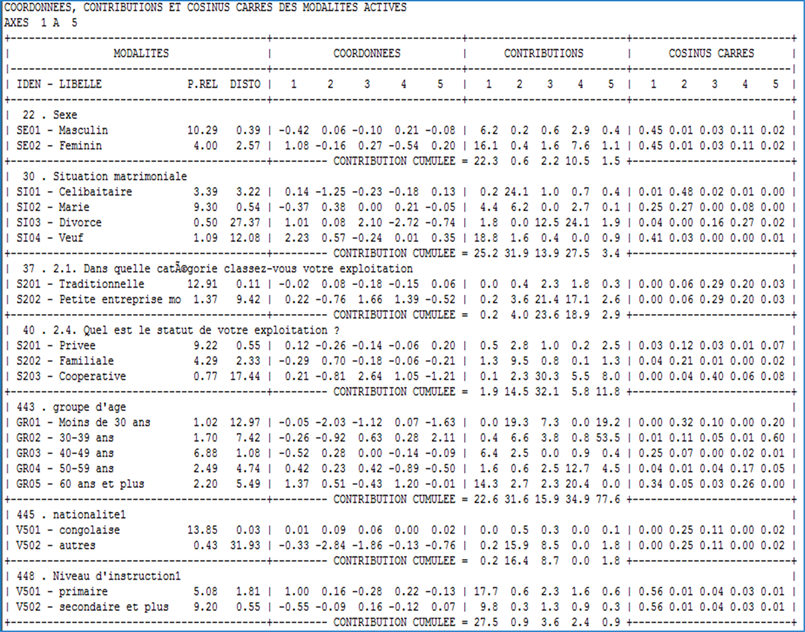

To ensure precision in terms of the quality of the interpretive elements on each axis, all modalities with a contribution greater than or equal to 3.22%, cosine square greater than 0.11 and test value in absolute value greater than or equal to 2 were interpreted. This was obviously done after having identified the variables that contribute most to each axis. It is a question of interpreting the oppositions and proximities between the different modalities of each variable.

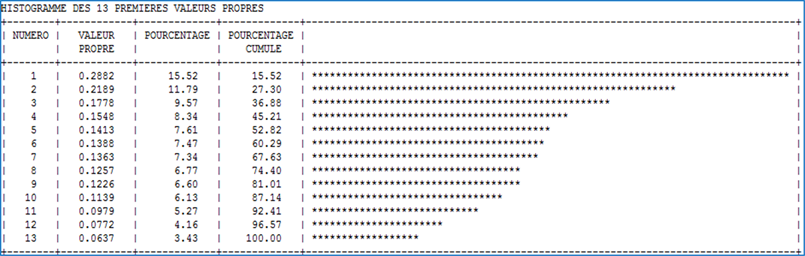

However, the elbow rule allows the selection of the axes likely to help achieve the objectives set by this study. Following a significant notch from the second axis, the elbow rule allows the first three factor axes to be retained. They contain 36.30% of the total inertia (see Annex 1).

4.1.2. Interpretations of the Factor Axes

The first factor axis contains 15.2% of the total inertia. To construct it, a number of variables are examined. These are the sex of the farmer (22.3%), marital status (25.2%), age group (22.6%) and education level (27.5%).

Indeed, this first axis opposes, on the one hand, individuals who are male and, on the other hand, those who are female. It also opposes married individuals and widowers. It opposes individuals aged between 40 and 49 years old to those over 60 years old. Finally, this axis opposes individual farmers who have a primary level to those who have at least a secondary level of education. In other words, Axis 1 contrasts individuals who have a primary level of education and those who have at least a secondary level of education, who are generally married, and aged between 40 and 60 years old. Most of these individuals are male. On the other hand, some of the individuals with secondary education or above are widowed. In addition, most of those aged 60 and over are female (Table 1).

The second factorial axis, however, accounts for approximately 12% of the total inertia. It characterizes, on the one hand, single individuals who have the status of private exploitation and are mostly of Congolese nationality. On the other hand, married individuals have a family occupation status. Some of them are married, and their ages range from 30 to 39 years old for some and less than 30 years old for others (see Annex 2).

4.2. Interpretation of the Estimated Coefficients

The results of the estimation are presented in the table below. The results allow used to deduce the variables that significantly influence access to credit. With regard to the overall results of the above model, it appears that the model is globally significant (Prob > chi2 = 0.003 < 5%). Thus, it is possible to draw inference from the signs of the significant coefficients. The results are interpreted at the 5%, 1% and 10% thresholds.

Thus, we can see that most of the variables in the model are not significant, and only the sector of activity of the individual, the status of the farm and the category of the farm are significant. This can be explained by the fact that in the database, the proportion of individuals with access to credit is low. The sample was dominated by individuals who did not have access to credit.

Variables such as gender, education, age group, and marital status appear to have no effect on the probability of accessing credit.

The category variable has a positive effect on access to credit. Belonging to the traditional small business group increases the probability of accessing credit relative to farmers in the modern small business category. The farm status variable has a positive effect on the decision to access credit. The fact that a farmer has private farm status decreases the likelihood of accessing credit compared to those with family and cooperative farm status. The farmer’s secondary activity influences access to credit. Indeed, the fact that a farmer practices agriculture (crop production) increases his or her chances of accessing credit compared to those who practice market gardening.

However, to better appreciate these effects, it is desirable to quantify them by conducting the analysis in terms of marginal effects and thereby identify the probability of accessing credit following a variation in the explanatory variable. Thus, the marginal effects show that if farmer who belongs to the category of modern small enterprise decides to change his or her group membership, i.e., to the group of traditional enterprises, his or her likelihood of accessing credit increases by 6.5%. Similarly, if an individual who practices agriculture decides to practice market gardening, he or she decreases the likelihood of accessing credit by 3.8% (see Annex 3).

4.3. Analysis of Results

Based on the results of the model below, it appears that the model is globally significant (Prob > chi2 = 0.000 < 5%). This implies that it is valid to interpret the signs of the significant coefficients (Table 2).

Thus, most of the variables have a significant influence on the decision not to resort to leasing. Indeed, the values of model coefficients are not directly interpretable because only the signs of the coefficients indicate whether the variable positively or negatively affects the probability Pi (Bourbonnais, 2009). The calculation of the odds ratio will allow us to better understand this sensitivity. The model’s coefficients are interpreted at the 1%, 5% and 10% thresholds. At these thresholds, a test of the nullity of the coefficients reveals that certain modalities of variables have no impact on the decision not to lease.

The model highlights a link between an individual’s marital status and not leasing. The reference modality is single. The marital status variable has a positive effect on the decision not to lease. Being married increases the probability of not leasing compared to being single.

Being married increases the risk of not leasing by 1.74 times compared to a single person. Being married appears here as a distinguishing factor for not leasing.

Education is a significant factor in not leasing. The more educated an individual is, the more likely he or she is not to lease.

Operating status has a positive effect on the decision not to lease. An individual having an operating status such as family, cooperative or other status increases the chance of not leasing compared to an individual with a private occupation status.

Gender is a significant factor in not leasing. Being female increases the chances of not leasing compared to being male.

Age has a significant influence on the probability of not leasing. This probability increases between the ages of 30 and 39 compared to an individual under 30. Therefore, being between 30 and 39 years of age increases the chances of not leasing (Table 2).

Moreover, an individual’s secondary activity has a clear influence on the probability of not resorting to leasing. Compared to individuals who practice agriculture, the probability of not leasing increases for individuals who practice fishing and market gardening. Only those individuals who fish and market gardening are more likely not to lease.

Income influences the decision not to lease. Individuals with high incomes (Income 3) have a higher probability of not leasing than individuals with low incomes (Income 1). Only high-income individuals do not access leasing.

5. Conclusion

The issue of SMEs financing through credit and/or leasing in developing countries in general and in the Republic of Congo in particular has been the subject of numerous investigations. On the basis of these observations, we have oriented our research towards this topic. To do so, we used a binomial logit model to identify the factors influencing the decision to access to bank loans and/or leasing.

The results show that age significantly influences the probability of not having access to leasing. Moreover, an individual’s secondary activity has a clear influence on the probability of not having access to leasing. Compared to individuals who practice agriculture, the probability of not having access to leasing, increases for individuals who practice fishing and market gardening. Only those individuals who practice fishing and market gardening are more likely not to have access to leasing.

Beyond these results, variables such as gender, education, age, and marital status appear to have no effect on the probability of accessing credit. The category variable has a positive effect on access to credit. Belonging to the traditional small business group increases the probability of accessing credit relative to farmers in the modern small business category. The farm status variable has a positive effect on the decision to access credit.

Annex

Annex 1

Graph 1. Histogram of eigenvalues

Annex 2

Graph 2. First and second factorial planes (axes 1 and 2)

Annex 3

Graph 3. Coordinates, contributions and square cosines

![]()

Table 1. Result of logit model estimation.

Source: Author based on an extract of Stata results. The *, ** and *** represent the 10%, 5% and 1% thresholds respectively.

![]()

Table 2. Marginal effects of other variables on the likelihood of accessing credit.

Source: Author based on an extract of Stata results. The *, ** and *** represent the 10%, 5% and 1% thresholds respectively.